Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

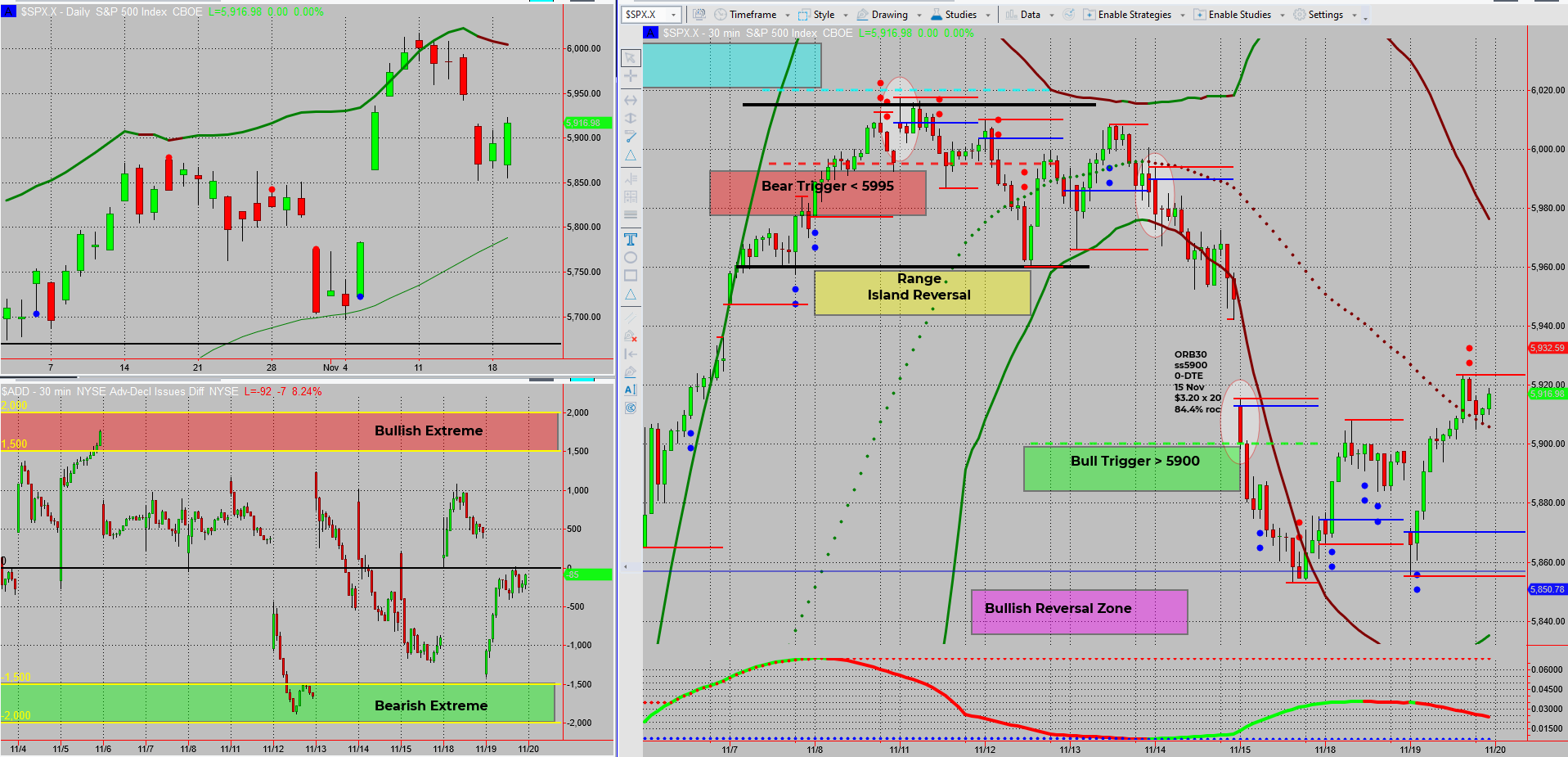

The market’s theatrics didn’t disappoint on Tuesday! While S&P futures danced deeper into my bullish reversal zone, the main SPX cash index stubbornly held its ground, teasing us with a double bottom. Let’s dive into what this means for the days ahead.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

Tuesday was a day of almosts. Futures dipped just slightly deeper into the bullish reversal zone but stopped short of a big move. Meanwhile, SPX itself decided to throw a curveball, planting a double bottom—a move often signalling exhaustion for bearish momentum.

- Daily Chart Signals: SPX is showing an inside/outside bar setup, often seen as a bullish signal.

- Bear Trap Alert: The flush down through Monday’s low might just be the bear trap we were expecting, leaving some bear traders scratching their heads.

- The Bull Case: With bullish signals stacking up, the stage is set for SPX to rally.

So, what’s next?

I’m slipping into my De Niro mode, going full Raging Bull. All signs point toward a strong push upward, and I’m ready to ride the wave.

Fun Fact

The SPX’s largest single-day gain ever was a whopping +12.86% on October 13, 2008. That’s like the market saying, “Hold my beer” during the height of the financial crisis.

This record-breaking gain came during an era of extreme volatility. It shows how even in the darkest financial moments, the markets can surprise with massive upward swings. Traders who kept their heads often reaped the rewards!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece