Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

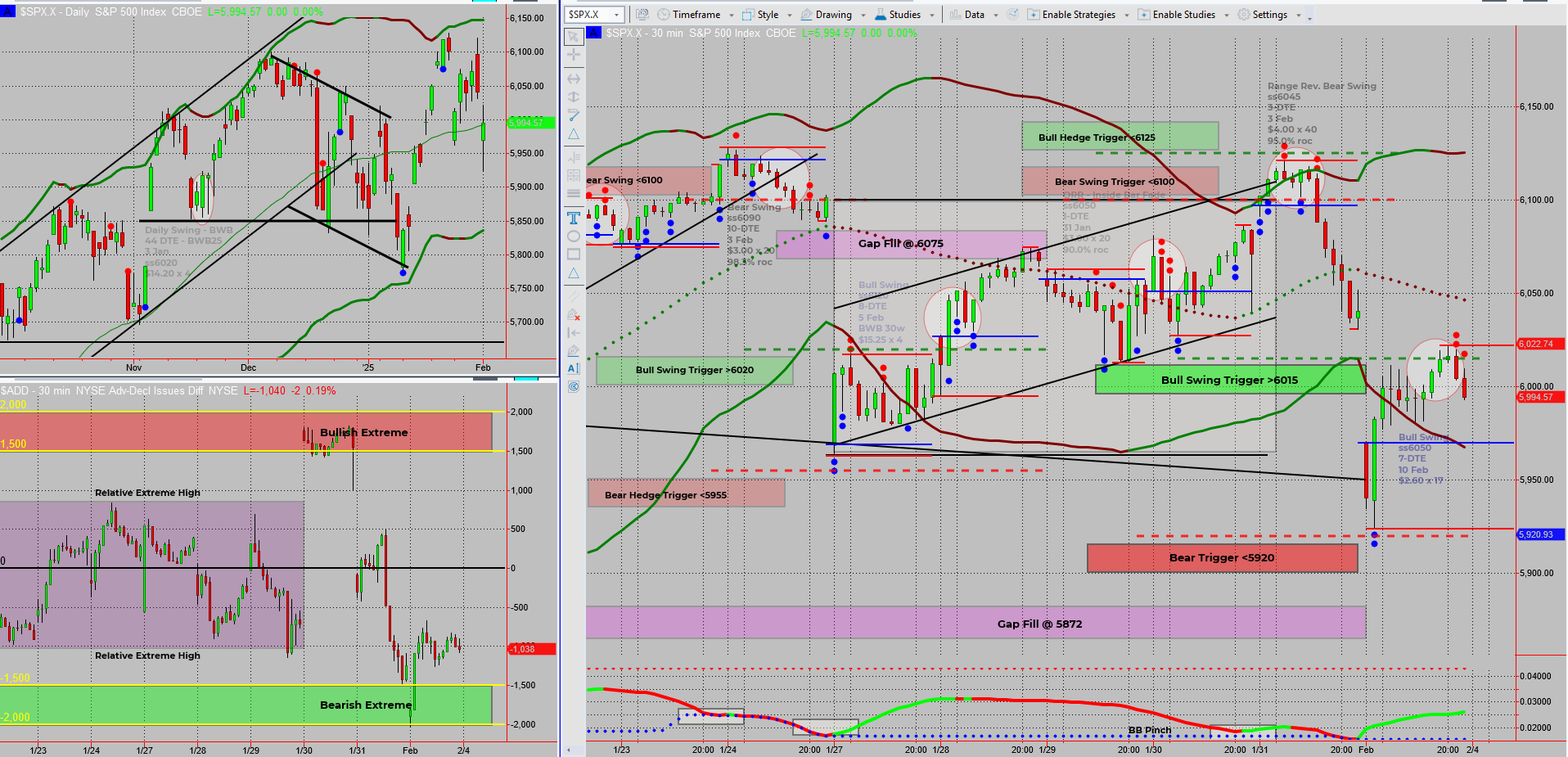

Monday’s market drama didn’t disappoint, with SPX taking a sharp dive as tariff chaos spread over the weekend. While most traders panicked, we watched our bearish trades smash through target exits for 95% & 98.3% gains. Not a bad way to start the week!

But now, the real question: what’s next? Are we setting up for a bullish breakout, or is this the calm before another bearish storm?

Let’s dive into today’s market outlook.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

Monday’s Tariff Turmoil: Big Drop, Big Profits

Over the weekend, fresh tariff war chaos rattled markets, sending futures plummeting ahead of Monday’s open. SPX dropped hard, following through on our bearish trade setups from last week.

The result?

✅ 95% & 98.3% gains locked in on our bear trades.

✅ Perfect execution of last week’s range reversal strategy.

The Key Question – What’s Next?

During our Fast Forward Group Call, we broke down an essential trading skill:

- Knowing when to PAUSE trading when markets get funky.

- Knowing when to RESUME trading once the setup is clear.

Now that the dust has settled, we’ve outlined two key triggers:

✔️ Bullish trigger has fired – favouring more upside.

✔️ Bearish trigger now serves as a hedge in case of reversal.

Fun Fact:

Back in 17th century Netherlands, tulips weren’t just flowers – they were a status symbol and the hottest speculative asset. As traders got swept up in FOMO, rare bulbs skyrocketed in price, some selling for the equivalent of a luxury house in Amsterdam today!

The bubble burst in early 1637 when buyers simply stopped showing up to auctions. With no one left to sell to, prices collapsed, and fortunes disappeared overnight. The event, known as Tulip Mania, became the first recorded financial bubble and a textbook lesson on the dangers of hype-driven investing.

While today’s markets are a bit more complex, the lesson remains: what goes up too fast… often comes down just as hard. ➡️

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece