No Plans Until News Fallout Settles Into Tradeable Reality

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Fed Wednesday D-Day has arrived, and here’s the systematic reality: very little has changed since yesterday’s briefing, and I’m not planning on doing anything until after the news fallout settles.

This might be the shortest briefing in newsletter history, but it’s also potentially the most valuable. Sometimes the best trading plan is admitting you don’t have a plan until the market shows its cards clearly.

The charts look remarkably similar to yesterday. The systematic positioning remains unchanged. The Russian Doll inside bars are still coiled and waiting. SPX continues its bullish grind while everyone holds their breath for 2:00 PM ET.

The beauty of systematic trading? It doesn’t require constant action. It requires patient precision.

Keep scrolling for the art of tactical waiting…

SPX Market Briefing:

Today’s briefing celebrates the underrated skill of systematic patience during high-volatility news events.

Current Systematic Status:

- SPX: Bullish positioning maintained, no changes from yesterday

- RUT: Russian Doll inside bars still compressed, awaiting catalyst

- Fed Decision: 2:00 PM ET – but real moves happen after initial reaction

- Systematic Plan: Absolutely nothing until fallout clarity emerges

The Art of Tactical Waiting:

Professional traders understand that Fed days require a different mindset. The announcement at 2:00 PM is pure theatre. The presser at 2:30 PM starts the real show. But the actual tradeable moves often don’t emerge until hours later when institutional positioning adjusts to the new reality.

This is where systematic discipline separates amateurs from professionals. Amateurs feel compelled to have opinions and positions before major announcements. Professionals wait for the dust to settle and trade the actual price action rather than their predictions.

Why Nothing Has Changed:

Yesterday’s analysis remains perfectly valid. The technical levels are identical. The systematic signals haven’t shifted. The only thing that’s changed is everyone’s anxiety level about something that hasn’t happened yet.

The Russian Doll setup in RUT remains compressed. SPX’s bullish grind continues unchanged, although we do now have an official range/pinch point to play with.

Today’s Systematic Plan:

- Pre-Announcement: Absolutely nothing except observation

- During Announcement: Continue doing absolutely nothing

- Post-Announcement: Wait for initial volatility to settle

- Post-Presser: Assess actual price action vs systematic levels

The Patience Paradox:

The market rewards those patient enough to wait for clear signals while punishing those who act on anxiety and speculation. Fed Wednesday tests this principle more than any other trading day.

In Other News…

FinNuts Market Flash

Tight ranges produce maximum market psychology

ES crept to +0.42% by 9:25 AM like Percy discovering the office tea supply actually got restocked. Overnight high 6,526, low 6,478 – tighter than Mac’s security on the premium whisky stash. VIX sitting at 13.0 suggests market fear levels somewhere between “mild concern about weekend plans” and “forgot to DVR favourite programme.” Liquidity decent but headline reactive, proving traders still jump at shadows.

Sector rotation discovers new favourite children

Semiconductors splitting personalities faster than office opinion on air conditioning – memory and foundry firms whilst AI leaders take a breather from being everyone’s darling. Software steady on sticky subscription demand because apparently paying forever for computer programmes is now normal. Refiners leading energy whilst exploration companies lag because processing oil beats finding it in today’s backwards economy.

Earnings calendar emptier than Wallie’s productivity reports

Light calendar into Fed meeting because corporate executives discovered wisdom of keeping quiet before Powell speaks. Select retailers trimming Q3 margin outlooks on fuel and wage costs like honest shopkeepers admitting reality bites. Industrial techs pointing to “back-half revenue back-end loading” which translates to “we’ll make money eventually, promise.” Analysts sharpening pencils on banks like students preparing for exams they know they’ll fail.

Cross-asset philosophy reaches graduate level complexity

Rates drifting lower with cut odds embedded whilst term premium remains sticky because bond markets can’t decide if they trust Powell’s promises. Dollar softness supporting multinationals and metals like weak currency actually helps someone for once. Options markets pricing volatility pop around Fed decision with quick decay, proving even derivatives expect anticlimax. Credit markets calm because apparently boring bonds are having their moment.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: The entire team was discovered in the conference room playing a board game called “Systematic Patience” while waiting for 2:00 PM.

Percy had arranged his desk pigeons in a perfect circle and declared they were “maintaining tactical formation until Fed clarity emerges.”

Hazel was spotted stress-eating biscuits while refreshing her “Post-Fed Crisis Management” protocols every thirty seconds.

Mac raised his pre-announcement whisky and toasted, “My dear colleagues, sometimes the most brilliant strategy is admitting you haven’t got one yet!”

Kash tried to explain how waiting for Fed announcements was “basically like HODLing but with actual strategic timing,” while Wallie just muttered, “In my day, we traded markets, not central bank press conferences.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

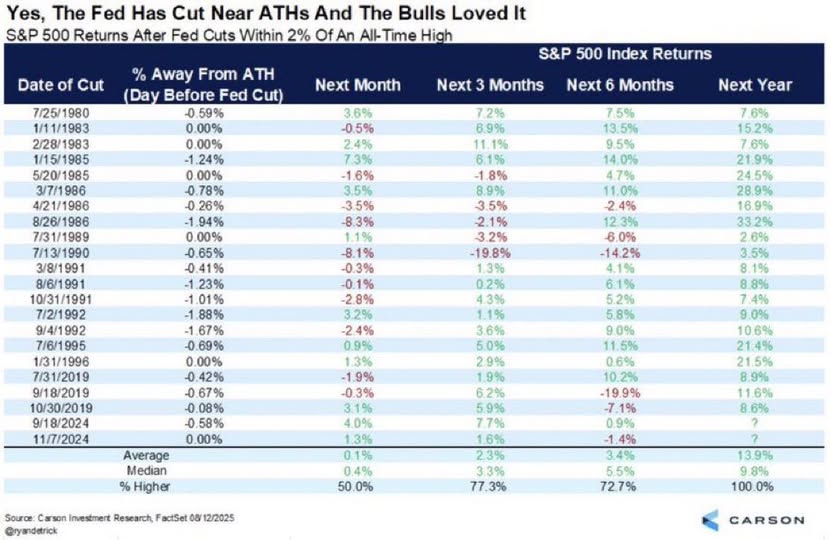

When the Fed cuts interest rates within 2% of stock market all-time highs, the S&P 500 has gone on to finish higher over the next 12 months 20 out of 20 times (100% hit rate) ![]()

![]()

![]()

Meme of the Day:

“When Fed Wednesday arrives but your systematic approach says ‘wait for the fallout to settle'”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.