Click, Flip, Fill – Trades Managed Without Panic Or Guessing

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Morning traders, Wednesday we flipped… then flopped… then dropped some more.

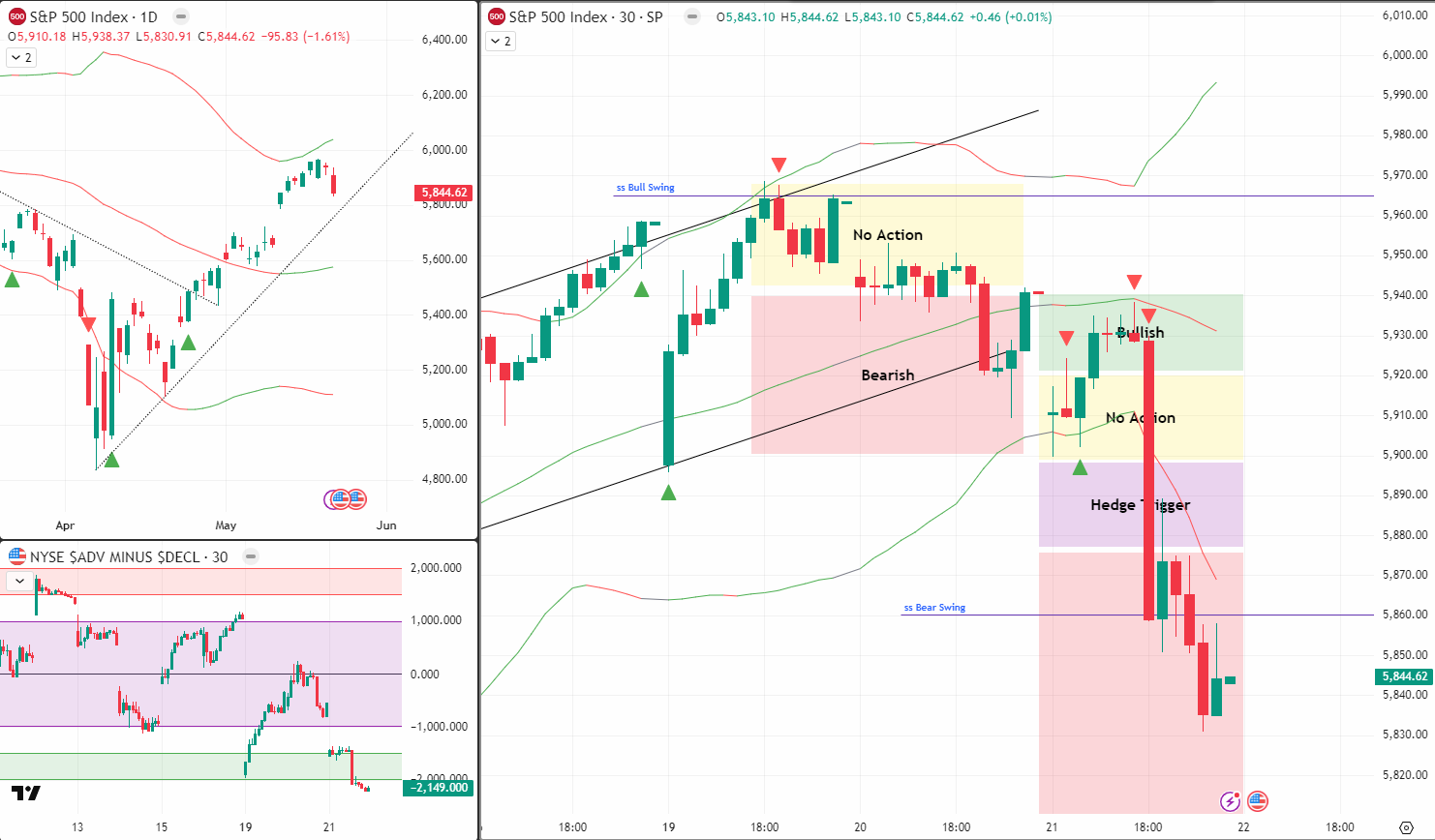

It started as a bullish Tag n Turn – but ended with a market flush, courtesy of midday tax bill fears. Classic SPX.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

SPX Market Briefing

The funny part? I didn’t even know about the news until hours later.

Didn’t need to.

That’s what system rules are for.

When price flipped, the system flipped with it.

Here’s how it unfolded:

-

We opened with a classic Tag n Turn setup

-

By midday, the pattern faltered, and the market dumped hard

-

On our live Fast Forward mentorship call, we discussed the hedge trigger

-

That level broke – and just as it should, the bear pulse bar fired

What did I do?

-

✅ Closed my bull swing trade for a partial loss (yep, second in a row – eye roll)

-

✅ Entered the new bear trade

-

✅ Followed the system. Zero hesitation.

Phew. [wipes brow]

That’s the most trade activity I’ve had to do in a while.

Alert fires.

Check charts.

Pause my show.

Leisurely stroll to the laptop.

Click click [expletive] click

“Come on you [expletive], fill!”

Aaaand done.

Back to the lazyboy.

As for today?

Futures are holding the overnight lows.

So we might see some follow-through selling at the open.

But again – we don’t guess.

We watch.

We wait.

We see what we see, when we see it.

And when the system says go – we go.

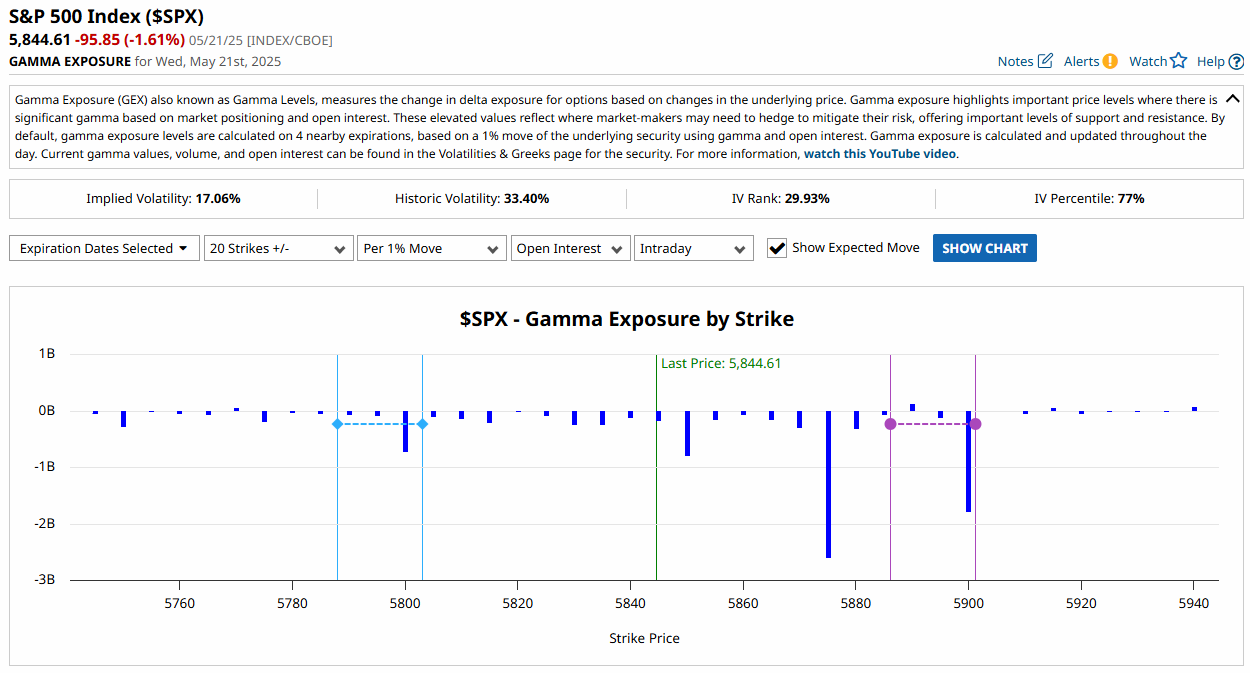

GEX Analysis Update

- Back to negative gamma – expect lots more volatility

Expert Insights:

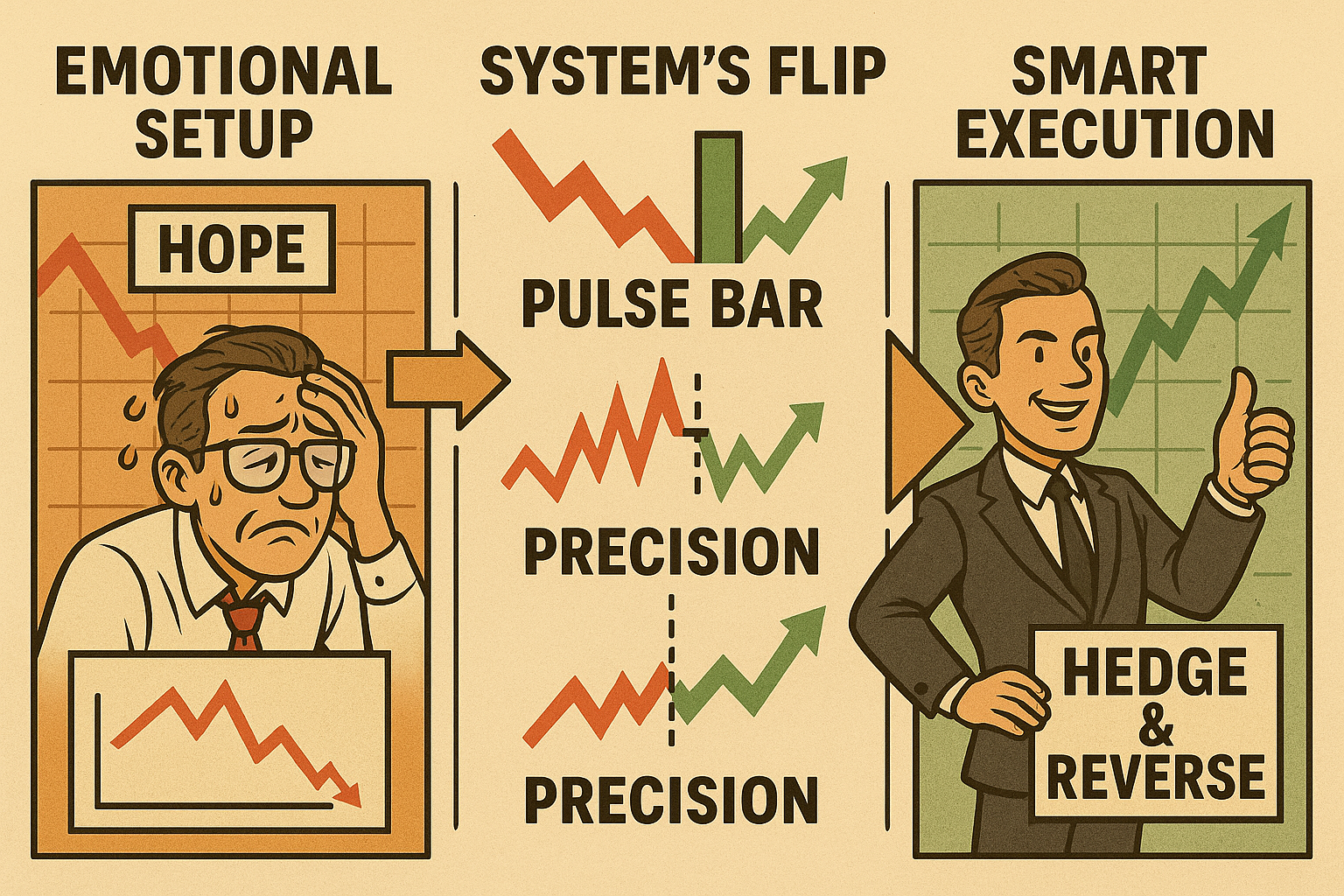

Mistake: Holding onto a broken setup because you’re emotionally committed

Why it hurts: Hope doesn’t hedge. And neither does ignoring the pulse bar.

Solution:

-

Trust the system’s flips – bullish to bearish, and back again

-

Accept small losses as tuition

-

Hedge and reverse trades with precision

Rumour Has It…

Sources say the tax proposal was leaked by “someone’s cousin who once visited Washington.”

