Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Markets are waking up in full meltdown mode, all thanks to weekend tariff mayhem and rising tensions throwing a wrench into global trade. SPX futures are deep in the red, but that’s not necessarily bad news if you’re positioned right!

With bear swings already paying out big and bull swings needing some management, the real question is—do we get follow-through selling, or is this just another knee-jerk overreaction?

Let’s dig in!

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

Trade War Whiplash Hits Markets Hard

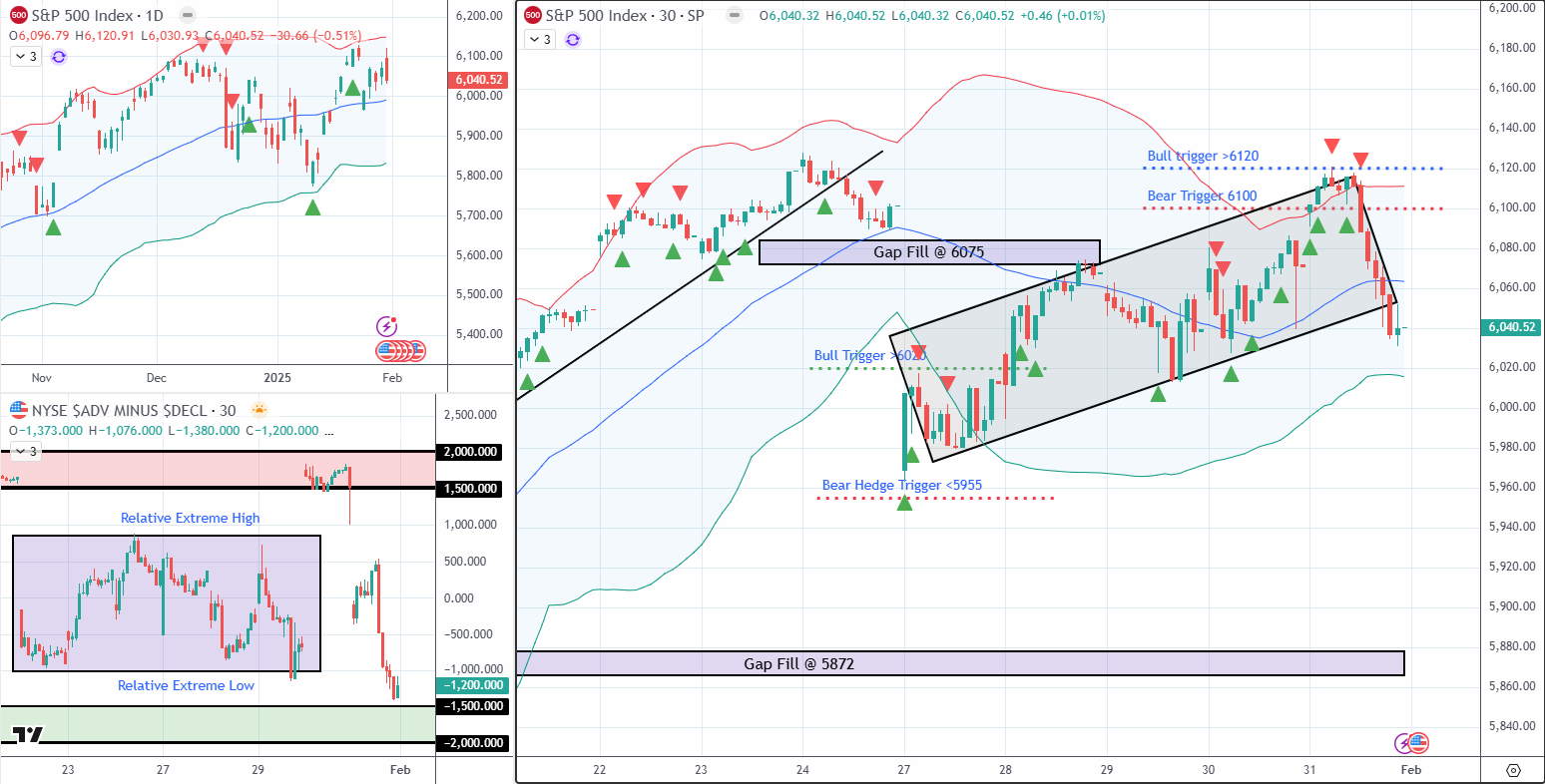

The overnight futures carnage was triggered by new tariff disruptions, retaliatory measures, and escalating trade war tensions—all set to take effect on Tuesday. The global market reaction was swift and brutal.

- SPX Futures: Hit a low of -120 points before bouncing to -80 points (-1.3%).

- Similar Pattern to Last Monday: Another huge gap down breaking out of last week’s range.

- Bearish Follow-Through or Bullish Bounce? Watching for a continuation lower or a bounce.

Trade Plan: Profits on Bear Swings, Managing the Bullish Side

Friday’s range reversal gave us an edge Last Friday before the Tariff excitement:

✅ Bear swings from Friday = Near-maximum gains at the open.

✅ Rolling the bull swing may be required—assessing once we see price action.

✅ Large gap downs = Risky entries—patience required before placing fresh trades.

⏳ Key Levels to Watch

Gap Fill Potential: Do we snap back into the prior range or confirm a deeper decline?

Early Flush or Fakeout Rally? Let the first 30-60 minutes set the tone before making big moves.

Fast Forward Group Call Strategy: Real-time assessment of market direction at the open.

For now, the plan is patience and precision—we wait for confirmation before making the next move.

Fun Fact:

The Worst Market Drop from Tariff Wars? In 1930, the Smoot-Hawley Tariff Act triggered a global trade collapse, slashing world exports by 66% and worsening the Great Depression.

Lesson Learned?

Tariffs are rarely good news for markets. Every major tariff war in history has caused volatility, market corrections, or outright crashes. Whether today’s chaos is temporary or the start of something bigger remains to be seen!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece