Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

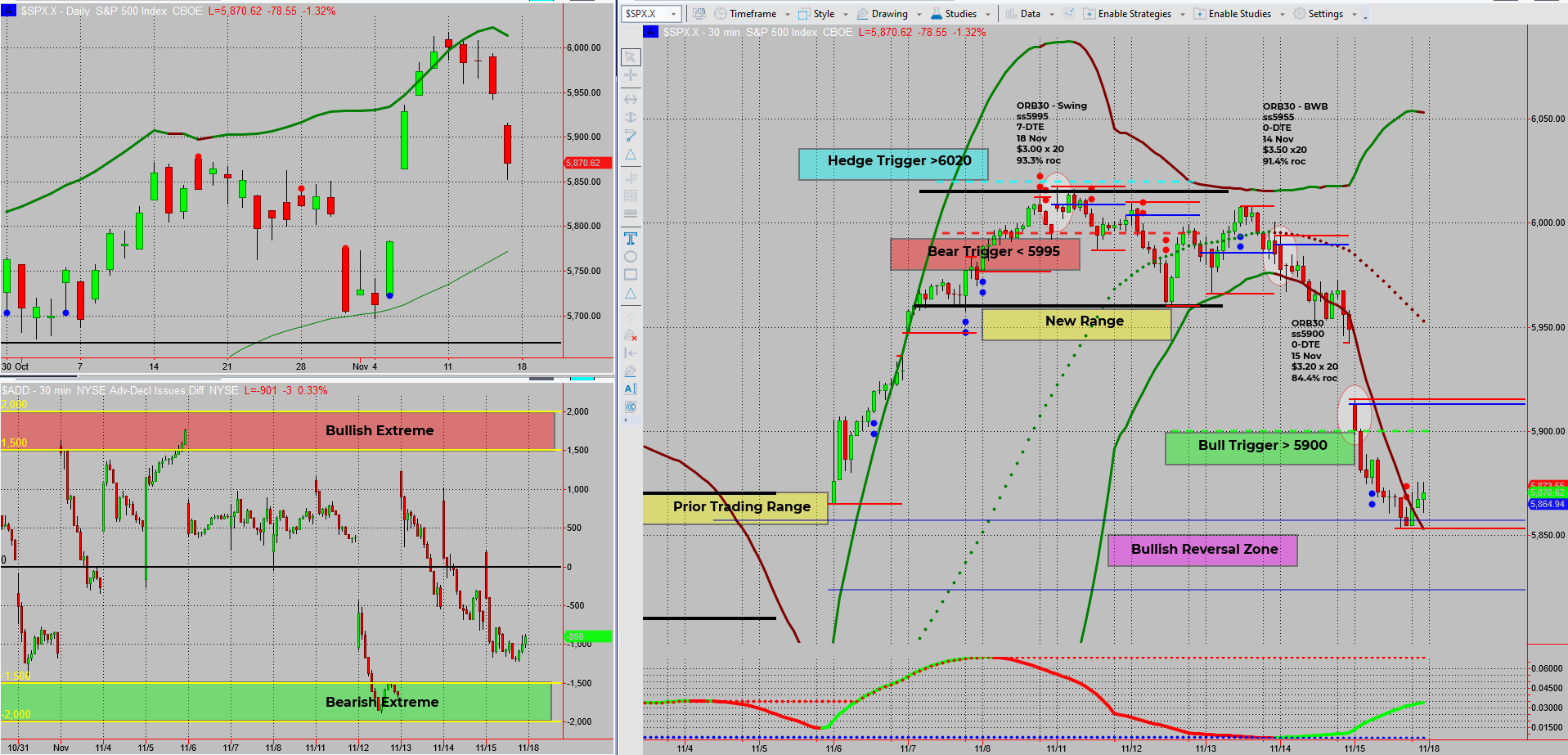

SPX played out exactly as anticipated this week, with a gap and go move forming an Island Reversal pattern—typically a bearish sign. The “Tag ‘n Turn” setup rewarded my traders with solid profits. Now, let’s look ahead and plan for what’s next.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

The SPX market didn’t disappoint last week.

That exciting gap and go move drew traders’ attention, showcasing an Island Reversal on the daily charts. This pattern often hints at a bearish shift, and while it was my less likely scenario, my “Tag ‘n Turn” setup and income swings caught the action perfectly.

But now, it’s time to shift gears.

Despite the recent bearish success, I’m eyeing bullish opportunities from this level, planning for strength into year-end and potentially the start of next year. This is where experience meets strategy – knowing when to pivot and hunt for new opportunities.

Here’s what’s on my radar:

- Watching key levels for potential stock swings.

- Ready to pounce on entry setups when conditions align.

- Keeping an eye on any surprise market moves.

As we enter this next phase, it’s all about staying nimble and ready to adapt.

Fun Fact

Did you know that the SPX has historically shown an upward trend from mid-November to year-end? Dubbed the “Santa Claus Rally,” this period sees more holiday cheer in the markets as traders and investors anticipate stronger returns.

The “Santa Claus Rally” isn’t just folklore. Over the past few decades, the SPX has seen positive returns during the last week of December and the first two trading days of January. This trend, attributed to festive optimism and new fiscal-year fund strategies, is something traders love to capitalize on. Just another reason to keep your eyes on those bullish plays as we head into the holiday season!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece