16 Wins. 1 Loss. 94% Win Rate. The Range Keeps Paying.

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

What a week.

The S&P 500 touched 7,000 for the first time in history. Microsoft lost $440 billion in a single day. Apple posted record everything. Bitcoin broke its 100-week moving average. Gold rampaged past $5,500. The Fed held rates whilst everyone waited for Powell to say the magic word.

And through all of that chaos? We just traded the range.

Same range we’ve been trading since October. Same boundaries. Same setups. Same systematic approach that doesn’t care whether Microsoft’s crashing or Apple’s soaring – because we’re not predicting headlines, we’re trading price levels.

The result? 17 trades. 16 wins. 1 loss. 94.1% win rate.

Tuesday tried to shake us. First trade of the day stopped out. The emotional response says quit, protect your capital, walk away. But that’s not how systematic trading works. We took the next valid setup. Recovered most of the loss. Ended the day net positive with the swings.

That one loss? It’s not hidden in this review. It’s highlighted. Because the lesson isn’t “never lose” – the lesson is “don’t quit after you do.”

Wednesday brought Fed Day. The market held its breath for Powell. We collected three wins during FOMC because premium sellers don’t care about press conferences – we care about theta decay and elevated IV crushing post-announcement.

Thursday delivered the trade of the week. SPX Tag ‘n Turn combined with an overnight Bed ‘n Breakfast swing. $90 index move. 90% ROC. The V-shaped entry at range highs we’d been discussing all week played out exactly as the pattern suggested.

Friday? Five trades. Five wins. Strong finish to close out January.

Here’s the full breakdown of every trade, every lesson, and why the range keeps paying…

Market DeBriefing:

Total Trades: 17 Wins: 16 Losses: 1 Win Rate: 94.1%

Strategy Breakdown:

- Premium Poppers (scalps): 14 trades (13 wins, 1 loss)

- Tag ‘n Turn Swings: 2 trades (2 wins)

- Bed ‘n Breakfast (overnight): 1 trade (1 win)

Instruments:

- SPX: 7 trades

- RUT: 10 trades

Average ROC (winners): 67.2% Best Trade: SPX TnT + BnB – 90% ROC ($90 index move) Only Loss: RUT Premium Popper – 95.5% loss (Tuesday)

The Week in Context

This was a week of contained chaos. The indexes continued their range-bound behaviour that’s persisted since October, bouncing between upper and lower boundaries like a ping pong match that nobody’s winning.

Key Market Themes:

- S&P touched 7,000 for the first time (Wednesday), then immediately retreated

- Microsoft lost $440 billion in a single day (Thursday) – worst since March 2020

- Apple posted record $143.8B revenue (Thursday)

- Gold rampaged to $5,500+ before retreating

- Bitcoin broke its 100-week moving average, crashed to $83K

- Fed held rates (Wednesday) – premium sellers collected regardless

- RUT head and shoulders pattern played out beautifully

The divergence between indexes was extreme. SPX nudging all-time highs whilst RUT broke down. Tech celebrating whilst healthcare crashed. The “schizophrenic market” theme from Tuesday’s briefing proved prescient.

Daily Breakdown

MONDAY 26 JAN 2026

Market Context: Gold rampage to $5,000+. Indexes gapped lower then climbed. RUT held lows whilst others rallied. Last week’s bear moves rolling into Monday.

TnT Status: SPX Flat (awaiting setup) | RUT Bearish below 2727.88

| Trade | Instrument | Strategy | Index Move | ROC | Result |

|---|---|---|---|---|---|

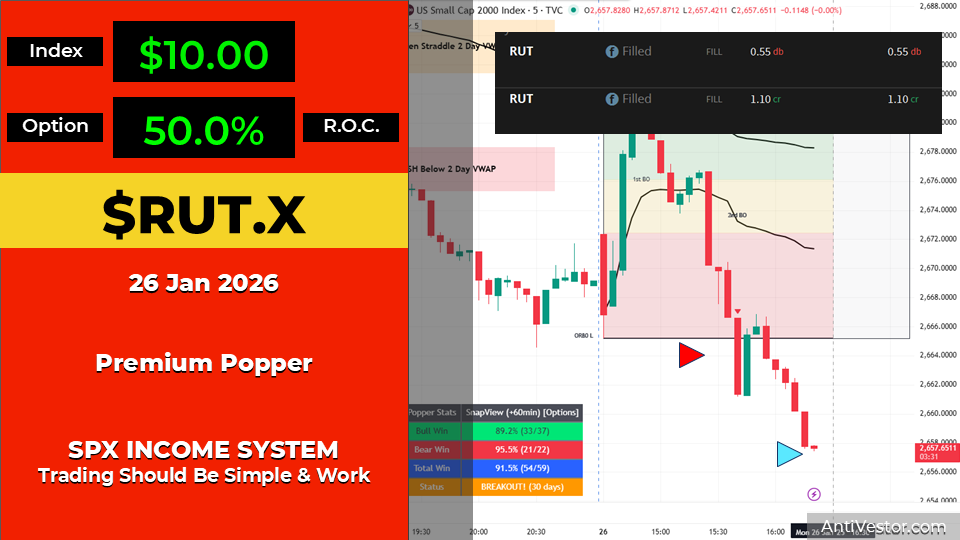

| 1 | RUT | Premium Popper | $10.00 | 50.0% | ✅ WIN |

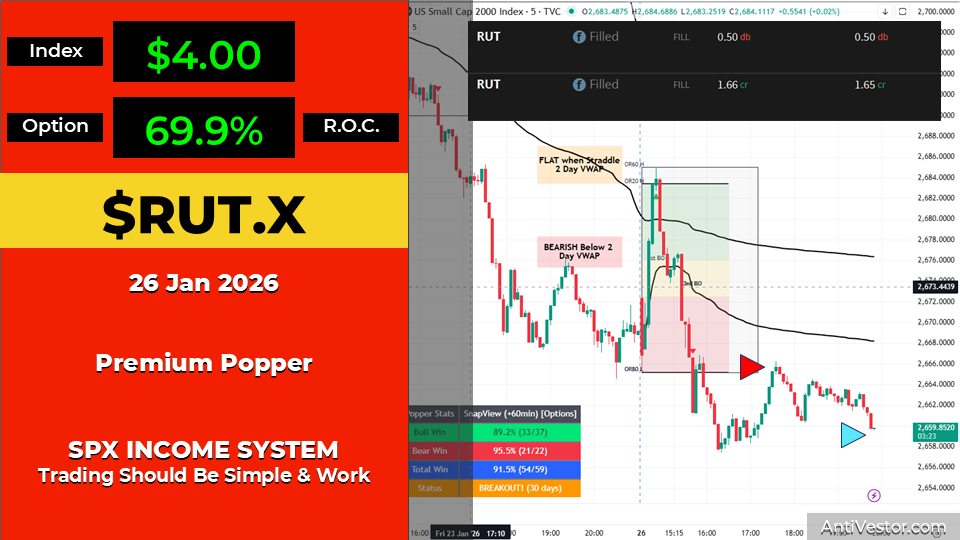

| 2 | RUT | Premium Popper | $4.00 | 69.9% | ✅ WIN |

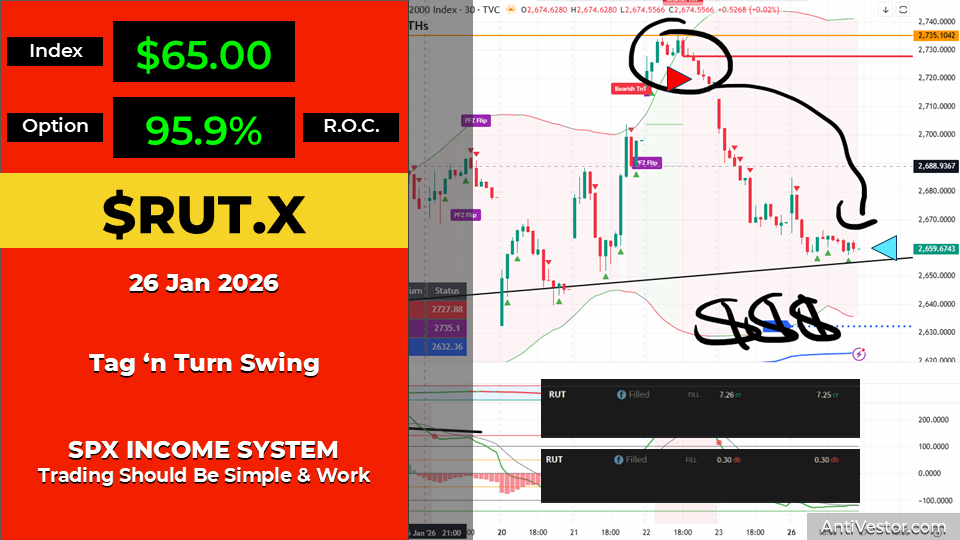

| 3 | RUT | Tag ‘n Turn Swing | $65.00 | 95.9% | ✅ WIN |

Session Notes:

- Both Poppers caught the bear break off the 5-day VWAP

- TnT swing entered at range highs, caught the initial bear leg

- RUT outperformed for scalping whilst SPX chopped

Day Result: 3/3 wins | Best: TnT 95.9%

TUESDAY 27 JAN 2026

Market Context: Gap down, rally all night, rally all day – except Uncle Russell who held lows. Nasdaq threw “hissy fit” breakout attempt. Indexes completely divergent. “Schizophrenic markets” theme established.

TnT Status: SPX Flat | RUT Bearish below 2727.88

| Trade | Instrument | Strategy | Index Move | ROC | Result |

|---|---|---|---|---|---|

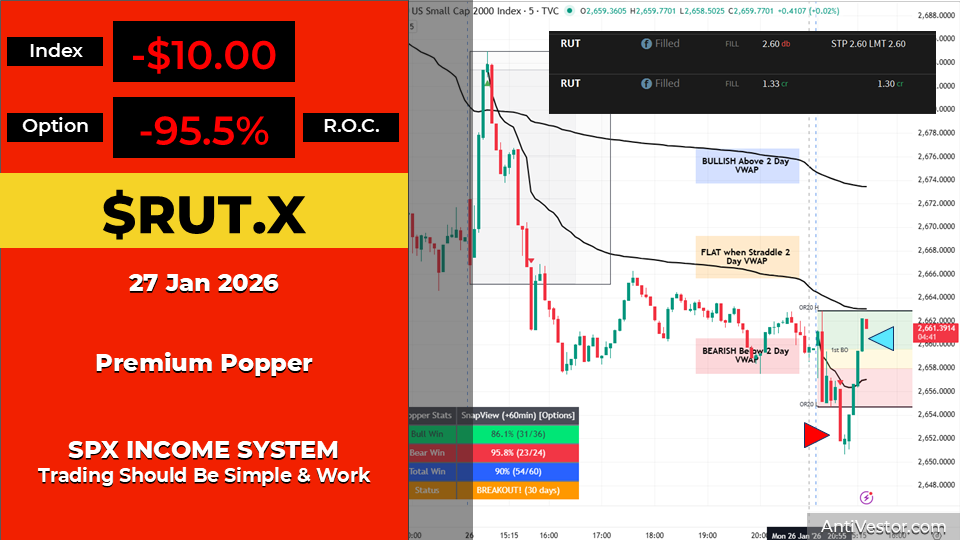

| 1 | RUT | Premium Popper | -$10.00 | -95.5% | ❌ LOSS |

| 2 | RUT | Premium Popper | $6.00 | 61.5% | ✅ WIN |

Session Notes:

- First trade stopped out – the only loss of the week

- Process Lesson: Didn’t quit after first loss. Took second valid setup.

- Second trade recovered most of the loss

- Combined with swing positions = net positive day

- No third opportunity before cutoff time

Day Result: 1/2 wins | Net: Small gain (with swings)

Key Learning: “It’s very easy to think fuck it and quit the day after a first loss – the second trade took the edge off the loss and on this occasion I didn’t see a 3rd opportunity before the cut off time – but there have been plenty of days in the past where that initial loss trade has turned into a net profit for the day just by following the process.”

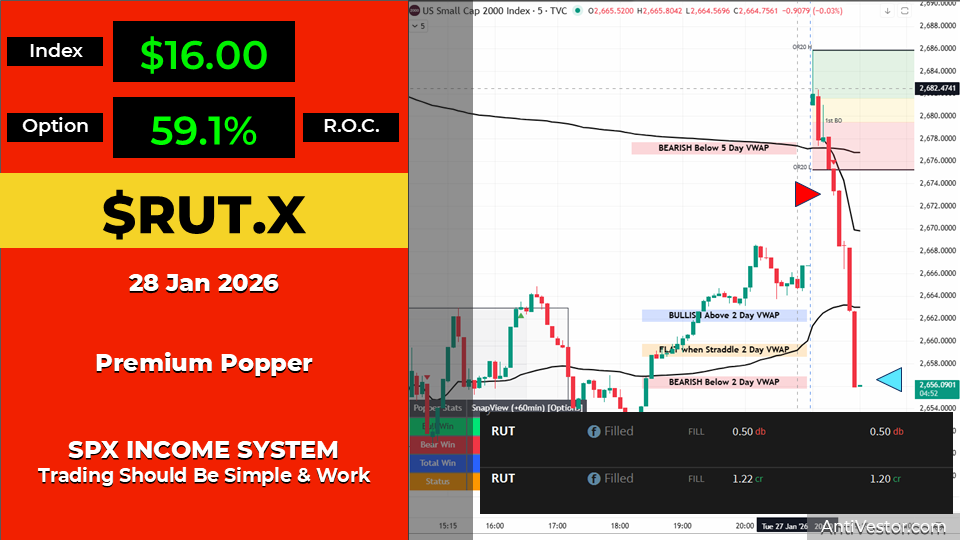

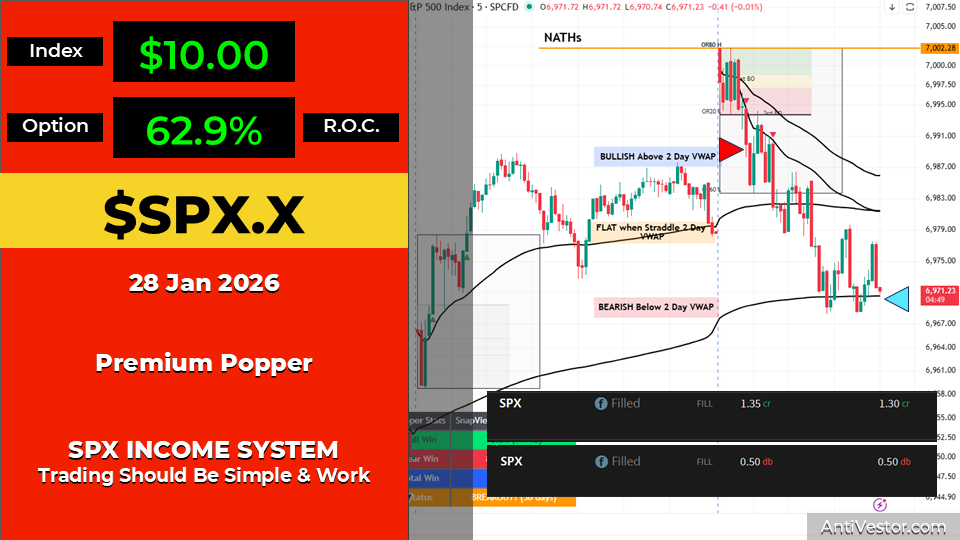

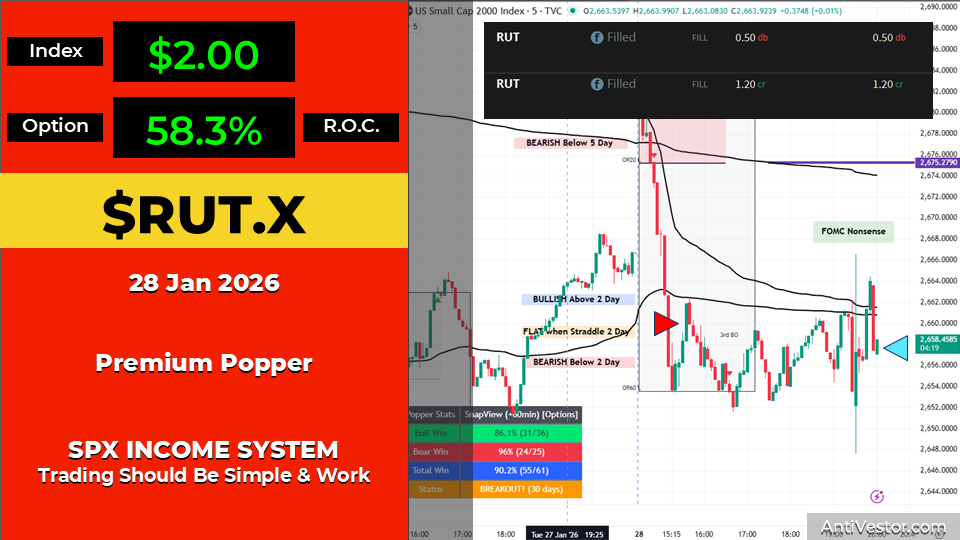

WEDNESDAY 28 JAN 2026

Market Context: Fed Day. S&P record 6,978 whilst UnitedHealth crashed 19.6% ($60B wiped). Healthcare massacre. Tech celebrated. Two completely different markets, same day.

