Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

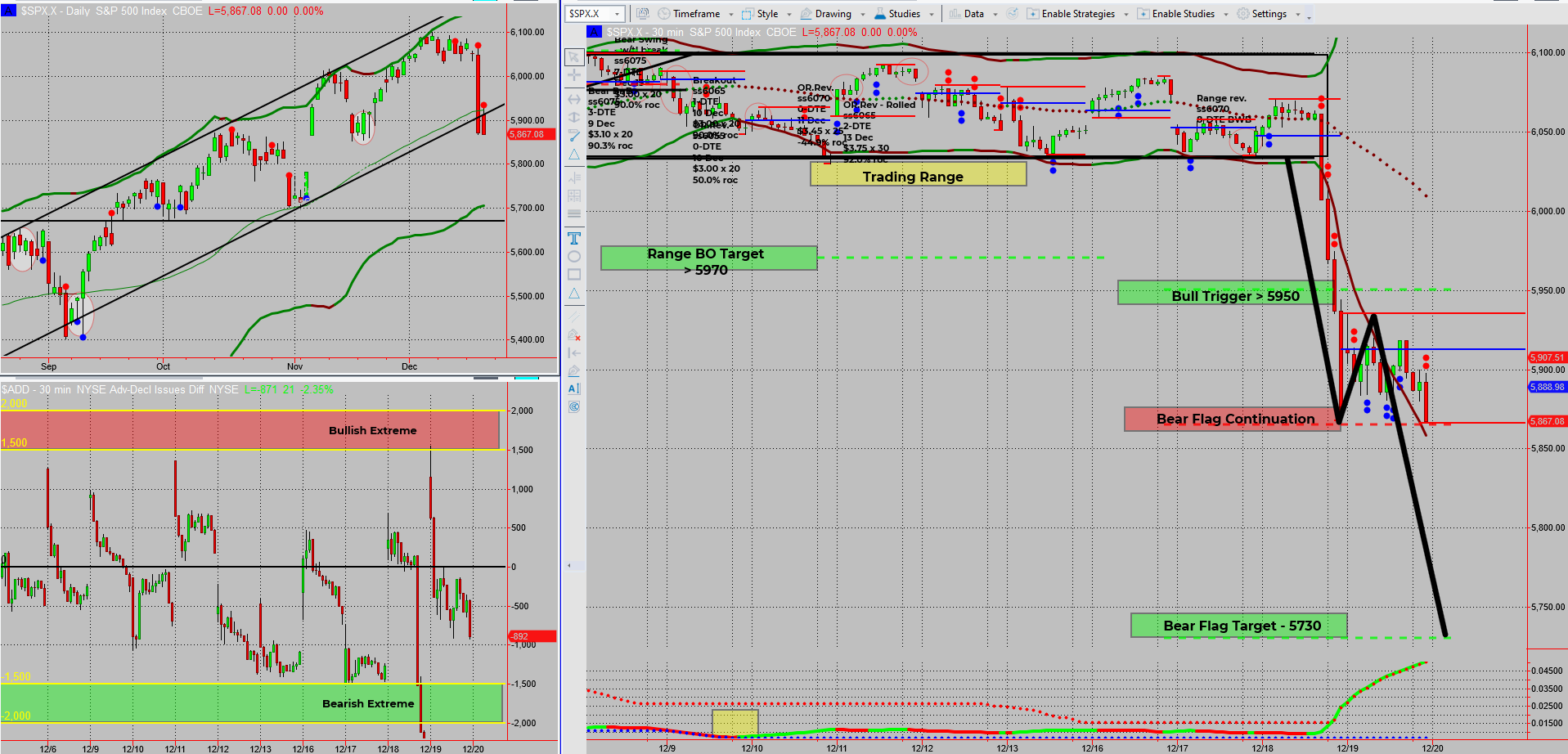

Markets thrive on unpredictability, and last week was no exception. SPX didn’t just break the anticipated range—it obliterated the typical range target! Friday’s price action revealed a bear flag pattern, a continuation signal projecting a target as low as 5730.

- December Déjà Vu: This sharp drop reminds me of December 2018, where markets took a notable dive. Back then, it caused panic, but the selloff was short-lived.

- Bearish Momentum: Overnight futures are already down another 50 points, adding fuel to the bearish continuation fire.

- Plan in Action: If the bear flag holds, 5730 is on the horizon. However, if it fails, I’m ready to pivot, with 5950 as my bull trigger.

- SPX Income Traders: While others panic, we profit. Playing both bullish and bearish setups means we’re positioned to succeed no matter the market’s mood swings.

As the dust settles from last week’s wild ride, the focus shifts to executing the plan, one trade at a time. Whether it’s a continuation down or a surprise reversal up, it’s all about trading the opportunities as they come.

Fun Fact:

Did you know that December is often called the “Santa Claus Rally” month? Historically, the S&P 500 has posted gains in 75% of Decembers since 1928. This year might not fit the trend—yet.

The “Santa Claus Rally” typically occurs during the final trading days of December and the first two of January. It’s often attributed to holiday optimism, end-of-year tax considerations, and institutional investors adjusting their portfolios. When it doesn’t happen, it’s seen as a warning for the year ahead.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece