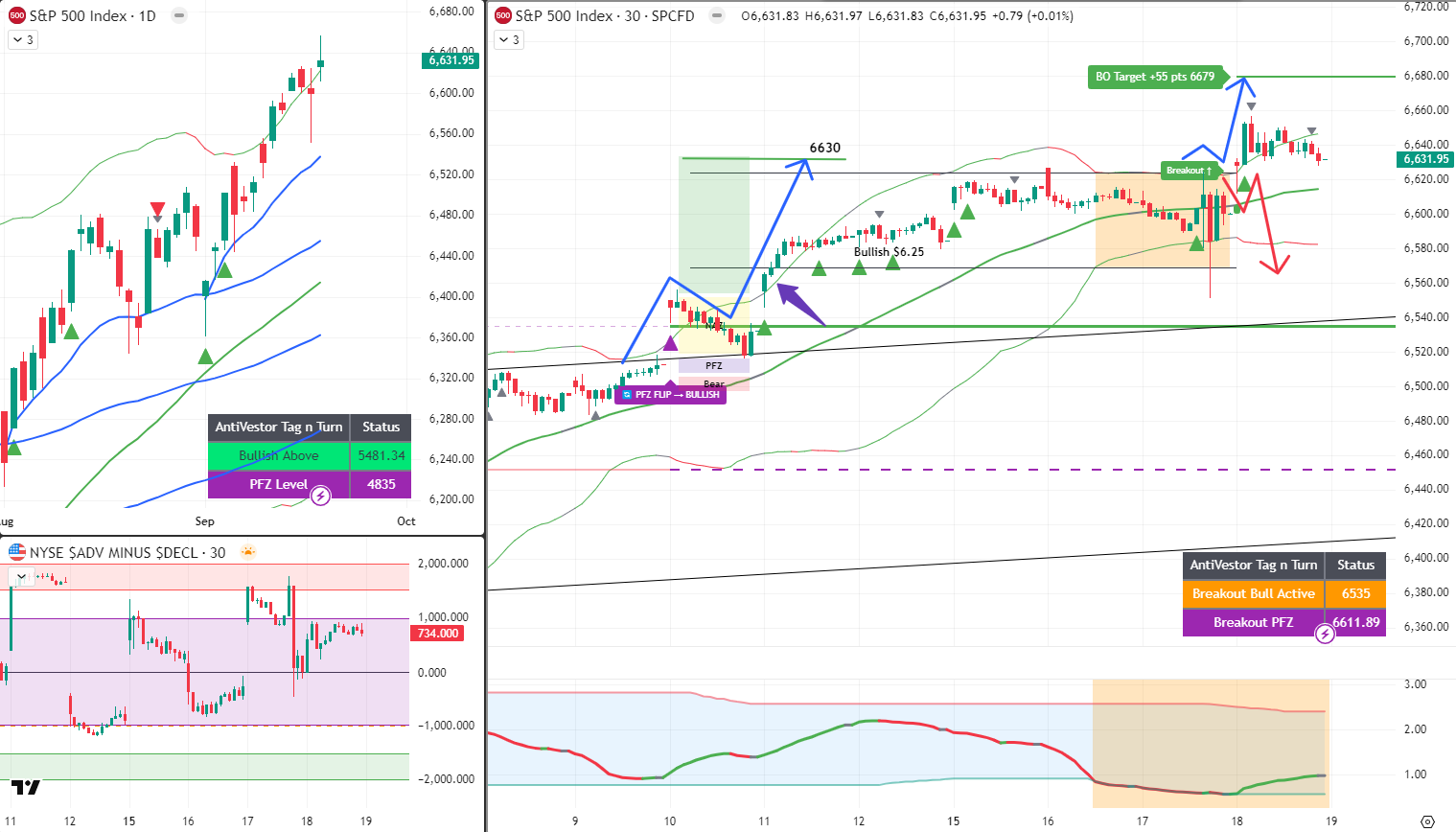

Bulls Still Bulling from 6560, New Bull Trigger Above 6633 Active

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s Friday. It’s triple witching. And here we are with huge bullish GEX expiration today, which brings up my big question: with the trillions in exposure that go away today and the subsequent hedges that stop propping this market up – are we finally going to see some real moves unfold, up or down for that matter?

Will volatility start to widen, and can we see more than a 50-point ATR again? These are the questions that matter when market structure shifts underneath while everyone’s watching the pretty charts.

That aside, the bulls are still bulling, the system is doing its thing, and we now await what comes next with mechanical precision.

I remain bullish from 6560, and the new bull trigger on this recent breakout is to stay bullish above 6633. I remain bullish until the breakout target is reached at 6679 OR we break back into the range below 6611.

Keep scrolling for the trillion-dollar question answered…

SPX Market Briefing:

Today marks the moment when artificial market support potentially evaporates, revealing what’s really underneath this grinding rally.

Current Systematic Status:

- SPX: Bullish from 6560, new bull trigger above 6633 active

- Breakout Target: 6679 upside target vs 6611 range re-entry downside

- GEX Expiration: Massive bullish exposure rolling off today

- Volatility Potential: First real opportunity for >50 point ATR in weeks

The Trillion-Dollar Question:

Triple witching Friday brings the moment of truth. With trillions in bullish GEX exposure expiring today, the hedges that have been propping up this market structure disappear. This isn’t just another options expiry – it’s potentially the removal of the training wheels that have kept volatility compressed.

The systematic question becomes: when dealer hedges stop providing artificial support, does the market reveal genuine strength or underlying weakness? Either outcome creates opportunities for mechanical approaches.

Mechanical Positioning Reality:

The bulls are still bulling with systematic precision. The 6560 level that triggered weeks ago continues working beautifully. The recent breakout above previous resistance has created a new bull trigger level at 6633 – stay above this level and the bullish momentum continues.

The beauty of mechanical trading? It doesn’t matter whether volatility expands from hedge removal or contracts from new positioning. The system adapts to whatever market structure emerges.

Today’s Range Definition:

- Upside Target: 6679 (breakout completion)

- Bull Trigger: Stay above 6633 (new breakout level)

- Range Re-entry: Below 6611 (back into previous consolidation)

The Volatility Question:

Can we finally see more than a 50-point ATR again? The compressed volatility environment has been artificially maintained by the massive options positioning that expires today. When those hedges disappear, genuine price discovery returns.

Today’s Systematic Plan:

- Pre-Market: Monitor overnight levels relative to 6633 bull trigger

- Opening Bell: Deploy Premium and Lazy Poppers as volatility potentially expands

- Intraday: Watch for breakout continuation to 6679 or range failure below 6611

- Close: Assess new market structure post-expiration for next week’s approach

All fun and games in the mechanical world of trading while market structure shifts underneath our systematic positioning.

In Other News…

FinNuts Market Flash

Easing leans whilst markets question everything

ES climbed +0.50% by 9:25 AM like Percy discovering the office finally restocked his favourite tea. NQ surged +0.60% whilst Dow managed +0.30% because apparently modern technology still beats century-old industrial companies. Overnight high around 6,600, low 6,550 – ranges wider than Mac’s collection of vintage whisky excuses. VIX modestly elevated whilst ten-year yield edges up because apparently nothing makes sense anymore.

Sector rotation discovers new market darlings

Semiconductors and large tech led like Mac leading the charge to the premium coffee machine. Intel’s massive gain catalysed semiconductor strength because apparently computer chips are having their moment again. Financials benefiting from steeper yield curves whilst energy underperformed on demand concerns – proving even oil can have popularity issues. Consumer and industrials mixed like Wallie’s feelings about actual productivity requirements.

Earnings calendar produces forward-looking anxiety

Limited major earnings today because corporate executives apparently discovered the wisdom of staying quiet. Tech-growth names highlighting forward guidance tied to AI and infrastructure spending because adding “artificial intelligence” to everything still works magic. Financials watching margin improvements like hawks whilst inflation pressure in services remains part of guidance concerns because apparently price increases didn’t get the memo about going away.

Cross-asset philosophy reaches graduate complexity

Rates moved up modestly even after cuts because bond markets have trust issues with central banker promises. Dollar softening supports gold whilst oil faces pressure from demand worries – proving even commodities can have emotional baggage. Credit spreads calm but options skew points to directional risk ahead because derivatives markets can smell trouble before anyone else notices.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered arranging his desk pigeons in “Triple Witching Formation” while claiming they had “predicted the exact GEX expiration impact through coordinated flight pattern analysis.”

Hazel was spotted frantically updating her “Triple Witching Crisis Protocols” while simultaneously preparing “Post-Hedge Market Structure Analysis” for when the props disappear.

Mac raised his pre-market whisky and declared, “My dear colleagues, when trillion-dollar hedges vanish, only systematic bulls survive the structural chaos!”

Kash was livestreaming about “GEX expiration being basically like a massive DeFi liquidity pool withdrawal but with actual trillion-dollar market impact,” while Wallie just grumbled, “In my day, we didn’t need trillions in artificial hedges to create proper market movement!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact: Stock Market Correction: Financial Speak for “Oops!”

A stock market “correction” is Wall Street’s polite way of saying “Well, that was embarrassing.”

When the market drops 10-20% from recent highs, traders don’t say “Holy cow, we messed up!” Instead, they calmly call it a “correction”-as if the market just realized it had spinach in its teeth and needed to fix itself in the mirror.

It’s the financial equivalent of calling a car crash a “sudden vehicular readjustment.”

The term suggests the market was wrong before and is now graciously fixing its mistake, like a professor correcting an error on the blackboard.

In reality, corrections often happen because investors suddenly remember that trees don’t grow to the sky and that what goes up usually comes down (thanks, gravity!).

But calling it a “correction” sounds so much more dignified than “panic sell-off” or “reality check.” It’s like wearing a tuxedo while getting dunked in a lake-you’re still soaking wet, but at least you look classy!

Meme of the Day:

When trillions in GEX expire but your mechanical bull swing just keeps doing its thing

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.