Anticipated Fall Tips Over – Then 3 of 4 Indexes Bounce Because Of Course They Do

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Morning traders, and we dawn on yet another new day where the anticipated fall from highs did indeed tip over.

However – and I’m reluctant to say this as it makes me cringe – we saw 3 of the 4 indexes… [GAaaCk]… bounce a little yet again at the end of the day.

The exception?

The Dow. Bless it for having some commitment.

Given we ended Wednesday with some larger wicks on the lower end of the day’s body, this would lead me to think we will – hard eye roll time – yet again have another inside day or narrow range of trading. I’d like to be wrong, but that’s my usual first thought with such occasions.

Generally, I remain bearish from pattern highs to pattern lows. The direction is clear even if the execution keeps getting interrupted by these tiresome end-of-day bounces.

Keep scrolling for the profit-taking wisdom…

Bears Deliver Profits. Markets Bounce Anyway. Discretionary Timing Proves Superior.

SPX Market Briefing:

Thursday arrives with Wednesday’s anticipated fall having tipped over beautifully before markets decided to bounce at day’s end because apparently commitment is too much to ask.

Current Multi-Market Status:

- SPX: Bear TnT hit short/medium profit exits, need hold below 6700 for 6600 trip, currently neutral awaiting fresh setup

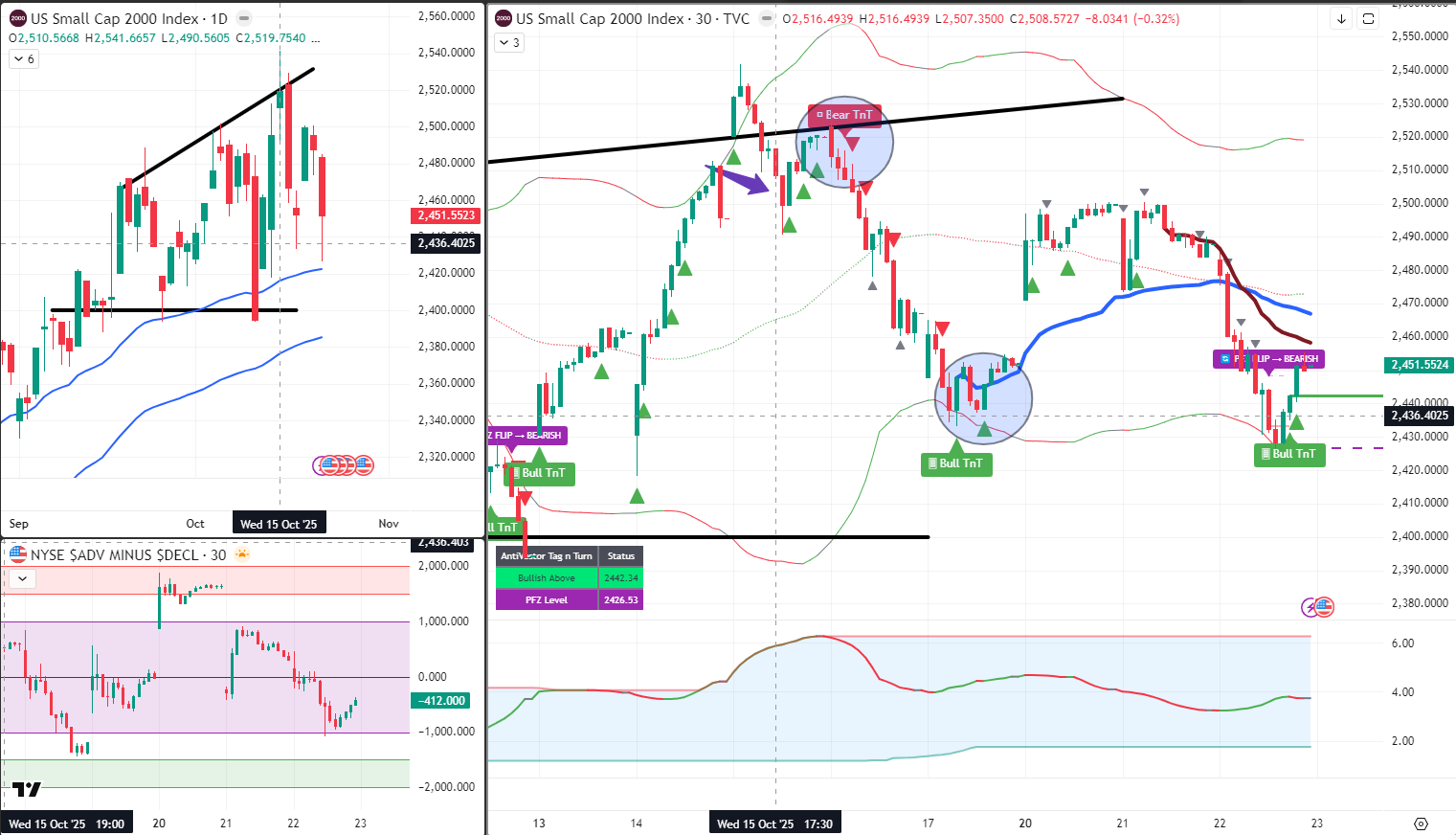

- RUT: Fresh Bear TnT developing at lower BB, clear levels over 2440/below 2425, bullish above 2442.34

- ES/YM/NQ/RTY: Range structure continuing, consolidation energy building

- CL: Recovery bounce pattern around $61 developing

- GC: Contained strength, not breaking out yet

- VIX: Lower but elevated, crash season fading

The [GAaaCk] Bounce Nobody Asked For

Wednesday delivered the anticipated fall from highs. Markets tipped over nicely. Bear setups started working. Short term and medium term profit exits triggered.

Then… [GAaaCk]… 3 of the 4 indexes decided to bounce at day’s end because apparently falling with conviction is too straightforward.

The Dow?

Stayed down like a professional.

The others?

Bounced like teenagers testing curfew rules.

This creates those lovely large wicks on the lower end of Wednesday’s candle body, which historically signals another inside day or narrow range coming Thursday.

Hard eye roll territory.

I’d genuinely love to be wrong about this prediction, but pattern recognition suggests we’re in for more narrow range nonsense rather than decisive directional movement.

Current Status: Bearish bias maintained, bounces remain tiresome, commitment issues persist

Bear Tag n Turn Performs Perfectly

Over on the usual playground timeframe, the Bear Tag n Turn performed exactly as expected. Gently rolled over, hit short term profit exits, hit medium term profit exits, delivered systematic returns through mechanical execution.

This is what proper setups do when you trust them.

If we can hold below 6700, then a trip to 6600 would be reasonable next target.

The structure’s there.

The levels are clear.

The execution just needs markets to stop bouncing at day’s end like commitment-phobic teenagers.

Current Status: Bear TnT profits collected, 6700 hold needed, 6600 next target

RUT – Fast Forward Group Prediction Vindicated

During our Fast Forward Group call, we discussed RUT potentially failing to reach the upper Bollinger Band.

Discretionary profit taking was discussed.

The reasoning was sound.

Uncle Russell delivered exactly that scenario.

RUT failed to reach upper BB as suspected.

Those discretionary profit exits?

Looking absolutely brilliant right now.

This is why group analysis combined with systematic frameworks creates superior positioning decisions.

The best trades aren’t always the ones you take – sometimes they’re the ones you exit perfectly.

And now? RUT’s tagging the lower BB with a fresh Turn developing.

Clear and tight over/under levels appearing:

- Over 2440 bullish

- Below 2425 bearish

- …Per Tag n Turn rules.

Alas, I was busy during this development and neglected to take action. But the levels remain crystal clear for anyone paying attention.

Current Status: Fresh Bull TnT developing, 2440/2425 clear levels, discretionary timing proved superior

Large Lower Wicks = Inside Day Incoming

Those large wicks on Wednesday’s lower end are classic technical signals. They typically precede inside days or narrow range trading sessions where markets accomplish absolutely bugger all.

It’s the market equivalent of someone threatening to leave a party but hovering by the door for two hours making small talk instead of actually departing.

Decisive? No. Predictable? Absolutely. Frustrating? You bet.

Current Status: Likely another inside day, narrow range expected, eye roll maintained

Poppers Popping Across The Team

Yesterday delivered excellent Popper opportunities with several members reporting successful entry opportunities. Multiple setups triggered. Multiple profits collected.

“Go Team!” energy properly deserved.

This is the beauty of mechanical frameworks applied across diverse participants – when setups trigger, everyone benefits simultaneously. No special insider knowledge required. Just systematic execution following clear rules.

Current Status: Poppers performing, team crushing it, systematic success

Generally Bearish But Markets Keep Bouncing

Here’s the frustrating reality: Generally bearish from pattern highs to pattern lows remains the correct bias. The directional thesis is sound. The technical structure supports downside movement.

But markets keep delivering these tiresome end-of-day bounces that prevent clean follow-through. It’s like trying to walk downstairs whilst someone keeps putting speed bumps on every third step.

Eventually gravity wins. Physics demands downward movement when positioned at highs. But the journey involves more bouncing than desired.

Patience with bearish bias whilst accepting bounce reality.

In Other News…

FinNuts Market Flash

Markets Cheer the Boring — Old Economy Throws a Party While Tech Gets a Reality Check

Wall Street’s decided excitement is overrated.

At 09:25 ET, S&P futures +0.2% to 6,750, Nasdaq +0.3% to 16,892 — calm as Percy counting tea bags during austerity.

Wednesday’s close was less inspiring: Dow –213 to 46,493, S&P –0.05%, Nasdaq flat-ish, as traders processed the brutal truth that not all earnings seasons can be binge-worthy.

The VIX held steady at 18.6, that awkward level between denial and acceptance — or, as Mac calls it, “whisky rationing discipline.”

️ Old Economy Goes Full Comeback Tour

Turns out, profitability is still fashionable.

Southwest +3.2% after an actual profit ($0.11 vs –$0.04 expected) — shocking proof that airlines can occasionally exceed expectations and find their luggage.

Lam Research popped on a $1.26 beat, and Warner Bros Discovery +15% on rumours of an acquisition, proving gossip pays better than streaming.

Meanwhile, Tesla –4.8% after hours on margin compression and IBM –4% on slowing software sales — apparently even the tech gods must now submit quarterly penance reports.

When investors say “we like proven models,” they really mean “we’re tired of hallucinated growth.”

Earnings: The Heroes, The Villains, and the Excuses

Tesla missed at $0.50 EPS vs $0.54 expected, revenue $28.1B, and operating expenses up 50% — with Musk offering “guidance” as clear as a Wallie PowerPoint.

IBM technically beat ($2.65 EPS) but Red Hat +14% instead of +16% reminded everyone that even software can age badly.

Southwest stood out for its $6.95B revenue and consistent guidance — a rare feat for an industry where profit forecasts are usually written in pencil mid-flight.

Cross-Asset Vibes — Flight to Quality or Just Fear in a Suit?

The yield curve steepens again — 2-year 3.427%, 10-year 3.935% — markets apparently trusting Powell’s soft landing choreography.

Dollar +0.12%, calm enough to boost commodities.

Gold +1.55% to $4,128, staging a rebound as traders remember you can’t melt optimism into jewellery.

Oil flat $58.13, stuck in an existential loop titled “Demand Concerns Continue.”

Everywhere you look: value > growth, large caps > small caps, and cash flow > vibes.

In short, Wall Street rediscovered fundamental analysis — and nobody knows quite what to do with it.

☕ Hazel’s Final Thought

Earnings season’s turning into a soap opera: tech crying in the corner while industrials pour champagne on themselves.

Investors now worship tangible profits again — until the next AI press release drops.

Markets call it “flight to quality.”

Hazel calls it “fear with better taste.”

— Hazel Ledger,

FinNuts Bureau of Reliable Profits and Earned Hangovers

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Tiresome End-of-Day Bounce Formation Flying” whilst claiming they had mastered “Bear Tag n Turn Profit Collection During Market Commitment Issues Advanced Cooing.”

Hazel updated her crisis management protocols to include “Fast Forward Group Prediction Vindication Procedures” alongside emergency plans for “Discretionary Profit Taking During Upper BB Miss Integration Processes.”

Mac raised his Thursday morning whisky and declared, “When Bear setups hit profit targets whilst markets bounce anyway, the proper response is collecting returns and maintaining eye roll discipline!”

Kash attempted livestreaming about “RUT discretionary exits being basically like timing DeFi protocol yield farming but with actual Fast Forward Group collaborative analysis” but got distracted celebrating Popper team success.

Wallie grumbled that in his day, markets fell “with proper conviction rather than this modern bouncing nonsense with large lower wicks and inside day frustration!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Dead Cat Bounces: When Hope Springs Eternal (And Stupid)

A “dead cat bounce” describes a temporary recovery in falling stock prices—because apparently even a dead cat will bounce if you drop it from high enough!

The dead cat bounce is Wall Street’s most morbid metaphor for false hope, describing those brief rallies that occur during major market crashes when investors mistake a temporary uptick for the beginning of recovery.

The name comes from the grim observation that even a dead cat will bounce if dropped from sufficient height—it doesn’t mean the cat is alive, just that physics happened. During every major crash, there are always traders who see a 5% uptick after a 30% decline and declare “the bottom is in!” with the confidence of someone who just found a twenty-dollar bill and assumes they’ve solved their mortgage problems.

These bounces trap optimistic investors who think they’re “buying the dip” but are actually catching a falling piano. The 1929 crash had several dead cat bounces that convinced people the worst was over, right before the market continued falling for three more years.

Professional traders know to expect these bounces and often use them as opportunities to sell into strength, while retail investors typically buy into them with the enthusiasm of someone shopping during a fire sale.

The dead cat bounce is proof that markets can be temporarily irrational in both directions, and that sometimes what looks like resurrection is just the last twitch of something that’s already deceased!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.