Pulse Bar Pro 2.1.1 Returns, Swing Bias Auto-Mapped

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

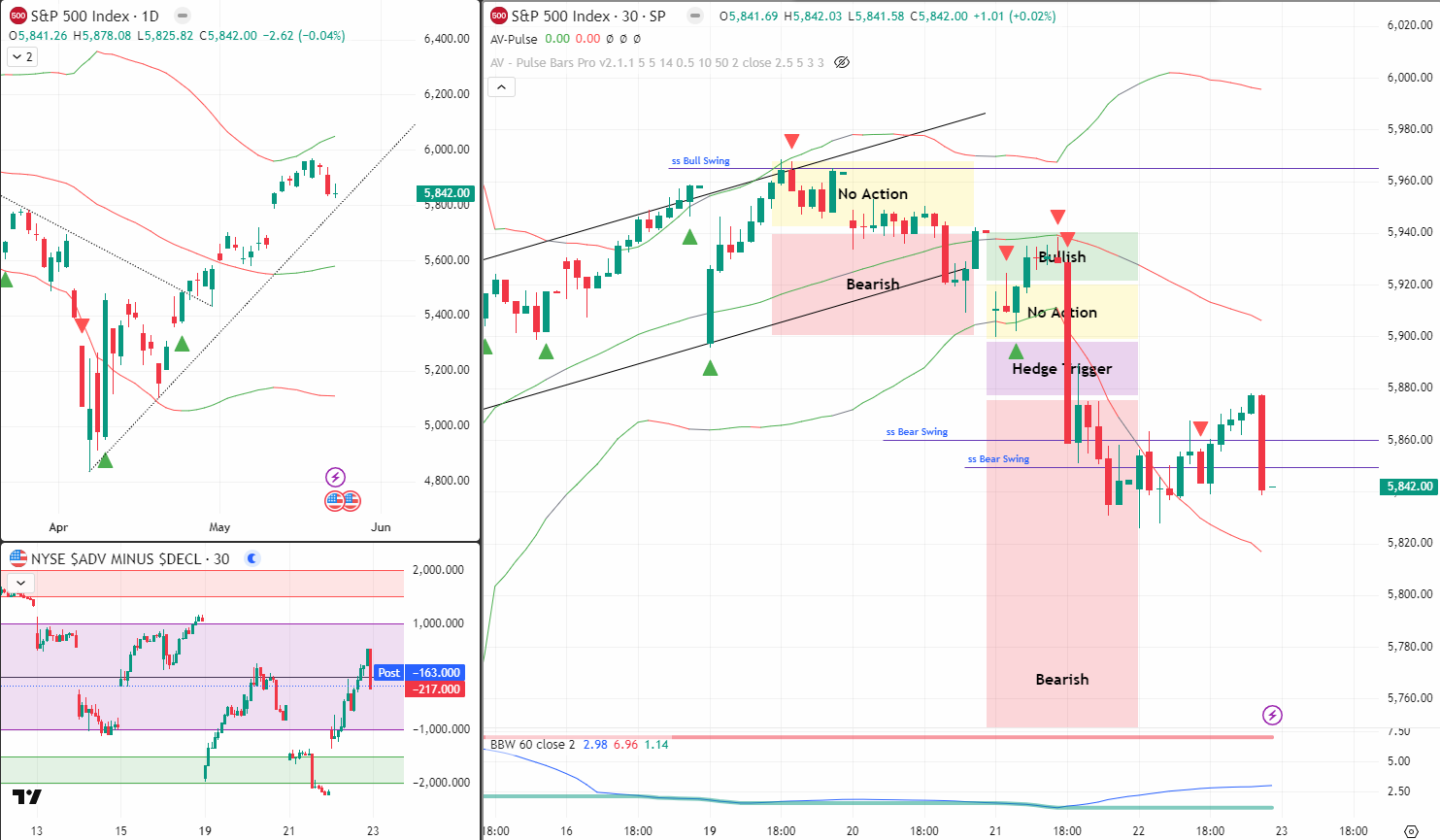

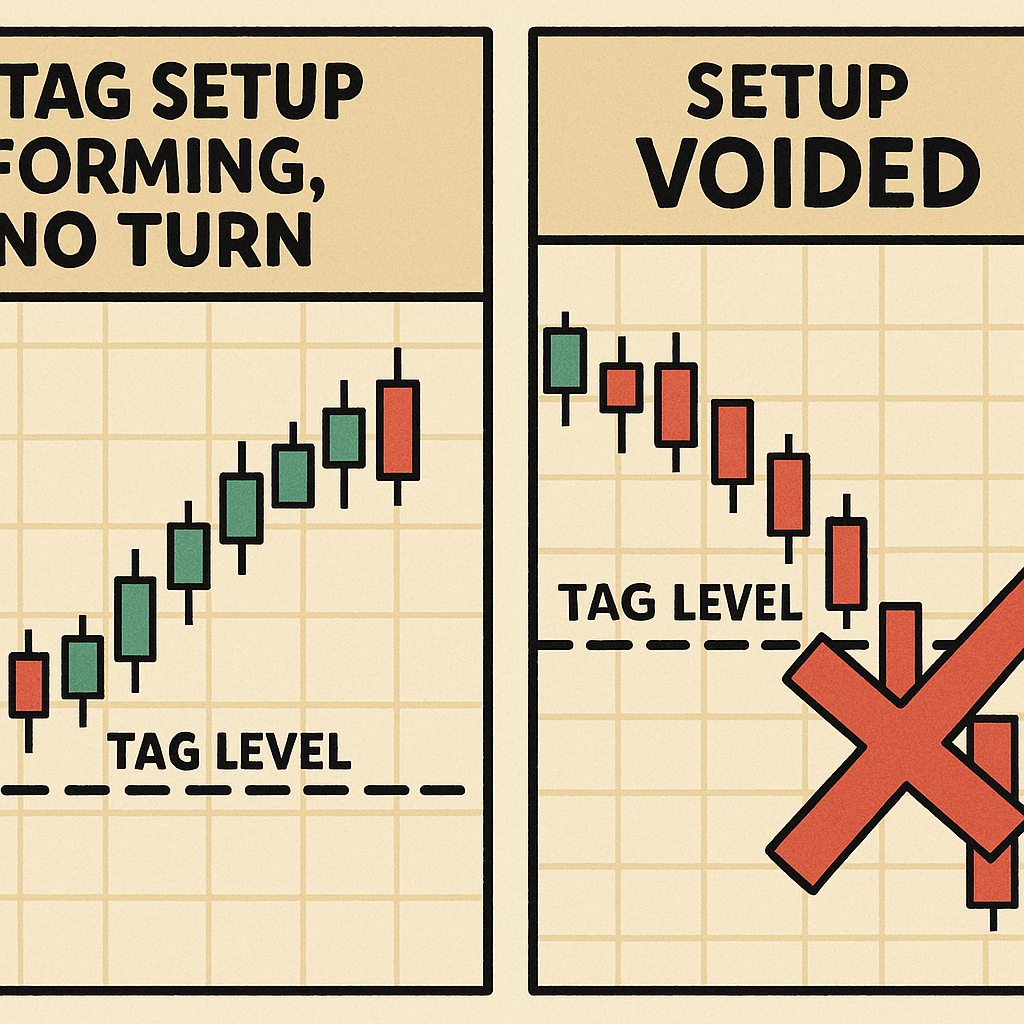

After Wednesday’s bear flip we saw most of Thursday meander and chop around. We tagged – but we never turned. The late-day push voided the setup, so we’re still in bear mode unless a new signal forms.

Interestingly, yesterday’s overnight swing still managed to close profitably. I’ll need to catch up on the write-ups for the last two trades as soon as I find time. And my exciting news? Pulse Bar Pro v2.1.1 is finally back for testing and looking sweet, sweet, sweet. It’s designed to work out the swing bias for you – mic drop!

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

SPX Market Briefing

After Wednesday’s clean bearish setup, Thursday’s price action was the market equivalent of shrugging – until it wasn’t.

We chopped around the tag level for most of the day. No reversal signal ever confirmed, and then came the final hour push lower. That move voided the tag – effectively telling us to stay short unless a new setup appears today.

There’s no bullish argument without a pulse bar. For now, bias stays bearish.

Meanwhile, the overnight swing trade wrapped up profitably – a subtle win tucked into a choppy session. That marks back-to-back trades that deserve proper documentation (and they’ll get it… just not today).

Why? Because I’m off the desk for most of Friday.

But while I’m out, version 2.1.1 of Pulse Bar Pro is now back in testing – and it’s slick. This version auto-detects the weekly swing bias so you’re never flying blind on your setups.

No trade alert this morning – we wait for the market to show its hand.

Expert Insights:

Mistake: Assuming a tag equals a reversal

Why it hurts: A tag without a turn is just friction – not conviction

Fix: Wait for the pulse bar trigger. Direction matters. Don’t front-run.

Rumour Has It…

A rogue AI at Goldman Sachs just upgraded the VIX to “emotional support animal” status, citing rising trader dependency and afternoon nap volatility. One analyst allegedly whispered, “I’m not bearish, I’m just tired.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

Meme of the Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.