Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

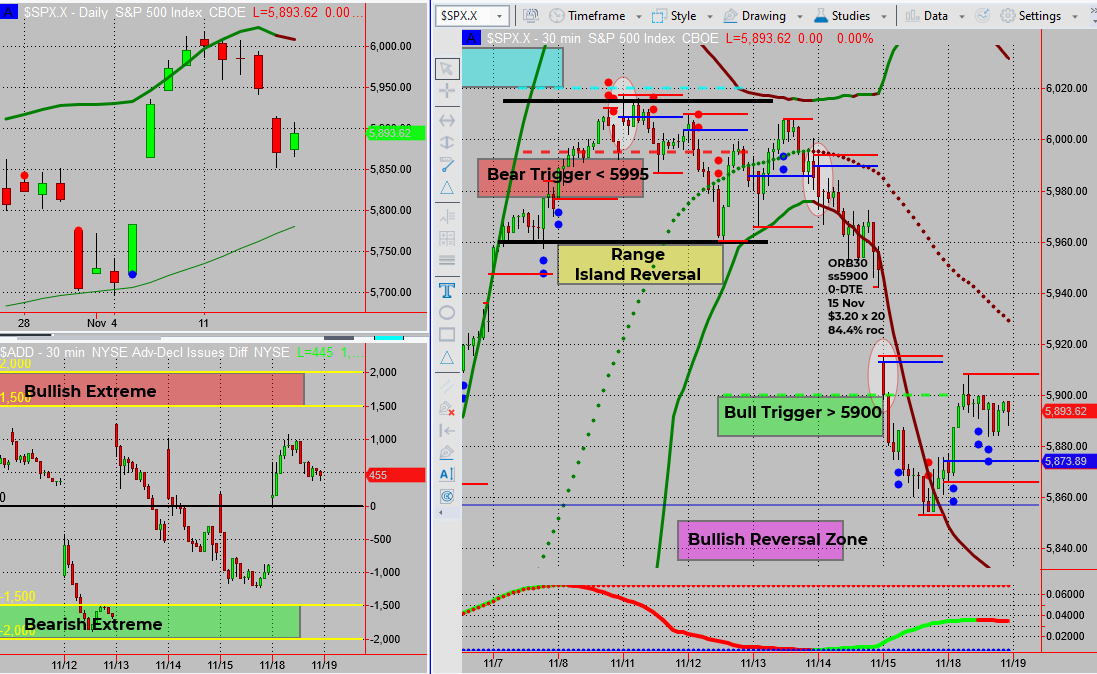

SPX is moving exactly as anticipated! With no red flag news until Thursday, we’re kicking off the week with a sideways shuffle and an inside day. Overnight futures are nudging back towards recent lows, reinforcing a slight bearish tilt that could make bear traders cheer. But watch out — this could set the stage for a reversal!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

The markets are ticking along as expected. With no major news until Thursday, SPX began the week printing an inside day — a classic sign of market indecision.

- Overnight Futures: Already showing a dip towards recent lows.

- Bearish Lean: The sideways drift has a subtle downward bias.

- Bullish Reversal Zone: Bears might get excited, but this is exactly where I start looking for a turnaround.

- Entry Strategy: If we push deeper, I might jump in with bullish income swings ahead of my usual triggers.

The market often teases traders with setups that seem too good to be true. This week’s potential deeper dive could turn into a textbook case of bear traps and reversals.

The question is: Will you be ready to pivot when the time comes?

Fun Fact

Did you know that the S&P 500 has only experienced an annual decline about 30% of the time since its inception in 1957? Talk about resilience! This index has historically shown that long-term patience pays off.

While the S&P 500 has had its share of turbulent years, its consistent growth over decades makes it a benchmark for long-term investors. Even during periods of economic uncertainty, it tends to recover and continue its upward trend, highlighting the strength of the U.S. economy and investor confidence.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece