Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

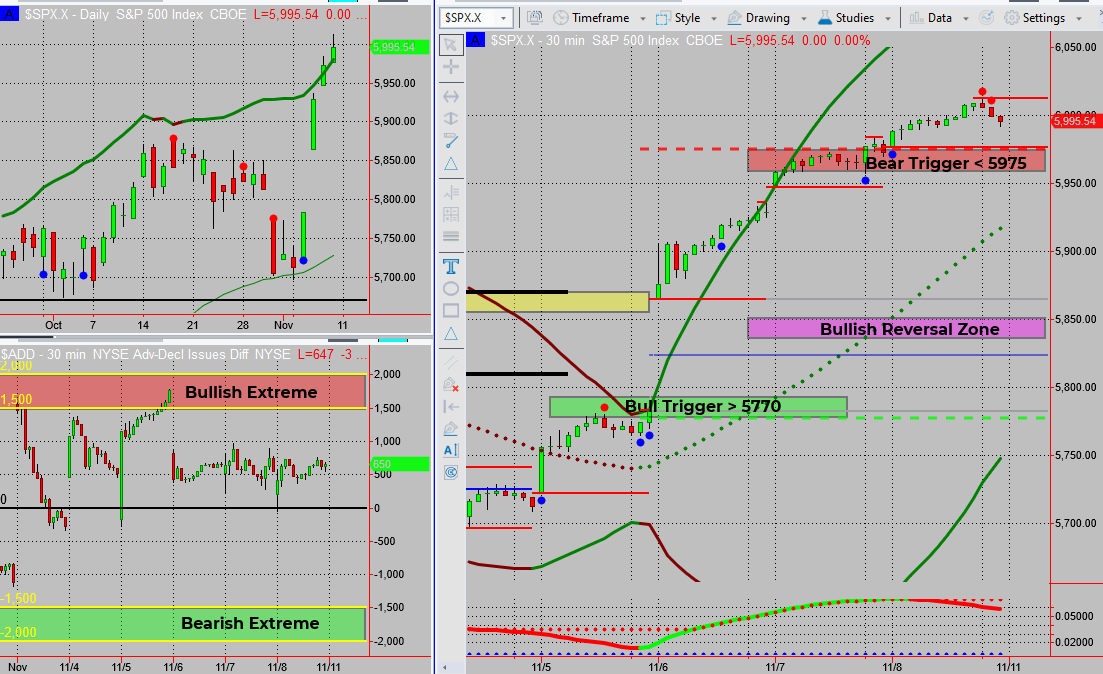

The post-election market rally is still going strong, but even the best rallies need a breather. Are we on the verge of a small pause or just getting started on the next climb? Let’s dive in.

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

The markets have been riding high since the election, with momentum that shows no signs of slowing down—at least for now. That said, recent daily charts are starting to show some wicks on top of candles, which may be early indicators of exhaustion.

The SPX Income System has flagged bearish setups with the classic ‘Tag ‘n Turn’ pattern, hinting at a potential pause or brief correction. This is no reason to panic, but rather an opportunity to prepare. If the market corrects down to our identified bullish reversal zone, it could be the perfect moment to jump in and capitalize on the next wave up.

Key Observations:

- Bullish momentum is still strong post-election.

- Wicks on daily candles suggest possible market exhaustion.

- Bearish setups detected by SPX Income System.

- Watching for a move to the bullish reversal zone for new entries.

Fun Fact

The iconic bull statue on Wall Street, created by artist Arturo Di Modica, was initially placed without permission in 1989. It became so popular that it was later allowed to stay and has since become a symbol of financial optimism.

The Wall Street Charging Bull was dropped overnight by the artist as a symbol of resilience and strength following the 1987 market crash. Though originally meant as a temporary installation, public demand secured its spot, transforming it into an enduring icon of financial markets and confidence.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece