Uncle Russell Falls Asleep with “Inside Inside Bar” Russian Doll Setup

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Monday was a crappy start to the week, but when you’re running systematic approaches, that doesn’t really matter too much. The swings are swinging exactly as designed.

SPX continues its slow grind higher, but momentum is nearly at a standstill. During our Fast Forward group calls yesterday, we looked at a few of the many different ways momentum can be assessed beyond eyeball mark one – proper systematic analysis rather than gut feelings.

Uncle Russell (RUT) has fallen asleep with an “inside inside bar” combo – kind of like a Russian Doll situation. It did something similar last week before the big one-day push on the breakout move, and given we have an explosive red flag news item on the dance cards this week, I’d expect something similar but news-driven to unfold.

That being said, a sideways grind works out just fine while the theta gets collected mechanically.

Keep scrolling for Fed Wednesday preparation and automation updates…

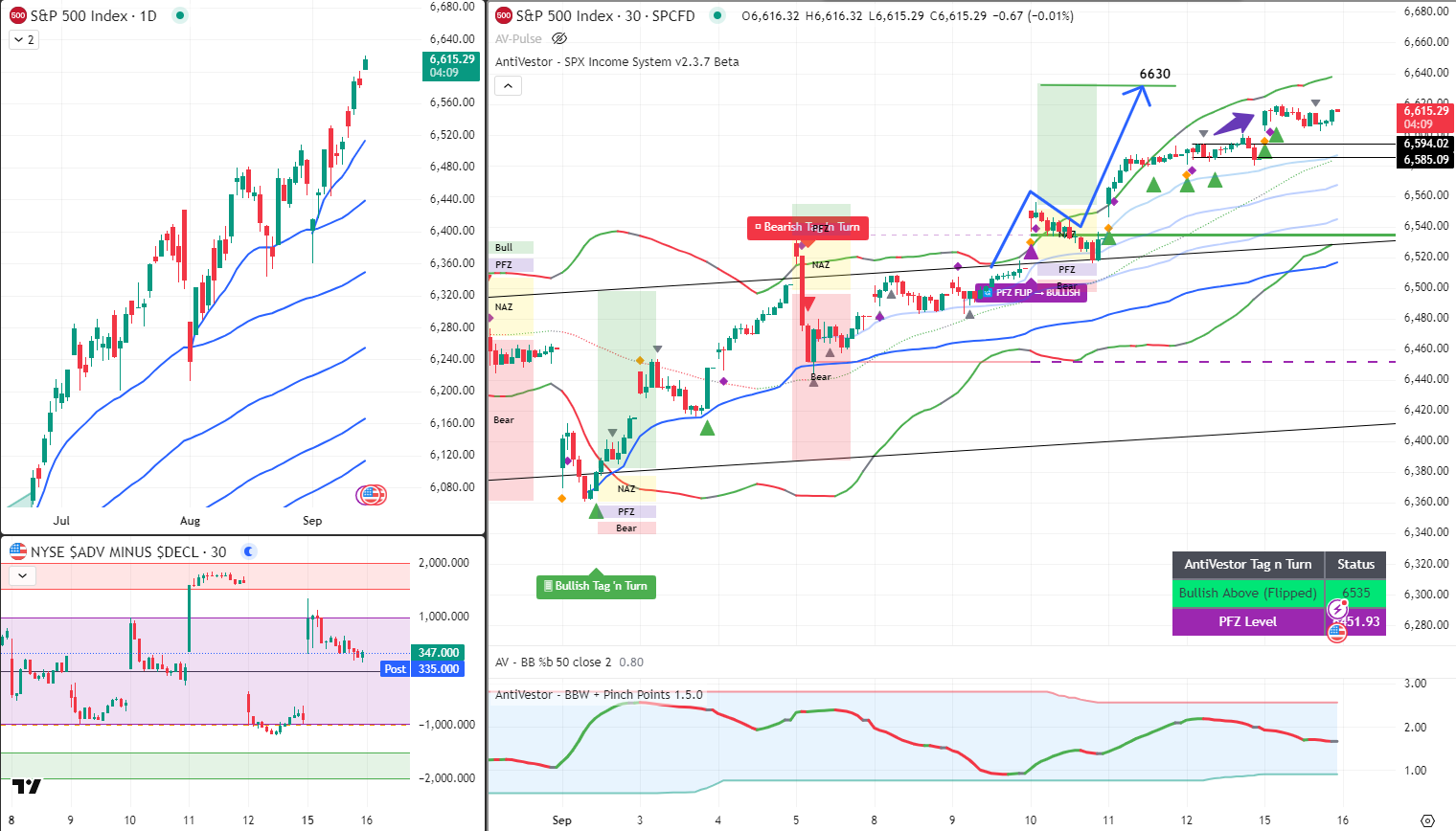

SPX Market Briefing:

The charts are telling a story of systematic patience being rewarded while market participants wait for Wednesday’s main event.

Current Systematic Status:

- SPX: Bullish but momentum grinding to near standstill

- RUT: Bearish with “inside inside bar” Russian Doll formation

- Fed Wednesday: Explosive red flag news item expected to drive significant action

- Theta Collection: Working beautifully during sideways grind periods

The Momentum Reality Check:

Yesterday’s Fast Forward group session explored multiple ways to assess momentum beyond simple visual analysis. When you’re running systematic approaches, having quantifiable momentum measures becomes crucial – especially when markets enter these grinding phases where direction becomes unclear but opportunities remain abundant.

SPX’s slow grind higher masks the underlying momentum deterioration that’s been building for weeks. The mechanical approach handles this perfectly because it doesn’t rely on dramatic movements to generate profits.

Uncle Russell’s Russian Doll Setup:

RUT’s “inside inside bar” formation creates a fascinating parallel to last week’s price action. Similar compression led to the explosive one-day breakout move, and with Wednesday’s Fed decision providing the catalyst, we could see history rhyme rather beautifully.

The key difference this time is we have a scheduled explosive event rather than spontaneous market dynamics driving the potential breakout.

Today’s Systematic Plan:

- SPX: Maintaining bullish bias while monitoring momentum deterioration

- RUT: Bearish positioning with explosive breakout potential on Fed news

- Premium Poppers: Waiting for opening bell deployment and volatility capture

- Lazy Poppers: Perfect conditions for theta collection during sideways action

Development Updates:

Behind the scenes, old strategies are being pumped back to life for SPX Income System integration. Pine scripts are getting slapped into shape for automated setup firing – because the best systematic trading happens when human emotion gets removed from the equation entirely.

The swings and the plan in general remain unchanged, but the execution precision keeps improving through technological enhancement.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered arranging his desk pigeons in “Russian Doll formation” while claiming the “inside inside bar” pattern was “clearly predicted by nested pigeon positioning analysis.”

Hazel immediately began updating her “Fed Wednesday Crisis Management Protocols” while muttering something about “explosive red flag news requiring enhanced shareholder communication strategies.”

Mac raised his morning whisky and declared, “My dear chaps, momentum may be grinding, but systematic persistence always prevails during pre-announcement anticipation!”

Kash tried to explain how inside bars were “basically like yield farming compression but with actual nested profit potential,” while Wallie just grumbled, “In my day, we didn’t need Russian metaphors to understand simple range compression. Markets spoke plain English!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

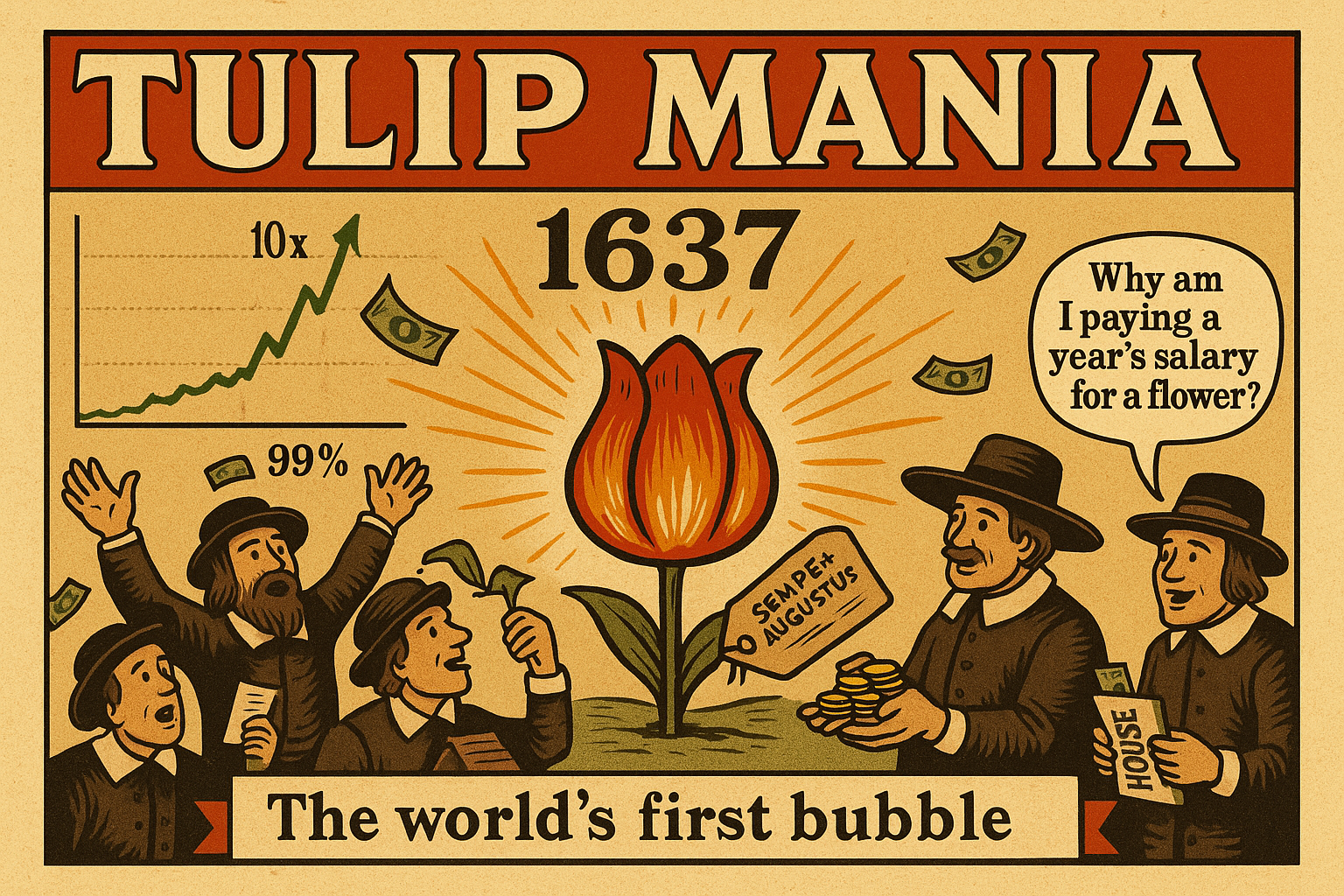

Fun Fact:

Tulip Mania: The Original “To the Moon” Investment

In 1637, rare tulip bulbs sold for 10 times a craftsman’s annual salary during history’s first recorded speculative bubble-proving that humans have been making terrible investment decisions for almost 400 years!

Tulip Mania was the 1600s equivalent of buying NFTs, except at least tulips were real and smelled nice! During the Dutch Golden Age, tulip bulbs became the ultimate status symbol, with rare varieties like the Semper Augustus trading for 5,200 guilders (about $750,000 today).

People literally mortgaged their houses to buy flower bulbs, treating tulips like they were shares in the Dutch East India Company instead of plants that would eventually die. The speculation got so intense that tulip futures markets developed, where people were buying contracts for bulbs that didn’t even exist yet-basically the world’s first derivatives market based on pretty flowers.

Professional traders, day laborers, and even servants joined the frenzy, convinced that tulip prices would rise forever because, obviously, everyone needs expensive flowers. The bubble burst in February 1637 when someone finally asked the obvious question: “Why am I paying a year’s salary for a flower bulb?” Prices collapsed 99% by May, leaving people holding beautiful flowers worth about as much as expensive confetti.

Tulip Mania became the template for every bubble since-irrational exuberance, FOMO investing, and the inevitable realization that maybe paying mortgage-money for luxury items wasn’t brilliant!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.