Just When You Think You’re Out – The Bears Pull You Right Back In

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

“Just when I thought I was out… they pull me back in!”

Read that in your best Al Pacino voice. Go on, I’ll wait.

Because that’s exactly what happened overnight. The bulls had their gap higher, their celebratory cigars lit, the champagne was chilling – and then the bears grabbed them by the lapels and dragged them right back into the family business.

What another fecking palaver.

Scroll down for the full breakdown

Including which index is spilling the beans on what comes next…

The Setup: Godfather Markets Edition

Here’s the thing about this week. We’ve had Trump doing his Jepetto routine – pulling strings, making indexes dance like Pinocchio after too much espresso. Tariffs on, tariffs off, Greenland threats, NATO tantrums, “I’ll start my own NATO with blackjack and hookers” energy.

But strip away the puppet master theatrics and ask yourself: what was actually developing before the weekend drama kicked off?

The bear.

That’s the narrative nobody’s talking about. The one that was quietly building whilst everyone was distracted by political theatre.

Multi-Market Status

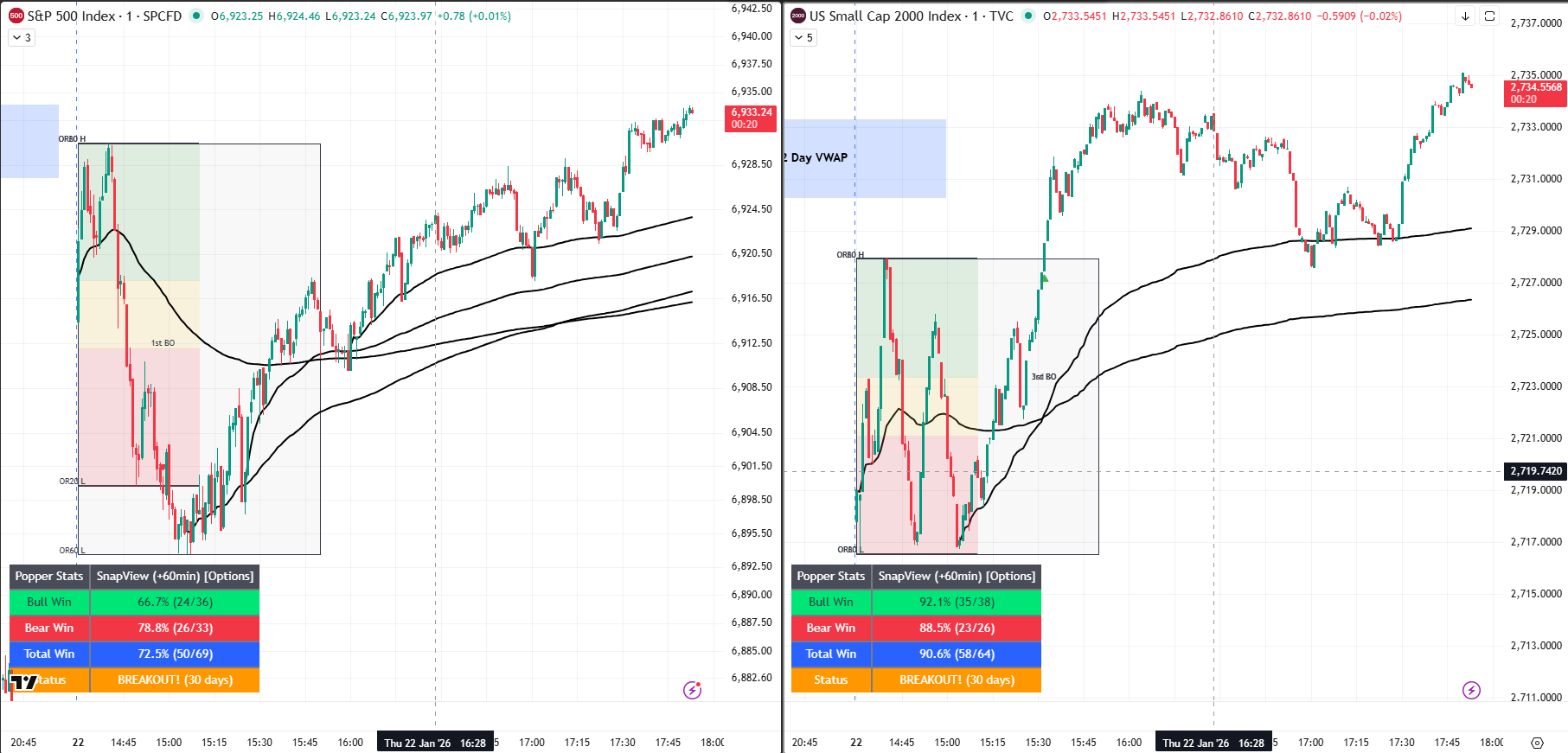

SPX: Flat – Awaiting Fresh Setup. The system officially flip-flopped into indecision. PFZ Level sitting at 6833.29. However – discretionary V-shaped conservative entry (6 Money Making Patterns) has me positioned bullish with a tight leash on the rising AVWAP.

RUT (Uncle Russell): Bearish Below 2735.1. Target 2630.48. Tagged new all-time highs, immediately flipped bearish – because of course it did. The initial breakout target has been reached. A secondary target sits slightly higher, depending on how you draw that upper boundary (it was a bit vague). Either way – job done, hat tip, now what?

ES: Gap fill reaction territory from earlier in the week. Same story, different instrument.

NQ (Nasdaq): Gap filling right up to that rising trendline we drew after the bull reaction off horizontal support lows. This is the interesting one. Weakest of the lot. Hasn’t been participating in anything bullish. If we’re looking for a leading indicator on the bear move – this is your snitch.

YM (Dow): Similar gap fill pattern. Following the herd.

Gold: Rampaging to safety highs. $4,966/oz. Best week since March 2020. Up 12% in January alone. Greenland uncertainty plus weaker dollar equals safe haven flows.

Bitcoin: Hibernating at $89K whilst Fear Index hits 20 (extreme fear). Yet whales accumulate. January ETF flows net near zero. Make of that what you will.

The Real Story

Forget Trump for a second.

Look at the price action without the political noise filter:

The futures turned overnight. Having already turned intraday. The indexes are reacting off their gap down levels from earlier in the week. RTY hit its target and immediately reversed. Nasdaq – the weakest player who’s been leading absolutely nothing bullish – is now gap filling right into resistance.

This is starting to look less like “Trump chaos” and more like “bear narrative that got interrupted by a weekend news cycle.”

Systematic Position Management

Given all the above, here’s the actual trade management happening:

The V-shaped conservative entry from the 6 Money Making Patterns got me bullish before the system officially decided what it wanted to do. Not coded up yet to find these automatically – that’s on the to-do list.

This creates discretionary flexibility within the systematic framework. We’re slightly off-piste here, but not lost in the wilderness.

The rising anchored VWAP becomes the leash. Price respects it? Bull swing stays on. Price violates it? Cull the position and pivot.

Hedge Status: Already took a small hedge yesterday to essentially lock in a small profit should there have been a large gap down today. Smart? We’ll see. But the overnight move down means I can cull the bull and cash in on the hedge for a gain if needed.

Premium Popper Update

RUT: Classic 1st breakout PopPop. Textbook stuff.

SPX: Had a bit of fun with VWAP and popped a popper on. The official debriefing is pending, but the charts are already posted in Slack for the community.

Profits Pop Pop indeed.

News That Actually Matters (Maybe)

Intel’s Earnings Paradox: Beat $0.15 EPS versus $0.08 expected. Revenue $13.7B beat. Market reaction? Down 12% because Q1 guidance landed at $11.7B-$12.7B versus $12.51B consensus. Supply constraints blamed. Stock went from $47 to $41 faster than you can say “forward guidance matters more than actuals.”

TikTok Saga Finally Ends: Five years of drama culminating in Oracle, Silver Lake, and MGX each taking 15% stakes. ByteDance kept 19.9%. Trump personally thanked Xi. 200 million US users can finally exhale. Algorithm retraining begins.

PCE Stuck at 2.8%: Both November headline and core above Fed’s 2% target. January rate hold now 95% probability. Strong spending meets stubborn inflation. Policy stalemate through first half expected.

Expert Insights

The Gap Fill Phenomenon

When multiple indexes simultaneously fill gaps from earlier sessions, it often signals a test of prior support/resistance levels rather than a directional commitment. In essence, markets are “checking their work” before the next sustained move.

The Nasdaq’s behaviour deserves particular attention here – when the weakest index in an up-move leads the way on any retracement, it often acts as the canary in the coal mine for broader directional shifts.

Systematic traders watch the laggard, not the leader.

[Source: Market structure principle – observable across multiple instruments today]

In Other News…

Intel Beats Earnings, Tanks 12%; P&G Misses Revenue, Rises 2.7%

Markets confirm nothing means what it should anymore.

Wall Street celebrated its second consecutive rally Thursday as investors discovered the secret to gains: simply ignore whatever doesn’t fit the narrative. Intel’s after-hours collapse now shadows Friday’s open like an unwelcome reminder that fundamentals occasionally matter.

The Beat That Became a Beating

Intel delivered $0.15 EPS versus $0.08 expected—nearly double the forecast—then promptly cratered 12% after hours. Q1 guidance of $11.7B-$12.7B missed the $12.51B consensus. CFO blamed “supply constraints,” which roughly translates to “we made the numbers but forgot to mention everything’s about to get worse.”

Rotation Roulette

GE Aerospace tumbled 7.4% despite beating because apparently profit-taking requires no actual logic. Meanwhile P&G climbed 2.7% after missing revenue, proving disappointment is merely opportunity wearing a different outfit. Meta surged 5.7% on AI optimism—the 2025 equivalent of mentioning blockchain in 2021.

The Bull Signal Nobody Asked For

Dow Transports hit an all-time high, triggering what technical analysts call a “confirmed bull signal.” Airlines, truckers, and rails rallying simultaneously whilst Intel melts down feels less like confirmation and more like the orchestra tuning up whilst the ship lists.

☕ Hazel’s Take

When beating earnings by 87% earns a 12% collapse and missing revenue earns a 2.7% rally, we’ve achieved perfect market enlightenment. Next week brings Apple, Microsoft, and Meta—presumably they’ll need to cure cancer to stay flat.

—Hazel, FinNuts

Rumour Has It…

The Financial Nuts Newsroom is buzzing with activity…

Percy is standing at the whiteboard, furiously circling the Nasdaq chart with a red marker. “Look at it! It’s the informant! It’s wearing a wire!”

Hazel adjusts her glasses whilst reviewing the overnight futures prints. “The correlation between Gold’s climb and Bitcoin’s cower is… troubling. It’s almost as if one asset class remembered what ‘store of value’ actually means.”

Kash is on three phones simultaneously. “Intel beat earnings AND tanked twelve percent? That’s not a paradox, that’s just Wall Street being Wall Street.”

Mac pours something amber into a crystal glass and mutters, “Trump’s not pulling the strings. He’s just making noise whilst the actual move develops underneath. Classic misdirection.”

Wallie looks up from his Bloomberg terminal: “The V-shaped entry pattern is lovely and all, but has anyone noticed that Uncle Russell tagged all-time highs and immediately said ‘nope’? That’s not bullish behaviour, that’s a warning shot.”

The team exchanges knowing glances. The bear might be the real story after all.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Gold is up 12% in January 2026, marking its best start to a year since 2008. That year, gold ultimately gained 5.5% by December despite the financial crisis volatility. The current surge is driven by Greenland geopolitical uncertainty, a weakening dollar, and investors seeking safety ahead of uncertain Fed policy.

Meanwhile, Bitcoin’s Fear & Greed Index hitting 20 (extreme fear) whilst simultaneously seeing whale accumulation mirrors patterns seen in late 2022 before major recovery moves.

The divergence between traditional and digital safe havens hasn’t been this pronounced since March 2020.

[Source: Historical gold performance data – Stock Trader’s Almanac / Crypto Fear & Greed Index – Alternative.me]

Meme of the Day:

“Just when I thought I was out, they pull me back in!” – but with a bull being dragged back by bears. Caption: “Bulls overnight. Every. Single. Time.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.