Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

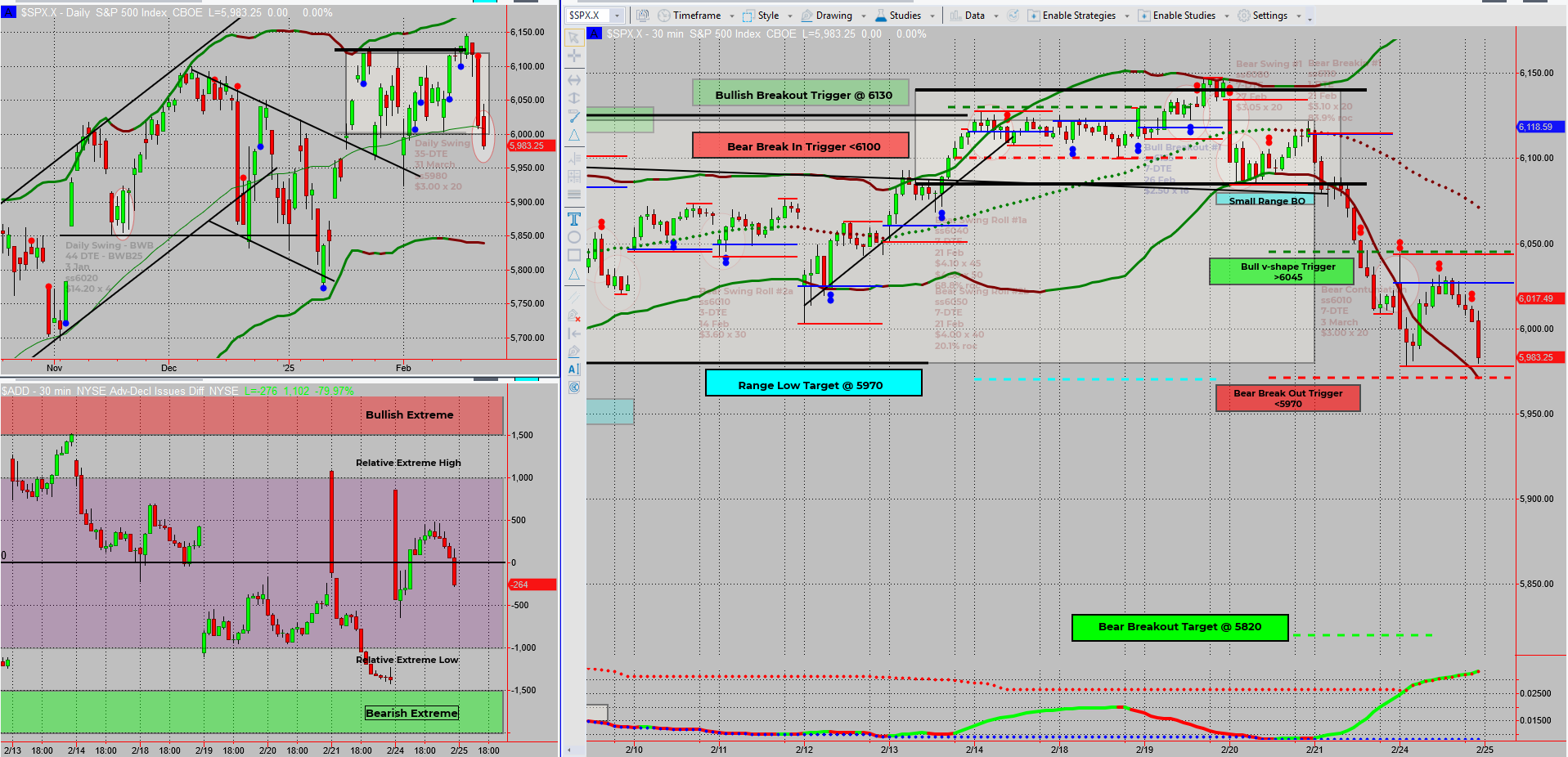

Monday came in swinging, continuing Friday’s move and landing price right at the range low target.

And what do we get?

A beautiful V-shaped reaction—just like we discussed in detail during our Fast Forward mentoring call.

Now we have two key scenarios unfolding, mirroring what we saw at the upper boundary of the range during the bullish breakout setup. Will we get a bullish turn, or will the market break down?

Triggers are set, charts are marked—now we wait.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

Monday continued Friday’s momentum, taking price straight into the range low target, where we saw a classic V-shaped price reaction.

While no pulse bars have appeared yet, the location of this reaction is ideal, lining up perfectly with our 6 money-making patterns.

This gives us two possible trade setups, similar to what we saw at the upper range boundary during the last breakout assessment.

Scenario 1 – The Bullish Turn

- ✅ V-shaped reaction at a key level

- ✅ If confirmed, we could see a move back up into the range

- ✅ Waiting for additional confirmation (pulse bars, momentum shift, etc.)

Scenario 2 – The Bearish Breakout

- ✅ If price breaks below the range low, it confirms a downside move

- ✅ A clean breakdown could lead to a continuation of bearish momentum

- ✅ This would be a mirror setup of the bullish breakout from earlier

Right now, both triggers are marked up on the charts, waiting for price to confirm the next move. Until then, it’s a watch-and-wait game, keeping an eye on any momentum shifts or additional signals.

Fun Fact

Did You Know the phrase “buy the rumour, sell the news” originated in the 18th century?

It was coined to describe the sharp market moves surrounding Napoleon’s defeat at Waterloo. Traders in the know made fortunes buying ahead of the news and selling into the ensuing hype!

The phrase became famous when financier Nathan Rothschild supposedly capitalised on early news of Napoleon’s defeat in 1815. He bought up British government bonds while others panicked and sold. Once the victory became public, prices soared, making Rothschild a fortune.

It’s a timeless reminder to think ahead in the markets.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece