Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

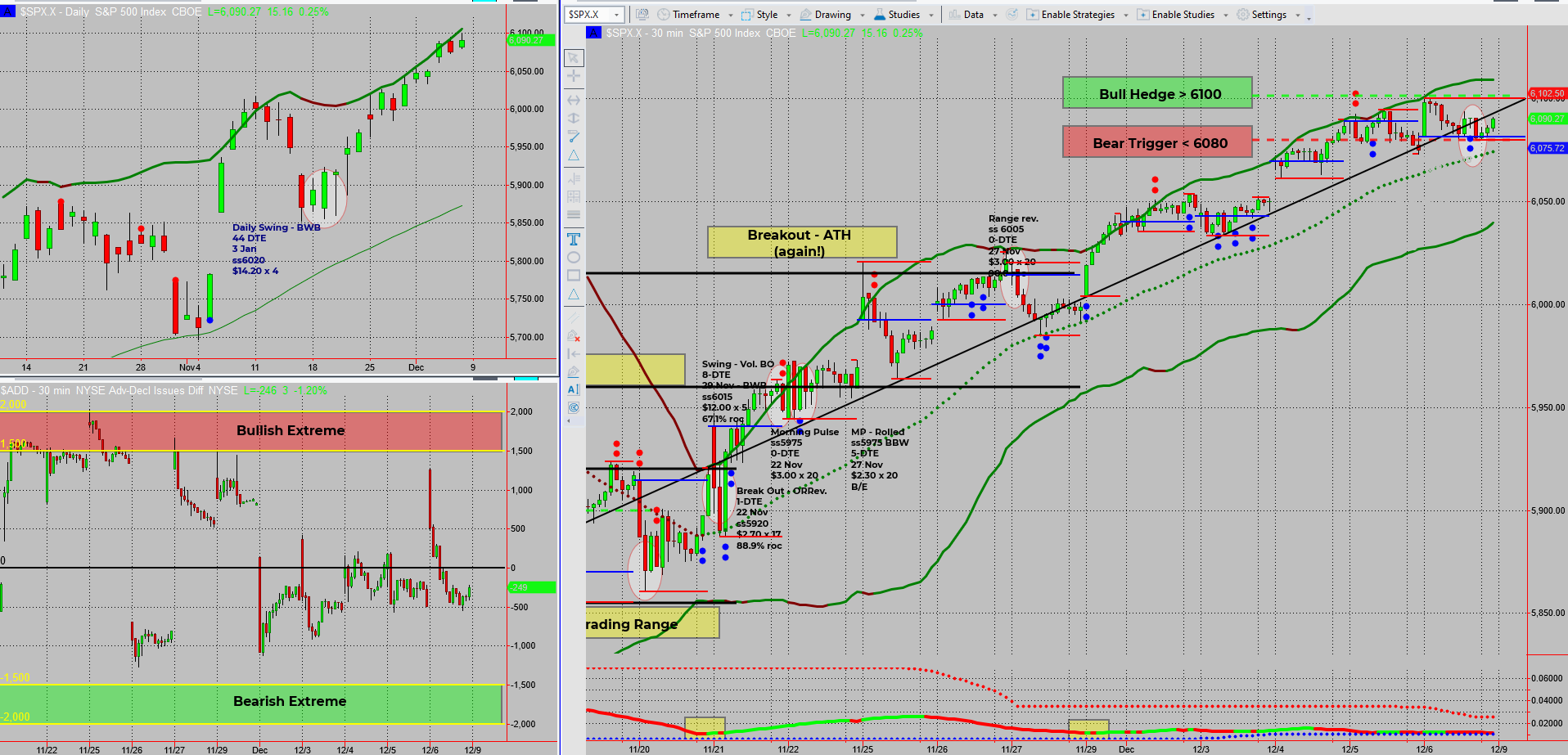

SPX is testing its limits, flirting with the uptrend line and teasing traders with potential breaks. Will we see bearish dips, or will the bulls charge back above $6100? Let’s dive into the setups for both scenarios!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX price action has been testing the patience of traders:

- Uptrend Drama: The well-established line saw another minor break. These “false alarms” have been frequent, making confirmation critical.

- Key Bear Level: Watch $6080—this is the potential bear trigger for short-term income swings.

- Key Bull Level: Above $6100, bullish momentum could return swiftly, minimizing downside risks.

- Short-term Outlook: A few bearish days might be on the horizon, followed by the next bullish surge.

Plan of Action:

- Be ready for bearish setups below $6080 but pivot quickly to bull triggers if $6100 breaks.

- Keep trades tight, allowing flexibility as price action unfolds.

Fun Fact:

SPX’s First Closing Price in History: The SPX debuted on March 4, 1957, with an initial price of 44.06. That’s right—44.06! Fast forward, and today, we’re talking thousands. A small reminder of just how much the market grows over time.

The SPX’s humble beginnings in 1957 underscore its journey as a powerhouse in the financial world. Starting at a modest 44.06, it reflects decades of economic growth and innovation. If this doesn’t scream “long-term wealth creation,” what does?

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece