Expanding Triangle Prison Traps All Four Indexes Near Upper Boundary

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well, that’s one way to start the trading week – emergency hospital trip with the Mother-in-Law trumps premium popping every single time. Something a bit scary that thankfully turned simple to fix.

So all is well that ends well, but bloody hell, what timing. Looks like I missed a great day’s trading – simple move up with little to no headaches. Well done to those who popped some premiums yesterday. You magnificent bastards know exactly who you are.

Now let’s get into today’s trading…

Scroll down to see what systematic prison we’re all trapped in…

SPX Market Briefing:

The Expanding Triangle Prison

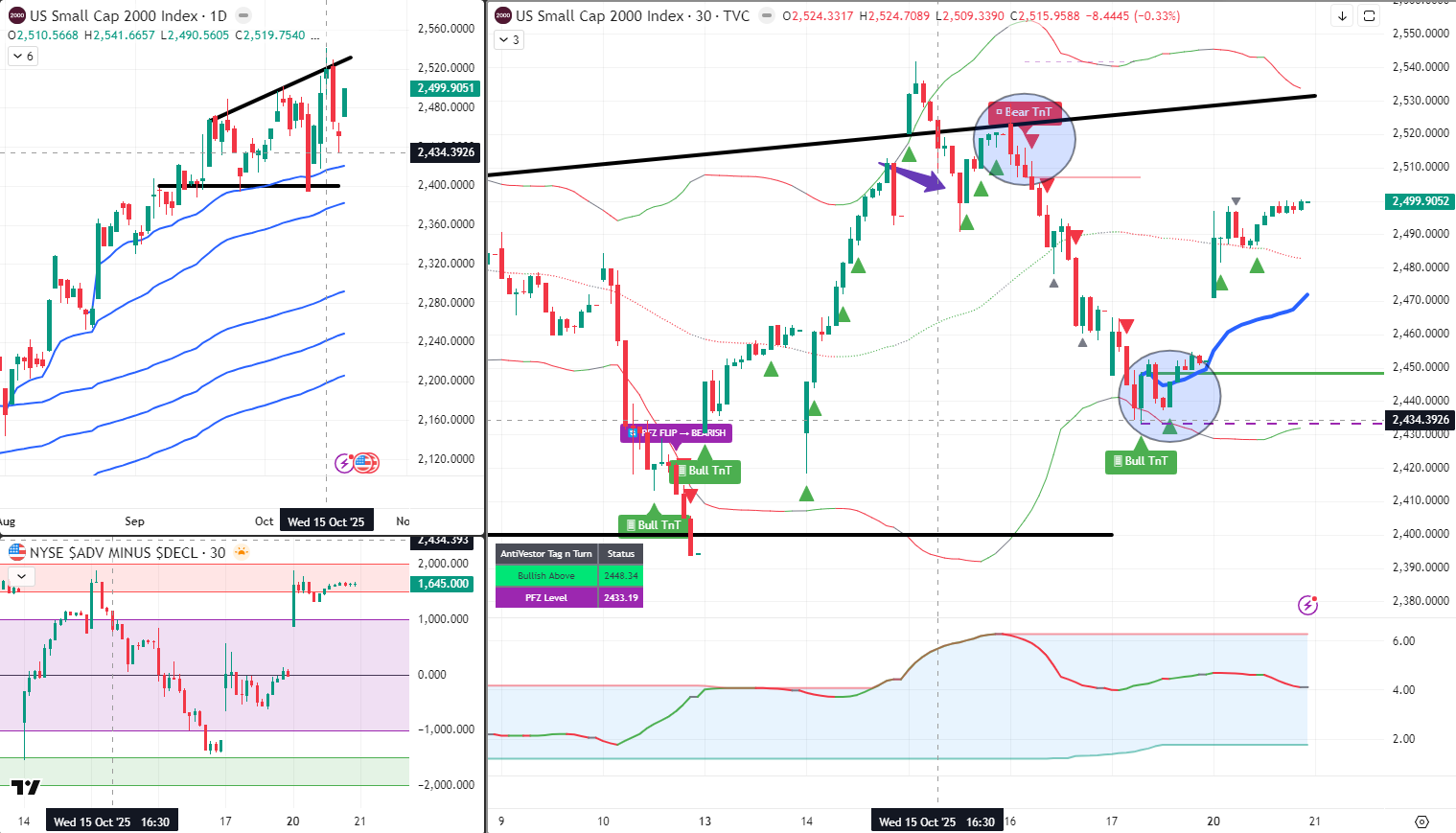

Starting with my snap market view: the usual 4 indexes remain in a developing expanding triangle type of pattern with prices near the upper boundary level. Since no breakout looks imminent, I would have to presume that the bear side of the ledger will have more pull and send us back to the pattern lows again.

Classic “trapped near the top with nowhere to go but down” setup developing nicely.

Gold’s Institutional Shenanigans

Gold continues to rip – although we’re seeing that delightful up-a-day-down-a-day pattern that looks to me like a little bit of institutional shenanigans ahead of the next big move.

The question is: will it be boom to the moon again or something more corrective? Someone with deep pockets is clearly positioning for something significant, and I’d quite like to know which direction they’re leaning.

VIX Gaslights the Bears

VIX appears to be signalling that the crash is cancelled – take your fear premium and go home, nothing to see here. But there’s still a small amount of elevation to keep the bears guessing or second-guessing themselves.

Classic market psychology torture chamber where nobody’s quite confident enough to commit fully either direction.