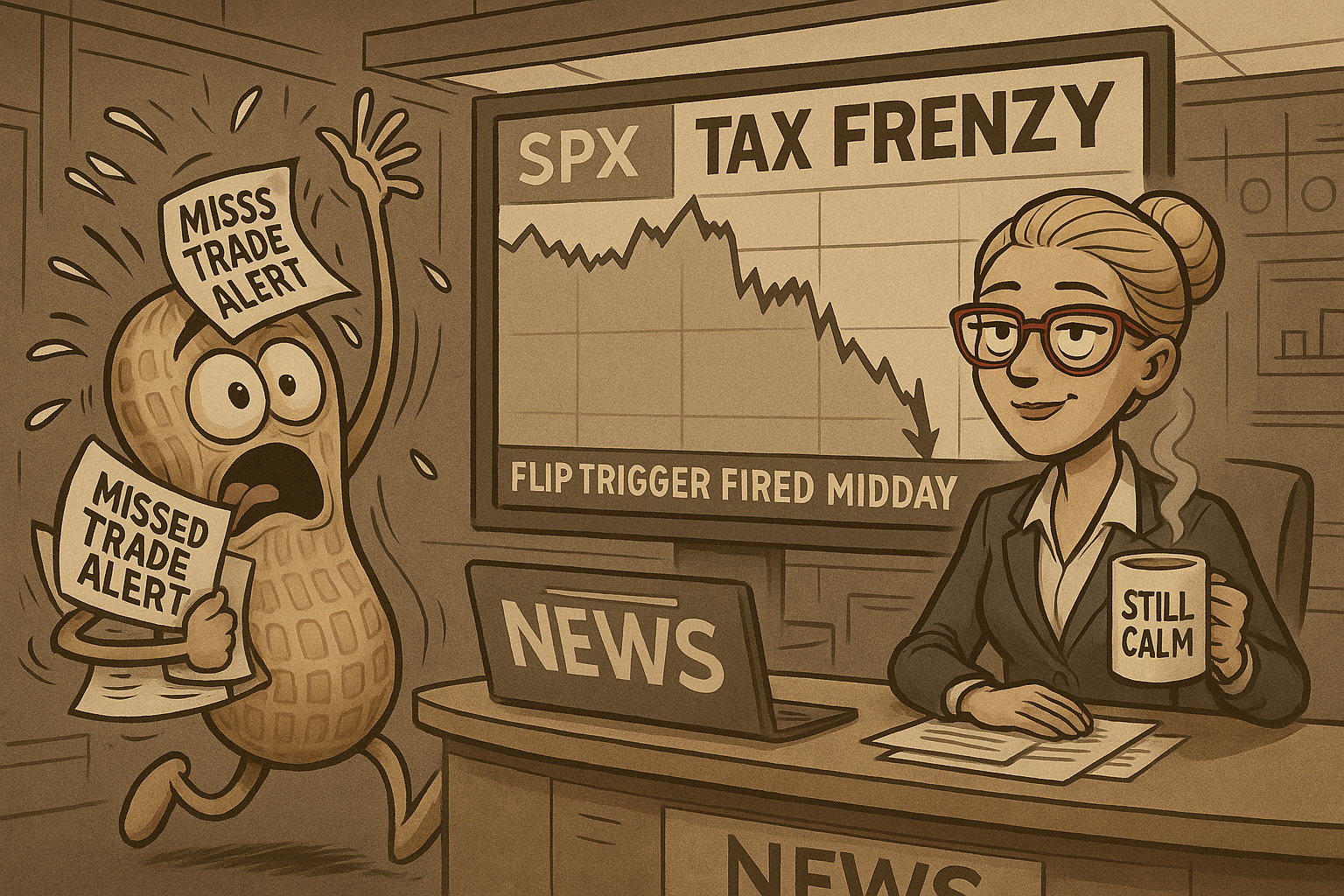

Meanwhile, over at AntiVestor HQ, a trader calmly executed a system flip with four clicks and one expletive.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Nvidia’s Meteoric Rise: From Enron’s Replacement to Tech Titan

In 2001, Nvidia was added to the S&P 500, replacing the scandal-plagued Enron. Since then, Nvidia has delivered a staggering total return of approximately 12,950%, transforming from a niche graphics chipmaker into a cornerstone of the AI and semiconductor sectors.

This remarkable ascent underscores the dynamic nature of the S&P 500, highlighting how companies can evolve and thrive within the index over time.

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.