Bear Tag n Turn Hangs On Cliff Edge Like Cat Clinging to Curtains During Hoover Attack

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s yet another Friday and another week is nearly over, and we may just have a few notes sung from the economic reports song sheet. But will it make the markets sing?

Overall, the main indexes are still grinding near their upper range boundaries. YM and RTY look weakest at the moment with ES and NQ closest to new all-time highs.

Here’s what’s giving me serious 1999 tech bubble flashbacks: We’re nudging yet another NATH level again. Every. Single. Day. It’s getting normalized exactly like the late 90s when daily new highs became so routine nobody even blinked anymore.

Prince’s 1999 was playing on every radio in the ’80’s (and every 3rd song through Dec 1999 beating Mariah Carey for a change).

“Tonight I’m gonna party like it’s 1999!” The tech bubble was inflating daily. New highs? Completely normal. NASDAQ printing fresh records? Tuesday’s weather report.

Gold and the stock indexes feel exactly like that for me right now.

Another NATH?

Cool. Add it to the collection.

We’ve normalized the extraordinary until it becomes mundane background noise.

Keep scrolling for the cliff-clinging bear drama…

Bear Setups Cling Desperately. Premium Poppers Compensate Nicely. Nursemaid Duties Continue.

SPX Market Briefing:

Friday brings economic data (Flash PMI, CPI numbers), end-of-week positioning, and the question of whether markets can sustain another NATH push or if bears finally get their feast.

Current Multi-Market Status:

- SPX: Bear TnT clinging to cliff edge, neutral awaiting fresh setup, nudging 6764 NATH

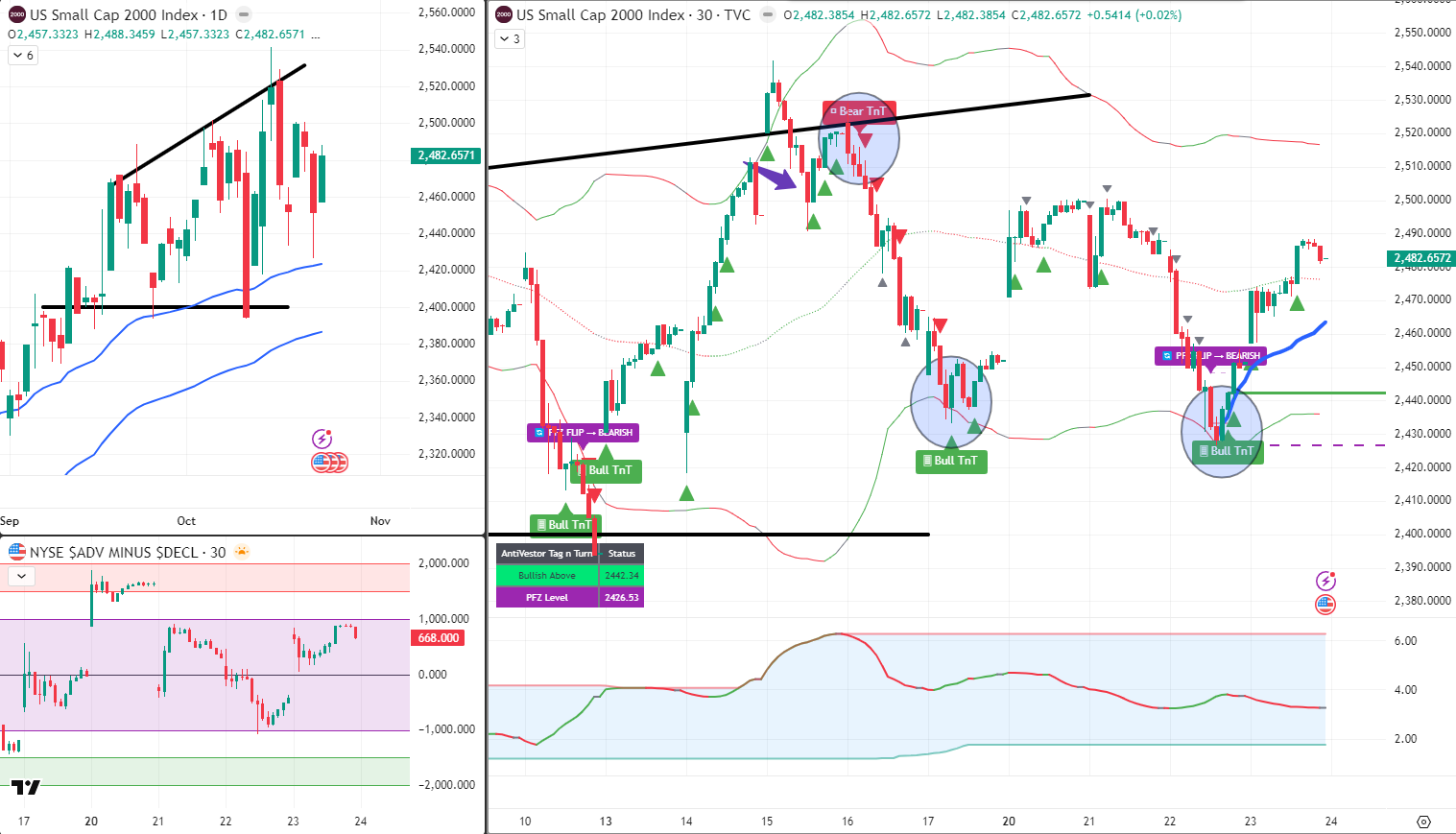

- RUT: Bull TnT active, missed entry waving from sidelines, bullish above 2442.34

- ES: Closest to NATH with NQ/YM/RTY, also back grinding upper range

- CL: Consolidating around $61.76, range-bound

- GC: May peek 4000 again, could correct to 3900 if fails

- VIX: Back to sleep at 17.10, wondering what fuss was about

- DXY: Lower highs developing, below 98 would excite currency bugs

Party Like It’s 1999 – NATH Normalization

Remember 1999? Prince had the soundtrack sorted. Tech stocks were printing fresh highs daily. NASDAQ became a one-way escalator to the moon. Everyone just… accepted it.

New all-time high on Monday? Normal.

New all-time high on Tuesday? Expected.

New all-time high on Wednesday? Background noise.

We’ve seen this film before. The extraordinary becomes mundane through repetition until nobody questions whether parabolic moves are sustainable. They just become the accepted reality.

SPX is nudging 6764. Gold’s flirting with 4000. ES and NQ are closest to their NATHs. And everyone’s treating it like checking the weather forecast.

That’s precisely when you should be paying attention.

Anyway, until we break up and out – I’m still bearish – which I’m sure Elton John once sung about. Or dancing, dancing bears maybe? Bah!

Current Status: NATH normalization déjà vu, bearish bias maintained, 1999 energy intensifying

Bear TnT Clings to Cliff Edge

Over on SPX, the Bear Tag n Turn is holding on to the cliff edge like a cat clinging to curtains during a hoover attack – desperate, undignified, and probably unsustainable.

We’re grinding at upper range boundaries. Bears need decisive downside movement. Instead, markets keep producing these tiresome grinds higher that prevent clean bearish follow-through.

The setup’s still valid. The positioning remains sound. But execution requires cooperation from price action, and right now price is doing its best impression of someone who won’t commit to dinner plans.

Current Status: Bear TnT cliff-clinging, awaiting decisive move, patience required

RUT – Missed But Not Bothered

Uncle Russell knows which side of its bread is buttered. My nervous exit for small profit earlier this week was still the right choice with hindsight. My only annoyance? I missed the Bull TnT setup again, so I’m waving this one from the sidelines.

Sometimes the best trade is the one you exit at the right time. Sometimes you miss the follow-up entry. That’s systematic trading – you won’t catch every move, but you’ll protect capital when uncertainty appears.

Current Status: Bull TnT active, missed entry, waving from sidelines, no regrets

Premium Poppers Compensate Nicely

Here’s the beautiful part about diversified systematic approaches: Interestingly, I’m making more Baron Greenbacks from the Premium Popper 2.0 setups, so I’m not worried about missing one trade in the scheme of getting several short-term day trades.

Four Premium Popper trades yesterday with the new setups. There could have been a few more, but alas I’m also playing nursemaid to a flu-ridden Mrs N and my mother-in-law. Such is the way of things, and I’m not greedy!

When RUT misses don’t materialize into trades, Premium Poppers keep delivering. When Bear TnTs cling to cliff edges, Poppers keep popping. This is why multiple strategies across different timeframes create resilient systematic approaches.

One strategy struggles? Another compensates. That’s the point.

Current Status: Premium Popper 2.0 delivering 4 trades, nursemaid duties limiting opportunities, diversification proving worth

Gold, VIX, and DXY Drama

Gold’s showing classic behaviour around the 4000 psychological level. May peek above again. If that level fails to hold, we could be in for a deeper corrective move to 3900. Classic technical setup – major psychological level testing commitment.

VIX has gone back to sleep and is wondering what all the fuss was about.

Crash season concerns? Apparently resolved.

October volatility? Seems finished.

Market uncertainty? Not according to VIX’s current nap.

DXY looks like it wants to move lower with what’s looking like lower highs now developing. Below 98 would send the currency bugs into a bit of a tizz. Dollar weakness typically supports risk assets and commodities – another tailwind for equity bulls.

Current Status: Gold testing 4000, VIX sleeping peacefully, DXY showing lower highs

Economic Data – Will Markets Sing?

Friday brings Flash Manufacturing PMI (forecast 51.9 vs 51.9 previous) and Flash Services PMI (forecast 53.5 vs 54.2 previous). CPI data showing Core CPI m/m at 0.3% forecast.

Will this make markets sing? Probably not. Data’s largely expected. No major surprises anticipated. Markets will likely absorb the numbers and continue their grinding consolidation near range boundaries.

Unless something unexpected appears, expect more of the same grinding behaviour.

Current Status: Economic data scheduled, expectations muted, grinding likely continues

Strong Friday Finish Incoming?

Let’s see if we can get a strong Friday finish to pop that premium on top of the metaphorical cake. End-of-week positioning, economic data absorption, potential month-end flows – all ingredients for either explosive movement or continued grinding consolidation.

Premium Poppers remain locked and loaded. Bear setups continue clinging. Bull setups keep running. Nursemaid duties persist. Flu-ridden household management continues.

Such is the life of systematic traders balancing markets with actual life.

Current Status: Strong Friday finish possible, premium popping opportunities waiting, cake metaphor deployed

In Other News…

Tech Tries to Smile While Energy Sets Itself on Fire

Wall Street’s mood Thursday felt like a hostage situation at a wellness retreat — everyone pretending it’s fine while nervously checking CPI spoilers.

S&P futures +0.3% to 6,758, Nasdaq +0.5%, VIX 17.85, meaning investors have returned to their favourite coping strategy: pretending volatility doesn’t exist if you don’t look directly at it.

Percy’s holding steady too, proudly sipping government-shutdown tea now on its fourth week of “temporary inconvenience.”

️ Energy Throws a Party — Everyone Else Holds Their Breath

Russia got sanctioned again, and oil decided that’s bullish for everyone except humanity.

Brent +5.4% to $65.99, WTI +5.6% to $61.79, while energy stocks exploded higher like someone spiked OPEC’s punch bowl.

Oklahoma became the new Nasdaq for a day:

-

Helmerich & Payne +9%

-

LSB Industries +7%

-

Vital Energy +7%

Meanwhile, Oracle and Amazon rallied on AI hype, Nvidia and Broadcom joined the afterparty — and Deckers –8% reminded everyone that not every company can outrun gravity or earnings math.

It’s a weird new world where footwear collapses, but crude oil prints new highs.

Intel’s Resurrection and Other Horror Stories

Intel rose from the dead like a silicon zombie — $0.23 EPS vs $0.01 expected, because apparently all it needed was one more quarter of investor disbelief.

Revenue $13.7B vs $13.4B — not bad, considering its foundry division is still losing $2.3B with –54.8% margins, which economists now classify as “performance art.”

Ford beat $0.45 vs $0.36, then immediately cut full-year guidance after a supplier fire, proving automakers can still multitask tragedy and success.

Somewhere, GM smirked quietly, drinking an “I Told You So” espresso.

Cross-Asset Reality Check (Now with Extra Cognitive Dissonance)

Treasuries keep steepening — 2-year 3.42%, 10-year 3.93% — as traders continue their favourite game: “Rate Cuts Are Coming (We Swear).”

But then oil screamed higher, tariffs add 0.07% to core CPI, and Goldman started sweating into its spreadsheets.

The market’s official stance heading into CPI?

“We’re absolutely confident about the thing we’re terrified about.”

The Fed’s path is clear: keep cutting rates until inflation stops noticing.

☕ Hazel’s Final Thought

Energy’s partying, tech’s pretending, and Ford’s on fire — literally.

Investors have chosen hope over logic, whisky over water, and “rate cuts fix everything” over math.

CPI’s coming.

Until then, everyone’s long on denial and short on caffeine.

— Hazel Ledger,

FinNuts Bureau of Selective Optimism and Energy Sector Euphoria

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “1999 Prince Party Formation Flying” whilst claiming they had mastered “NATH Normalization During Tech Bubble Repeat Pattern Advanced Cooing.”

Hazel updated her crisis management protocols to include “Bear Cliff-Clinging Response Procedures” alongside emergency plans for “Premium Popper Compensation During Missed RUT Setup Integration Whilst Providing Flu Season Nursemaid Services.”

Mac raised his Friday morning whisky and declared, “When Bear setups cling to cliff edges whilst Premium Poppers deliver four trades and trader plays nursemaid, diversified systematic approaches prove delightfully resilient!”

Kash attempted livestreaming about “NATH normalization being basically like DeFi protocol parabolic pumps but with actual 1999 Prince soundtrack” but got distracted trying to remember Elton John’s dancing bears lyrics.

Wallie grumbled that in his day, markets fell “with proper conviction rather than this modern cliff-clinging nonsense with normalized new highs and flu-ridden household management!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The $350 Billion “I Quit” That Broke Records

Apple co-founder Ronald Wayne sold his 10% stake back to Jobs and Wozniak for $800 just 12 days after starting the company—that stake would be worth over $350 billion today!

This is history’s most expensive case of “I’m out!” In 1976, Ronald Wayne co-founded Apple with Steve Jobs and Steve Wozniak, but after 12 days of worrying about potential business debts, he sold his 10% stake back to his partners for $800.

That 10% stake would be worth over $350 billion today—more than the GDP of most countries! Wayne was 41 while Jobs and Wozniak were in their 20s, and he had more to lose financially if the company failed. While his young partners were willing to risk everything on their garage startup, Wayne chose the “safe” path and walked away from what would become history’s greatest investment opportunity.

The irony is perfect: in trying to protect his financial security, Wayne gave up enough money to buy small countries. He later said he has no regrets, but this remains the ultimate example of how playing it “safe” can sometimes be the riskiest decision of all.

Every time you see an iPhone, remember that someone once thought Apple wasn’t worth the risk. Sometimes the biggest risk is not taking any risk at all!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.