Eight Popper Trades, Eight Wins – Fast Forward Watches Live Perfection Again

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Morning traders, and what a difference a day makes (and some of the overnight pre-market trading). It’s not quite a Black Friday black swan situation, but the selling pressure is finally accelerating rather than bouncing.

ES down 0.63% yesterday with no end-of-day rally to excite the market, then down another 1.34% overnight. No bounce. No recovery. Just continued selling pressure building momentum.

And that’s the smallest move we saw yesterday.

Uncle Rus is taking the crown with 2% drop yesterday and another 1.84% drop overnight so far.

For time reference, I’m doing this just after the UK open, many hours prior to the US open, so there’s potential for even more downside before American traders finish their morning coffee.

Even though there’s no “10% in ten minutes” drama, I’ll take it!

I Still think this is the start of the seasonal bigger move we often see this time of year.

Keep scrolling for the eight-for-eight Popper perfection…

Selling Accelerates. No Bounce. Gold Torches. Eight Poppers Perfect.

SPX Market Briefing:

Thursday brings accelerating overnight selling pressure, gold’s flight-to-safety confirmation, SPX mess requiring patience, and another perfect Popper execution day delivering eight wins from eight trades.

Current Multi-Market Status:

- ES Futures: Down 0.63% yesterday, down another 1.34% overnight – selling accelerating

- RUT (Uncle Rus): Down 2% yesterday (crown winner), down another 1.84% overnight

- Gold: Monumental rampage higher whilst stocks accelerate lower

- SPX: Absolute mess – but bears finally getting the meal they’ve been waiting for

- RUT: Crystal clear BB Tag n Turn patterns – simple, clean, no judgement needed

- Premium Poppers: Perfect 8-for-8 execution live in Fast Forward sessions

- Crash Season: ~15 days left in October window – bears finally eating

The Accelerating Selling Pressure

What a difference a day makes, and overnight pre-market trading confirms the downside momentum building rather than bouncing.

ES down 0.63% into yesterday’s close with no rally excitement. Then overnight decides to continue the selling with another 1.34% lower. That’s the smallest move we witnessed.

Uncle Rus claiming the volatility crown: 2% drop yesterday, another 1.84% drop overnight by UK open. Time reference matters here – I’m writing this many hours before US open, so potential exists for even more downside before American traders arrive.

No bounce.

No recovery.

Just accelerating selling pressure.

When markets drop hard into close then continue dropping overnight without any recovery attempt, that’s not whipsaw action – that’s momentum building in one direction. Bears finally getting fed after weeks of patience.

The Flight to Safety Confirmation

Even though there’s no “10% in ten minutes” dramatic collapse, I’ll take the accelerating movement we’re getting!

That Gold continues its monumental rampage higher whilst stocks accelerate lower confirms the flight-to-safety thesis many have been discussing. That traditional flight to safety, dollar hedge, inflation hedge, hedge of hedges is finally holding that torch high with proper conviction whilst equities sell off.

Just as soon as we see the stock indexes drop a few more percentage points, we can make it all official and the “Told you so” crowd can come out of hibernation and start doing their TikTok dances or whatever they do these days.

Gold rampage plus equity selling creates that lovely confirmation systematic traders recognise as proper risk-off positioning. Not divergence – convergence into classic flight-to-safety behaviour.

The Seasonal Crash Window

I still think this is the start of the seasonal bigger move we often see this time of year. With around 15 days before the end of October and “crash season” concludes, bears are finally getting their meal rather than just watching from the sidelines.

Just a tiny bit more sell-off will keep me very happy. Not asking for 1987 redux. Not demanding 10% single-day collapses. Just proper systematic directional movement that rewards bearish positioning through October’s historical volatility window.

Fifteen days remain. Bears are finally eating.

SPX: The Absolute Mess (But Bears Happy)

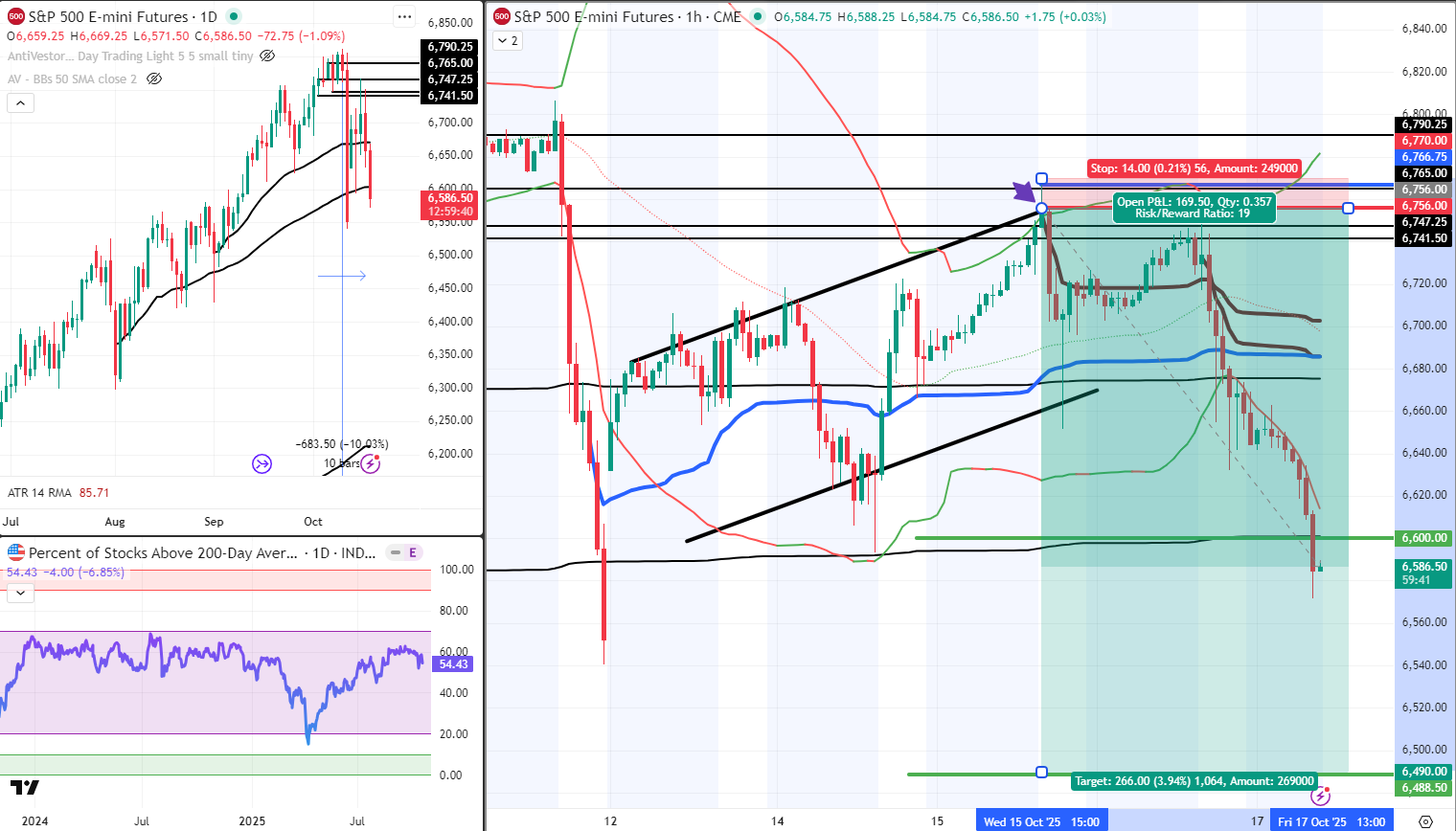

Looking at my actual payday strategies, SPX hasn’t quite reached the upper Bollinger Band for a Tag n Turn setup. That said, I was looking at a slightly bigger picture bear swing using ES Futures, which I am currently short on, and used that setup yesterday to close out my Tuesday bull entry for effectively a break-even trade.

This is a little off script, but the SPX is an absolute mess at the moment.

So it won’t do any harm to revert back to my Monday assessment: Sit and wait out the “shitty boing boing.”

When price action becomes too choppy for clean systematic signals, frameworks permit patience rather than forcing trades into messy conditions. The bear trigger is likely to be the PFZ trigger for the current trade, and with today’s overnight futures continuing the gap down, that’s likely to happen today at the opening bell.

ES Futures positioning: Currently short using bigger picture bear swing. Closed Tuesday bull for break-even rather than sitting through unnecessary drawdown whilst SPX sorts itself out. Now watching bears finally get fed.

RUT: The Crystal Clear Alternative

RUT is playing a lot nicer, with a clear and clean chart showing:

- Tag Bollinger Band low ✓

- Move to Bollinger Band high ✓

- Tag n Turn back bearish ✓

Super simple to read.

No questions.

No judgement needed.

When one instrument creates mess, another often provides clarity. This is why multi-instrument systematic approaches matter – SPX confusion doesn’t prevent RUT execution.

RTY Futures nibble: Also took a small position on RTY futures using the 4hr chart. Just a nibble, mind you. When clarity appears on larger timeframes, tiny systematic positioning tests probability without risking substantial capital.

CL Crude: Continuation Bear Move

My crude oil tiny bull swing didn’t play out and flipped back to bearish for the continuation move. My data shows November contract, but I’ve traded the December contract. TradingView will jiggle things around officially over the weekend during contract rollover.

Sometimes setups don’t trigger. Sometimes they reverse before completion. Systematic frameworks accept both outcomes as part of probability mathematics rather than personal failures requiring emotional processing.

Crude positioning: Bearish continuation active on December contract.

The Eight-for-Eight Popper Glory

Which leaves me to ring the gong again on the Premium Popper trades with another glorious winning day.

I’ll go into more detail on a separate debriefing, but we ended up 8 wins for 8 trades.

The first few were again live in front of my Fast Forward Insiders group, and semi-live in my members’ Slack group. Students watching systematic frameworks deliver perfect execution two sessions in a row creates powerful educational validation.

Yesterday: 5-for-5 perfection

Today: 8-for-8 flawless execution

Combined: 13 consecutive Popper wins across two sessions

This isn’t luck. This isn’t market conditions favouring strategies. This is probability mathematics functioning exactly as backtested frameworks promise when executed mechanically without emotional interference.

The Friday Brunch Consideration

I think that’s all for now. Bear swings are swinging, Poppers are popping perfectly, and bears are finally eating after weeks of patience.

I may enjoy a relaxing start to my weekend and take Friday off. I’ll see what the day brings. A quick brunch with Mrs N before the US markets open does seem a nice way to ease myself into Friday and the weekend.

With systematic positions running independently, Popper execution delivering consecutive perfect sessions, and bears finally getting fed, perhaps Friday’s best trade is recognising when markets need you less than your wife does.

Today’s Systematic Positioning:

- ES Futures: Currently short on bigger picture bear swing, closed Tuesday bull for break-even

- SPX: Absolute mess – but bears finally eating after weeks of patience

- RUT: Crystal clear BB Tag n Turn bearish – simple, clean, no judgement execution

- RTY Futures: Small 4hr nibble taken on clarity

- CL Crude: Tiny bull swing failed, flipped bearish for continuation (December contract)

- Premium Poppers: Perfect 8-for-8 execution live in Fast Forward and Slack

- Gold: Monumental rampage whilst stocks drop confirms flight-to-safety thesis

- Selling Pressure: Accelerating overnight – down 0.63% yesterday, down another 1.34% overnight

- Crash Season: 15 days remain – bears finally getting their meal

- Friday Plans: Possibly brunch with Mrs N – markets can manage without constant supervision

In Other News…

FinNuts Market Flash

The Semiconductor Circus: AI Hype Meets Gold Fever

S&P futures down –0.08% at 09:25 ET Friday, closing Thursday at 6,671.06 — about as inspiring as Percy discovering the “restocked” tea is just supermarket own-brand dust. Dow futures off –0.11%, Nasdaq flat, because even tech bros need a recovery nap after a week of inhaling AI hopium. Overnight range 6,665–6,678, tighter than Mac’s whisky rations after a losing streak.

Semiconductors Take a Victory Lap While Everyone Else Claps Like Captive Audience Members

TSMC’s earnings beat sent Nvidia +1.3%, Broadcom +1.4%, Micron +3.4%, and AMD — bless it — flatlined like Wallie’s motivation during quarterly reviews. Financials limped towards Friday’s Amex print while defensives quietly cried into their spreadsheets. Gold miners popped 4–6% as gold hit a $4,365 all-time high, confirming we’re now in the part of the cycle where people call shiny rocks an “asset class.”

TSMC’s AI Sermon: The Gospel According to Jensen and Wei

TSMC reported $31.7B in revenue versus $31.5B expected — a whole $200 million better, enough to make Wall Street faint with joy.

They raised 2025 growth guidance to the mid-30% range and announced $40B capex, 70% of it to feed the AI beast.

CEO Wei called AI demand “very strong,” CFO Huang dubbed 2026 “healthy” — and somewhere, a Goldman intern updated the “AI narrative” deck for the 12th time this week.

Meanwhile, American Express reports today with $4.00 EPS consensus, because nothing says “macro signal” like pretending charge-card data equals GDP.

⚖️ Cross-Asset Madness: When Gold’s on Coke and Bitcoin’s in Therapy

Gold up 60% year-to-date and shining brighter than the Fed’s denial complex. Traders calling it a “safe haven” while simultaneously buying Nvidia at 40× sales.

Bitcoin, meanwhile, is down bad — $536M in ETF outflows, all twelve funds red. Crypto bros muttering about “decoupling” again, which is finance code for “we have no idea what’s happening.”

Powell’s Tuesday speech basically announced the end of quantitative tightening and an official start to quantitative vibes — rate-cut odds now at 100% for October. Because when in doubt, print the pain away.

Hazel’s Closing Note

The market’s lost the plot. AI stocks performing miracles, gold auditioning for the next Marvel movie, Bitcoin sulking in the corner, and the Fed cosplaying as a guidance counsellor.

If this is “price discovery,” then I’m a bloody unicorn.

— Hazel Ledger, FinNuts Bureau of Bad Habits & Market Therapy

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Accelerating Selling Pressure Formation Flying” whilst claiming they had mastered “Systematic Eight-for-Eight Premium Popper Consecutive Perfection During Bear Meal Time Advanced Cooing.”

Hazel updated her crisis management protocols to include “Gold Torch Flight to Safety Confirmation Assessment Procedures” alongside emergency plans for “SPX Absolute Mess Bears Finally Eating Patience Protocol Integration Processes.”

Mac raised his Thursday morning whisky and declared, “When markets accelerate lower overnight without bounce whilst eight consecutive Popper wins deliver during live student observation, Friday brunch with Mrs N proves more valuable than watching bears eat!”

Kash attempted livestreaming about “Uncle Rus 2% crown-winning drop plus another 1.84% overnight being basically like DeFi liquidity pool catastrophic cascade without recovery bounce” but got distracted celebrating his own eight-for-eight Popper perfection day.

Wallie grumbled that in his day, traders required “constant market supervision during selling acceleration, not this modern systematic independence nonsense with Friday brunch date prioritisation whilst bears finally eat!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact: The Hydrogen Bomb Detective

A clever economics professor discovered America’s nuclear secrets in the 1950s… by watching stock prices!

When the U.S. was secretly developing the hydrogen bomb, physicist were forbidden from revealing which materials they used.

But Professor Armen Alchian noticed that Lithium Corp’s stock kept spiking during bomb tests. He deduced that lithium was the secret fuel—and he was right! The company’s stock rose 461% that year. Talk about reading between the lines! ⚛️️

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.