ES Futures Pump 60 Points Overnight While Bull Swing Keeps Swinging

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The thing we’ve been waiting for all week has finally arrived – we’re in a post-Fed world, and what a bloody circus it was.

Fed delivered the expected 25 basis point cut (first of the year) with another 50 basis points expected before year end. Then came the press conference nonsense that was spewed in typical central bank fashion.

The markets responded exactly as you’d expect: running around in circles like headless chickens before eventually settling down like nothing had happened.

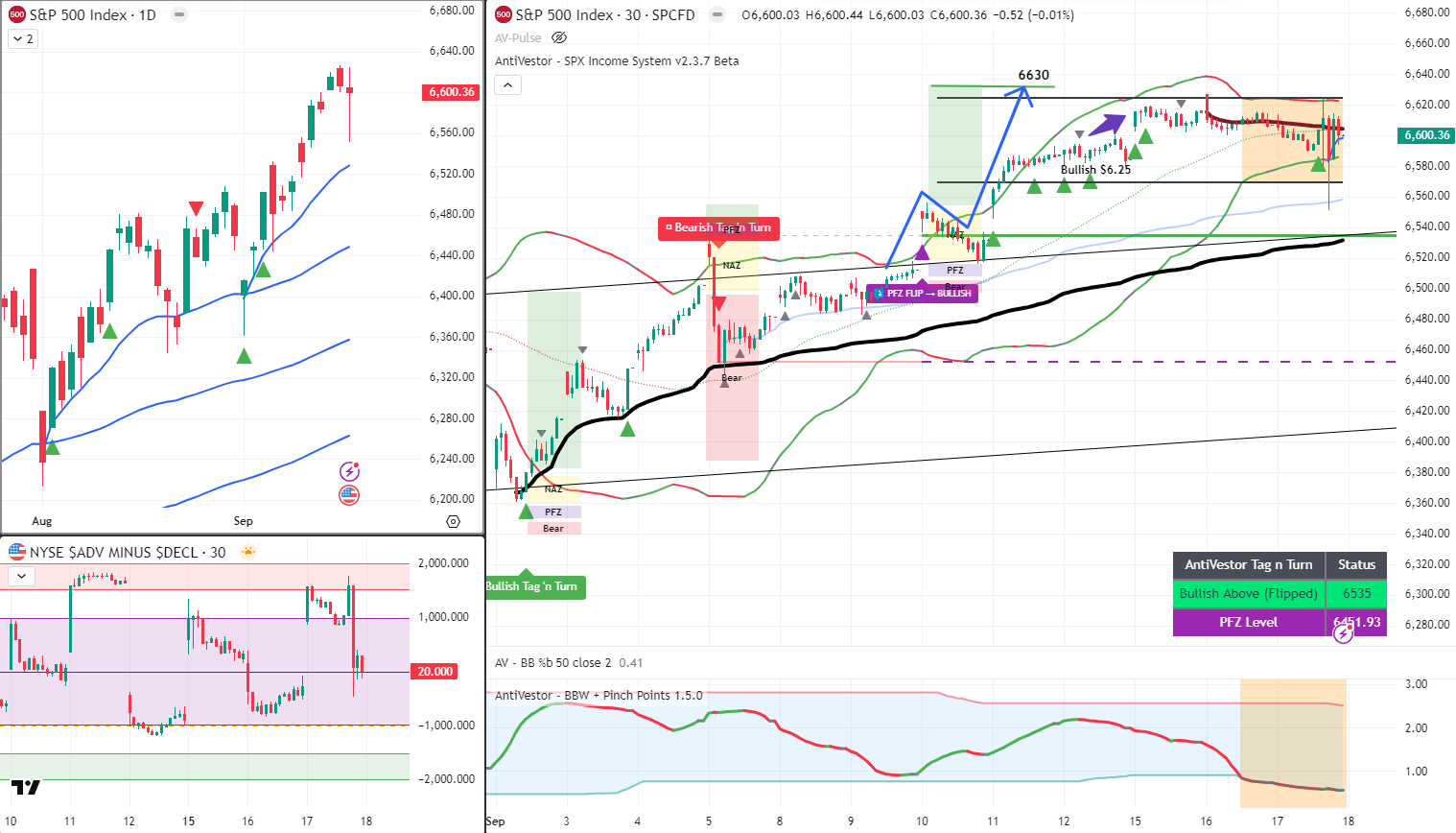

For my systematic purposes, SPX yoyo’ed wildly up and down, then settled relatively unchanged. But ES futures overnight are pumping higher by 60 or so points as I type this, which puts a smile on my face since my bull swing is still swinging beautifully.

A profit exit may be awaiting me very soon.

Keep scrolling for OPEX triple witching tsunami ahead…

SPX Market Briefing:

Yesterday’s Fed circus is behind us, but Friday’s OPEX triple witching could make yesterday’s volatility look like a gentle breeze.

Current Systematic Status:

- Fed Decision: 25bp cut delivered, 50bp more expected by year end

- SPX: Bull swing still active, profit exit potentially imminent

- ES Futures: Pumping 60+ points overnight, confirming bullish continuation

- Range Status: Potential break higher could create fresh entry opportunities

The Post-Fed Reality:

The systematic approach handled Fed day exactly as designed. While discretionary traders got whipsawed by the yoyo action, mechanical positioning stayed consistent. The bull swing that was established weeks ago continues working beautifully.

ES futures pumping overnight suggests the initial Fed reaction settled into bullish continuation rather than uncertainty. This should take us out of the newly created range and offer up fresh systematic opportunities.

Friday OPEX Triple Witching Tsunami:

Here’s what should have everyone’s attention: Friday is set to be one of the largest OPEX events on record, with over $1.1 trillion in delta notional expiring for the S&P 500. Nearly 90% of those positions are call options.

As these call-heavy positions expire, dealers will need to unwind their hedges. This process could remove the support that’s been stabilising the market throughout this grinding higher phase. For systematic traders, that shift opens the door to sharper swings and directional moves as fresh positioning takes hold.

Crash Season Reality Check:

We’re in crash season – have I mentioned that? I’ll be banging that drum until we either pop ‘n drop or exit gracefully stage left through the October stage door.

The combination of massive option expiry, dealer hedge unwinding, and seasonal weakness creates a perfect storm for increased volatility. Systematic approaches thrive in these environments because they’re built for uncertainty rather than grinding predictability.

Today’s Systematic Plan:

- Bull Swing: Monitoring for profit exit signals as overnight strength continues

- Range Break: Watching for fresh entry opportunities post-Fed positioning

- OPEX Preparation: Ready for increased volatility and directional clarity

- Premium/Lazy Poppers: Standing by for deployment as market motion resumes

Other than that, we’re back in motion looking for entries and setups. The post-Fed world brings fresh opportunities for those patient enough to wait for proper signals.

In Other News…

FinNuts Market Flash

Brace for rotation whilst optimism gets carried away

E-mini S&P futures jumped +0.50% by 9:25 AM like Kash discovering the office expense account still has money left. Nasdaq surged +0.60% whilst Dow managed a modest +0.15% because apparently old industrial companies can’t compete with shiny technology. Overnight high 6,600, low 6,520 – ranges wider than Percy’s mood swings during earnings season. Dollar slipped whilst gold stayed steady because precious metals have better emotional regulation than currency traders.

Sector rotation discovers new teacher’s pets

Financials surged like Mac after discovering the premium coffee machine accepts his security card. Banks and insurers firm on steeper yield curves because apparently making money off interest rate differentials never goes out of style. Tech strong but selective – AI and cloud picks outperforming whilst semiconductors face regulatory pressure because governments suddenly care about computer chips. Energy flat as demand uncertainty limits upside, proving even oil can have commitment issues.

Earnings calendar lighter than Wallie’s schedule

Few standout earnings today because apparently corporate executives are saving drama for later in the week. Financials watching net interest margin improvements like hawks eyeing field mice. Consumer and industrial firms cautious on demand whilst cost pressures remain because inflation apparently didn’t get the memo about going away. Macro data releases front-loading risk into week’s end like students cramming for Friday exams.

Cross-asset themes reach philosophical complexity

Rates dropped modestly after cuts but term premium remains entrenched because bond markets have trust issues with central bankers. Dollar weakening helping commodity themes whilst gold holds value like a reliable friend during uncertain times. Oil affected by oversupply concerns because apparently there’s too much black gold floating around. Credit spreads stable with high yield mildly outperforming, proving even junk bonds can have their moment.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered trying to teach his desk pigeons the phrase “25 basis points” while claiming they had “predicted the exact Fed decision through advanced cooing pattern analysis.”

Hazel was spotted updating her “Post-Fed Recovery Protocols” while simultaneously preparing “OPEX Crisis Management Procedures” for Friday’s $1.1 trillion expiry event.

Mac raised his post-Fed whisky and declared, “My dear chaps, headless chickens may run in circles, but systematic bulls simply keep charging forward!”

Kash tried to explain how OPEX was “basically like a massive NFT expiry but with actual trillion-dollar delta implications,” while Wallie just grumbled, “In my day, we didn’t need trillion-dollar derivatives to create proper market volatility!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

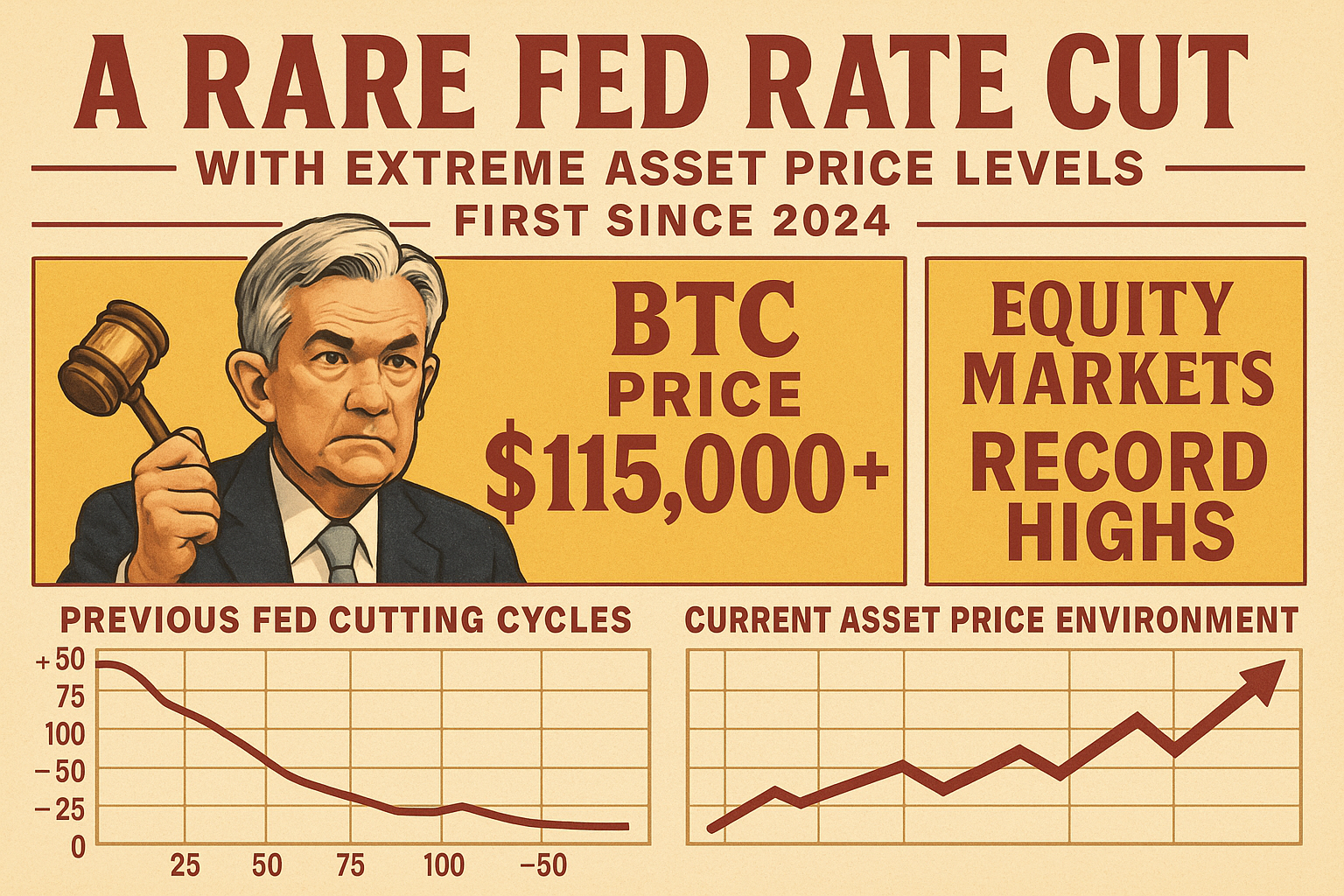

It is the first time since 2024 that the Fed cut interest rates while BTC price was above $115,000 and equities were near record highs.

Meme of the Day:

When Fed cuts 25bp and markets run like headless chickens but your bull swing just keeps swinging

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.