Lazy Popper Strike Selection Reality Check: 40 Delta vs 30 Delta Outcomes

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

A mixed start to the week for me – some winners, some losses, and one very important reminder about why mechanical trading beats emotional decision-making.

Nothing quite tests your systematic discipline like getting phone calls from the hospital while you’re live trading with the Fast Forward group. “Come collect your wife early from her minor procedure – she’s sedated and ready to go.”

Try explaining to SPX that you need to pause the market for a medical emergency. Spoiler alert: it doesn’t care.

But here’s the beautiful thing about having mechanical setups – they work even when life throws curveballs at your trading day. Some trades meandered to success, others taught expensive lessons, and one required a hospital trip with a sedated and giggly wife.

Keep scrolling for the full damage report and lessons learned…

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

SPX DeBriefing:

Sometimes the best trading lessons come from the messiest trading days. Yesterday delivered both systematic wins and human error reminders in equal measure.

Trade 1: Tag ‘n Turn Swing (The Beautiful Meander)

- Strategy: Flipped bearish swing position

- Premium Collected: $5.00

- Closed At: $0.30

- Result: 94% ROC

- Lesson: Being mechanical produces the Benjamins

The Tag ‘n Turn swing meandered its way to a gorgeous 94% ROC. No drama, no stress, just systematic patience rewarded with systematic precision. This is what happens when you trust the process and let time do the heavy lifting.

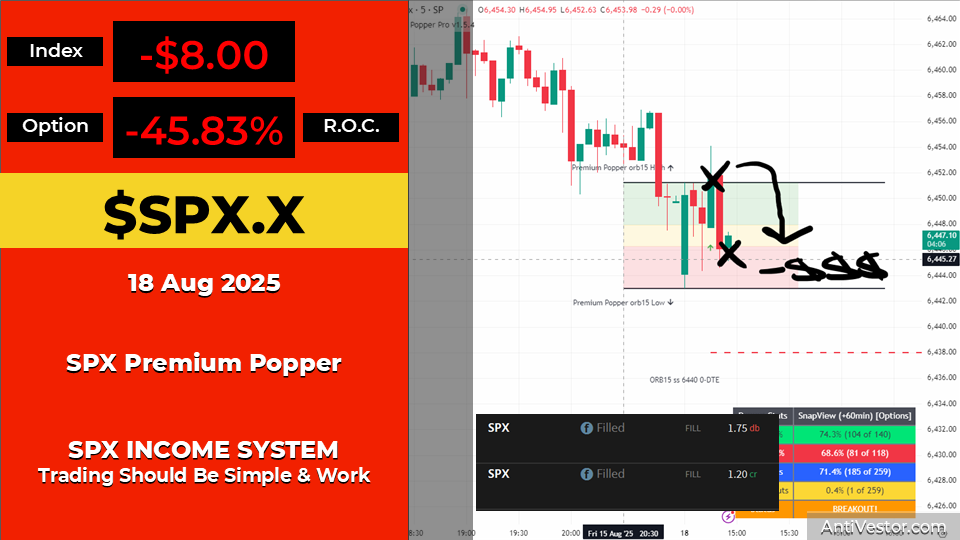

Trade 2: Premium Popper #1 (The Hospital Call Cock-Up)

- Strategy: Opening range breakout scalp

- Premium Collected: $1.75

- Closed At: $2.55

- Result: -45.83% ROC

- The Mistake: Exit plan way too tight while distracted by phone calls

Here’s where human error meets systematic trading. I was live trading with the Fast Forward group when the hospital called about collecting my sedated wife. In the distraction, I set my exit plan way too tight according to my own rules. Other students using proper exits saw the profit objective reached.

Lesson learned: wake up and pay attention.

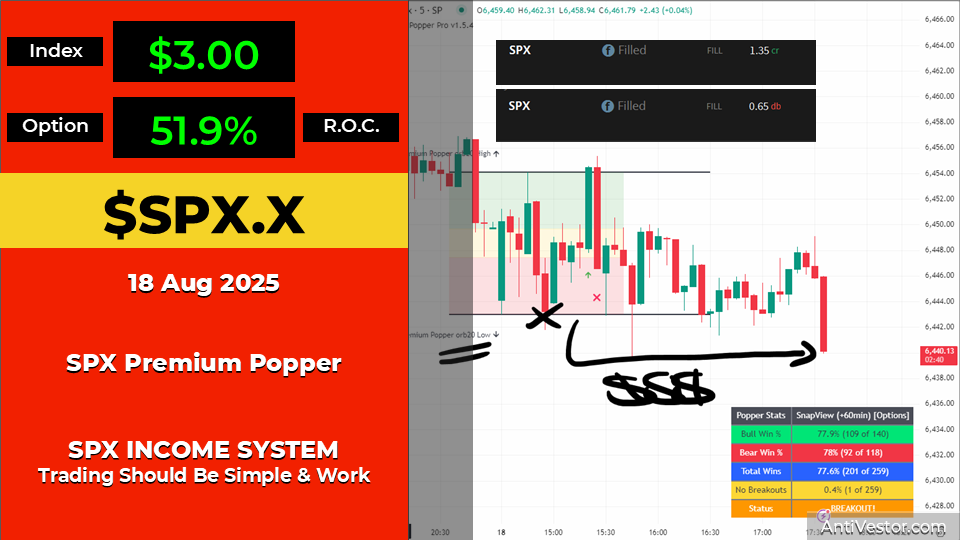

Trade 3: Premium Popper #2 (The Redemption)

- Strategy: Second breakout attempt with correct orders

- Premium Collected: $1.35

- Closed At: $0.65

- Result: 51.9% ROC

- The Fix: Proper orders placed, then wandered off to hospital

Decided to correct my mistake with a second breakout trade. Orders placed correctly this time, then off to collect the giggly wife.

Thanks to time decay and proper exit rules, the profit target was reached.

Net result on scalp strategy:

- lost 55c

- made 70c

- Net = 15c profit despite the cock-up.

Trade 4: Lazy Popper (The Strike Selection Reality Check)

- Strategy: Bear Lazy Popper post-hospital

- Premium Collected: $2.25

- Result: -94.7% ROC

- Strike Selection: 40 delta (6445) vs 30 delta (6450)

- Outcome: Almost max loss vs max profit depending on strike

Back from the voodoo man with sedated and giggly wife in tow. Once she was fed and watered, the Lazy Popper had set up. Strike selection reality: 6450 strike would have been max profit, but my greedy little mitts chose 6445 (40 delta instead of 30 delta). Almost max loss this time. No lessons to learn here – I’m consistent with my strike selection, and the numbers all work out in the end.

The Human Element: All in all, a good day for being mechanical and a really good day to not have to screen watch as SPX yoyoed around all day. Sometimes life intervenes, and that’s exactly when systematic approaches prove their worth.

Expert Insights:

Tight exit rules during high-stress situations often stem from emotional decision-making rather than mechanical discipline. When distractions arise, reverting to proven systematic parameters becomes even more critical.

Strike selection in 0-DTE strategies represents a consistent risk/reward choice rather than trade-by-trade optimization. Systematic traders choose their risk profile and stick to it through both winning and losing cycles.

The ability to place correct orders and walk away demonstrates the ultimate systematic advantage – trades that work without constant monitoring or emotional interference.

Rumour Has It…

Breaking from the Financial Nuts newsroom: Hazel was spotted drafting new “Medical Emergency Trading Protocols” after hearing about the hospital calls during live trading.

“We need procedures for sedated spouse collection during market hours,” she announced while updating her risk management manual. “This clearly falls under ‘Act of Life’ trading disruptions.”

Percy immediately suggested that sedated family members could provide “enhanced market intuition through pharmaceutical-induced clarity,” while Mac raised his whisky glass and declared, “My dear boy, any trader who can profit while managing medical emergencies deserves a medal!”

Kash tried to explain how hospital visits were “basically like yield farming but with actual recovery yields,” while Wallie just muttered, “In my day, we didn’t answer phones during trading hours. Discipline meant discipline.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.