Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

⏳ The markets gave us the perfect blend of patience, strategy, and a well-timed bearish setup last week.

With bearish pulse bars firing, a trend break, and a V-shaped entry, we knew a downside move was brewing. And when the Tariff War drama hit over the weekend? That was the cherry on top.

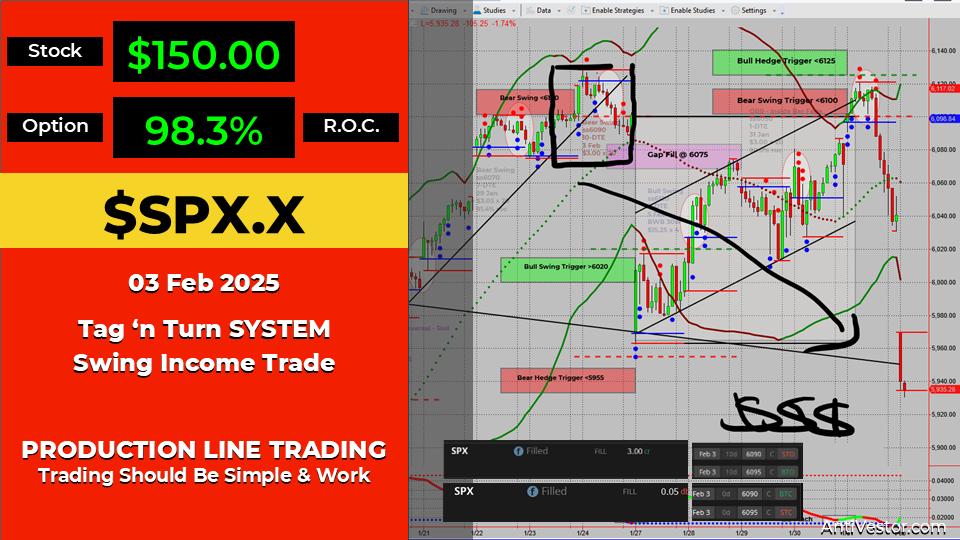

Let’s break down this 98.3% win!

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

The Setup: A Textbook Bearish Entry

- Market moving straight up? Patience was key—waiting for a conservative entry made the most sense.

- Bearish pulse bars, a V-shaped entry, and a trend line break confirmed our Fast Forward Group call analysis.

- The “tariff war” news over the weekend added fuel to the bearish move, making for an easy exit.

The Execution: Premium Collected & Time Decay Doing the Work

- Premium collected: $3.00 – A solid setup from the get-go.

- Exit price: $0.05, thanks to Monday’s favourable gap down.

- Total return: 98.3% – A near-perfect trade, proving once again that you don’t need a massive move when you’ve got time decay working in your favour.

Lessons from the Trade

- Patience wins – Straight-line moves are risky; waiting for a solid conservative entry was key.

- Time decay works magic – We didn’t need a huge directional move, but when it happened, it sealed the deal.

- Follow the process – SPX Tag ‘n Turn setups are designed to profit from these precise conditions.

Fun Fact:

Tariff Wars & Market Chaos: A Long History!

Did you know the Smoot-Hawley Tariff Act of 1930—meant to protect US businesses—worsened the Great Depression by triggering global trade wars? Markets plunged 90%, proving tariffs and market moves go hand in hand!

The Smoot-Hawley Tariff Act was intended to protect American farmers and industries, but instead, it sparked worldwide retaliation. Countries slapped tariffs on US goods, crippling international trade. The Dow Jones plummeted from 381 to 41 over three years—one of the most severe collapses in history. Since then, markets have learned to fear tariff wars, making last weekend’s sell-off eerily familiar.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece