10-0 Winning Streak. 100% Win Rate. Lazy Trading at Its Finest

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

You know what’s better than one winning trade?

Seventy of them.

Across eighteen different traders. In the middle of January’s absolute circus of Trump tariffs, Greenland threats, Intel disasters, and markets doing their best impression of a cat on a hot tin roof.

And here’s the thing that makes this batch particularly delicious: half these wins happened whilst traders were doing something else entirely. Running errands. Eating lunch. Deliberately not watching the chaos unfold.

That’s not luck. That’s systematic trading doing exactly what it’s designed to do.

Let’s celebrate the wins, shall we?

Scroll down to see who banked what – and how they did it whilst living their actual lives…

The Stories Behind The Numbers

The Perfect 10

Swanky Swank didn’t just have a good week. He had a perfect one.

10 Lazy trades. 10 wins. 0 losses. Both SPX and RUT. Over 10 consecutive trading days.

“Lazy RUT and SPX both performed perfectly again today. Each are at 100% over the last 10 trading days.”

That’s not a hot streak. That’s systematic execution meeting favourable conditions and doing exactly what it’s supposed to do. Boring? Perhaps. Profitable? Absolutely.

The Comeback Kid

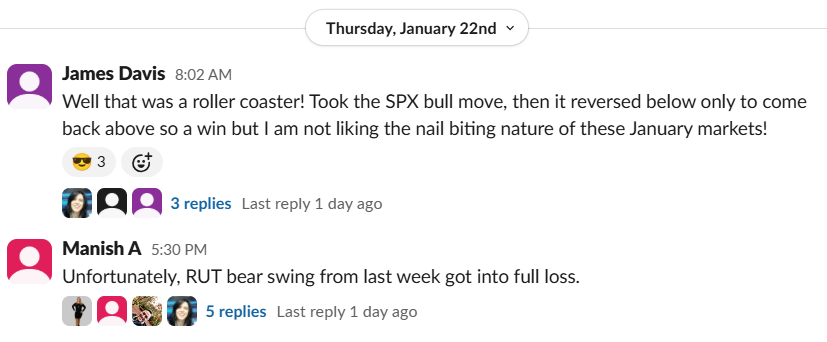

James D. started 2026 with ambition. After finishing last year on a winning streak, he upped his stakes.

Then January happened.

“It’s been a tough week for me. After finishing last year with a string of wins I decided to up my stakes in 2026 but I’ve had a run of trades against me this week which has been dispiriting.”

But here’s the thing about systematic traders – they don’t stay down. By Friday, James had logged three 100% winners in a row.

“Nice to finish this week with a win.”

Resilience. Discipline. Recovery. That’s the systematic way.

The Lunch Break Millionaire (Almost)

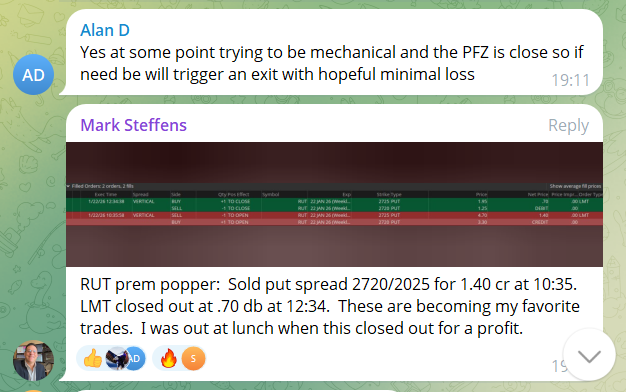

Mark S. placed his RUT Premium Popper at 10:35. Set his limit order for 50%. Then went to lunch.

“LMT closed out at .70 db at 12:34. These are becoming my favourite trades. I was out at lunch when this closed out for a profit.”

This is what we mean by lifestyle trading. The system works. You eat a sandwich. Profits happen.

The Errand Runner

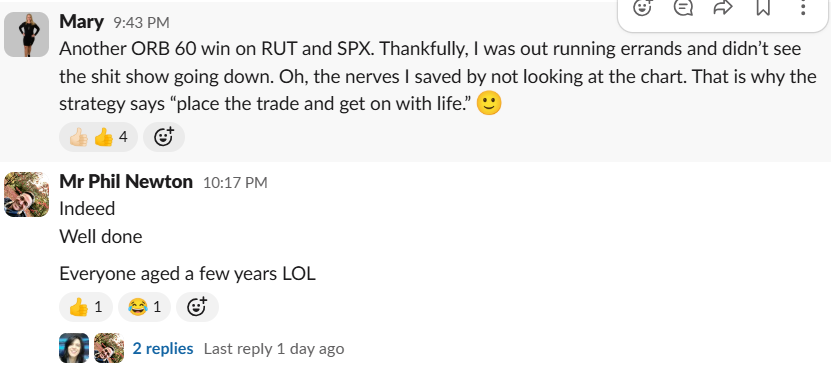

Mary took the ORB 60 on RUT and SPX. Then she left.

“Thankfully, I was out running errands and didn’t see the shit show going down. Oh, the nerves I saved by not looking at the chart. That is why the strategy says ‘place the trade and get on with life.'”

She came back to wins. No heart palpitations required.

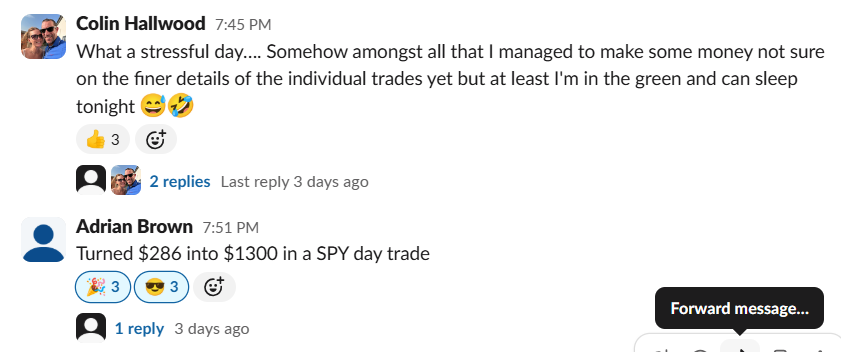

The Big Fish

Adrian B. wasn’t messing about.

$286 in. $1,300 out. A single SPY day trade. +354% return on capital.

Sometimes the market just hands you one. The skill is being positioned to catch it.

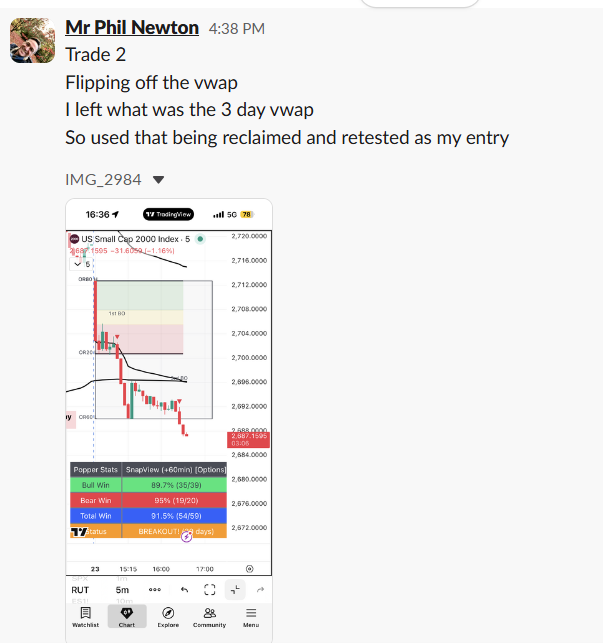

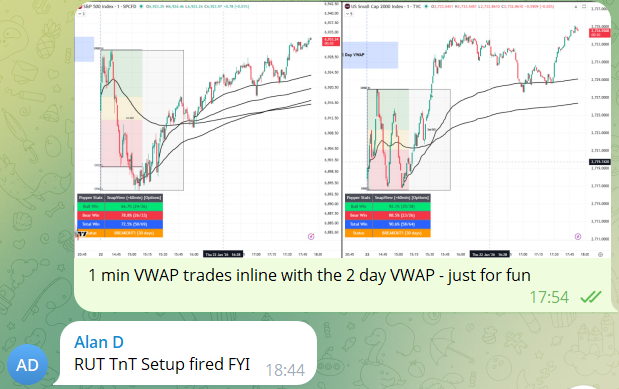

The VWAP Disciples

A recurring theme this week: traders crediting VWAP and AVWAP for keeping them out of trouble and getting them into winners.

James B.: “VWAP rightly kept me out of RUT today. Great addition to the process.”

Bill H.: “2 day VWAP is an awesome filter.”

Colin H.: “AVWAP… game changer.”

When multiple traders independently cite the same tool as transformative, that’s signal, not noise.

The Multi-Market Expansion

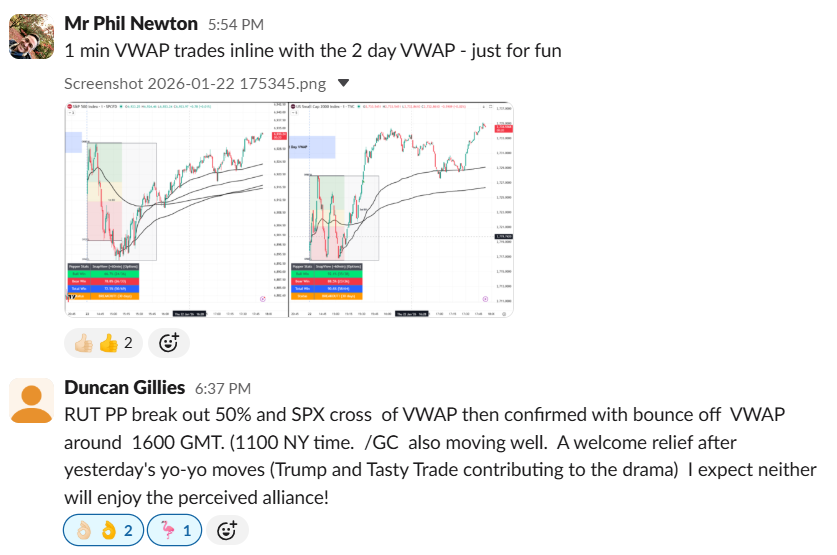

Duncan G. isn’t just trading SPX and RUT anymore. This week he logged wins on Gold futures (/GC) and Crude (/CL) alongside his index trades.

90% on a Gold BWB. 90% on an SPX BWB. Plus his usual Premium Popper wins.

The systematic framework travels. Different instruments, same principles, similar results.

WALL OF WINS – Week Ending: 24 January 2026

| Name | Results | Highlights |

|---|---|---|

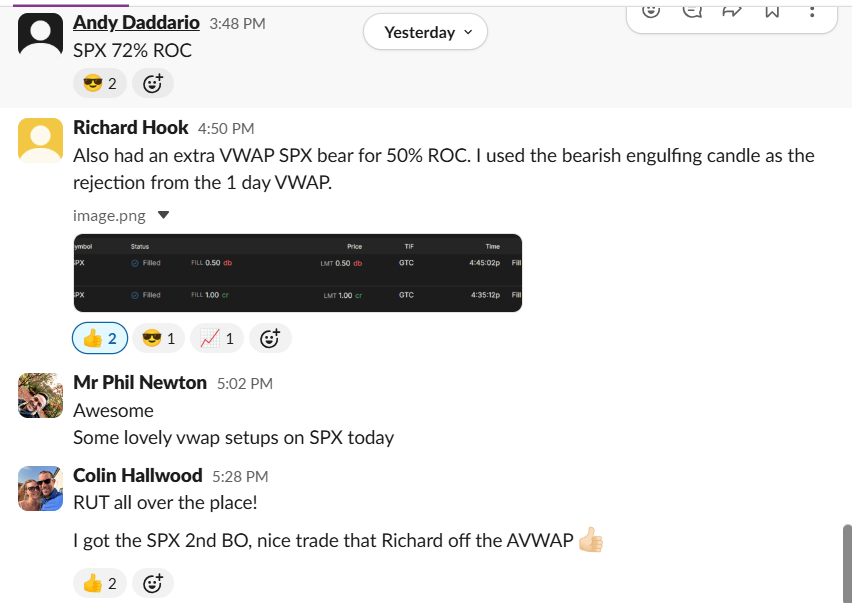

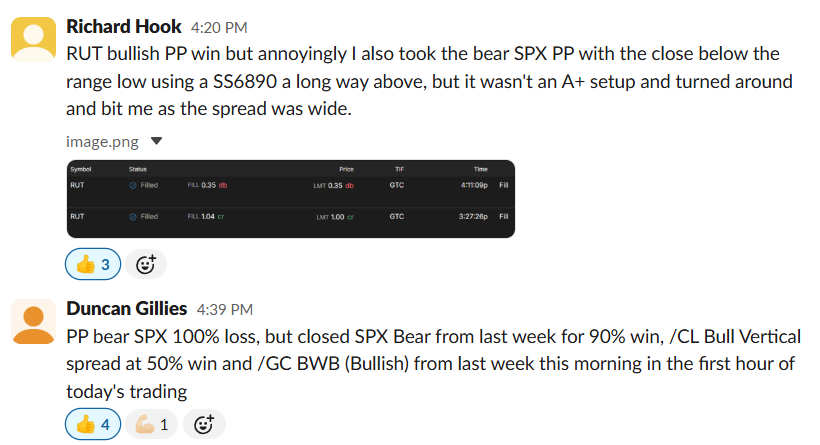

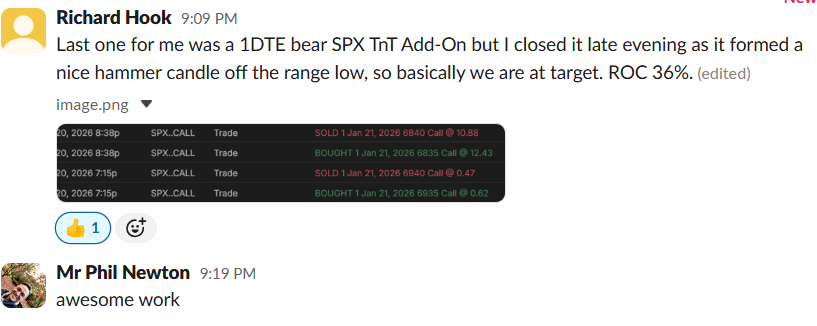

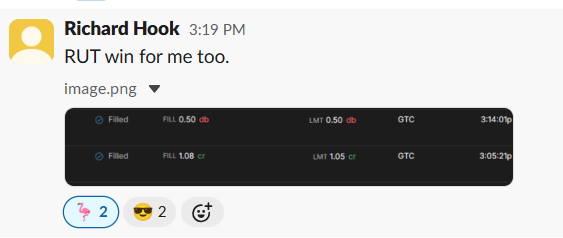

| Richard H. | 50% · 50% · 50% · 50% · 94% · 50% · 36% · 50% · 50% | [Popper] “Nice SPX for 50% ROC but sadly first failed RUT PP for a long time.” (Jan 16) [Popper] “SPX obeyed the rules as well for 50% ROC.” [ORB] “Nice 50% ROC on RUT. My ‘mistake’ was to reduce my position size as I was nervous about the very small opening range of only 5 points. Obviously that doesn’t make a difference and is irrelevant.” (Jan 15) [TnT] “Closed last weeks SPX TnT swing for 94%. Made up for my SPX bear PP loss this morning.” [Popper] “RUT bullish PP win but annoyingly I also took the bear SPX PP… it wasn’t an A+ setup and turned around and bit me” [VWAP] “Also had an extra VWAP SPX bear for 50% ROC. I used the bearish engulfing candle as the rejection from the 1 day VWAP.” [1DTE] “Last one for me was a 1DTE bear SPX TnT Add-On but I closed it late evening as it formed a nice hammer candle off the range low, so basically we are at target. ROC 36%.” (Jan 21) [ORB] “I took the ORB60 PP break out for another 50% ROC win on RUT. I didn’t think the rejection was strong enough off the 3 day VWAP, so I waited.” [Popper] “RUT win for me too.” ($1.08/$0.50) [Transparency] Openly sharing losses alongside wins throughout |

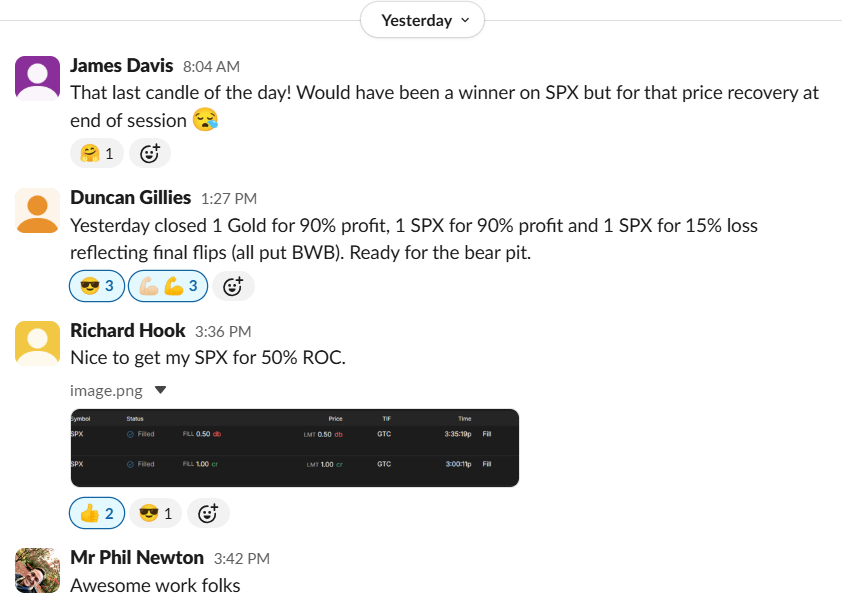

| Duncan G. | 50% · 50% · 90% · 90% · 50% · 50% · 50% | [Popper] “Picked up 50% on SPX PP in just under 20 min. Bounce (really a static launch) off yesterday and todays VWAP after opening range break out.” [Popper] “SPX PP 50%” [BWB] “Yesterday closed 1 Gold for 90% profit, 1 SPX for 90% profit and 1 SPX for 15% loss reflecting final flips (all put BWB). Ready for the bear pit.” [Popper] “SPX PP for 50% – Any one know what is happening in gold futures?” (Jan 16) [BWB] “closed SPX Bear from last week for 90% win” [Crude] “/CL Bull Vertical spread at 50% win” [Popper] “RUT PP break out 50% and SPX cross of VWAP then confirmed with bounce off VWAP around 1600 GMT. /GC also moving well.” (Jan 22) |

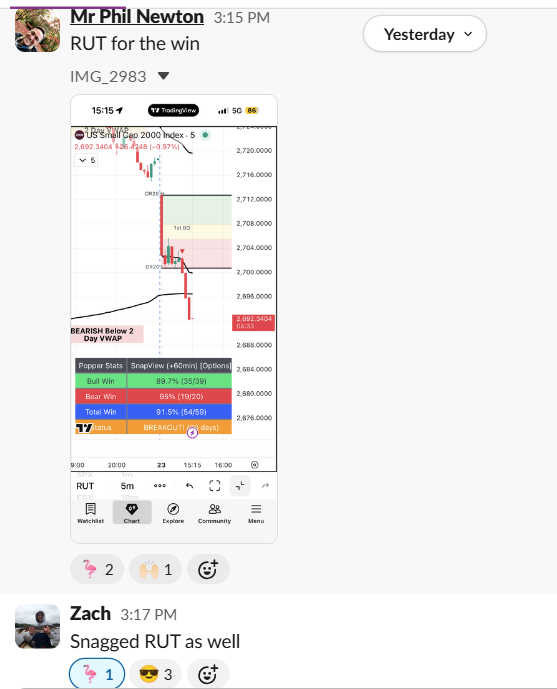

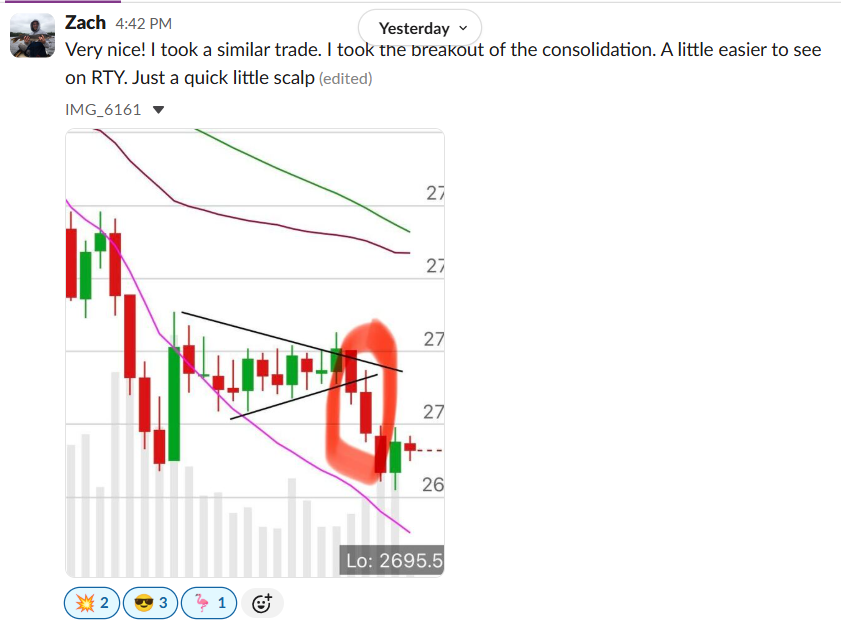

| Zach | 50% · 50% · 50% · 50% · 50% | [Popper] “Took 50% from RUT. Absolute tear again, unreal.” [VWAP] “Took bearish trade on SPX as price closed back below 1-day VWAP. Closed at 50% return” [Popper] “Snagged RUT as well” [Scalp] “Very nice! I took a similar trade. I took the breakout of the consolidation. A little easier to see on RTY. Just a quick little scalp” |

| Andy D. | 72% · 74% · 81% · 79% | [Popper] “SPX 72% ROC” [ORB] “RUT 74% ROC. Waited for the 2nd pullback at 9:55 Eastern…. ” [Recovery] “Older RUT I never closed for 81% win!” [VWAP] “Closed the SPX bounce off the 2 Day VWAP for 79%. Nice way to end the week!” |

| Colin H. | 50% · 50% · 50% · profitable week | [VWAP] “Agreed! Second layer of confirmation” [Popper] “I got the SPX 2nd BO, nice trade that Richard off the AVWAP” [Popper] “SPX profits on PP – hesitated at yesterdays low for a smidge – then pushed through” [ORB] “ORB 20 profits – waited for price to go above the bo bar 2 bars later, nice reaction off the AVWAP too ” [ORB] “just the first rut orb20 for me so far ” [Milestone] “sure is… and another profitable week. ” [Recovery] “What a stressful day…. Somehow amongst all that I managed to make some money not sure on the finer details of the individual trades yet but at least I’m in the green and can sleep tonight “ |

| James B. | 60% · – | [ORB] “Took same trade as @Colin H Third bar break of the ORB20 – closed for 60% as received 1:20 at entry! bosh” [Discipline] “VWAP rightly kept me out of RUT today. Great addition to the process / toolset” |

| James D. | 50% · 100% · 100% · 100% | [Popper] “Got a Premium Popper win on SPX early doors but sweating heavily on a RUT Lazy right now! Hope it drops….” [Popper] “took a small win on the SPX Premium” (Jan 15) [Lazy] “Finally a win on the SPX Lazy. As Phil know, it’s been a tough week for me. After finishing last year with a string of wins I decided to up my stakes in 2026 but I’ve had a run of trades against me this week which as been dispiriting, so nice to finish this week with a win.” (Jan 17) [Lazy] “Well that was a roller coaster! Took the SPX bull move, then it reversed below only to come back above so a win but I am not liking the nail biting nature of these January markets!” (Jan 22) |

| Mary | 50% · 50% · 100% · 80% paper | [ORB] “Another ORB 60 win on RUT and SPX. Thankfully, I was out running errands and didn’t see the shit show going down. Oh, the nerves I saved by not looking at the chart. That is why the strategy says ‘place the trade and get on with life.’ ” [Lazy] “Nice little win on a lazy day trade on SPX, but a partial loss on RUT = a wash – Oh, well. Tuesday is another day.” [Paper/Milestone] “I’ve been paper trading the 4 candle system and those are running at about an 80% win rate.” |

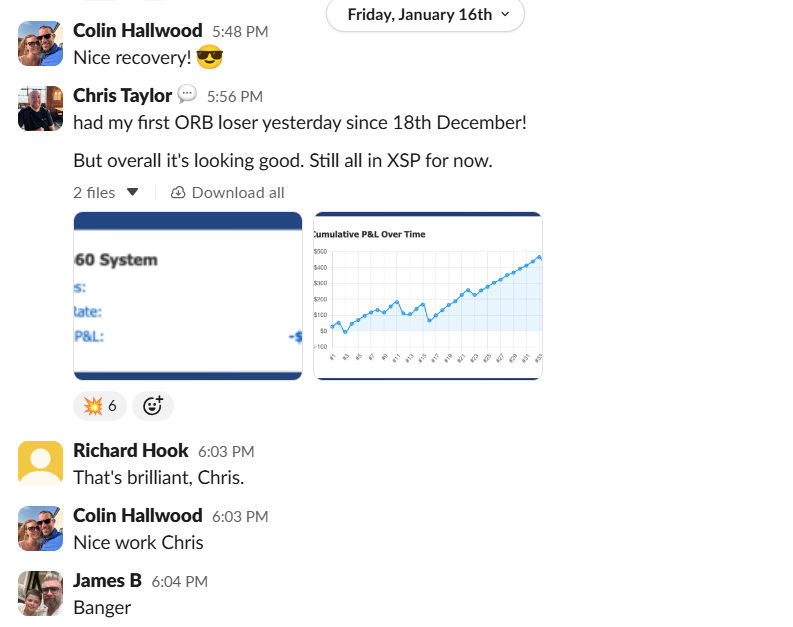

| Chris T. | 50% · 50% | [ORB] “While I grapple with the vwap the orb’s are still chugging along for me. ORB30 winner today in the bank” [Milestone] “had my first ORB loser yesterday since 18th December! But overall it’s looking good. Still all in XSP for now.” (equity curve shared) |

| Paul H. | 50% | [ORB] “50% on Rut. Got in on the second break. Was a little cautious after yesterday.” |

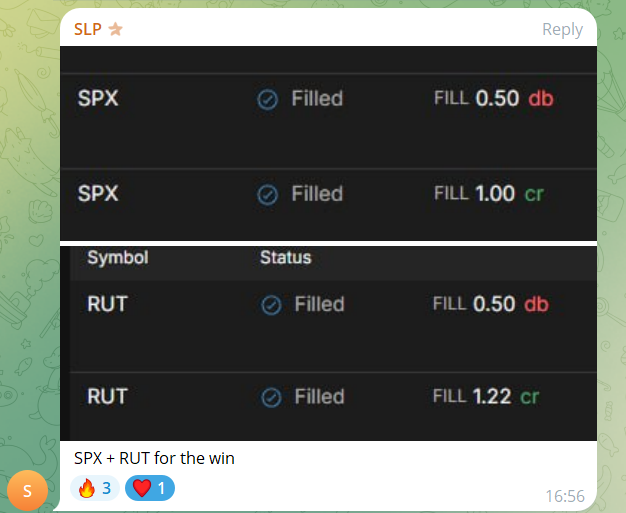

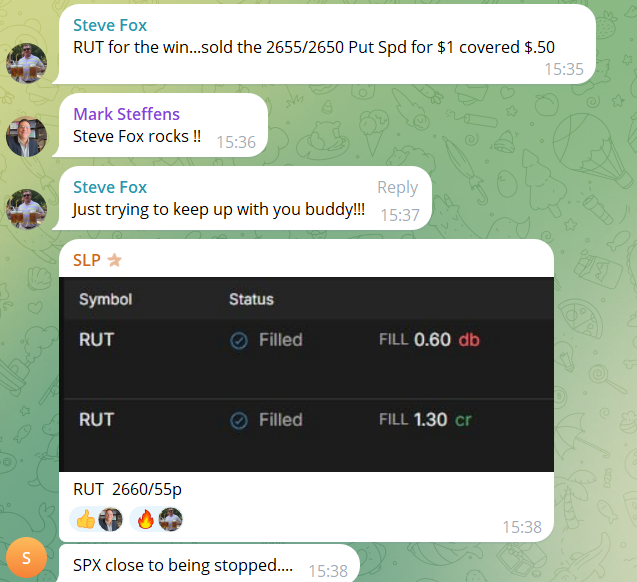

| SLP | 50% · 50% · 54% | [Popper] “SPX + RUT for the win” (SPX $1.00/$0.50, RUT $1.22/$0.50) [Popper] “RUT 2660/55p” ($1.30/$0.60) [VWAP] “Another nice example of VWAP usage… #SPX” (Jan 22) |

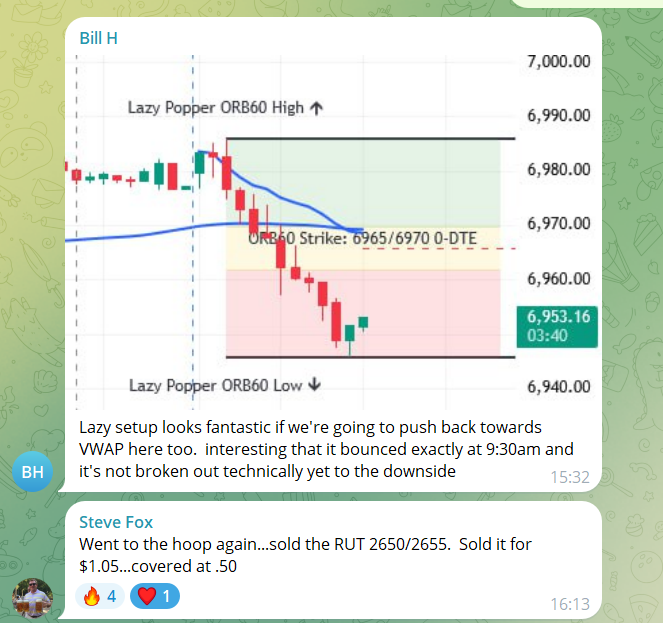

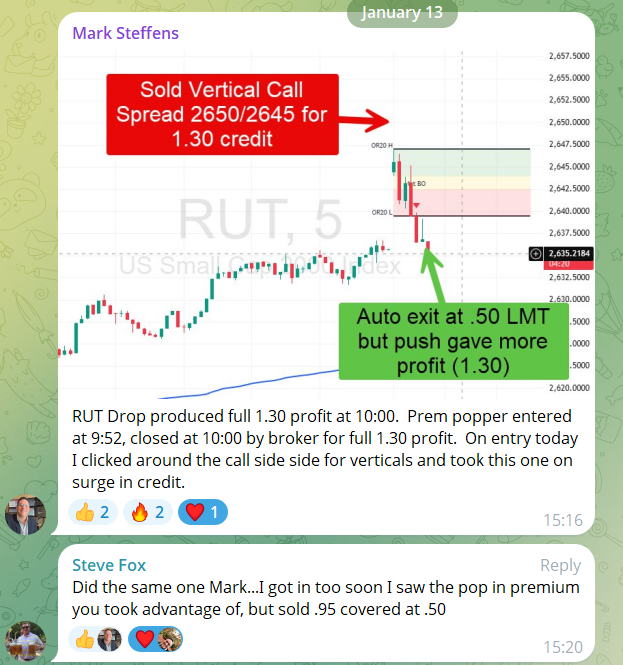

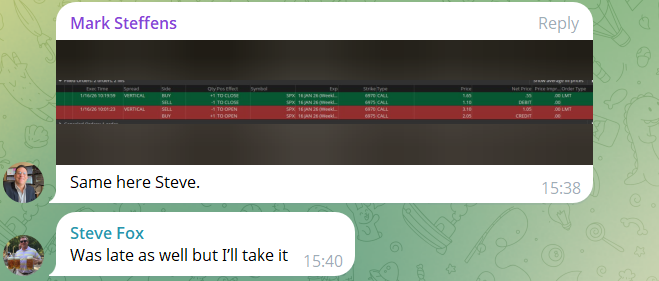

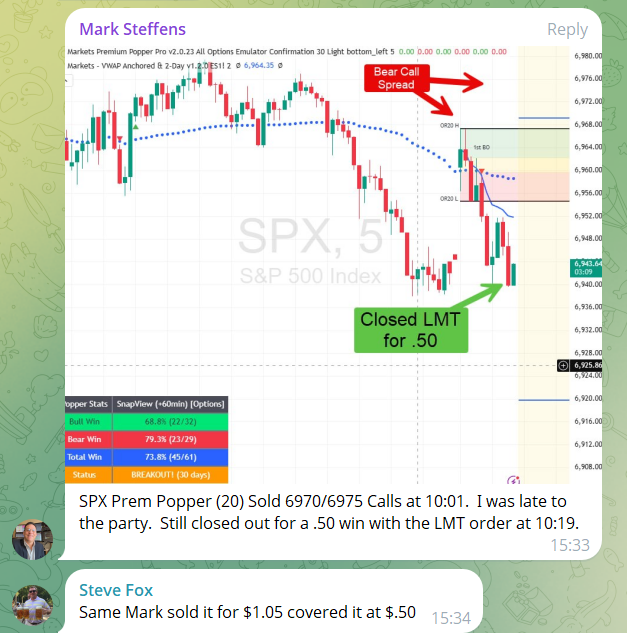

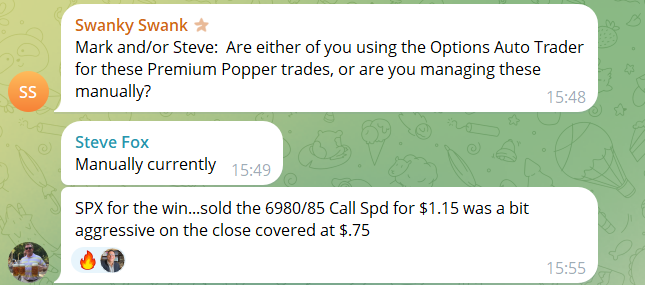

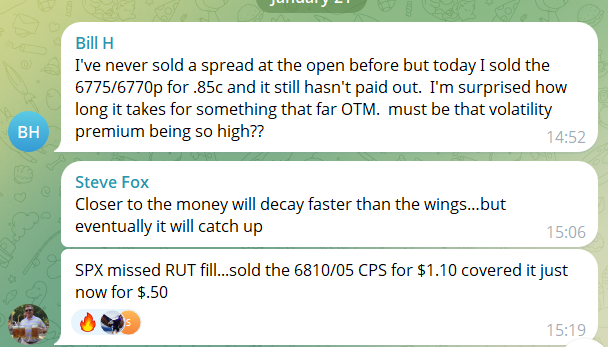

| Steve F. | $1.05/$0.50 · $0.95/$0.50 · $1.00/$0.50 · $1.05/$0.50 · $1.10/$0.50 · $1.15/$0.75 | [Popper] “Went to the hoop again…sold the RUT 2650/2655. Sold it for $1.05…covered at .50” [Popper] “Did the same one Mark…I got in too soon I saw the pop in premium you took advantage of, but sold .95 covered at .50” [Popper] “RUT for the win…sold the 2655/2650 Put Spd for $1 covered $.50” [Popper] “Same Mark sold it for $1.05 covered it at $.50” [Popper] “SPX missed RUT fill…sold the 6810/05 CPS for $1.10 covered it just now for $.50” (Jan 21) [Popper] “SPX for the win…sold the 6980/85 Call Spd for $1.15 was a bit aggressive on the close covered at $.75” |

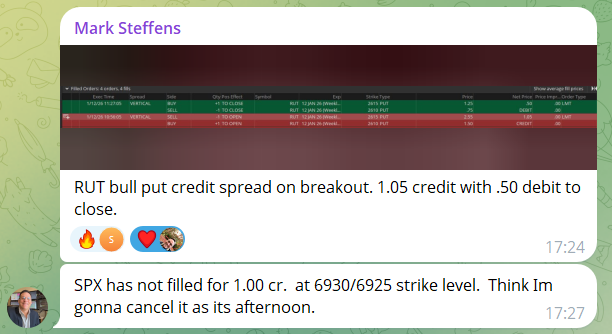

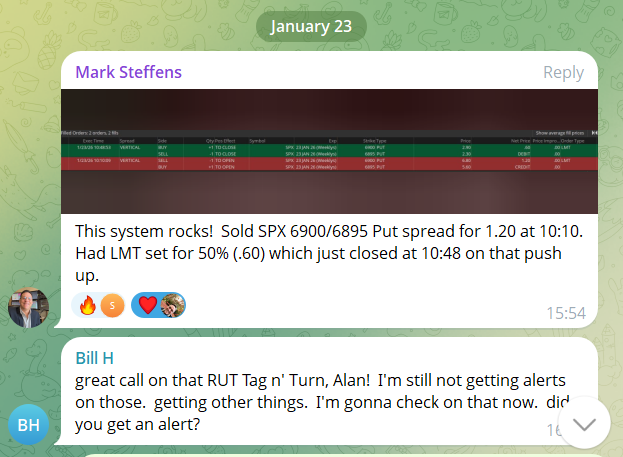

| Mark S. | $1.30 full · $1.05/$0.50 · 50% · 50% | [Popper] “RUT Drop produced full 1.30 profit at 10:00. Prem popper entered at 9:52, closed at 10:00 by broker for full 1.30 profit.” [Popper] “RUT bull put credit spread on breakout. 1.05 credit with .50 debit to close.” [Popper] “This system rocks! Sold SPX 6900/6895 Put spread for 1.20 at 10:10. Had LMT set for 50% (.60) which just closed at 10:48 on that push up.” (Jan 23) [Popper/Lifestyle] “RUT prem popper: Sold put spread 2720/2025 for 1.40 cr at 10:35. LMT closed out at .70 db at 12:34. These are becoming my favorite trades. I was out at lunch when this closed out for a profit.” |

| Bill H. | $1.10/$0.30 · $1.10/$0.30 · $0.55 | [Popper] “almost got 1.30 for it but it wouldn’t fill. got 1.10 and reloaded at 1.10 again 🙂 sold for .30c just because :)” [Multi-market] “I got mashed around by SPX today but made a small fortune on UNG so I’m just about as happy as I can be :)!” [Testimonial] “2 day vwap is an awesome filter” |

| Alan D. | $2.00 · $5.40 | [TnT] “Yes got an alert and already out today took it off at $2” [TnT] “RUT TnT Setup fired FYI… I go a fill same at 5.40” |

| Swanky Swank | 100% · 100% · 10-0 streak | [Lazy/Milestone] “Lazy RUT and SPX both performed perfectly again today. Each are at 100% over the last 10 trading days.” |

| Adrian B. | +$1,014 | [Scalp] “Turned $286 into $1300 in a SPY day trade” (+354% on capital) |

| Byron H. | 100% · 100% | [Lazy] “Lazy worked for both SPX and RUT (after giving heart attack from 11:00 – 2:00).” |

KEY STATISTICS

| Metric | Value |

|---|---|

| Unique Traders | 18 |

| Total Winning Trades | 70+ |

| Date Range | Jan 13 – Jan 23, 2026 |

| Strategies Represented | Premium Popper, ORB (20/30/60), Lazy, TnT, VWAP/AVWAP, BWB, 1DTE |

| Instruments | SPX, RUT, XSP, SPY, RTY, /GC (Gold), /CL (Crude), UNG |

STANDOUT HIGHLIGHTS

Win Streaks & Big Numbers:

- Swanky Swank: 10-0 on Lazy over 10 trading days

- Adrian B.: $286 → $1,300 (+354%) single SPY day trade

- Richard H.: 94% TnT swing

- Duncan G.: 90% on Gold and SPX BWBs

- Andy D.: 81%, 79%, 74%, 72% – consistently above 50% target

Lifestyle Moments:

- Mary: “I was out running errands and didn’t see the shit show going down… place the trade and get on with life”

- Mark S.: “I was out at lunch when this closed out for a profit”

- Byron H.: Lazy wins “after giving heart attack from 11:00 – 2:00”

Discipline Wins:

- James B.: “VWAP rightly kept me out of RUT today”

- Paul H.: “Was a little cautious after yesterday”

- Richard H.: “it wasn’t an A+ setup and turned around and bit me” – learning moment

Testimonials:

- Mark S.: “This system rocks!”

- Bill H.: “2 day vwap is an awesome filter”

- Colin H.: “AVWAP… game changer”

- Swanky Swank: “100% over the last 10 trading days”

Multi-Market Expansion:

- Duncan G.: Trading /GC (Gold) and /CL (Crude) alongside SPX/RUT

- Bill H.: “made a small fortune on UNG”

STRATEGY BREAKDOWN

| Strategy | Wins | Typical ROC |

|---|---|---|

| Premium Popper | 25+ | 50%–73% |

| ORB 20/30/60 | 12+ | 50%–74% |

| Lazy Popper | 8+ | 100% |

| VWAP/AVWAP | 10+ | 50%–79% |

| TnT Swings | 5+ | 36%–94% |

| BWB | 4+ | 90% |

| 1DTE | 2+ | 36% |

KEY THEMES THIS WEEK

VWAP as Primary Filter:

- Repeatedly cited as “game changer” and “awesome filter”

- 2-Day VWAP keeping traders out of bad setups

- Multiple entries confirmed by VWAP reactions

Volatile January Markets:

- James D.: “nail biting nature of these January markets”

- Colin H.: “What a stressful day”

- Duncan G.: “yo-yo moves (Trump and Tasty Trade contributing to the drama)”

- Despite volatility: System rules protected capital

RUT Outperforming SPX:

- Cleaner price action noted

- Higher win rates on RUT setups

- Multiple traders preferring RUT entries

Standout Moments

The Streak: Swanky Swank hit 10-0 on Lazy trades over 10 trading days. Both SPX and RUT. 100% win rate. That’s not luck – that’s systematic execution.

The Comeback: James D. started 2026 rough after upping stakes. Finished the week with three 100% winners. “Nice to finish this week with a win” – resilience rewarded.

The Lunch Trade: Mark S. was literally eating lunch when his RUT Premium Popper closed for profit. “These are becoming my favourite trades.” Lifestyle trading in action.

The Errand Run: Mary was out running errands, didn’t see any of the intraday chaos, came back to wins. “That is why the strategy says ‘place the trade and get on with life.'”

The Big One: Adrian B. turned $286 into $1,300 on a single SPY day trade. +354% return on capital. Sometimes the market just hands you one.

What They’re Saying

“This system rocks!”

– Mark S.

“2 day VWAP is an awesome filter”

– Bill H.

“AVWAP… game changer”

– Colin H.

“100% over the last 10 trading days”

– Swanky Swank

“Place the trade and get on with life”

– Mary

The Transparency Corner

Richard H. deserves a special mention. Not just for his nine wins including a 94% TnT swing. But for this:

“RUT bullish PP win but annoyingly I also took the bear SPX PP… it wasn’t an A+ setup and turned around and bit me.”

He shares the losses alongside the wins. That’s real trading. That’s how people actually learn. Wins are great, but knowing what doesn’t work is equally valuable.

The Takeaway

Volatile January markets. Trump drama. Yo-yo price action. And yet – 18 traders logged 70+ wins using the same systematic frameworks.

The thread running through every testimonial? Rules protected capital. VWAP kept traders out of bad setups. Position sizing prevented disasters. Mechanical exits locked in profits whilst traders were at lunch, running errands, or deliberately not watching the chaos unfold.

That’s not trading. That’s systematic income generation with a side of lifestyle freedom.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.