TnT Status: SPX Flat | RUT Bearish

| Trade | Instrument | Strategy | Index Move | ROC | Result |

|---|---|---|---|---|---|

| 1 | RUT | Premium Popper | $16.00 | 59.1% | ✅ WIN |

| 2 | SPX | Premium Popper | $10.00 | 62.9% | ✅ WIN |

| 3 | RUT | Premium Popper | $2.00 | 58.3% | ✅ WIN |

Session Notes:

- Three trades during group calls – all winners on Fed Day

- Trade 1: RUT bear break off 5-day VWAP

- Trade 2: SPX bear break off the new all-time high

- Trade 3: RUT VWAP retest – meandered sideways, profits from time decay

Day Result: 3/3 wins | Best: SPX 62.9%

Key Learning: “What about FOMC? Make a decision – trade ’em or don’t trade ’em – it makes little difference to premium sellers.” Trade 3 proved this perfectly – price went sideways during FOMC nonsense, still collected 58% ROC from theta decay alone.

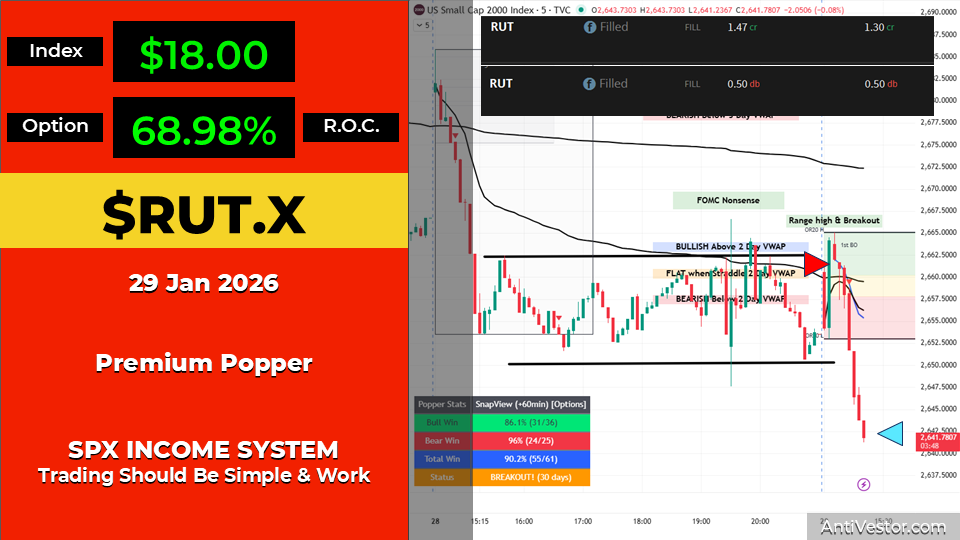

THURSDAY 29 JAN 2026

Market Context: S&P touched 7,000 intraday then closed flat (peak 2026 energy). Meta +10% on $135B “superintelligence” bet. Microsoft -7% on “only” 39% Azure growth. SAP -14% (AI existential crisis). Gold hit $5,500.

TnT Status: SPX unofficially bearish at range highs | RUT bearish, H&S playing out

