From Tuesday’s Crash to Wednesday’s Surge – Emotional Rollercoaster Complete

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well Fuck-a-doodle-doo.

Trump U-turns again.

At this stage, I’m convinced he’s just playing patty-cake with the world economy to… well, I’m not gonna say that.

But we’re all thinking it.

Yesterday was an emotional rollercoaster – playing out exactly as you might expect from a breakdown – and then his “Just kidding!” announcement flipped the market narrative on a dime. Again.

Tuesday: Worst selloff since October. “Sell America!” headlines everywhere.

Wednesday: Best day since November. S&P turns positive for 2026. Bears left holding the bag.

We might not need a crack Nixon interviewer to get at the truth here.

He’s saying it loud and proud, and everyone’s nodding along like this is normal.

Mr Trump-iagi Says “Tariffs on! Tariffs off!”

Greenland deal! No deal! Deal framework!

Markets whipsaw. Rinse. Repeat.

I’ll step off this soapbox now – I don’t have a horse in this race being a non-US resident. But it sure is fun to watch, despite being a headache to trade from time to time.

Keep scrolling – the charts are calmer than the politics…

When Politicians Flip, Systems Stay Steady.

Market Briefing:

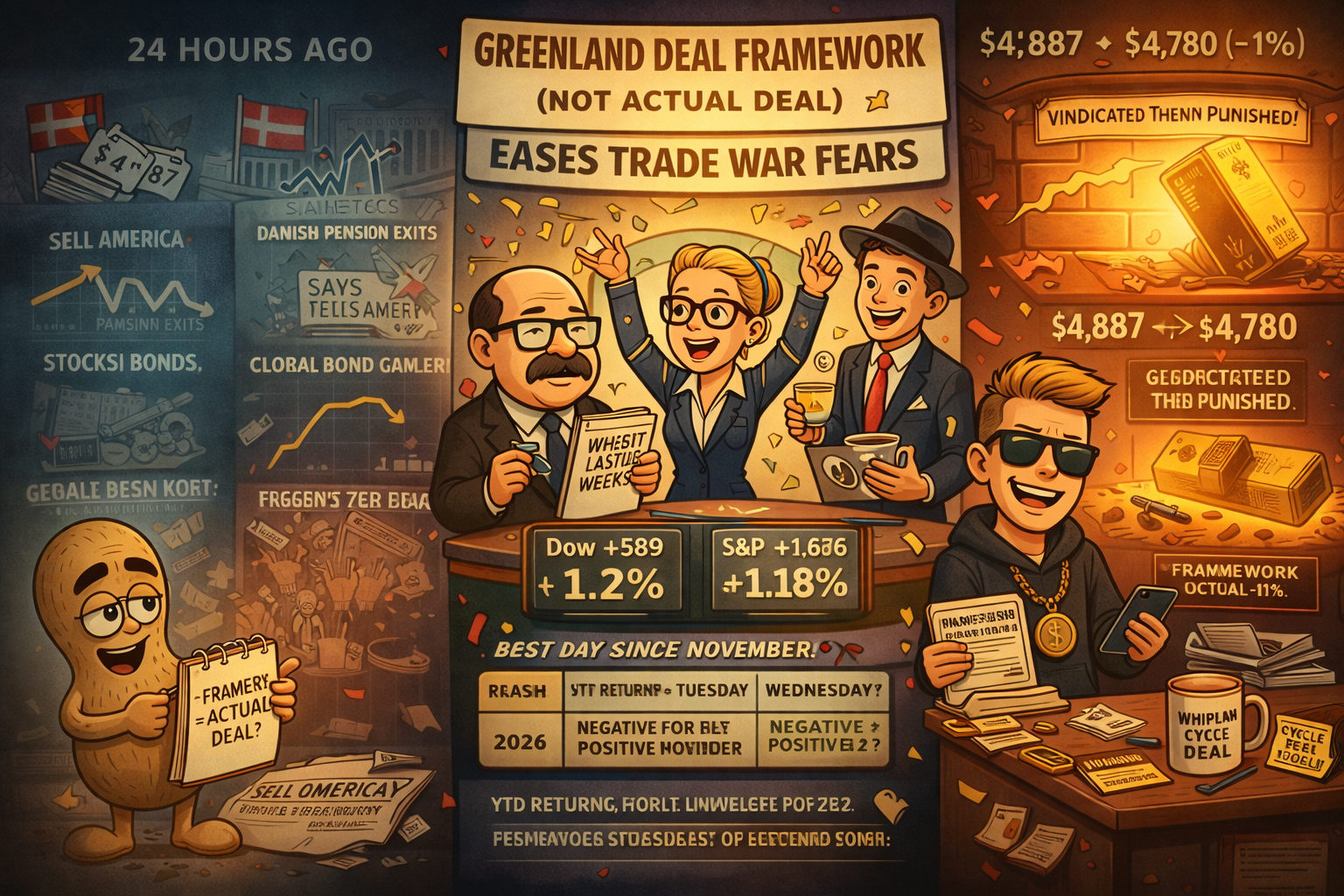

The “Just Kidding” Rally

Let’s recap the whiplash:

Tuesday: Trump announces 10% tariffs on 8 NATO allies. Greenland ultimatum. Markets crater. “Sell America” trend materialises. Dow drops 875 points. VIX spikes. Bears celebrate.

Wednesday: Trump calls off Europe tariffs. Announces Greenland deal framework with NATO. Markets surge 1.2%. S&P turns positive for 2026. Energy, materials, tech lead gains. Bears… confused.

Bessent told Davos – (not to be confused with Davros – I swear I thought the Daleks were invading!) – the administration was “not concerned” about market volatility.

I bet they’re not.

Current Multi-Market Status:

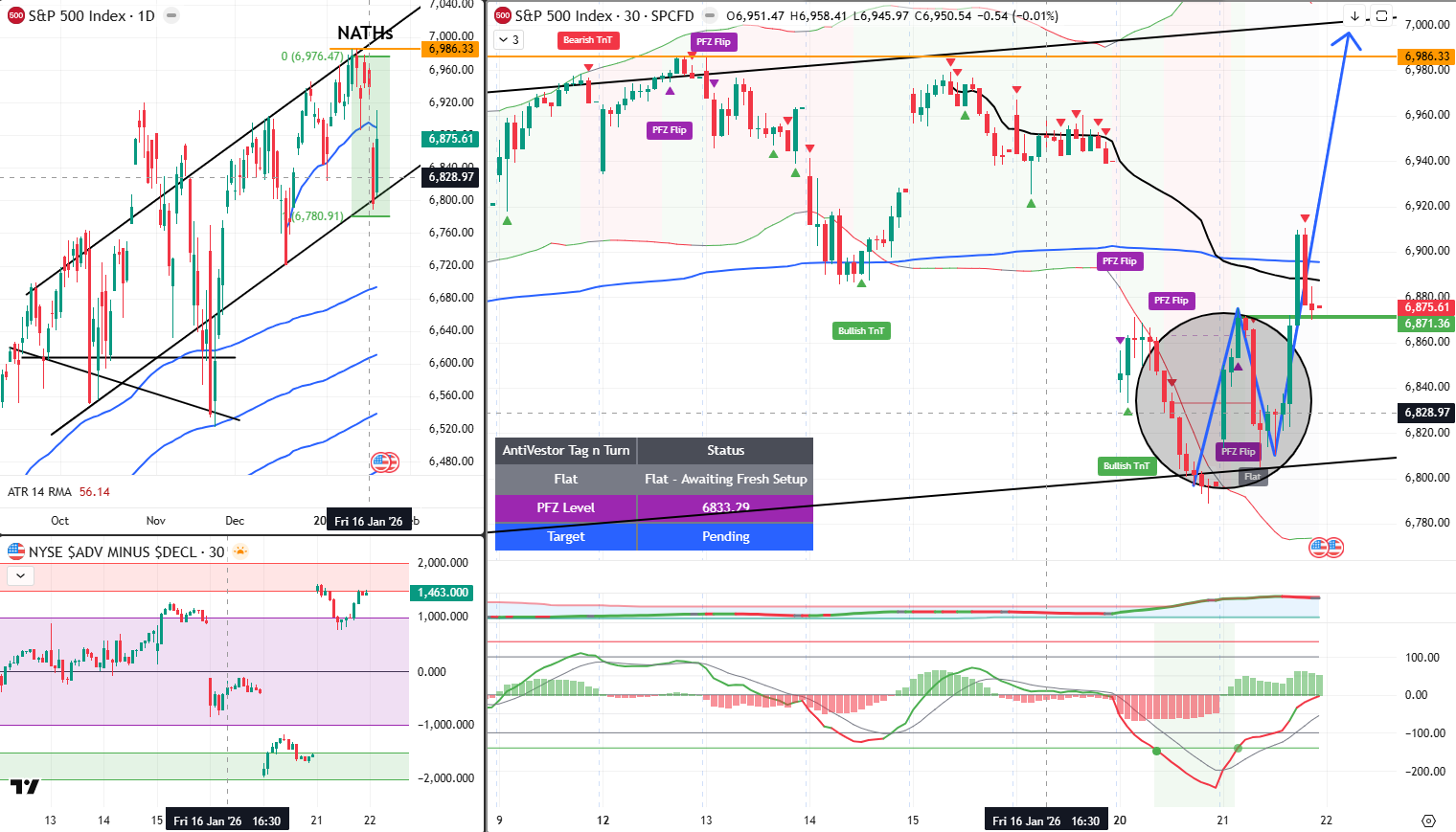

- SPX: TnT Flat – Awaiting Fresh Setup – PFZ 6833.79 – Target Pending

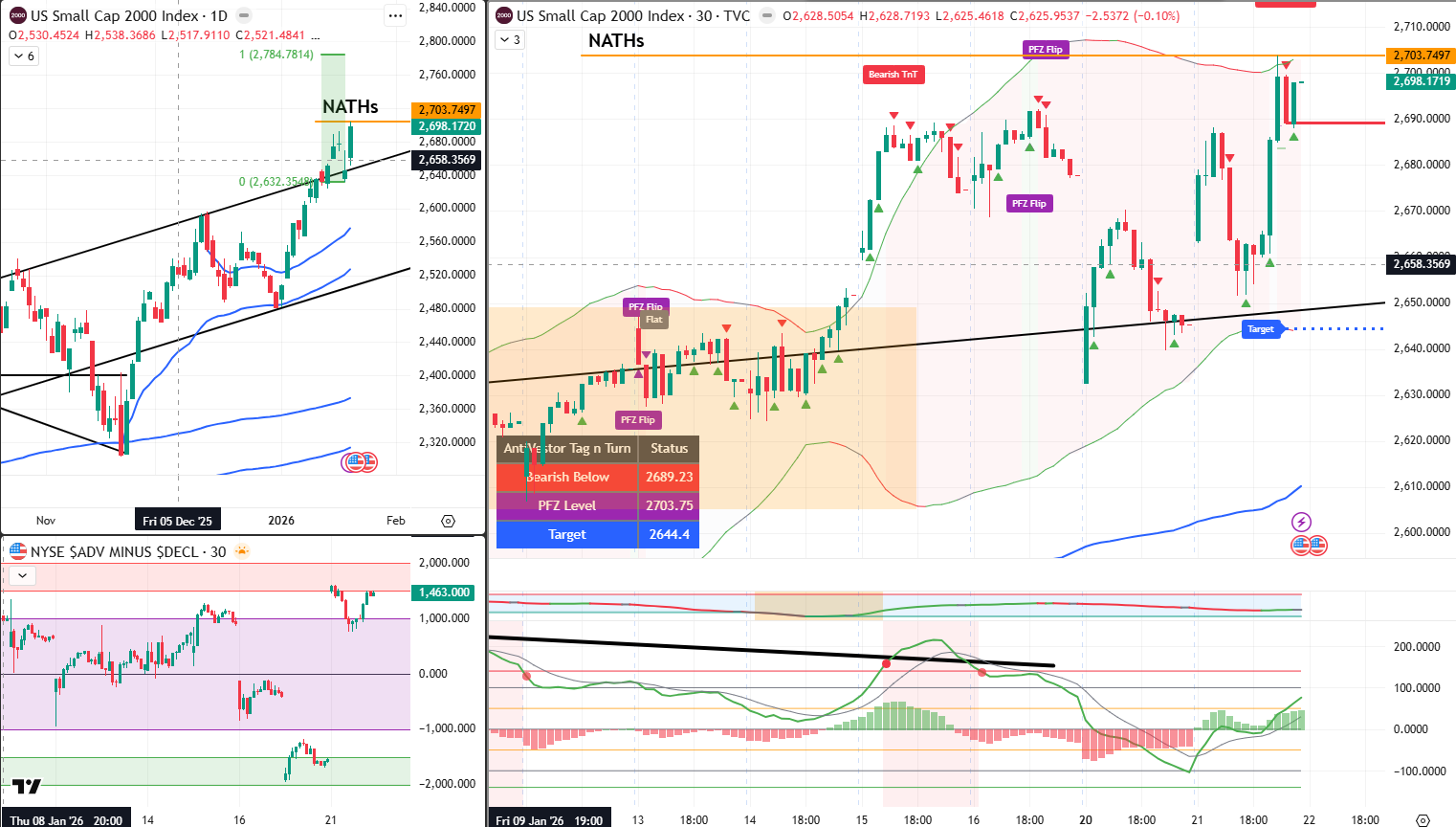

- RUT: TnT Bearish Below – Status 2689.23 – PFZ 2703.75 – Target 2644.4 (flipping bullish after open)

- ES: 6,951.00 – Recovering strongly towards NATHs

- YM: 49,456 – Back in business

- NQ: 25,688.00 – Tech leading the bounce

- RTY: 2,719-2,727 – At NATHs, breakout confirmed

- GC: 4,891.1 – Still at NATHs (flight to safety bid remains)

- CL: 59.93 – Bouncing

- VIX: 16.07 – Collapsed back to complacency

- BTC: 89,963.31 – Steadying after Tuesday’s plunge

RUT: The Firm Breakout

Uncle Russell has made his move.

While the other indexes were teasing bear breakouts that never quite committed, RUT has delivered a firm breakout to the upside. The range that contained price for weeks has been decisively cleared.

Breakout target: 2784 level.

My initial bear TnT that developed during the selloff will be flipped to bullish using the PFZ level – probably just after the opening bell. The larger pattern is now pointing up.

SPX: V-Shaped Conservative Entry

As we discussed yesterday, SPX is setting up for a V-shaped conservative entry pattern. The TnT is flat and awaiting fresh setup, which means we’re in decision territory.

The teased bear breakout has reversed back into range. Range reversals are now the theme across indexes – those who chased the breakdown are being squeezed.

This is why we wait for mechanical confirmation rather than chasing headlines.

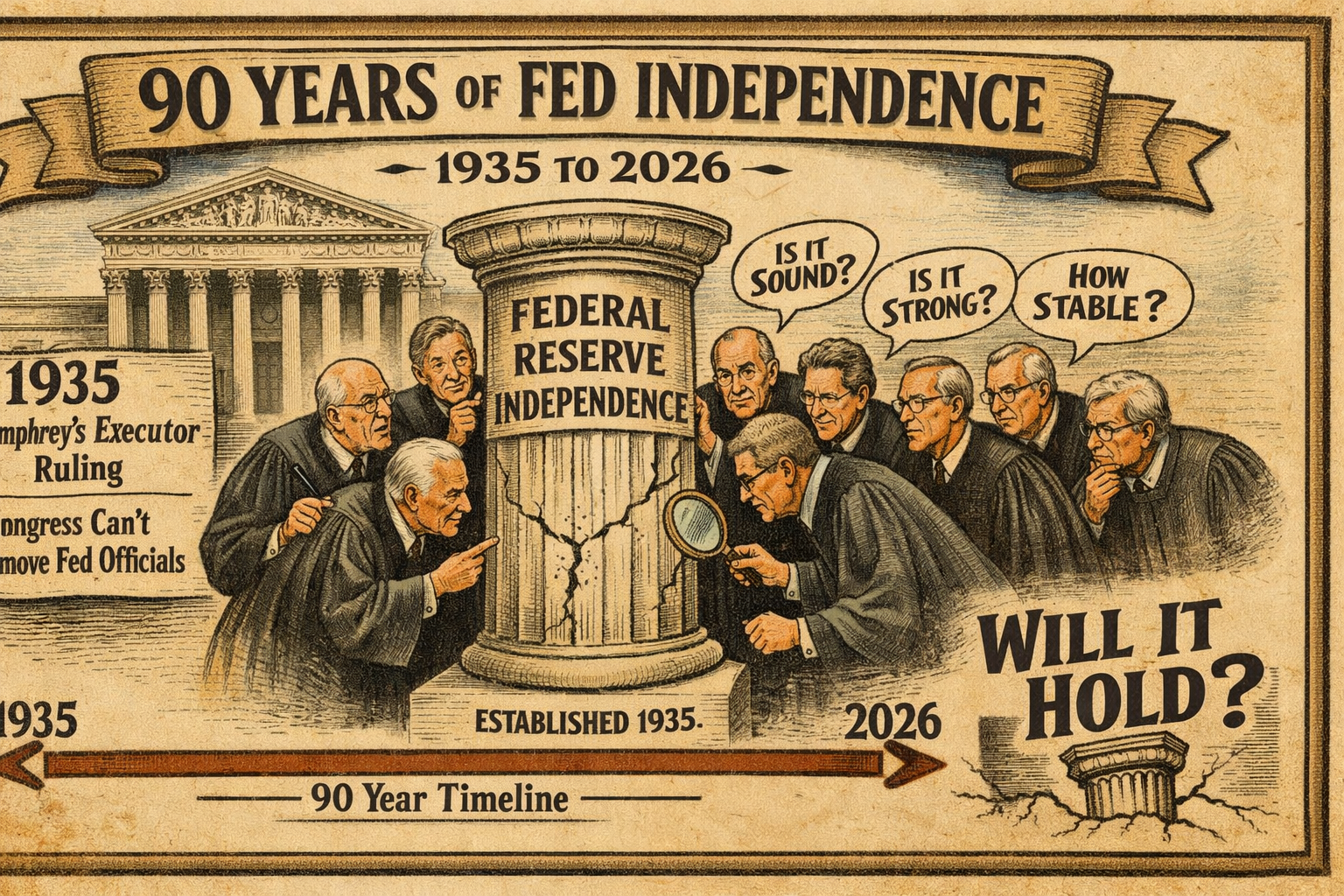

Supreme Court Wildcard

Worth watching: All nine justices questioned Trump’s bid to fire Fed Governor Lisa Cook yesterday. Kavanaugh warned it “would weaken if not shatter” Fed independence.

Powell and Cook attended the arguments. The ruling could protect central bank independence for years – or open Pandora’s box.

For now, markets are ignoring this in favour of the tariff relief rally. But it’s a story that could matter later.

PCE Data Today

The 43-day shutdown created a data vacuum. Today we get delayed PCE inflation data covering October and November.

Economists expect 2.7-2.8% core PCE. Anything above 2.8% could force the Fed to stay restrictive longer.

One more potential volatility catalyst in a week that’s already had plenty.

Expert Insights:

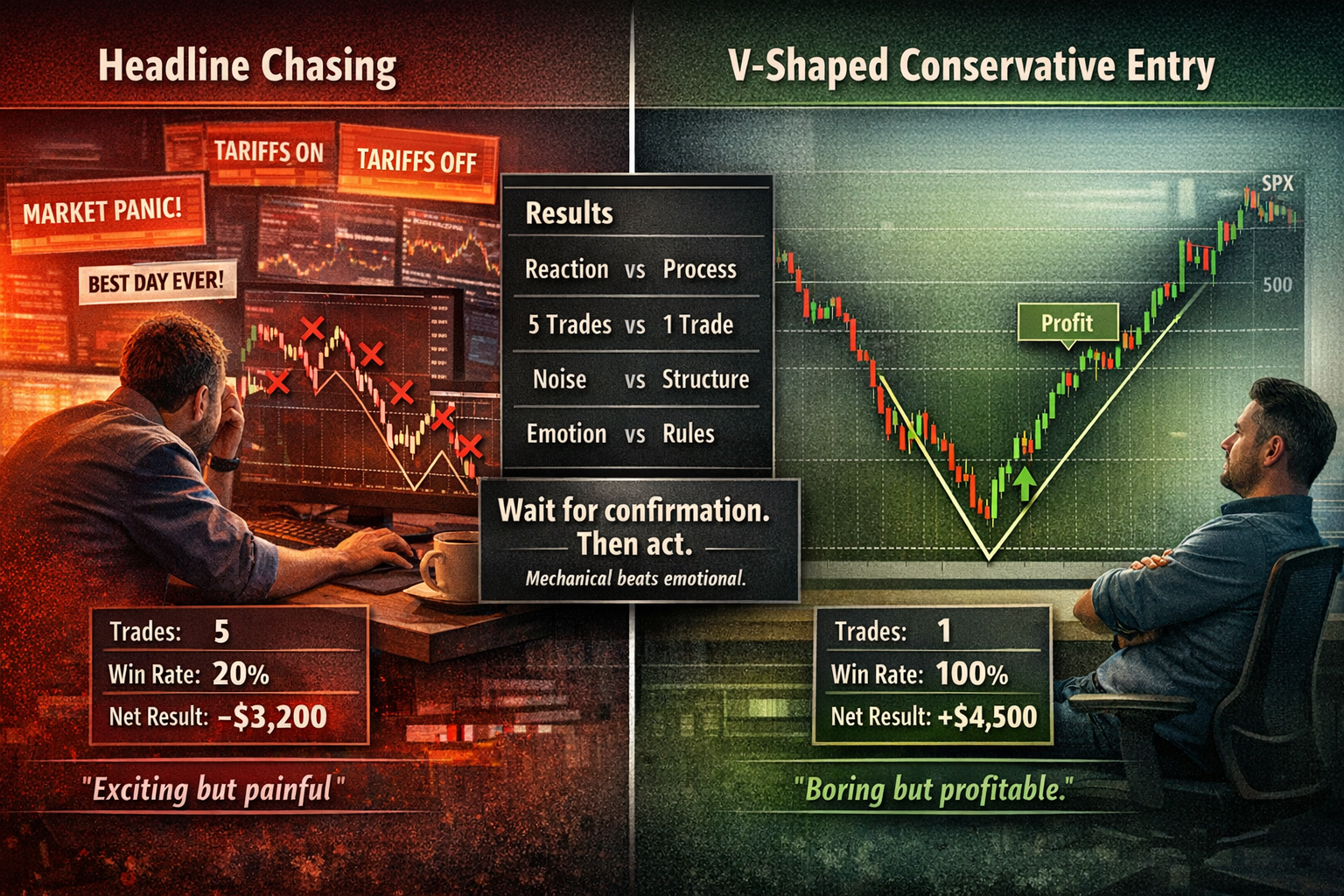

Trading the Untradeable

When political announcements can reverse market direction in minutes, the only defence is mechanical discipline.

Tuesday’s breakdown looked textbook. Wednesday’s reversal made it a trap. Traders who chased either direction based on headlines are nursing losses. Traders who waited for confirmation patterns are still positioned correctly.

The V-shaped conservative entry exists precisely for moments like this. Rather than guessing which political tweet will stick, we wait for price to confirm direction and then join the move already in progress.

Boring? Perhaps. Profitable? Consistently.

In Other News…

Crisis Resolved by “Framework” Announcement in Record 24 Hours

S&P positive for 2026 again. Gold falls after being vindicated. Supreme Court questions Fed overreach whilst markets ignore.

Markets posted best day since November as Greenland “deal framework” eased trade war fears—24 hours after “Sell America” trade materialised stocks surged 1.16%, Nasdaq +1.18%, Dow +589 proving framework announcement sufficient to reverse foreign capital flight. Supreme Court questioned Trump’s Fed overreach but markets ignored because apparently judicial oversight of monetary policy interference less important than vague deal outline. S&P turned positive for 2026 again after being negative Tuesday demonstrating year-to-date returns now measured in daily whiplash cycles.

When 24 Hours Reverses Institutional Crisis

Wednesday’s surge erased Tuesday’s “source of uncertainty, not safe haven” narrative through unspecified “framework” announcement reversing Danish pension exits and global bond contagion. VIX fell to 15.58 from 18.84, gold pulled back 1% to $4,780 after hitting $4,887 record proving precious metals vindicated then immediately punished for being correct. Markets treating geopolitical crisis → framework → resolution cycle as normal two-day pattern not concerning volatility.

Semiconductors Rally on “AI Infrastructure Demand Optimism”

Intel +11%, AMD +8%, Micron +7% on renewed optimism about thing causing previous concern—AI infrastructure spending validated again after being questioned Tuesday. Intel reports tonight expecting paltry $0.08 EPS, $13.4B revenue yet stock rallying because apparently data centre sales projected +29% matters more than actual profitability. Netflix beat with 325M subscribers, $12.05B revenue (+18% YoY) then fell 5% on Warner Bros acquisition concerns proving results still irrelevant during framework announcements.

⚖️ Supreme Court Questions Fed Overreach (Markets Shrug)

Supreme Court questioning Trump’s Fed overreach received less market attention than Greenland framework—judiciary examining executive branch interference in monetary policy treated as background noise whilst vague trade announcements move indices 1%+. Markets prioritising deal frameworks over constitutional framework demonstrates selective institutional concern.

☕ Hazel’s Take

Best day since November on framework, S&P positive again, Supreme Court Fed concerns ignored, gold punished after vindication. When 24-hour crisis-to-resolution cycle becomes normal and framework announcements reverse capital flight whilst judicial oversight ignored, probably acknowledging markets optimise for trading opportunities not institutional stability.

—Hazel, FinNuts

Rumour Has It…

Percy has created a “Trump U-Turn Tracker” on his desk. He’s currently at 47 reversals since the inauguration and has started taking bets on when the next one hits. Hazel pointed out that gambling in the office violates several HR policies, to which Percy replied: “So does my chart orientation, but nobody’s stopped me yet.”

Wallie raised his tumbler to the Supreme Court coverage and muttered something about “institutions still mattering.” When asked if he thought Fed independence would survive, he simply said: “Lasted longer than my third marriage. Odds are decent.”

Kash is convinced the tariff reversal is somehow bullish for his meme coin portfolio. “Uncertainty breeds opportunity!” he announced. Mac gently reminded him that his portfolio is down 40% from last week’s uncertainty. Kash called it “accumulation phase.”

Meanwhile, the entire team watched the VIX collapse from 20 to 16 in stunned silence. Percy broke it by asking: “Does this mean my tracker resets?”

The Financial Nuts consensus: “Political whiplash continues. Coffee rations at emergency levels. Percy’s U-Turn Tracker needs a bigger whiteboard.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Meme of the Day:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.