SPX Bearish Tag ‘n Turn at Crime Scene

Over on my usual timeframe playground, SPX has signalled another Tag ‘n Turn – this time bearish, and interestingly right at the spot of that previously BIG Friday sell-off that had us all worried about crash season acceleration.

Will we see the same speed of movement again, or will we see another new all-time high push from here? The setup’s there. Now we wait to see if history rhymes or the market decides to write new poetry entirely.

Uncle Rus Dragging His Feet

Uncle Rus (RUT) is dragging its feet by comparison. Having already popped a new all-time high prior to the big sell-off, this is looking more like a lower high development inside the larger volatility pattern.

It’s so far not giving any warning signs, and there’s a nice tight PFZ to flip back to bearish should we see the sell-off unfold properly. Patience required here whilst we wait for proper confirmation.

System Doing Its Job

All in all – and despite my own concerns about missing Monday whilst playing hospital chauffeur – the system is doing what it’s supposed to be doing and highlighting the turns and the moves quite nicely.

Mechanical precision continues working independently, even when life throws proper curveballs at the systematic trader.

In Other News…

Futures steady after Monday rally whilst earnings wave begins

Stock futures hovering near unchanged Tuesday morning following Monday’s gains that saw S&P 500 close at 6,740 like Percy maintaining composure after discovering adequate tea supplies restocked. Dow closed at 46,695 whilst Nasdaq climbed to 22,942 with Apple leading Monday’s advance. VIX remains elevated at 22 down from Friday’s 25.40 but still above 20 threshold signalling ongoing caution like Mac rationing premium whisky whilst maintaining availability.

Sector rotation demonstrates technology leadership returning

Technology led Monday with Nasdaq outperformance as semiconductors rebounded on Trump-Xi trade optimism proving presidential mood swings drive sector performance. AMD surged 24% Monday on OpenAI deal giving ChatGPT maker potential 10% AMD stake because apparently artificial intelligence companies acquiring chip manufacturers constitutes business strategy now. Financials stabilised after Thursday’s regional bank selloff with Zions up 4.7% Monday despite disclosing $60M loan loss.

Earnings calendar produces critical week ahead

Tuesday brings GE Aerospace expecting $1.46 EPS up 27% year-over-year, General Motors, Coca-Cola before bell whilst Netflix reports after close with $6.96 EPS and $11.51B revenue expected. Seventy-five percent of S&P 500 companies reporting so far beat estimates per Bank of America proving corporate guidance sandbagging works brilliantly. Magnificent 7 expected showing 14.9% earnings growth versus 6.7% for remaining 493 companies proving concentration risk remains fashionable.

Cross-asset signals reveal Fed certainty persisting

Ten-year Treasury yield steady near 4.02% whilst gold pulls back slightly from $4,255 highs but remains up 56% year-over-year. Dollar Index weak at 98.28 down 8.8% year-to-date supporting commodities broadly. Fed funds futures price 100% probability of October 28-29 cut with 88% chance December follows proving central bankers telegraphed intentions successfully. CPI data Friday delayed nine days by shutdown will provide first inflation read since September because economic statistics need government funding apparently.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom…

Percy Peanut was discovered teaching his desk pigeons “Hospital Emergency Formation Flying” whilst claiming they had mastered “Premium Popping Independence During Family Medical Crisis Advanced Cooing Protocols.”

Hazel Ledger frantically updated her “Expanding Triangle Prison Break Procedures” across multiple screens displaying trapped price action near upper boundaries. “INSTITUTIONAL SHENANIGANS DETECTED,” flashed one monitor as Gold’s up-day-down-day pattern triggered her pattern recognition algorithms. She’s simultaneously tracking VIX’s crash cancellation signals whilst maintaining bear second-guessing probability matrices.

Mac raised his morning whisky in solemn tribute to those who successfully popped premiums on Monday whilst others dealt with real-life emergencies. “To mechanical systems that don’t require hospital visits,” he toasted, surrounded by expanding triangle pattern charts and Mother-in-Law emergency protocol documentation.

Kash attempted livestreaming confused explanations about why SPX flipped bearish Tag ‘n Turn exactly where Friday’s big sell-off started – “Is this Groundhog Day or proper market structure?” – whilst simultaneously promoting his new DeFi protocol: “TrianglePrison Coin – earn yield whilst trapped near resistance!” His audience debates whether this represents double-top rejection or launch pad for new all-time highs.

Wallie grumbled about “proper lower high formations” on RUT versus “modern all-time-high-chasing nonsense” whilst reviewing tight PFZ levels waiting to flip bearish. “Back in my day, we respected expanding triangles and didn’t dance around upper boundaries like idiots waiting for lightning to strike!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The Fed’s Ultimate Insurance Policy

The “Fed Put” sounds like a golf term, but it’s actually Wall Street’s favourite get-out-of-jail-free card!

This cheeky term refers to the Federal Reserve’s perceived promise to swoop in and save the markets whenever things get ugly. Named after a “put option” (which lets you sell stocks at a set price as insurance), the “Fed Put” was born during Alan Greenspan’s tenure as Fed Chair.

After the 1987 Black Monday crash, Greenspan issued a one-sentence statement basically saying “Don’t panic, we’ve got this” and then slashed interest rates. Markets loved it so much they started expecting Fed rescues every time stocks sneezed!

It’s like having a parent who always bails you out of trouble—eventually you start taking bigger risks because you know they’ll catch you. Critics say it creates “moral hazard” where investors gamble recklessly, knowing the Fed will probably save them.

Hey, if someone promised to cover your casino losses, you’d probably bet bigger too!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.