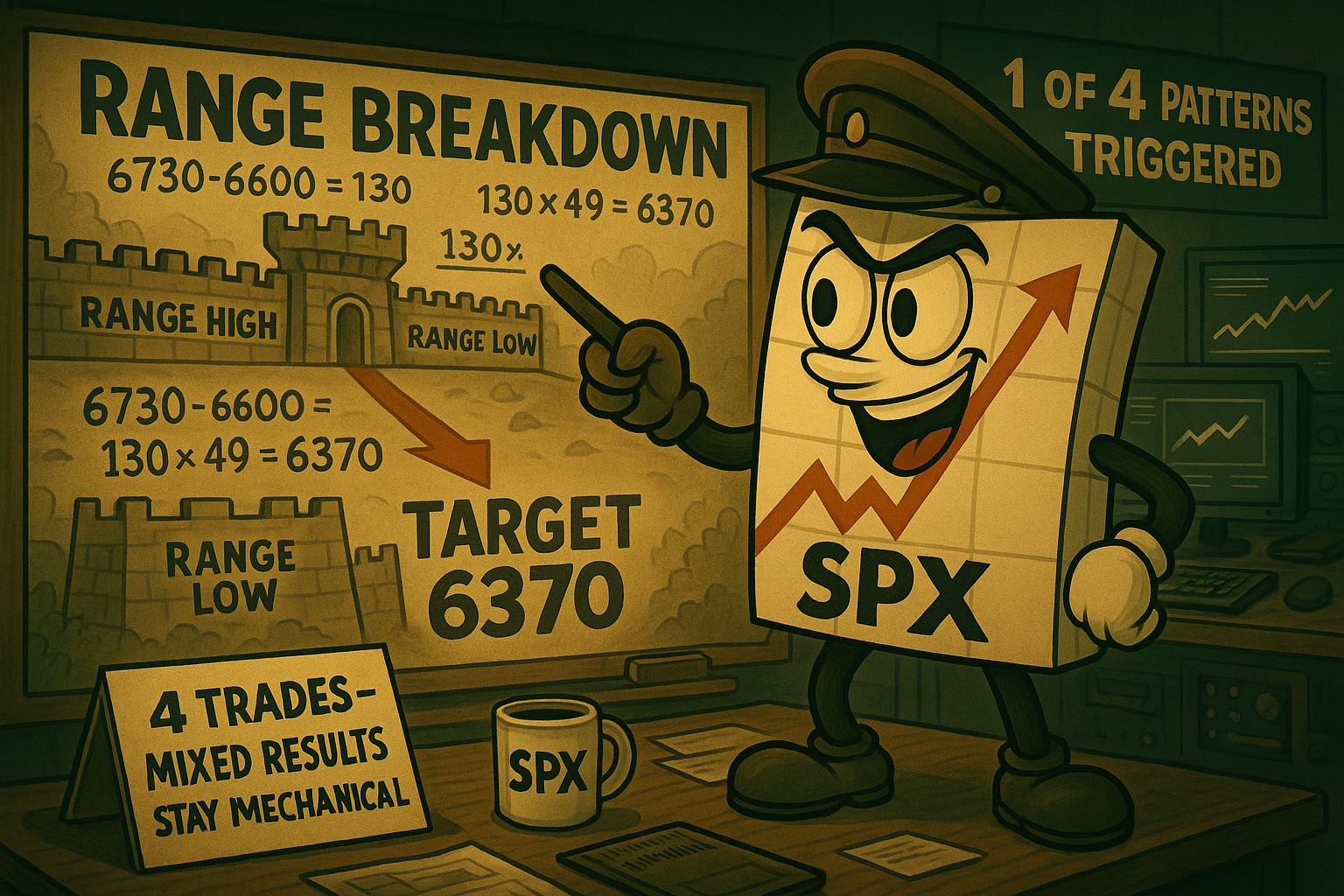

One of Four Patterns Triggers as Breakdown Confirms Below Range Lows

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Tuesday’s plan rolled out nicely – exactly what systematic traders want to see. Clear signals, defined levels, and mechanical execution regardless of individual trade outcomes.

The result was mixed for me personally – Premium Popper dropped an L, but the Lazy Popper win took a good chunk out of that loss for a net small hit on the day. More importantly, the market delivered the systematic signal we’ve been waiting for.

The bear swing is now firmly active after the breakdown through range lows. Basically, 1 of the 4 patterns we’ve been hunting just triggered with mathematical precision.

This range breakdown has its own pattern target down at 6370 – that’s the height of the range projected down from the range low. Clean, mechanical, no guesswork required.

Keep scrolling for the systematic deployment plan…

Most Trade SPX Blind. You’ll Trade It Like You Designed It.

Pulse bars flip the lights on. You see it. Trade it. Bank it.

SPX Market Briefing:

The chart is telling the exact story systematic traders live for: clear pattern completion with defined targets and mechanical decision points.

Current Systematic Status:

- Range Breakdown: Confirmed below range lows

- Bear Swing: Firmly activated (1 of 4 patterns triggered)

- Pattern Target: 6370 (range height projected down)

- Decision Point: Target vs failure determination ahead

We now have a little crossover situation between range trading and seeing if the pattern gets to target versus taking the next bullish Tag ‘n Turn too soon. This is where systematic discipline separates profitable traders from emotional reactors.

The Systematic Plan for Bear Swing:

Delaying bullish setups in the usual disciplined way:

Option 1: Wait until after the breakout target has been reached at 6370 level Option 2: Wait for a failure of the breakdown and a move back into the range above 6425

This is the way.

No guessing, no emotional reversals, just mechanical patience until the market shows its hand clearly.

Today’s Mechanical Deployment:

Premium Popper and Lazy Popper – Plans remain mechanical as always, simply waiting for the software to light up trades after the opening bell. Individual results will vary, but systematic approach remains constant.

This is also the way.

The Beauty of Systematic Clarity: Range breaks don’t happen often, but when they do, they provide the cleanest directional signals in systematic trading. Pattern targets remove the guesswork from profit objectives, while failure levels give clear reversal signals.

Yesterday’s mixed personal results (Premium Popper L, Lazy Popper win) matter far less than the systematic signal clarity we’re now operating with. The bear swing activation gives us a clear directional bias until proven otherwise.

In Other News…

FinNuts Market Flash

FUTURES ACHIEVE MAGNIFICENT MEDIOCRITY

S&P 500 stumbled to +0.28% by 9:25 AM like Percy after his third pint – technically upright but barely. Nasdaq’s +0.25% wouldn’t impress a particularly unambitious sloth, while Dow’s +0.15% suggests it’s actively trying to cure insomnia. Asia actually bothered to show up this time, making our overnight action look like it was choreographed by narcoleptic tortoises.

ENERGY DISCOVERS IT HAS A BACKBONE

Crude oil erupted like Wallie finding out the coffee machine’s broken, dragging energy stocks along for the ride while airlines immediately started sobbing about fuel bills. Apparently flying giant metal death traps was supposed to be economical. Semiconductors opening more bipolar than Mac’s mood swings – tracker headlines wrestling Nvidia’s insufferable smugness like corporate cage fighting.

EARNINGS CALENDAR LONELIER THAN KASH’S WEEKEND PLANS

ZoomInfo throwing themselves to the pre-market wolves while Palo Alto Networks cowering until after dark like financial vampires. Corporate guidance now sounds like PhD dissertations on international trade – tariff pass-through costs dominating conversations because making actual products apparently wasn’t complicated enough already. Mid-cap retailers teasing back-to-school numbers, proving parents will financially immolate themselves for overpriced pencil cases.

CROSS-ASSET CIRCUS CONTINUES ITS TOUR

Dollar index face-planted to 97.8 faster than office resolutions in January while gold sits motionless at 3,360 like a well-trained golden retriever. Ten-year yield camping at 4.32% with all the excitement of watching grass grow in reverse. Credit markets behaving like choirboys except single-B spreads having minor nervous breakdowns, proving even junk has standards. Oil’s tantrum bumped breakevens up 2 basis points – enough to make Fed officials question their life choices if this bollocks persists.

-Hazel

Expert Insights:

Range breakdown pattern targets calculated using range height projections provide mechanical profit objectives that remove emotional decision-making from trade management. The 6370 target represents mathematical precision rather than hopeful guessing.

Delaying bullish setups until either target completion or failure signals prevents premature reversal attempts that typically fail during genuine directional moves. Systematic patience often outperforms reactive trading during pattern completion phases.

The crossover between range trading completion and directional bias activation requires disciplined adherence to predefined decision points rather than emotional interpretation of market “feels.”

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted rearranging his desk pigeons into “breakdown formation” while pointing excitedly at the range low breach.

“The birds clearly predicted this systematic activation,” Percy announced while adjusting tiny charts around the windowsill. “Their flight patterns have been descending all week – textbook pattern target forecasting!”

Hazel immediately updated her systematic protocols to include “Pattern Target 6370 Achievement Metrics” while muttering something about “finally, clear mathematical objectives instead of emotional guesswork.”

Mac raised his morning whisky and declared, “My dear chaps, a proper breakdown calls for proper celebration – even if we’re riding it downward!”

Kash tried to explain how pattern targets were “basically like DeFi farming but with actual range projections,” while Wallie just nodded approvingly at the mechanical approach, saying, “Finally, trading with defined parameters instead of wishful thinking.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

According to research by Johns Hopkins Carey Business School, the volume of 0DTE (zero days to expiration) options on S&P 500 stocks more than doubled between 2021 and 2024, and accounted for more than 43% of the total daily options volume on those stocks as of 2024. Additionally, by midyear 2023, 0DTE options strategies had grown to more than 40% of all options trades tied to the S&P 500 index.

[Source: NerdWallet – “0DTE: What Investors Should Know About Zero-Day Options”]

Meme of the Day:

“When the range finally breaks and your pattern target activates exactly as calculated”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.