S&P Touches 7,000. Closes Flat. That’s January 2026 in One Sentence.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

“I’m a rocket ship on my way to Mars, on a collision course…”

That’s gold right now. $5,500 and climbing. Like a satellite out of control. Like Lady Godiva.

I’m sure Queen won’t mind me borrowing a few lyrics because honestly, nothing else captures this gold chart quite as well.

Meanwhile, the S&P 500 touched 7,000 for the first time in history yesterday. Then closed flat at 6,978. Because of course it did.

“Could these markets be any weirder?”

Chandler voice

Meta just announced they’re spending $135 billion on “superintelligence.” Microsoft dropped 7% because Azure only grew 39%. SAP crashed 14% because their CFO admitted AI might let customers “do everything themselves.”

And somewhere in the background, we’re all just waiting for someone at the Fed to start shouting

“PIVOT! PIVOT! PIVOT!”

…like Ross moving a couch.

Same patterns. Same ranges. Same chaos. Let’s trade it.

Scroll down for the systematic breakdown – including why Fed Day produced 3 wins for premium sellers…

Market Briefing:

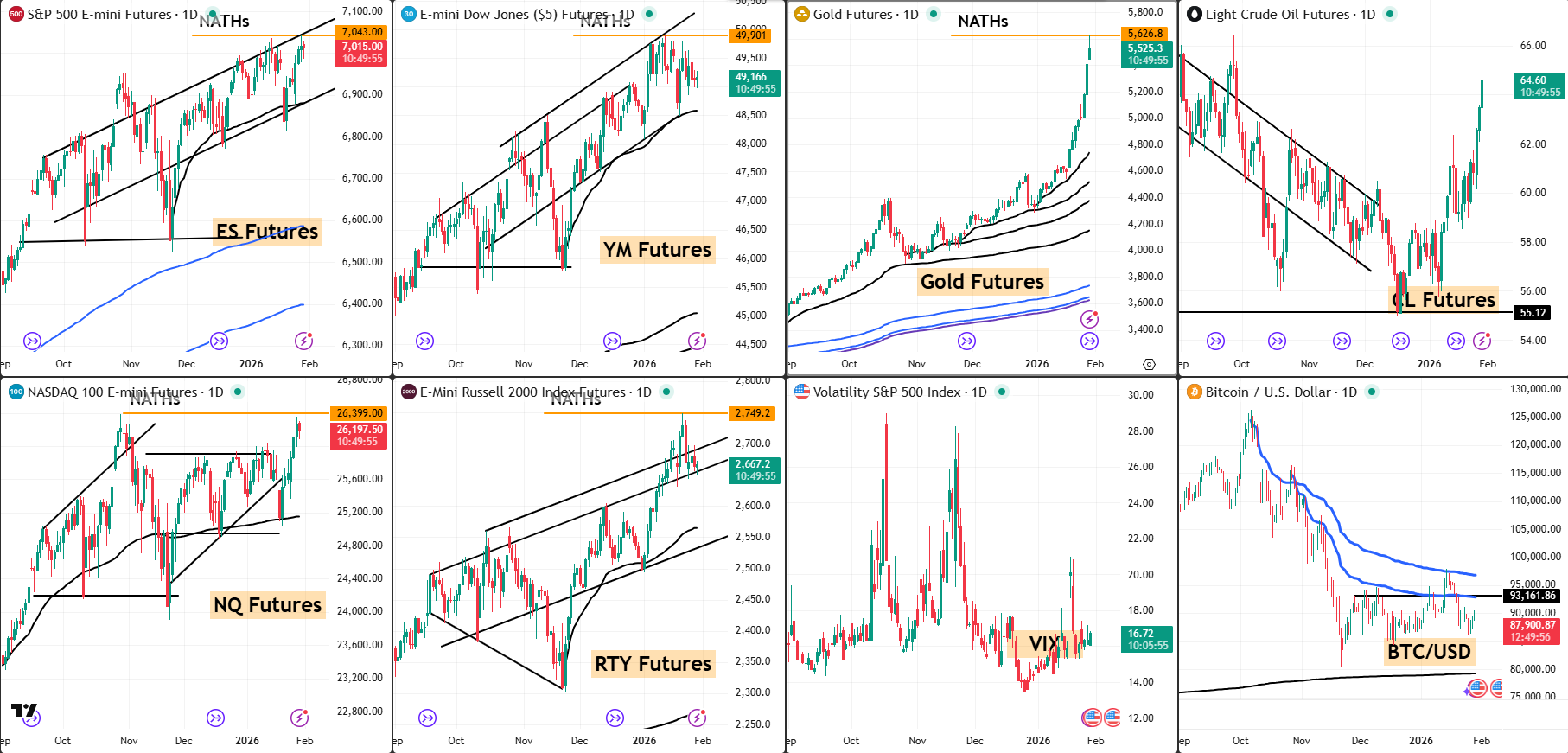

Multi-Market Status

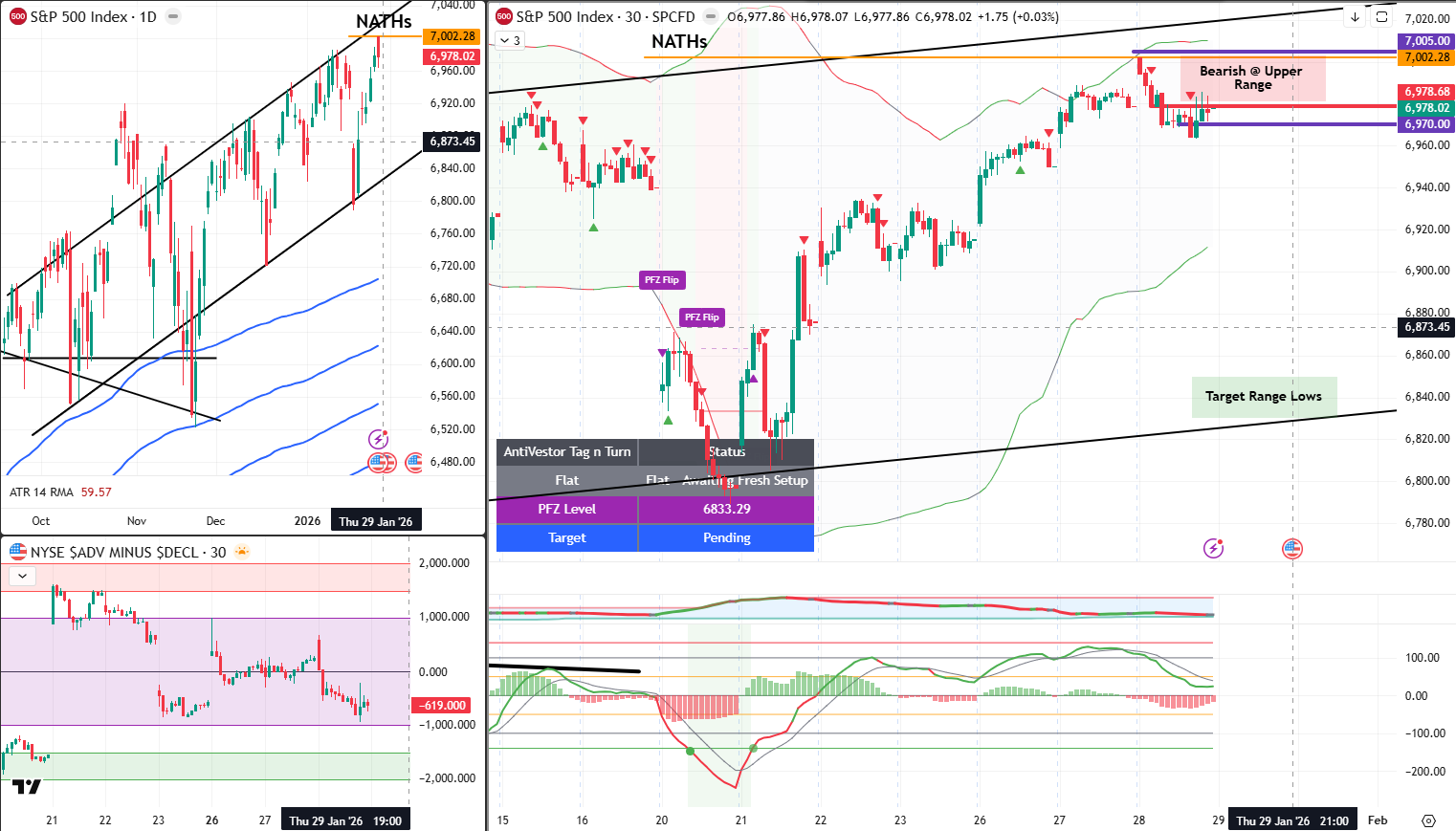

SPX: Flat – Awaiting Fresh Setup. PFZ Level 6833.29. Target pending. But here’s the thing – price is unofficially bearish. Back at the range boundary with a V-shaped entry presenting itself. Same setup, opposite direction from the discretionary bullish play. Target is range lows. One of the 6 Money Making Patterns in action.

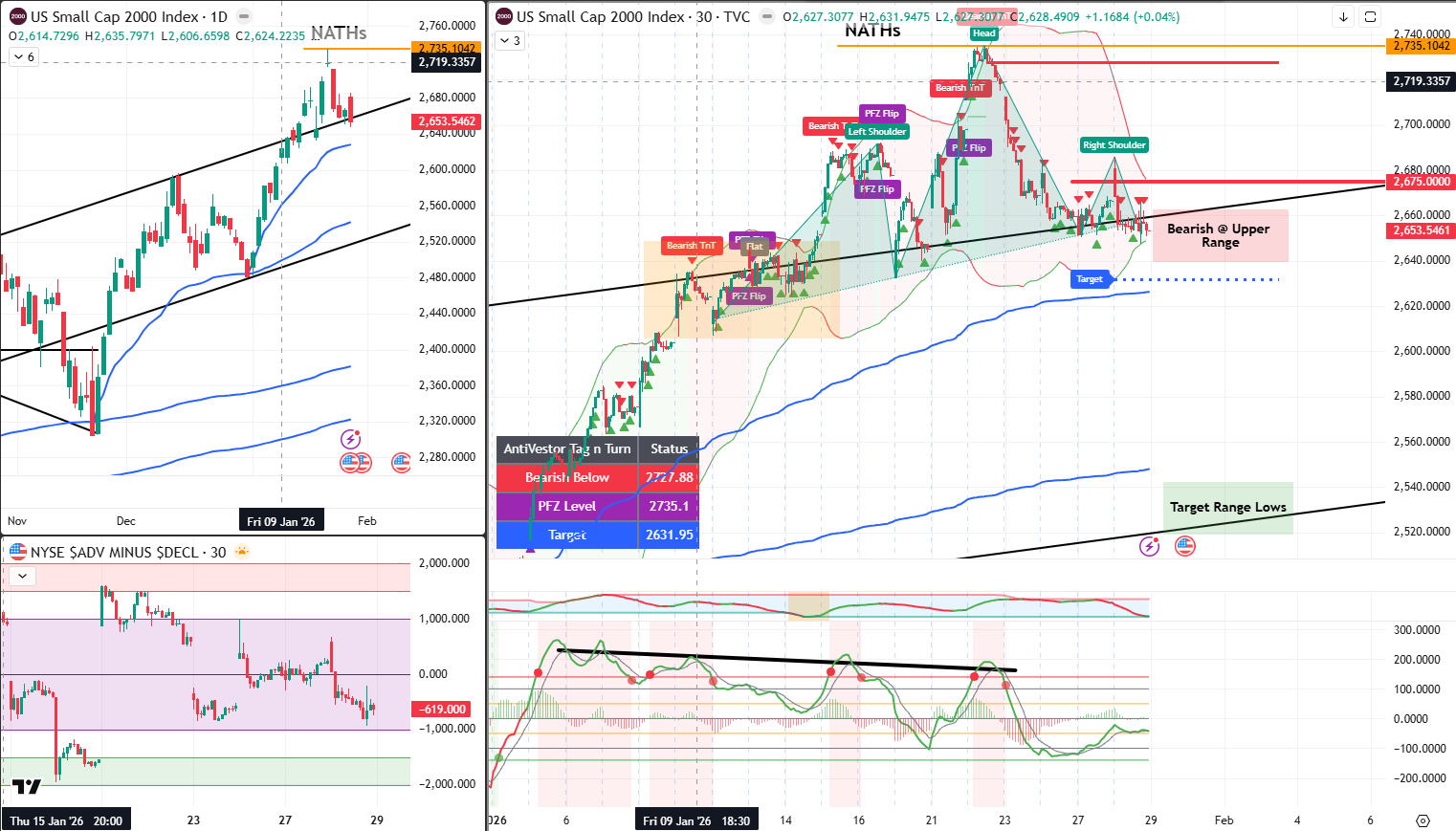

RUT: Bearish Below 2727.88. PFZ Level 2735.1. Target 2631.95. Still bearish. Still grinding. And for fun, I’ve spotted a head and shoulders pattern forming right at the NATH and range high. If the neckline breaks, we could finally see price push back into the range properly. Or it flips and flops. Month end approaching – we get paid either way.

ES Futures: 7,015 – touched 7,043 yesterday before retreating. The 7,000 party was short-lived.

NQ Futures: 26,197.50 – Meta’s 10% surge offset Microsoft’s 7% drop. Net result: basically flat.

YM Futures: 49,166 – recovering from the healthcare massacre, now dealing with Microsoft drag.

RTY Futures: 2,667.2 – grinding towards target. Head and shoulders pattern developing.

Gold: $5,525 – ROCKET SHIP MODE. Don’t stop it now. It’s having such a good time.

VIX: 16.72 – popped on Fed Day, immediately crashed back. Blue smarties and metaphoric couches.

Bitcoin: $87,900 – still stuck at $88K whilst gold parties. The “digital gold” narrative looking increasingly awkward.

The Contained Pattern Reality

Here’s what’s actually been happening since October:

The indexes have been trading in well-defined patterns. Rising channels. Consolidation ranges. Support and resistance levels that keep getting respected.

All the headlines about 7,000 and new highs? That’s noise. The structure hasn’t changed. Price touches the upper boundary, pulls back. Touches the lower boundary, bounces. Rinse and repeat.

Yesterday was the perfect example. S&P touched 7,000 – the upper boundary of this entire move – and immediately retreated. Closed flat. The pattern holds.

What changes things: A decisive break above with follow-through. Or a decisive break below. Until then? Same ranges. Same setups. Same opportunities.

The SPX Bearish Setup

Let’s talk about what’s developing on SPX:

Price is back at the range boundary – the upper edge of this consolidation we’ve been tracking. The V-shaped entry that worked for the discretionary bullish swing? Same pattern, opposite direction.

The Setup:

- Price at upper range boundary

- V-shaped entry presenting

- Target: range lows (around 6873 area marked on chart)

- This is one of the 6 Money Making Patterns – sell the rally at range resistance

We’re officially flat on the TnT system, awaiting fresh setup. But the discretionary read says bearish at these levels makes sense. The same pattern recognition that caught the bounce now suggests the fade.

The RUT Head and Shoulders

Something interesting forming on Russell:

Right at the NATH and range high, there’s a pattern that looks suspiciously like a head and shoulders. Left shoulder, head at the absolute peak, right shoulder forming now.

What it could mean:

- If neckline breaks, classic H&S target takes price well into the range

- Confirms the bearish TnT signal we’ve been riding

- Finally gives RUT the catalyst to push back into its larger consolidation

Or:

- It flips and flops like everything else this month

- Month end sees prices pause before moving

Either way – the bearish swing is positioned, target at 2631.95. We get paid on direction or time decay. The pattern is just context.

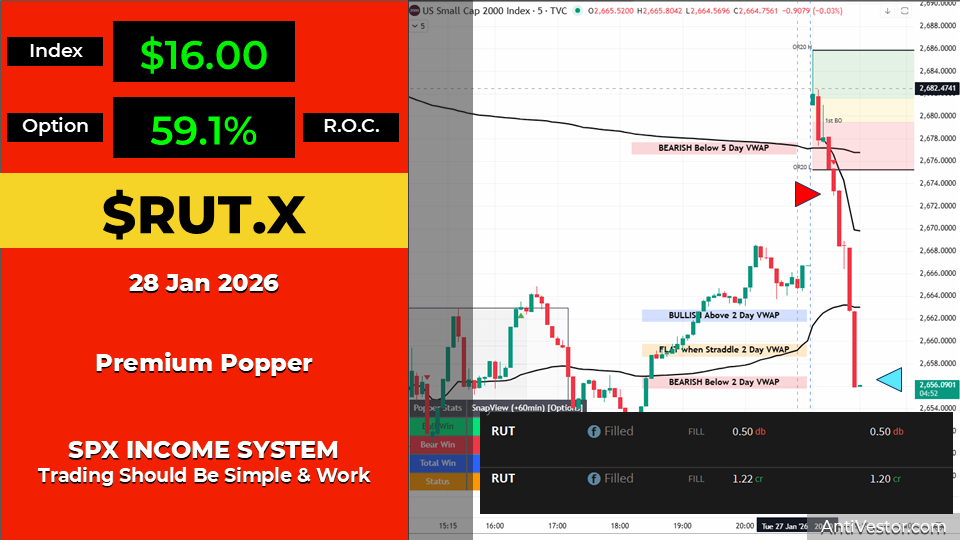

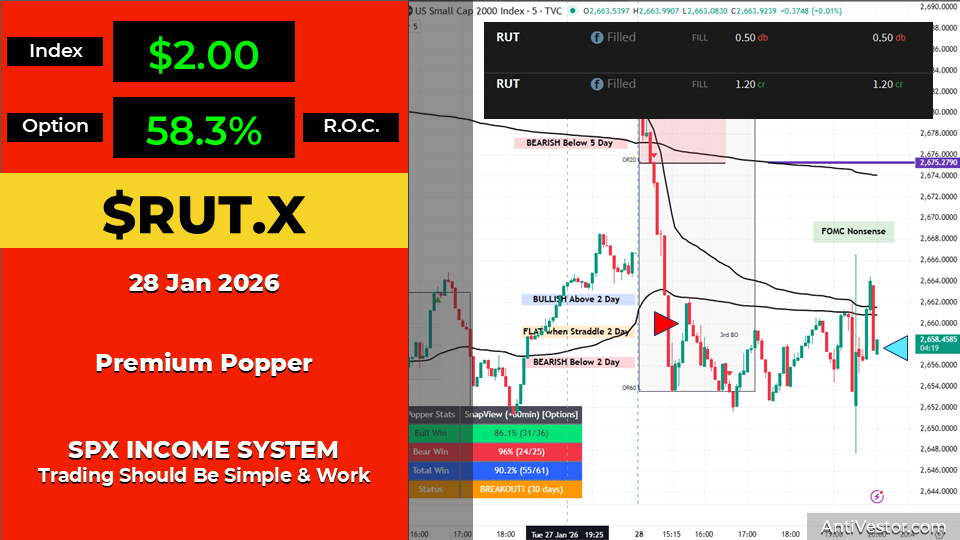

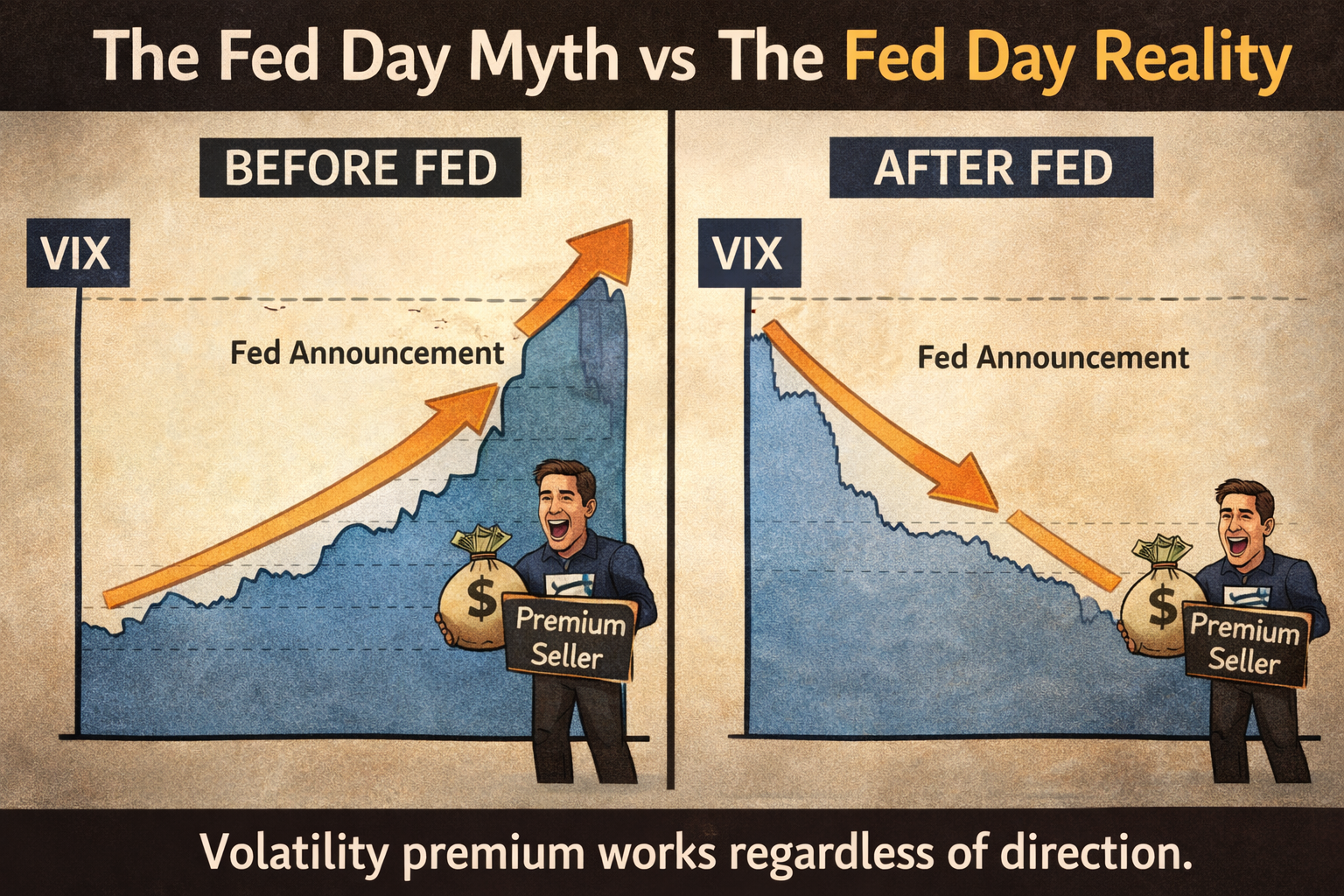

Fed Day Premium Seller Lesson

Three trades during the group calls yesterday. All winners. On Fed Day.

Trade 1 – RUT ORB20: Bear break off the 5-day VWAP. $16 index move. 59.1% ROC.

Trade 2 – SPX ORB20: Bear break off the new all-time high. $10 index move. 62.9% ROC.

Trade 3 – RUT VWAP Retest: Meandered sideways. $2 index move. 58.3% ROC. Profits from time decay, not direction.

The lesson: “What about FOMC?”

Make a decision. Trade them or don’t trade them. It makes little difference to premium sellers.

We’re not betting on what Powell says. We’re not predicting the market’s reaction. We’re selling premium into elevated volatility and letting theta do the work.

Trade 3 is the perfect example – price went sideways during FOMC nonsense, and we still collected 58% ROC from time decay alone.

Popper Stats (30-day rolling):

- Bull Win: 86.1% (31/36)

- Bear Win: 96% (24/25)

- Total Win: 90.2% (55/61)

The Big Tech Divergence

Yesterday’s earnings told three very different stories:

Meta (+10%): Revenue $59.9B (+24%). EPS $8.88. Then the bombshell – 2026 capex guidance of $115-135 billion for “superintelligence” infrastructure. Zuckerberg’s biggest AI bet ever. Market loved it.

Microsoft (-7%): Beat revenue ($81.3B). But Azure grew “only” 39%. Below whispers. Capex hit record $37.5B. Market hated it. Cloud deceleration spooks everyone questioning AI payoff timelines.

Tesla (+2%): Quietly beat. EPS 50c vs 45c expected. Revenue fell 3% but robotaxi progress and $2B xAI investment lifted spirits.

SAP (-14%): The nightmare scenario. Cloud backlog grew 16% vs 26% expected. CFO warned AI could let customers “do everything themselves.” Enterprise software existential crisis in real time.

Tonight: Apple reports. The last of the mega-caps. Then shutdown deadline Friday midnight.

Expert Insights

The Fed Day Trading Myth

Conventional wisdom says avoid trading on Fed days – too much uncertainty, too much volatility, too much risk of getting whipsawed by Powell’s comments.

The data tells a different story for premium sellers.

VIX typically elevates into Fed decisions, pricing in uncertainty. This elevated IV means richer premiums. When the decision lands (usually as expected – holds are boring), IV often crushes regardless of direction.

Premium sellers profit from this IV crush. Whether price goes up, down, or sideways, the volatility premium deflates post-announcement.

Yesterday’s three trades demonstrated this perfectly. Directional bets could have been whipsawed. Premium collection worked regardless of Powell’s word choices.

[Source: Options pricing dynamics around FOMC announcements]

In Other News…

Meta Promises “Superintelligence” for $135B; Microsoft’s 39% Growth Deemed Disappointing

S&P touched 7,000, immediately retreated. Markets commitment issues confirmed.

Wall Street witnessed history Wednesday—briefly. The S&P 500 kissed 7,000 intraday then closed flat at 6,978, apparently deciding historic milestones require a bit more thought. Meta surged 10% after promising to spend up to $135 billion on “superintelligence” whilst Microsoft crashed 7% because 39% Azure growth simply wasn’t enough.

The Superintelligence Shopping Spree

Meta delivered $59.9B revenue (+24%), $8.88 EPS, then casually announced $115-135B in 2026 capex for “superintelligence.” Markets loved it—up 10%. When spending GDP-of-small-nations on AI promises triggers euphoria rather than concern, we’ve entered a phase where ambition outweighs arithmetic. Ad impressions +18%, pricing +6%, sanity optional.

When 39% Isn’t Enough

Microsoft beat revenue at $81.3B but Azure’s 39% growth “disappointed.” The stock crashed 7%. In what reality is 39% growth disappointing? This one, apparently. SAP joined the carnage, down 14%, proving enterprise software’s sin was simply not being AI-adjacent enough.

️ Fed Holds, Government Wobbles

Fed voted 10-2 to hold rates—Waller and Miran dissented because even monetary policy requires drama. Shutdown deadline hits Friday midnight over DHS funding. Gold above $5,500 suggests someone’s taking the “government dysfunction” trade seriously.

☕ Hazel’s Take

Apple reports tonight expecting record $138B revenue. If that disappoints, we’ll know expectations have fully departed reality. S&P touched 7,000 and flinched—perhaps it saw what’s coming Friday.

—Hazel, FinNuts

Rumour Has It…

The Financial Nuts Newsroom has a Queen soundtrack playing…

Percy is air-guitaring to Don’t Stop Me Now whilst watching the gold chart. “Satellite! Out of control! This is literally what’s happening!”

Hazel pulls up a Friends clip on her phone. “Could these markets BE any more confusing?” She pauses. “Actually, don’t answer that.”

Mac raises his glass. “Meta’s spending $135 billion on superintelligence. Microsoft’s crying about 39% growth. SAP’s admitting AI will make them obsolete. This is fine.”

Kash is counting yesterday’s Popper wins. “Three trades. Fed Day. All green. Someone tell me again why we’re supposed to avoid FOMC?” He grins. “Premium sellers don’t care about Powell.”

Wallie is drawing on his RUT chart. “Head… and shoulders. Right at the top. If this neckline breaks…” He trails off, looking almost excited. “We might actually get some follow-through for once.”

The newsroom collectively holds its breath. Follow-through would be nice.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Meta’s $135B AI Bet in Context

Meta’s 2026 capex guidance of $115-135 billion represents the largest single-year infrastructure investment commitment in technology history. For context:

- It exceeds the entire GDP of over 100 countries

- It’s more than the combined 2025 capex of Microsoft ($37.5B), Google ($32B), and Amazon ($30B)

- It’s roughly equivalent to NASA’s entire budget for three years

Zuckerberg called it an investment in “superintelligence” – marking the first time a major tech CEO has publicly used that term in earnings guidance.

Whether this becomes the greatest investment of the AI era or the most expensive white elephant in corporate history won’t be known for years. But the scale is unprecedented.

[Source: Company earnings reports, government budget data]

Meme of the Day:

“PIVOT! PIVOT! PIVOT!”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.