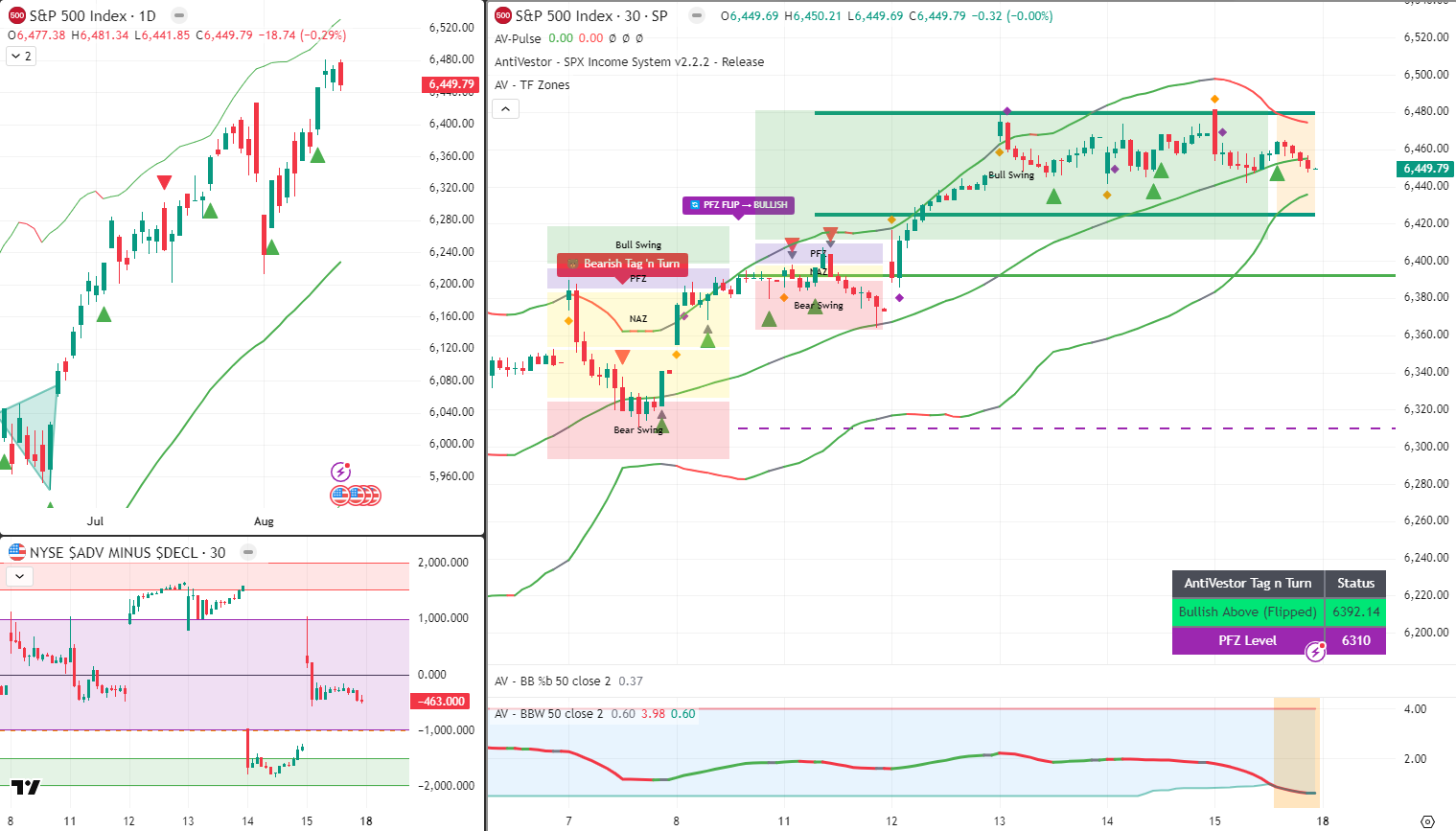

Range Highs and Lows Auto-Plotted, 60-Point Battleground Mapped

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

…and what another glorious week this promises to be!

The monthly expiration flew past without any headaches – in fact, the Premium Popper and Lazy Popper traders racked up 2 back-to-back wins for the day on top of the week’s huge successes for all my traders. I just love seeing these results from Friday’s and last weeks action.

Friday basically gapped higher then meandered lower, and something beautiful happened: the poppers popped and the Bollinger Bands got pinched. Officially!

This is exactly what systematic traders live for – clear regime changes that trigger new playbooks. When the bands squeeze, the game changes, and we adapt accordingly.

Keep scrolling for the new 4-pattern tactical deployment…

Trade SPX Like a Machine. Get Paid Like a Boss.

Rule-based spreads. Defined risk. Cash-settled. Welcome to trader freedom.

SPX Morning Briefing:

The chart is telling a crystal-clear story this morning: range mode is officially activated.

Current Regime Shift:

- Bollinger Bands: Officially pinched after Friday’s action

- New Playbook: 4 of 6 money-making patterns now active

- Range Parameters: Auto-plotted highs and lows via temporary tool

- Range Height: Approximately 60 points of battleground

When bands pinch, we flip the script. Bollinger Band patterns step aside, and range trading patterns take center stage. The temporary auto-plotting tool I’ve created marks these levels precisely – this functionality will be woven into the official SPX Income System tools.

The 6-Pattern Hierarchy: Currently Inactive:

1. Buy the dip

2. Sell the rally

Now Active (Patterns 3-6):

3. Buy range lows

4. Sell range highs

5. Buy break of range highs

6. Sell break of range lows

DTE Adjustment: The 60-point range height changes our swing trading approach. Instead of the usual 7-day cycles, we’re looking at 0-3 day timeframes. When ranges compress, opportunities accelerate.

Today’s Mechanical Plan:

Premium Popper – Waiting for the mechanical setup at the open. Range environments often provide excellent opening volatility for quick collection.

Lazy Popper – Also waiting for mechanical setup after the first hour of open. Post-volatility theta decay works beautifully in range-bound conditions.

Range Trading – Now we hunt patterns 3-6 based on where price interacts with the auto-plotted levels. More details during today’s mentorship call at the opening bell.

Let’s see if we can again hit the ground running with this new tactical deployment.

In Other News…

FinNuts Market Flash

FUTURES PRETENDING TO BE EXCITED

S&P 500 crawled to a thrilling +0.28% by 9:25 AM – the financial equivalent of a polite golf clap. Nasdaq managed +0.25% while Dow shuffled along at +0.15%, all moving with the urgency of Wallie approaching his expense reports. Overnight ranges tighter than Percy’s wallet, with Asia doing slightly better because apparently even their markets have more ambition than ours.

ENERGY WAKES UP SCREAMING, EVERYONE ELSE YAWNS

Crude oil jumped two points like it suddenly remembered it had bills to pay, dragging energy stocks along for the ride. Airlines and parcel companies immediately started whimpering about fuel costs because nothing ruins a good day like actually having to pay for petrol. Semiconductors opening mixed – export headlines battling Nvidia’s earlier strutting like a confused popularity contest.

EARNINGS CALENDAR LONELIER THAN MAC’S LUNCH BREAK

ZoomInfo brave enough to report pre-market, Palo Alto Networks waiting until after dark like financial vampires. Everyone obsessing over tariff pass-through costs and FX translation because apparently corporate guidance now reads like international relations textbooks. Mid-cap retailers teasing back-to-school numbers, proving parents will bankrupt themselves for overpriced notebooks regardless of economic conditions.

CROSS-ASSET TEA LEAF READING INTENSIFIES

Dollar index slumped to 97.8 while gold sits perfectly still at 3,360 like a well-behaved pet. Ten-year yield hovering at 4.32% – boring enough to cure insomnia. Credit markets mostly calm except single-B spreads widening because even junk bonds have standards. Oil’s little tantrum pushed breakeven inflation up two basis points, which might actually matter if it keeps this up instead of going back to sleep.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted celebrating the Bollinger Band pinch by arranging his desk pigeons into “squeeze formation.”

“The birds clearly predicted this compression,” Percy announced while adjusting tiny charts around the windowsill. “Their wing-spread patterns have been narrowing all week – textbook volatility forecasting!”

Hazel immediately updated her risk management protocols to include “Pigeon Formation Analysis” as an official technical indicator, muttering something about “if it works, document it.”

Kash tried to explain how range trading was “basically like yield farming but with actual ranges,” while Mac raised his morning whisky and declared, “My dear chaps, compressed volatility is simply the market catching its breath before the next grand adventure!”

Wallie just nodded approvingly at the mechanical range levels, saying, “Finally, clearly defined parameters instead of wishy-washy trend following nonsense.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact: ETF tsunami

According to CoinShares, cryptocurrency investment products recorded $44.2 billion in inflows during 2024 – a 320% increase from the previous record of $10.5 billion set in 2021.

The historic launch of spot Bitcoin ETFs in the United States contributed to the bulk of these record-breaking inflows.

[Source: Cointelegraph – “Crypto ETPs start 2025 with $585M inflows – CoinShares”]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.