ORB5 Bulls Got Engulfed, Premium Sellers Got Paid – 95.3% Win Rate Secured

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s Phil, and we’re closing out 2025 with a proper bang.

Two setups. Two wins. 88.4% combined ROC. And I’m heading out for New Year’s Eve whilst other traders are still glued to screens hoping for “one more signal.”

The market gave us a failed bull trap right out the gate, then served up a textbook breakout for dessert. We took both, collected premium on both, and walked away before lunch.

This is what systematic trading looks like. Not exciting. Not stressful. Just consistently profitable.

Let’s break down how we ended the year.

Your tea’s getting cold. Scroll down before it does. ☕

Still satisfying 97.2% of bull setups and 92.9% of bear setups?

DeBriefing:

Trade Summary

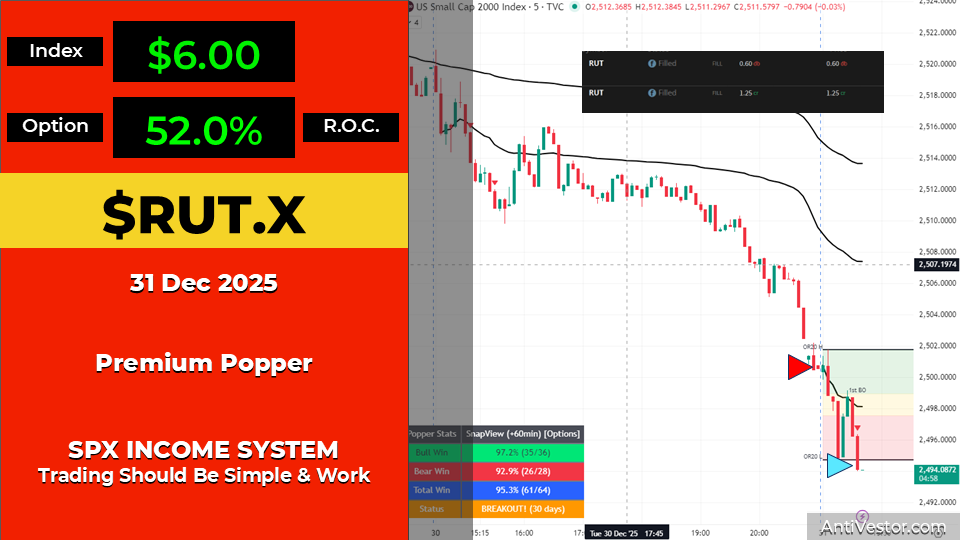

| Field | Trade 1 | Trade 2 |

|---|---|---|

| Ticker | $RUT.X | $RUT.X |

| Strategy | Premium Popper | Premium Popper |

| Direction | Bear | Bear |

| Setup | Failed ORB5 Bull + Bearish Engulfing | ORB20 1st Breakout |

| Setup Grade | A | A |

| Index Move | $6.00 | $3.00 |

| Premium Collected | $1.25 | $1.10 |

| Buyback Price | $0.60 | $0.70 |

| Return on Capital | 52.0% | 36.4% |

| Status | ✅ WINNER | ✅ WINNER |

Combined ROC: 88.4%

The Setup

Well folks, we’re ending the year with a bang.

Trade 1: The Failed Bull Trap

Right out the gate.

We were below the 2-day VWAP so I’m remaining bearish. Then I noticed something beautiful – the ORB5 bullish setup was failing. Not just failing quietly either. It got engulfed on the very next bar.

Failed bull ORB5 into a bearish engulfing?

Rude not to.

$1.25 in premium collected.

Trade 2: The Classic Breakout

This was textbook stuff. Classic 1st breakout on the ORB20.

It popped. It dropped.

Then I got bored because it’s New Year’s Eve and I’m heading out.

$1.10 collected.

The Trades

Trade 1 bought back for $0.60.

52% ROC.

Trade 2 bought back for $0.70.

36.4% ROC.

Combined? 88.4% ROC to close out 2025.

What Made This Work

Two different setups. Same systematic approach.

Trade 1 was the higher-conviction play – multiple confluences stacking up. Below VWAP bias. Failed bull signal. Bearish engulfing confirmation. When the market gives you that many reasons to take a trade, you take the trade.

Trade 2 was the bread-and-butter breakout. Nothing fancy. ORB20 triggers, premium gets collected, theta does its thing.

Neither trade required me to predict anything. Neither trade required me to stare at screens for hours. Neither trade required me to be clever.

Just systematic. Just mechanical. Just paid.

The Lifestyle Angle

Done just in time for tea and biscuits.

And maybe a small sherry.

It’s New Year’s Eve.

The market’s open.

Other traders are glued to their screens trying to squeeze out one last play before midnight.

Me? I’m heading out.

Because trading should be simple. And it should work.

PopPop.

Rumour Has It…

Whose brilliant idea was it to trade on New Year’s Eve?

The Financial Nuts newsroom was in chaos.

Not because of the markets – those were behaving perfectly predictably.

No, the chaos was entirely self-inflicted.

Percy had brought in a party horn and kept blowing it every time a candle closed green.

“It’s festive!” he insisted, whilst Wallie covered his ears and muttered something about “statistical significance of holiday noise.”

Hazel was trying to file year-end reports whilst simultaneously tracking two Premium Popper setups.

Her “COFFEE” mug had been refilled four times. (and looked surprising like red wine)

It was 10am.

“Failed ORB5 into bearish engulfing,” Mac announced, cigar smoke curling towards the ceiling.

“Textbook. Someone should take that.”

Kash didn’t look up from his phone.

“Already done. Already banked. Already posting the screenshot.”

“But the year-end analysis?” Wallie started.

“Will still be there in January,” Mac cut him off. “Unlike that premium, which just decayed beautifully.”

Percy blew the party horn again.

“95.3%,” Hazel said quietly, staring at her screen. “We actually ended the year at 95.3%.”

The room went silent. Even Percy lowered the horn.

“Drinks are on Kash,” Mac declared.

“Why me?!”

“Because you keep telling everyone how much you made in crypto. Time to prove it.”

The party horn sounded one final time. Nobody complained.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.