| Trade | Instrument | Strategy | Index Move | ROC | Result |

|---|---|---|---|---|---|

| 1 | SPX | Premium Popper | $30.00 | 62.96% | ✅ WIN |

| 2 | RUT | Premium Popper | $18.00 | 68.98% | ✅ WIN |

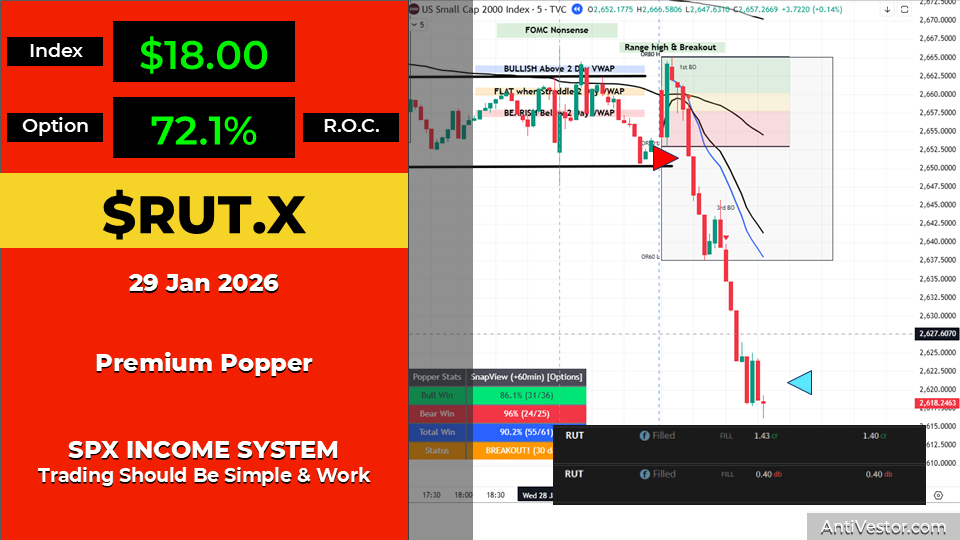

| 3 | RUT | Premium Popper | $18.00 | 72.1% | ✅ WIN |

| 4 | SPX | TnT + BnB Overnight | $90.00 | 90.0% | ✅ WIN |

Session Notes:

- Best day of the week – four trades, four wins

- SPX Popper caught bear break from range high resistance

- Both RUT Poppers caught the H&S breakdown continuation

- TnT + BnB overnight swing: V-shaped entry at range highs delivered beautifully

- $90 index move on the swing = trade of the week

Day Result: 4/4 wins | Best: TnT+BnB 90%

FRIDAY 30 JAN 2026

Market Context: Bear dreams came true then reversed overnight. Microsoft -10% ($440B gone). Apple record $143.8B. Bitcoin broke 100-week MA. Bull bear ping pong continues. Same range since October.

TnT Status: SPX making bear move | RUT breaking down, H&S target in sight

| Trade | Instrument | Strategy | Index Move | ROC | Result |

|---|---|---|---|---|---|

| 1 | SPX | Premium Popper | $20.00 | 58.3% | ✅ WIN |

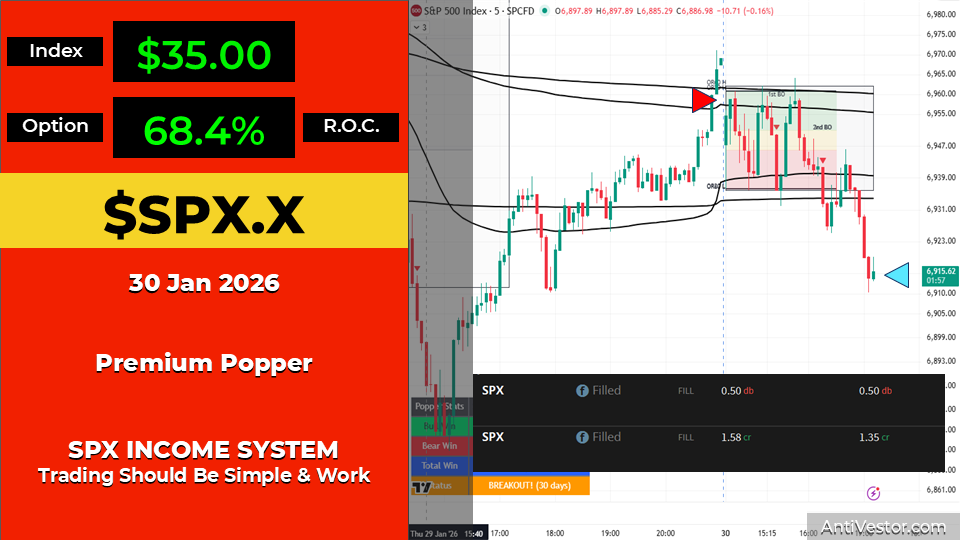

| 2 | SPX | Premium Popper | $35.00 | 68.4% | ✅ WIN |

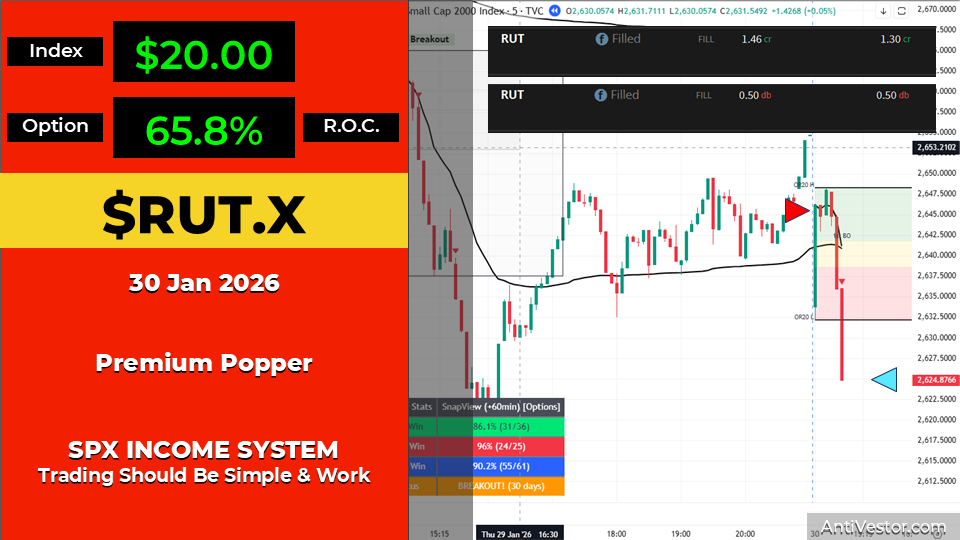

| 3 | RUT | Premium Popper | $20.00 | 65.8% | ✅ WIN |

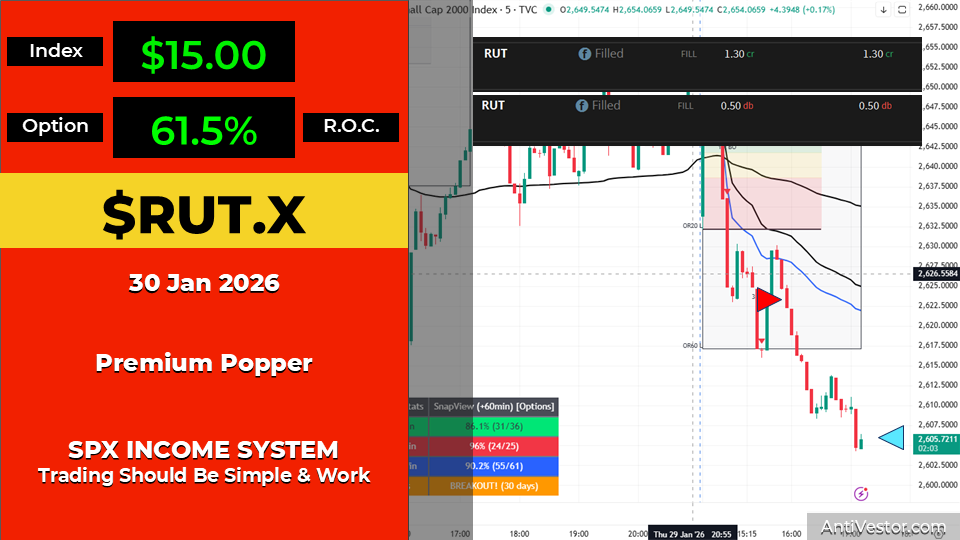

| 4 | RUT | Premium Popper | $15.00 | 64.5% | ✅ WIN |

| 5 | RUT | Premium Popper | $15.00 | 61.5% | ✅ WIN |

Session Notes:

- Five Poppers, five wins – strong finish to the week

- SPX trades caught the bear continuation from range highs

- RUT trades caught the H&S breakdown – pattern working beautifully

- Multiple opportunities as volatility remained elevated

Day Result: 5/5 wins | Best: SPX 68.4%

Strategy Performance Summary

Premium Poppers (Morning Scalps)

| Metric | Value |

|---|---|

| Total Trades | 14 |

| Wins | 13 |

| Losses | 1 |

| Win Rate | 92.9% |

| Average Winner ROC | 63.0% |

| Average Index Move (wins) | $14.85 |

| Largest Winner | $35 move / 69.9% ROC |

| Only Loss | $10 move / 95.5% loss |

By Instrument:

- SPX Poppers: 5 trades, 5 wins (100%)

- RUT Poppers: 9 trades, 8 wins (88.9%)

Tag ‘n Turn Swings

| Metric | Value |

|---|---|

| Total Trades | 2 |

| Wins | 2 |

| Win Rate | 100% |

| Average ROC | 93.0% |

| Average Index Move | $77.50 |

Trades:

- RUT TnT (26 Jan): $65 move, 95.9% ROC – Bear swing from range highs

- SPX TnT + BnB (29 Jan): $90 move, 90.0% ROC – V-shaped entry at upper boundary

Key Lessons This Week

1. The Range Keeps Paying

Price has been moving between upper and lower range boundaries since October. The playbook remains simple:

- At upper boundary → assess for breakout or reversal

- No breakout → fade towards range lows

- At lower boundary → opposite logic

This week proved it again. SPX touched 7,000 (upper boundary), immediately reversed. RUT head and shoulders at range highs broke down exactly as the pattern suggested.

2. Process Over Emotion

Tuesday’s session was the textbook example. First trade: loss. Emotional response says quit. Process says take the next valid setup. Second trade recovered most of the loss. Day ended net positive with swings included.

“The system doesn’t have emotions. It doesn’t get discouraged by one loss. It just takes the next valid setup. Be like the system.”

3. Premium Sellers Don’t Care About Fed Days

Wednesday proved this definitively. Three trades during FOMC. Three wins. Trade 3 went sideways during Powell’s presser and still collected 58% ROC from time decay.

The decision (hold) was predictable. The language created some volatility. Premium sellers profit from elevated IV crushing post-announcement – direction doesn’t matter.

4. Divergence Creates Opportunity

The indexes weren’t just divergent this week – they were schizophrenic. SPX at all-time highs. RUT breaking down. Dow bleeding from healthcare. Nasdaq throwing tantrums.

This divergence created opportunities in both instruments. RUT’s bearish trend provided consistent short setups. SPX’s range resistance provided fade opportunities. Both paid.

5. The TnT + BnB Combination

Thursday’s $90 move / 90% ROC trade highlighted the power of combining strategies:

- TnT identified the bearish setup at range highs

- BnB overnight component captured the gap move

- V-shaped entry pattern (6 Money Making Patterns) provided the trigger

Swings capture the bigger moves. Poppers collect consistent daily income. Together they compound.

Week Statistics

| Metric | Value |

|---|---|

| Trading Days | 5 |

| Total Trades | 17 |

| Total Wins | 16 |

| Total Losses | 1 |

| Win Rate | 94.1% |

| Perfect Days | 4 (Mon, Wed, Thu, Fri) |

| Best Day | Thursday (4/4, including 90% TnT) |

| Total Index Points Captured | $391 |

| Average Trades/Day | 3.4 |

By Day of Week:

- Monday: 3/3 (100%)

- Tuesday: 1/2 (50%) – only loss day

- Wednesday: 3/3 (100%)

- Thursday: 4/4 (100%)

- Friday: 5/5 (100%)

Looking Ahead

What Worked:

- Bear setups at range highs

- RUT H&S pattern recognition

- Fed Day premium selling

- Process discipline after losses

- TnT + BnB swing combinations

What to Watch:

- SPX remains at upper range boundary – continue favouring reversals until breakout confirmed

- RUT H&S target around 2,630 area – bear swings remain favoured

- Month-end rebalancing may create additional volatility

- February could see continuation of range-bound behaviour

System Status:

- Premium Popper: BREAKOUT (30-day stats strong)

- Tag ‘n Turn: Working beautifully in range environment

- Overall: The range keeps paying. Stay systematic.

Final Thought

“When you know where the range boundaries are, you don’t need to predict direction. You just need to be positioned correctly when price reaches them.”

This week delivered 16 wins from 17 trades. Not because we predicted the market. Not because we knew Microsoft would crash or Apple would surge. But because we:

- Identified the range boundaries

- Took setups at those boundaries

- Followed the process regardless of news

- Didn’t quit after the one loss

Same system. Same approach. Consistent results.

Pop Pop.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.