Why ignoring real-time news makes me a better trader (and human)

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

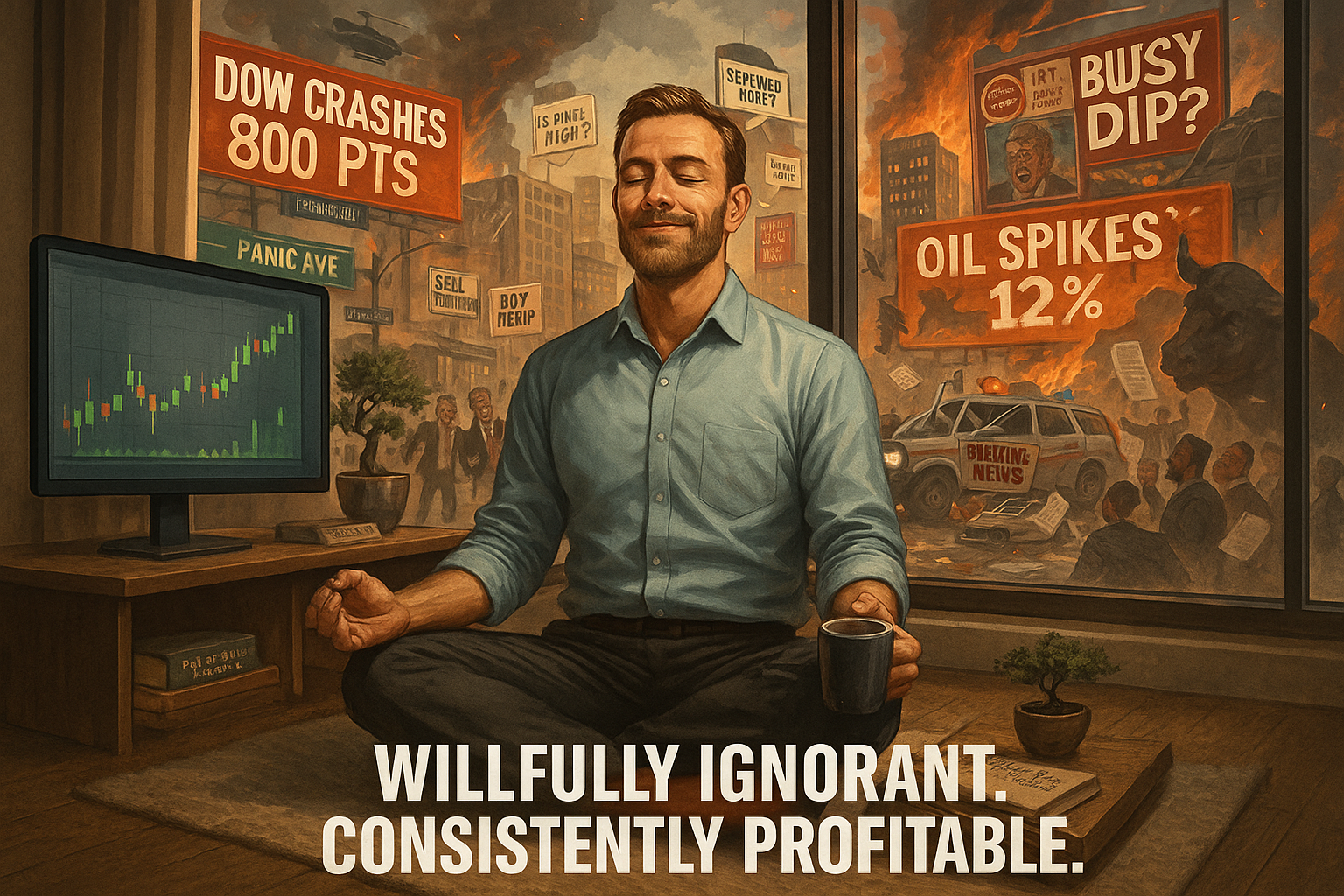

Confession Time: I’m Willfully Ignorant (And Proud)

I haven’t watched live market news in over 20 years. Not once.

While the financial world races to “break” every story, I’ve made it a principle to not even glance until the dust settles. It’s not because I’m lazy. It’s because I’m strategic.

The more I ignore, the more I win. The less I know in the moment, the more I understand what actually matters.

And the quieter my head – the clearer my trades.

SPX. 30 Minutes. One Trade. Job Done.

Trade less. Profit more. This isn’t trading… it’s income engineering.

The Origin Story: Stop Guessing, Start Winning

Like every new trader, I started by devouring every market-moving headline.

Fed minutes. Crude oil inventories. Apple’s latest earnings whisper. I tried to make sense of it all – connecting dots, chasing catalysts, drawing conclusions. I wanted to know why everything moved.

And I missed everything that actually mattered.

Eventually, I gave up. Gave in. And switched gears.

I stopped trying to guess the “why.”

I started focusing on price, patterns, and probability.

I built rules. A system. A process.

And results followed.

Why Too Much Info Kills Performance (and Sanity)

Real-time news creates a real-time panic loop.

-

The brain gets hit with a headline

-

It triggers emotional response

-

You enter a state of urgency over strategy

The dopamine hit from “breaking news” feels productive – but it’s a tax on your focus.

In reality, it’s like trying to trade with a fog machine in your head.

I don’t need that fog. I need signals. I need systems. I need sanity.

My “After the Fact” Rule: Read News Like a Detective, Not a Doomsday Cultist

Let’s be real. I do keep my ear to the ground.

But on my terms.

When I want to.

Not while the chaos is unfolding.

I’ll skim a few summaries after the market closes or over coffee the next day. That’s it.

No live squawk boxes. No breaking alerts. No drama.

I’ve trained myself to scan for sentiment, patterns, and price behavior – not narratives.

The Sanity Bonus: Ignorance = Mental Freedom

This discipline expanded beyond trading.

I don’t follow politics in real time.

I mute crisis-hungry headlines.

I skip the outrage Olympics.

My stress levels are lower.

My thinking is clearer.

And I don’t start the day with cortisol and caffeine coursing through my bloodstream.

Willful ignorance is not avoidance.

It’s selective awareness.

Systems Don’t Need News – They Need Rules

The SPX Income System doesn’t care about CPI, Powell, or the latest Middle East panic tweet.

It cares about:

-

A 30-min Pulse Bar

-

A $5 wide spread

-

Defined risk

-

High probability profit zones

I trade a single bar.

Place a credit spread.

Collect consistent income.

No news interpretation.

No fundamental thesis.

No “gut feel” nonsense.

I’m not here to predict. I’m here to profit.

The Trader’s Guide to Willful Ignorance

Want to copy this edge?

Step 1 – Turn off all real-time notifications.

Step 2 – Read news after the fact, never during live markets.

Step 3 – Replace info consumption with data-based decisions.

Step 4 – Build a trading system so tight, it doesn’t need noise.

Step 5 – Trust the setup more than the story.

You’ll be shocked how clear things get.

The Real Edge: Control What Enters Your Mind

Most traders try to win by out-analyzing the market.

I win by protecting my attention.

That’s the hidden edge.

You don’t need to know more.

You need to do less, better.

And let the system do the work.

So yes – I’m willfully ignorant.

And I’ve never been more consistent, confident, and calm.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.