Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Last week’s market action was like watching a cat decide whether to jump off a shelf—hesitation, commitment, regret, and then chaos.

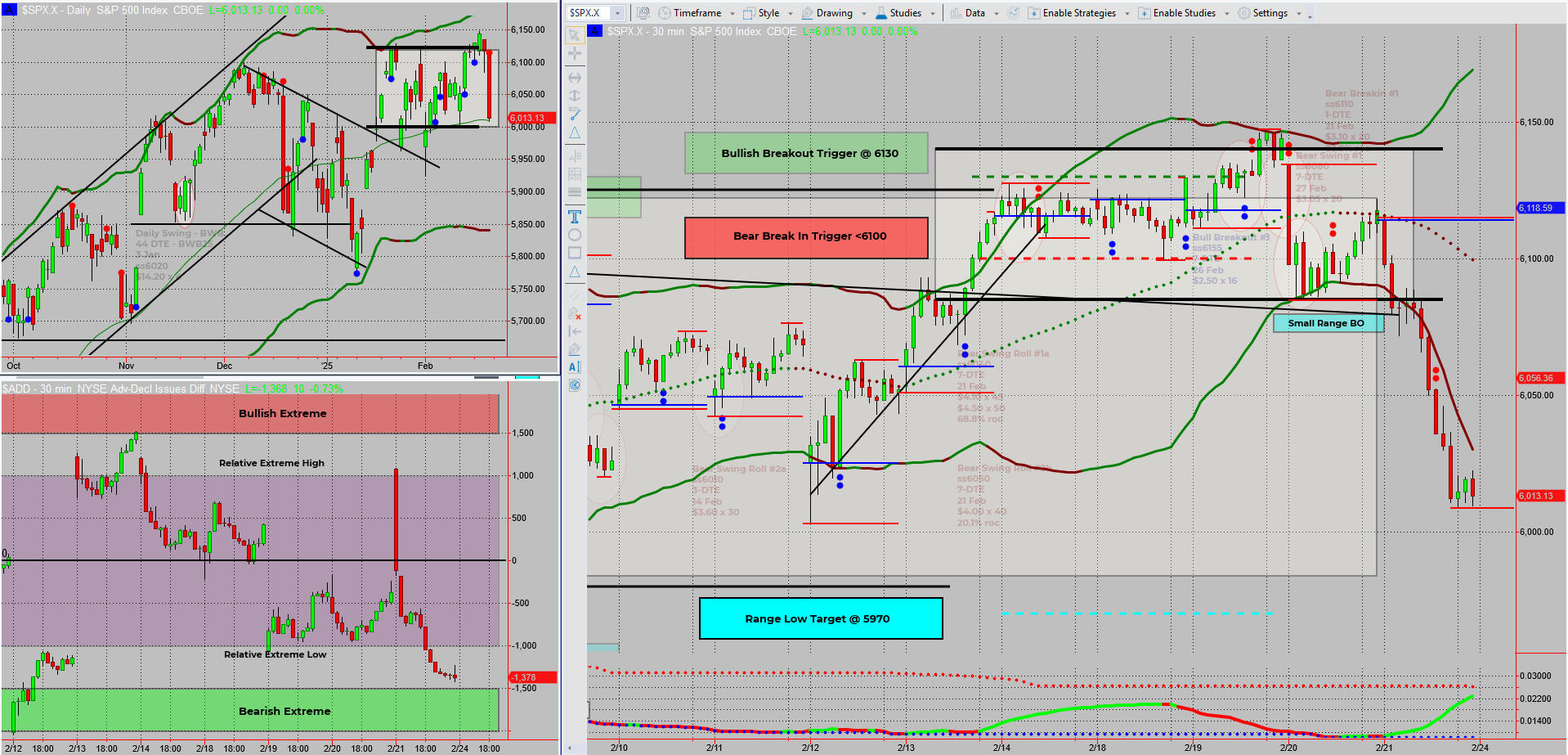

SPX pushed through the bull trigger on Wednesday, only to whip back through the hedge & bear trigger, finally showing some real movement on Friday. But before we get too excited, SPX is still stuck inside a larger range, with 6000 as the next key battleground.

Will we see a range breakout or another rejection?

Let’s dive in.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

SPX Moves – But Is It Just Another Range Play?

Last week gave us plenty of action, but SPX hasn’t truly escaped its larger range yet.

What happened last week?

- SPX broke the bull trigger on Wednesday

- Immediately flipped back through the hedge & bear trigger ♂️

- Friday’s move finally opened things up

Now, we’re eying 6000 as the next decision point.

Two potential setups:

- ✅ Range Reversal – Price rejects 6000 and moves back inside the range

- ✅ Breakout Trade – SPX clears 6000, confirming a new leg up

Either way, I’ll be watching closely for the next trade setup.

VIX Says ‘No Crash… Yet’

The volatility index (VIX) remains below 20, meaning:

- No imminent crash signals

- Fear is elevated but not panicking

- Still room for surprises, but not full-blown chaos (yet!)

If VIX jumps past 20 and keeps climbing, then we’ll talk about more extreme downside risk.

Overnight Futures – A Small Bounce, But No Turn Yet

Futures are slightly green, but they don’t confirm:

- A major bullish turn ❌

- A full-blown breakdown ❌

Right now, it’s more noise than signal.

What’s Next?

I remain bearish on my income swing trades

Waiting for confirmation—either:

- Bullish reversal (v-shaped price action shift)

- Bearish breakdown (clean range break below 6000)

For now, it’s another waiting game—but one that could pay off big when the next major move arrives.

Fun Fact

Did you know? In 2010, the Flash Crash wiped out nearly $1 trillion in market value in just 36 minutes, only to recover almost entirely by the end of the day. The culprit? A single trader’s algorithm running wild.

The Lesson? Sometimes, market chaos isn’t about fundamentals—it’s just a rogue algorithm losing its mind.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece