SPX Kisses Record Highs. Dow Loses $60B on One Stock. Pick Your Reality.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Tuesday told two completely different stories depending on which index you were watching.

Story One: S&P 500 closes at a record 6,978.60. Tech celebrates. Microsoft up 2.2%. Apple up 1.1%. Champagne all round.

Story Two: Dow collapses 409 points because UnitedHealth imploded 19.6% – the worst day in company history. $60 billion gone. One stock. One day. Healthcare massacre whilst tech threw a party.

Same market. Same day. Completely different realities.

And today we get Fed Day on top of this circus. Powell speaks at 2:30pm. Tesla, Microsoft, and Meta report after close. Gold just smashed through $5,100.

The divergence continues. The chaos continues. The opportunities continue.

Scroll down for the systematic breakdown – including why one loss and one win still equals a net gain…

Market Briefing:

Multi-Market Status

SPX: Flat – Awaiting Fresh Setup. PFZ Level 6833.29. Target pending. The bull swing hit the upper Bollinger Band and is looking ready for a fresh setup. Price nudging new all-time high territory at 6,978. Officially flat but the charts are coiling for something.

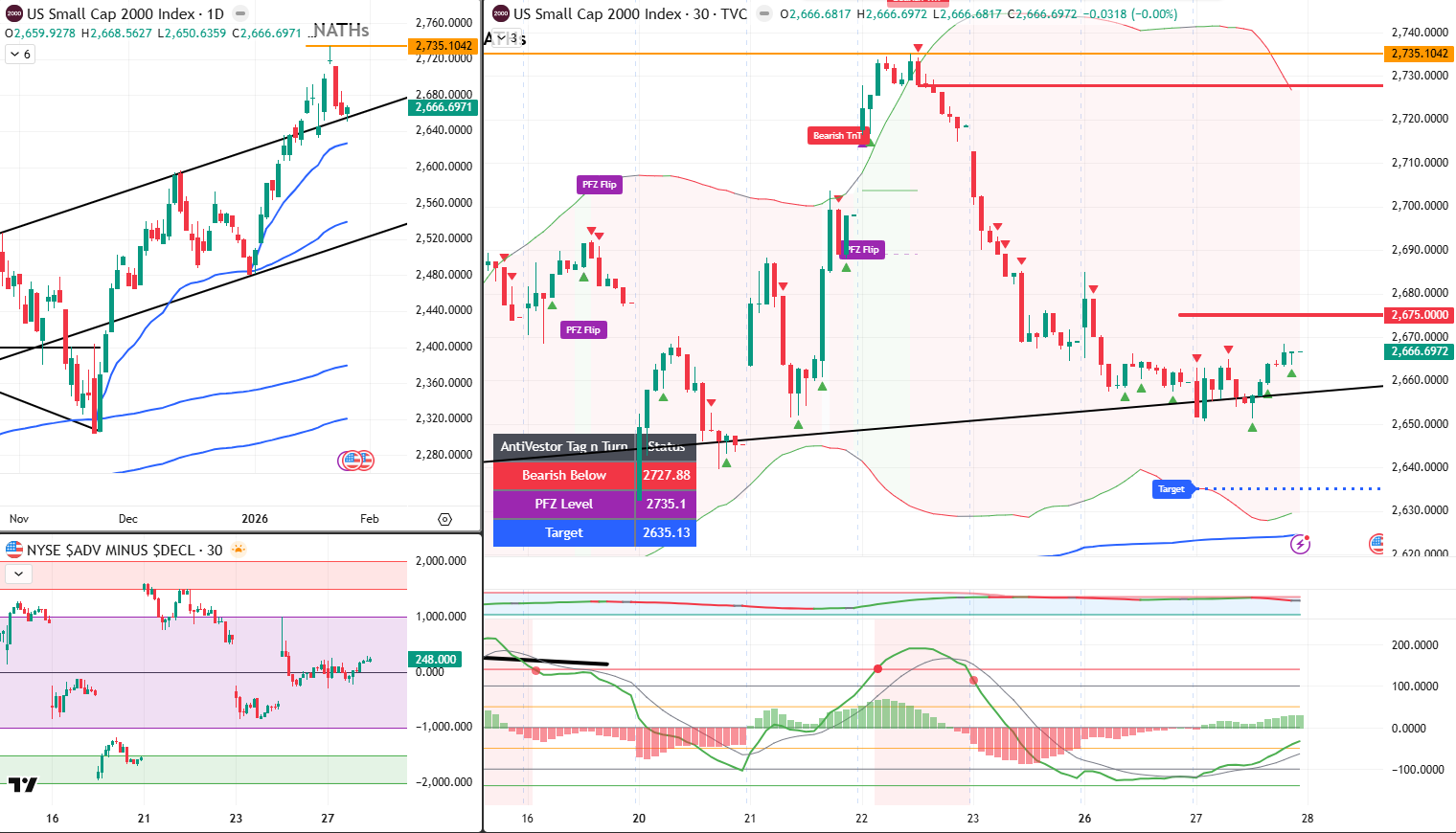

RUT: Bearish Below 2727.88. PFZ Level 2735.1. Target 2635.13. Uncle Russell remains firmly in weekend mode – bearish, unbothered, watching everyone else get excited. Cashed out and reloaded on the bear swings. Target in sight.

ES Futures: 7,030.25 – kissing the psychological 7,000 level. New all-time high territory.

NQ Futures: 26,280.75 – finally showing up to the party. Better late than never. Attempting the bull breakout after missing every move for a month.

YM Futures: 49,180 – trying to recover from Tuesday’s 409-point bloodbath. UnitedHealth still dragging.

RTY Futures: 2,689.7 – bearish, consolidating, watching the chaos from the sidelines.

Gold: RAMPAGE CONTINUES. Smashed through $5,100. Dollar at 4-year lows. Safe haven demand screaming.

VIX: 16.27 – elevated but controlled. Watching and waiting.

Bitcoin: $89,228 – holding $89K. Extreme fear on the index. Tonight determines direction.

The Two Markets Story

Let’s be clear about what happened Tuesday:

The Tech Market: S&P 500 record. Nasdaq +0.91%. Microsoft +2.2%. Apple +1.1%. Micron +5.4%. AI enthusiasm alive and well.

The Healthcare Market: UnitedHealth -19.6%. Humana -20%. Elevance -13%. CVS -13%. $60 billion wiped from one company because Trump’s CMS proposed a 0.09% Medicare Advantage rate increase instead of the 4-6% Wall Street expected.

Same day. Same market. Completely opposite outcomes.

This is the divergence we’ve been talking about. It’s not just between indexes anymore – it’s within indexes. The S&P 500 hit a record whilst one of its largest components had its worst day in history.

Welcome to 2026.

The Nasdaq Late Arrival

After missing every move for a month, Nasdaq finally decided to show up.

The hissy fit we mentioned yesterday? It’s turning into an actual breakout attempt. NQ at 26,280 is pushing above resistance whilst the other indexes do their own thing.

Better late than never, but the question remains: is this the start of something real, or just another false breakout in an environment where nothing correlates?

We don’t predict. We watch and respond.

RUT Bear Swing Update

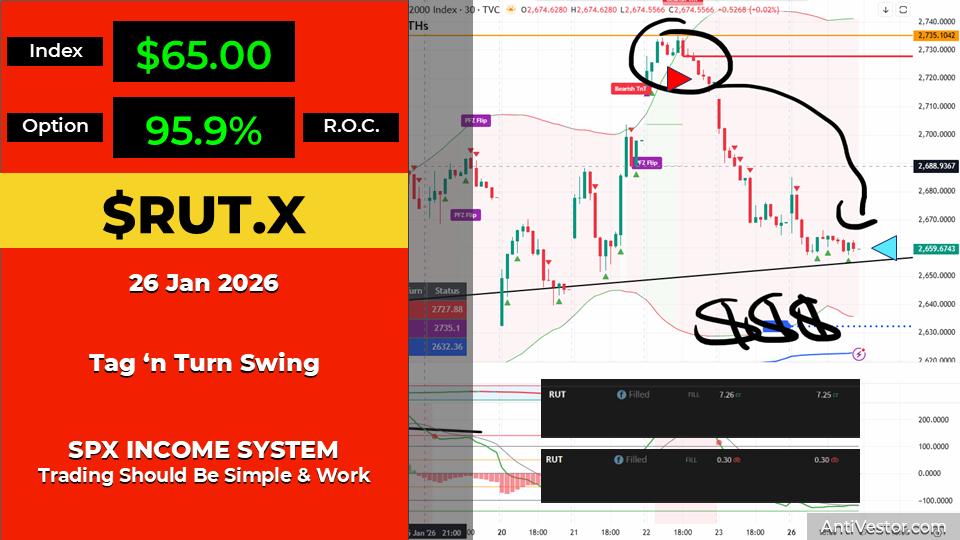

The RUT Tag ‘n Turn from 26 Jan delivered beautifully:

RUT TnT Swing: $65 index move. 95.9% ROC.

Cashed out and reloaded on the bear continuation. Target at 2635.13 remains in sight. Uncle Russell’s weekend mode continues – bearish, methodical, ignoring the drama elsewhere.

SPX bull swing and swung to the upper Bolly and looking ready for a new setup

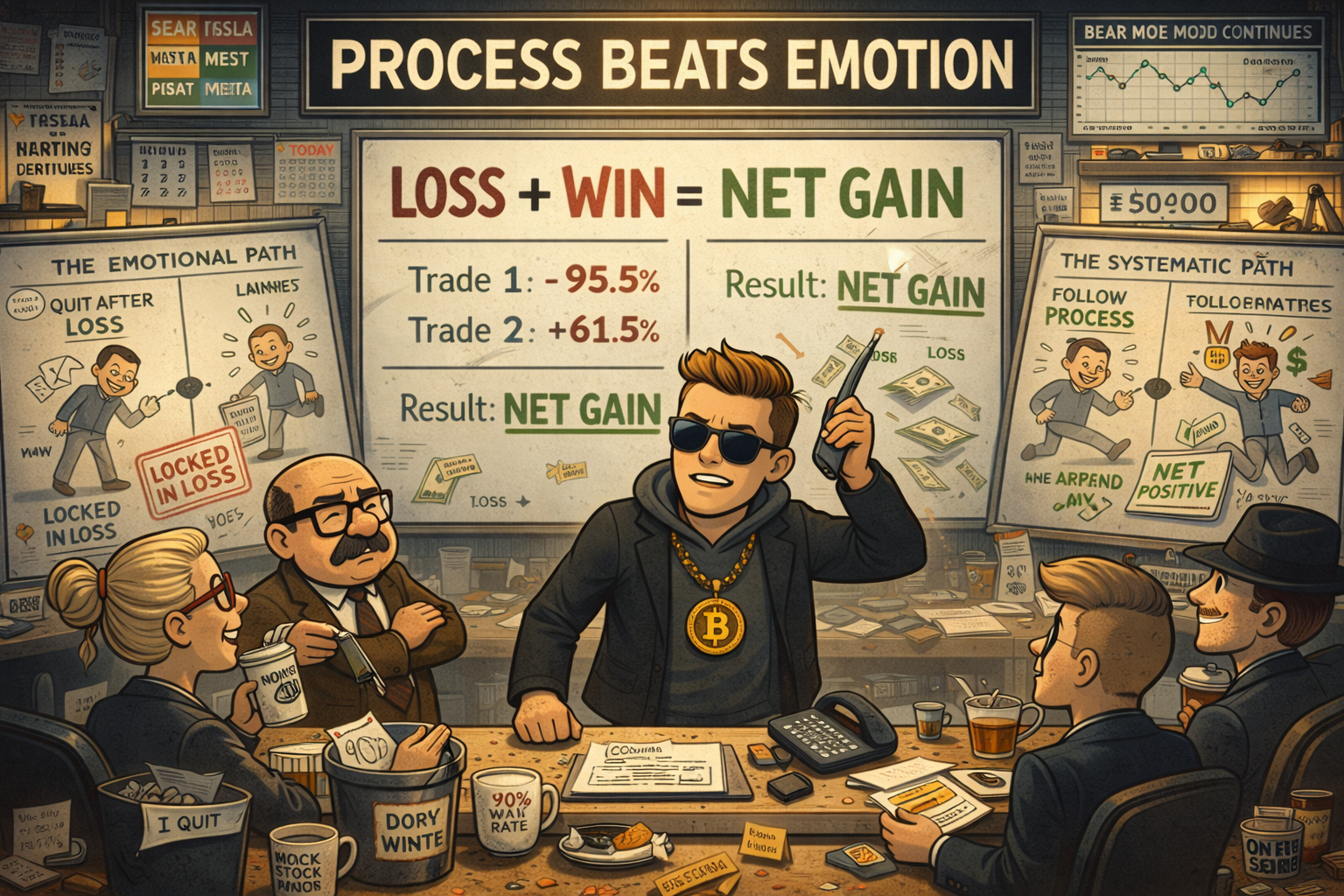

The Process Lesson

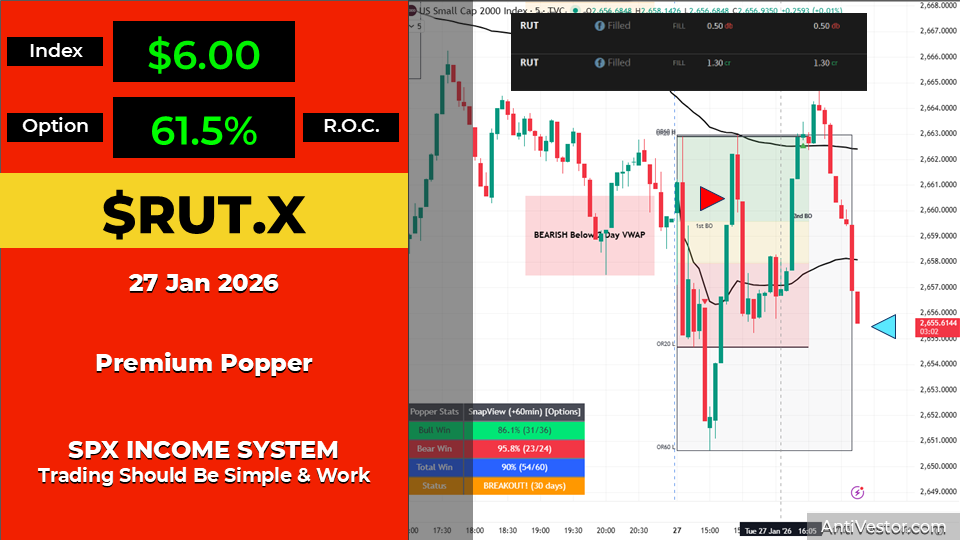

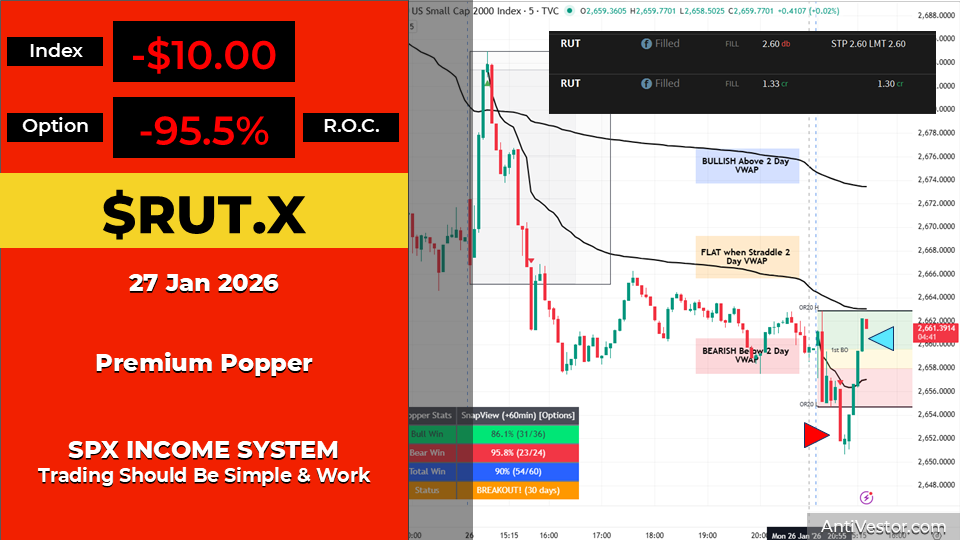

Yesterday’s Premium Popper session taught a valuable lesson:

Trade 1: Loss. -$10 index move. -95.5% ROC.

At this point, the emotional response is “fuck it, I’m done for the day.” Cut your losses. Walk away. Protect your capital and your sanity.

But that’s not how systematic trading works.

Trade 2: Win. $6 index move. 61.5% ROC.

The second trade took the edge off the loss. Combined with the swing positions, the day ended net positive.

The lesson: Follow the process. There have been plenty of days where that initial loss turned into a net profit by the end of the day – just by not quitting early.

The system doesn’t have emotions. It doesn’t get discouraged by one loss. It just takes the next valid setup.

Be like the system.

Popper Stats (30-day rolling):

- Bull Win: 86.1% (31/36)

- Bear Win: 95.8% (23/24)

- Total Win: 90% (54/60)

- Status: BREAKOUT!

One loss doesn’t break a 90% win rate system. But quitting early might mean missing the wins that follow.

RUT Swing

RUT Premium Poppers

Fed Day Playbook

2:00pm ET: Federal Funds Rate decision. Hold at 3.5%-3.75% is certain. No surprises expected.

2:30pm ET: Powell press conference. This is where it gets interesting.

What markets want to hear: Rate cut timing. Any hint of when the easing cycle begins.

What Trump wants: Cheaper money. He’s made that clear.

Wild cards: DOJ subpoena looming. Supreme Court weighing Fed Governor Cook’s removal. Political pressure on the Fed is higher than it’s been in decades.

The decision is predictable. The language is not. Watch the 2:30pm presser for any shift in tone.

After Hours Gauntlet

Tonight’s earnings after close:

Tesla: Expecting delivery pressure after 8.6% decline in 2025. AI/robotaxi narrative vs reality check.

Microsoft: $3.88 EPS expected (+20% YoY). AI capex scrutiny. Azure growth in focus.

Meta: $8.15 EPS expected (+1.6%). Metaverse losses. Reality Labs burn rate.

Three reports that could move the entire market. Or create more divergence. Probably the latter.

Expert Insights

The Process vs The Emotion

One of the most documented patterns in trading psychology is the tendency to quit after early losses. Studies show that traders who exit after first losses underperform those who continue following validated systems.

The math is straightforward: a 90% win rate system will have losing trades. If you quit after every loss, you systematically remove yourself from the winning trades that follow.

The edge isn’t in avoiding losses – it’s in ensuring you’re present for the wins that statistically follow.

Yesterday’s 1 loss + 1 win = net gain is a perfect example. The trader who quit after Trade 1 locked in a loss. The trader who followed the process ended the day positive overall and small loss when just looking at the premium poppers.

[Source: Trading psychology principle – systematic vs discretionary performance data]

In Other News…

S&P Hits Record as Dow Crashes 409 Points on Same Day

UnitedHealth beat earnings then lost $60 billion. GM missed the memo about tech dominance.

Wall Street achieved peak absurdity Tuesday: the S&P 500 set a record whilst the Dow collapsed 409 points. The culprit? UnitedHealth alone—proving one stock can drag an entire index into the abyss. Meanwhile GM surged 8.8% because apparently cars still exist.

The Beat That Killed

UnitedHealth delivered $2.11 EPS versus estimates, then promptly crashed 19.6% after guiding revenue down 2% to $439B. Humana followed with -20%, Elevance -13%, CVS -13%. When beating expectations triggers a $60B wipeout, the expectations themselves may have been the problem. That 0.09% CMS proposal continues its rampage.

Old Economy’s Revenge

GM beat $2.51 versus $2.20 expected, raised guidance to $11-$13 EPS for 2026, hiked dividends 20%, and announced a $6B buyback. Stock surged 8.8%. Turns out building physical things people actually buy remains a valid business model. Someone inform the AI capex enthusiasts.

The Great Divergence

Tech countered the healthcare massacre: Microsoft +2.2%, Micron +5.4%, Broadcom +2.4%. Tonight’s confessional brings Microsoft, Meta, and Tesla—the latter facing margin pressure whilst the former two face AI spending scrutiny. Gold above $5,100 and dollar at four-year lows suggest someone’s hedging everything.

☕ Hazel’s Take

Record highs and 409-point crashes occurring simultaneously feels less like a market and more like two parallel universes briefly touching. Fed speaks at 2 PM, Powell at 2:30, shutdown odds at 76%. Place your bets on which reality survives.

—Hazel, FinNuts

Rumour Has It…

The Financial Nuts Newsroom is processing Tuesday’s chaos…

Percy is standing between the healthcare and tech screens, looking genuinely confused. “So the S&P hit a record… whilst one of its biggest stocks had its worst day ever? How does that even work?”

Hazel doesn’t look up. “Weightings. Tech is bigger than healthcare. Math still maths.”

Mac raises his glass to the UnitedHealth chart. “Sixty billion dollars. One day. One stock. Because someone expected 4% and got 0.09%. This is why we trade systematically.”

Kash slams down a phone. “The Popper loss yesterday had me ready to walk. Then the second trade hit. Net positive. Process over emotion. Every. Single. Time.”

Wallie is drawing on his RUT chart again. “Russell doesn’t care about Fed Day. Russell doesn’t care about healthcare. Russell just keeps grinding towards target. Be like Russell.”

The newsroom collectively nods. Russell’s got the right idea.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The Single Stock Impact Phenomenon

UnitedHealth’s 19.6% drop on Tuesday removed approximately $60 billion in market capitalisation – equivalent to the entire market cap of companies like FedEx or General Motors disappearing in a single session.

Despite this, the S&P 500 hit a record high because UnitedHealth represents only about 1% of the index by weight, whilst the top 7 tech stocks (which rallied) represent over 30%.

This concentration means the S&P 500 can hit records whilst individual sectors experience massacres – a divergence that would have been impossible under more balanced index construction.

[Source: Index weighting analysis – S&P methodology]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.