Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

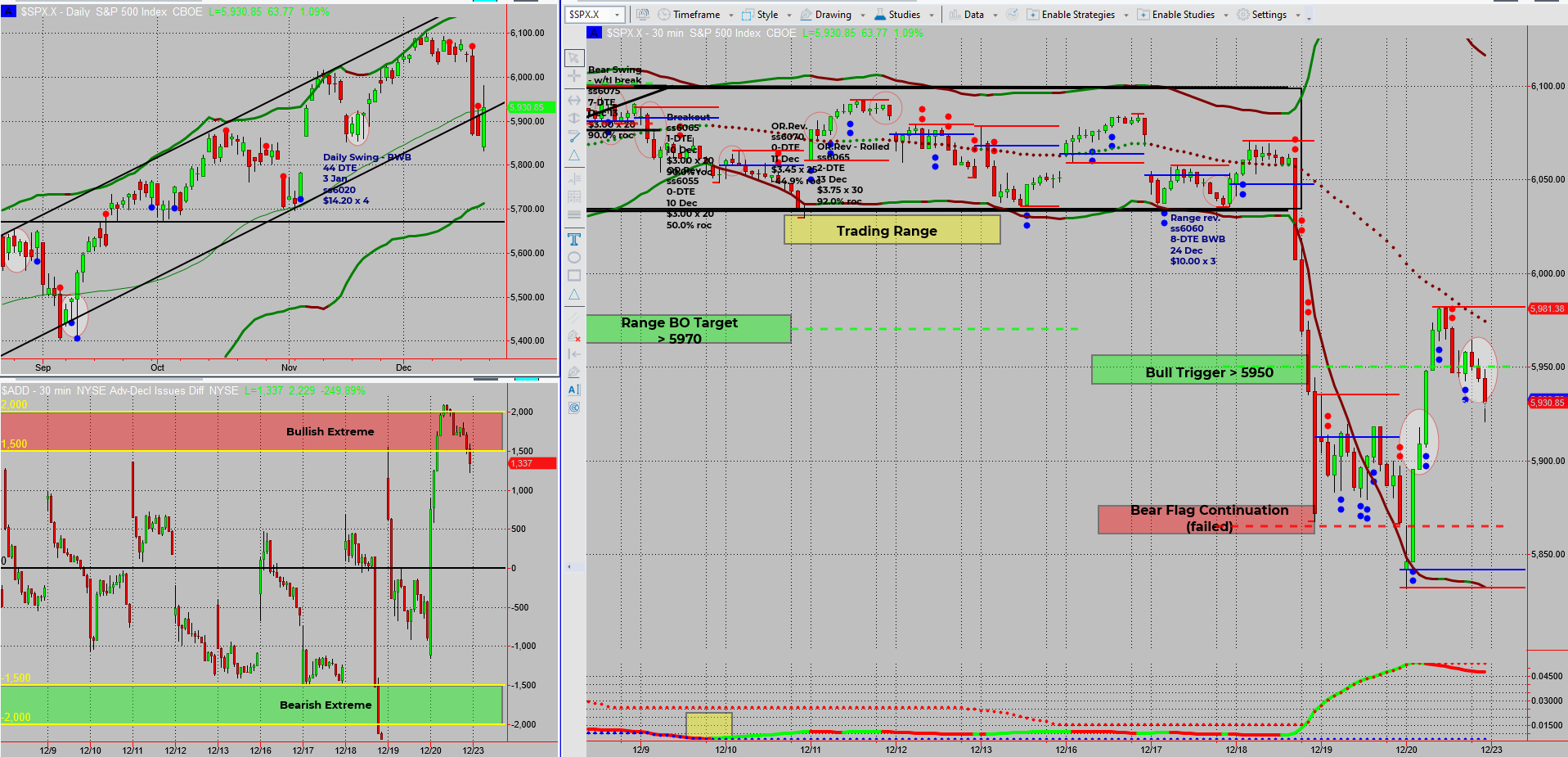

Friday’s session played out as one of the outlined scenarios—a failed bear flag. Overnight futures teased a bearish continuation, dropping 50+ points before a sharp rally into the open. By lunch, SPX had sailed through the bull trigger with bullish pulse bars lighting the way.

- Key Observations:

- Morning Momentum: A strong upward move dominated the morning.

- Afternoon Pullback: A lazy descent formed a notable wick on the daily chart, hinting at indecision.

- Monday Outlook: Narrow-range day likely as markets pause post-rally.

- Current Market Dynamics:

- Wide Bollinger Bands are contracting, signaling reduced volatility.

- A shortened holiday week (Merry Christmas! ) means lighter trading volumes.

- Bullish income swings, despite being challenged, are not far from being back to black with minimal/no action required.

- My Game Plan:

- Short-Term: Expect consolidation near the current level.

- Mid-Term: Watch for breakout setups after the pause.

- Trades: Staying patient before committing to new positions.

Fun Fact:

The S&P 500 includes companies with a combined market value of over $40 trillion, which is more than the GDP of the United States and the European Union combined!

The S&P 500 isn’t just a collection of companies—it’s an economic powerhouse. Covering 11 sectors and accounting for around 80% of the U.S. stock market value, the index is a barometer of the American economy. Giants like Apple, Microsoft, and Amazon significantly influence its performance. The index’s combined market cap surpasses the GDP of most countries, showcasing the immense scale of these corporations and their impact on global markets.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece