Positive Gamma Positioning Acts as Volatility Shock Absorber

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

New week, and nothing really has changed from Friday’s last morning briefing in terms of levels and actions. We’re starting fresh with little to no red flag news of importance to note for the week ahead.

The S&P 500 closed the week at 6661, posting a solid 1% weekly gain as markets navigated through the highly anticipated FOMC circus. What made this week particularly noteworthy was the extreme complacency at its start: one-month realised volatility sat at a meagre 8%, and implied volatility hit basement-level 5% for Monday.

These are some of the lowest volatility readings we’ve seen in the past six months, creating the perfect conditions for that grinding upward momentum that characterised most of the week.

Overnight futures are down around 20 points or 0.3%, which sits comfortably inside the normal range of movements. Nothing dramatic, nothing systematic-breaking, just another Monday morning in the mechanical trading world.

Keep scrolling for the volatility compression reality check…

SPX Market Briefing:

The post-OPEX landscape reveals a market structure built on extreme complacency and dealer positioning rather than fundamental conviction.

Current Systematic Status:

- S&P 500: Closed at 6661 with 1% weekly gain through FOMC

- Volatility Environment: 8% realised vol, 5% implied vol – six-month lows

- Dealer Positioning: Positive gamma creating volatility shock absorber effect

- Overnight Action: ES down 20pts (0.3%) – normal range territory

The Volatility Compression Reality:

Much of the market’s resilience throughout last week’s FOMC can be attributed to current positive gamma positioning from dealers, which has created a powerful shock absorber for volatility. This isn’t bullish conviction – it’s mechanical market structure.

The compressed volatility environment that created perfect conditions for grinding upward momentum also creates perfect conditions for explosive moves when that compression finally breaks. It’s like a spring coiled tight – the longer it stays compressed, the more violent the eventual release.

The Complacency Setup:

When realised volatility hits 8% and implied volatility touches basement-level 5%, you’re not witnessing market strength – you’re witnessing market complacency. These readings suggest participants have become so comfortable with gradual grinding moves that they’ve forgotten markets can actually move violently in either direction.

This type of extreme positioning historically precedes rather than prevents significant volatility expansions.

Risk Management Reality:

The current volatility compression means any unexpected catalyst could trigger sharp moves in either direction if IVs expand enough. While existing market positioning favours continued upside through that positive gamma shield, appropriate risk management remains paramount to account for these possibilities.

Today’s Systematic Plan:

- Pre-Market: Monitor 20-point overnight decline for any systematic level breaks

- Opening Bell: Deploy Premium and Lazy Poppers in low-volatility environment

- Intraday: Watch for any catalyst that might shatter the volatility compression

- Week Ahead: Light red flag news calendar – focus on technical levels and positioning

This Week’s Calendar:

- Tuesday: Flash Manufacturing PMI, Flash Services PMI, Fed Chair Powell speaks

- Thursday: Final GDP, Unemployment Claims

- Friday: Core PCE Price Index

Nothing earth-shattering, but Powell speaking Tuesday could provide the catalyst needed to test this compressed volatility environment.

In Other News…

Tight ranges reveal market’s true personality

ES crept to +0.42% by 9:25 AM like Percy discovering the office biscuit tin actually got refilled overnight. Overnight high 6,528, low 6,476 – tighter than Mac’s security on the good whisky cabinet. NQ managed +0.50% whilst RTY climbed +0.29% because apparently small companies still matter sometimes. VIX at 13.1 suggests fear levels somewhere between “mild concern about lunch plans” and “forgot to set the alarm clock.”

Sector rotation plays advanced musical chairs

Semiconductors splitting faster than office opinions on thermostat settings – memory and foundry firms whilst AI leaders pause for breath like exhausted marathon runners. Software steady on sticky subscription demand because paying forever for computer programmes is apparently the new normal. Refiners leading energy whilst exploration companies lag on rangebound crude, proving processing beats finding in today’s economy.

Earnings calendar emptier than Wallie’s to-do list

Light calendar because corporate executives discovered the art of strategic silence. Select retailers trimming Q3 margin outlooks on fuel and wage costs like honest shopkeepers admitting reality occasionally bites. Industrial techs pointing to “back-half revenue back-end loading” which translates to “trust us, we’ll make money eventually.” Analysts sharpening pencils on banks like students preparing for exams they know they’ll struggle with.

Cross-asset philosophy reaches doctoral thesis levels

Rates drifting lower at front end with cut odds embedded whilst term premium stays sticky because bond markets have commitment issues with central banker promises. Dollar softness supporting multinationals and metals like weak currency actually benefits someone for once. Options markets pricing volatility pop around upcoming speakers with quick decay, proving even derivatives expect disappointment.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered arranging his desk pigeons in “Basement Formation” while claiming they had “predicted the exact 5% implied volatility reading through advanced underground cooing analysis.”

Hazel was spotted updating her “Extreme Complacency Protocols” while simultaneously preparing “Volatility Explosion Management Procedures” for when the compression inevitably breaks.

Mac raised his Monday morning whisky and declared, “My dear chaps, when volatility hits basement levels, only systematic positioning survives the eventual eruption!”

Kash was livestreaming about “positive gamma being basically like DeFi yield farming but with actual market shock absorption properties,” while Wallie just grumbled, “In my day, we had proper volatility! None of this 5% implied nonsense – markets moved like they meant it!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact: Stock Ticker: The Original Financial Twitter

The stock ticker, invented in 1867, transmitted prices over telegraph lines at 1 character per second. Today’s high-frequency trading would have taken roughly forever!

Before Edward Calahan invented the stock ticker in 1867, getting stock prices was like playing the world’s slowest game of telephone.

Prices were communicated by word of mouth or mail, which meant by the time you found out a stock had crashed, you could have knitted a sweater with the time you wasted.

The ticker tape machine was revolutionary-it could transmit stock prices over telegraph lines at the blazing speed of 1 character per second! That’s about 285 times slower than a snail-paced internet connection from 1995.

The machine made that distinctive “tick-tick-tick” sound that gave it its name, and suddenly traders had access to real-time information. Well, “real-time” if your definition of real-time included a coffee break between each letter.

The ticker tape became so iconic that they threw ticker tape parades for heroes-literally celebrating with the shredded remnants of financial data. Today’s high-frequency trading algorithms would have had a nervous breakdown waiting for a single stock quote! ⏱️

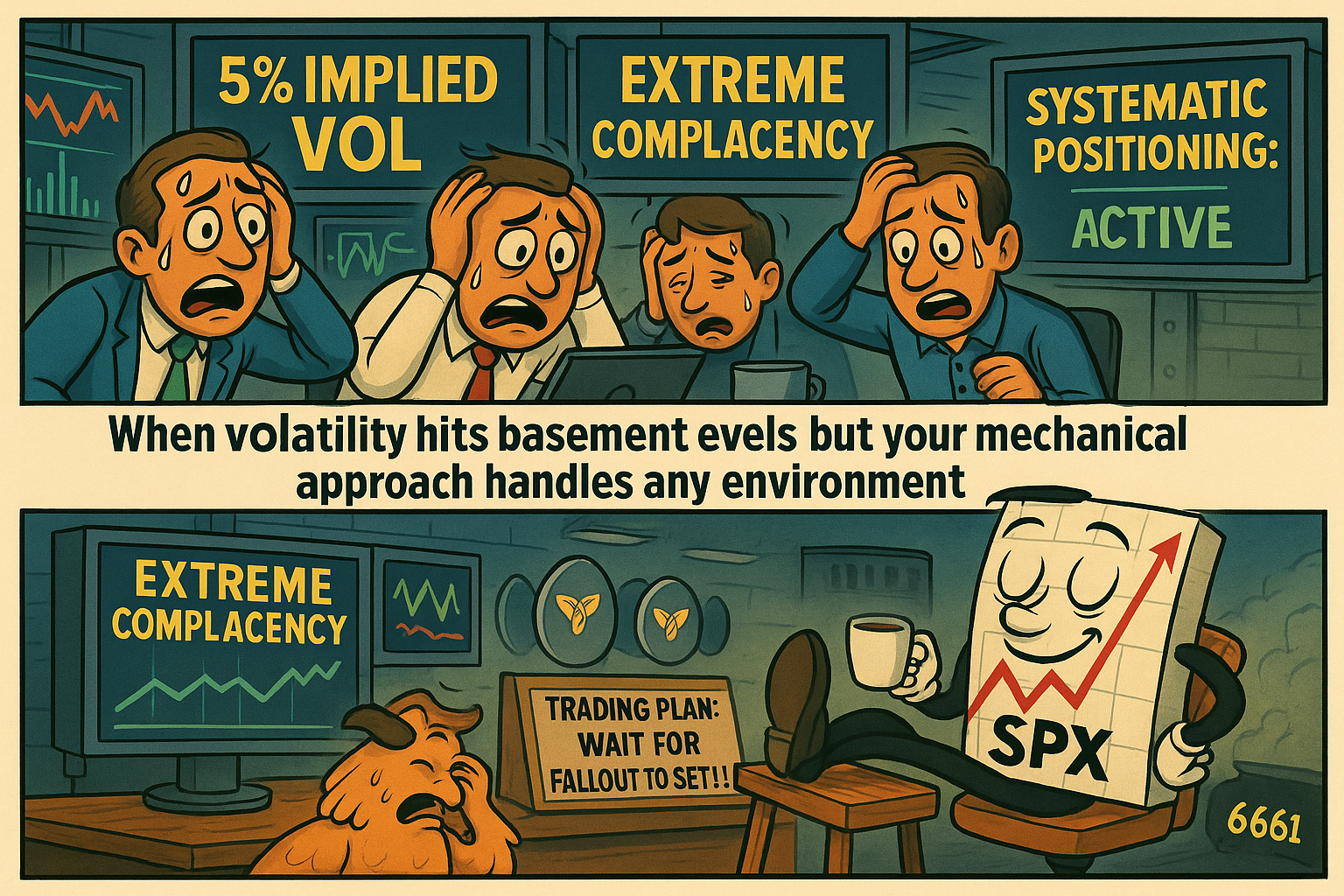

Meme of the Day:

When implied volatility hits basement level 5% but your systematic approach just keeps doing its thing

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.