Tuesday/Wednesday Retest Prediction Materialises Immediately Wednesday Morning

Inside Day High and Low Liquidity Sweeps Execute Perfectly

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

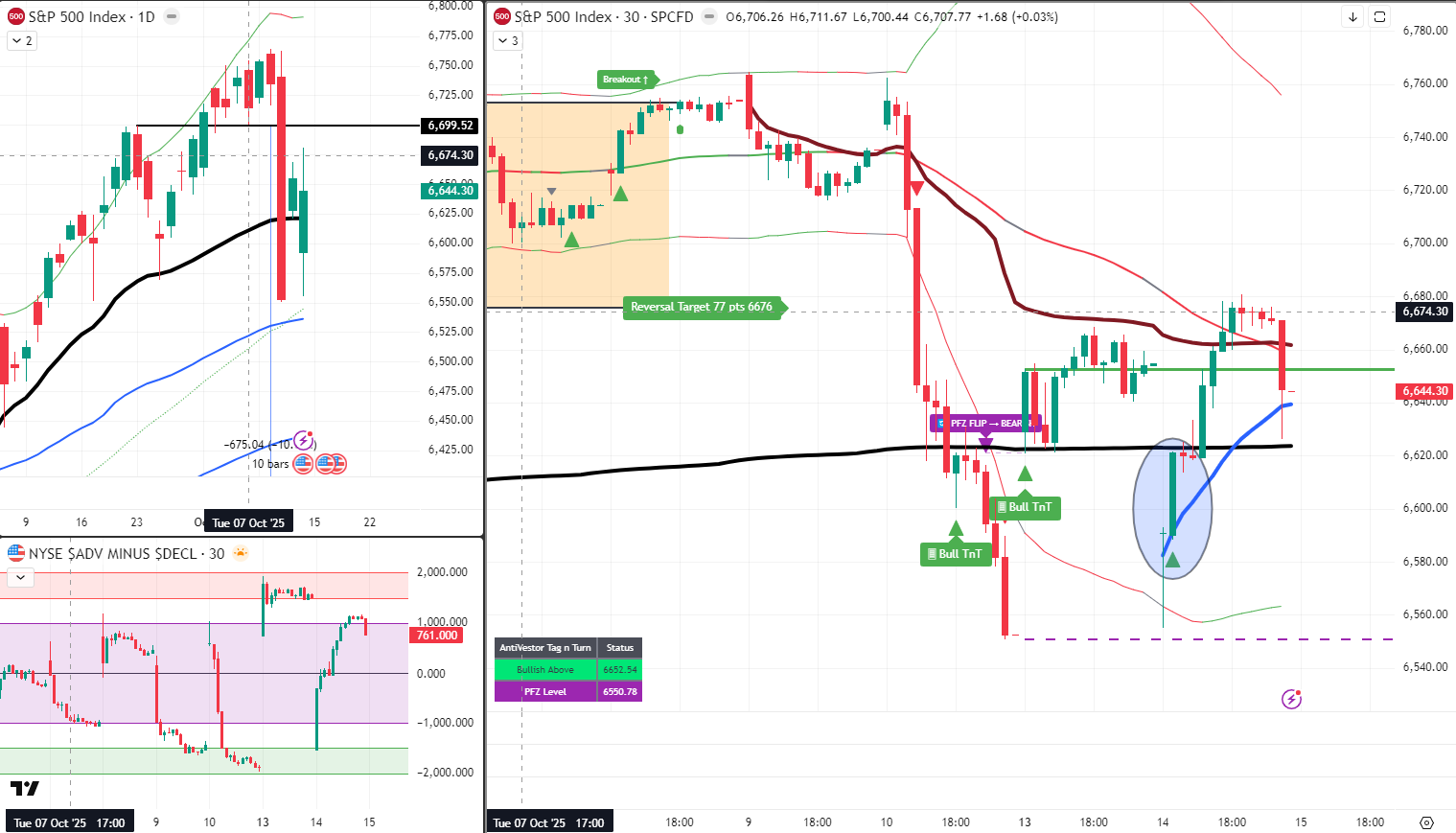

As we head into Wednesday’s trading, the retest I was thinking might happen on Tuesday/Wednesday unfolded right out the bloody gate. As did the inside day high and low liquidity sweeps – exactly as discussed.

So with a little patience and using “me ole noggin,” I’ve avoided having to sit through some potential drawdown shenanigans whilst market makers finished their breakfast buffet.

The system was officially bullish, and now so am I – using the gap down, 60-min ORB, the first pulse bar of the day, plus whatever interpretive dance involving coffee beans and questionable hand gestures the trading gods required for proper ceremonial entry protocol.

And so we’re back bullish, a few strikes better off after the yoyo dust has settled.

Keep scrolling for the RUT ridiculous follow-through…

Retest Materialises. Liquidity Swept. Bulls Board Better Strikes.

SPX Market Briefing:

Wednesday brings the predicted retest materialising immediately at market open, with systematic patience delivering superior positioning after liquidity hunting concluded.

Current Multi-Market Status:

- SPX: Now officially bullish – gap down + 60-min ORB + first pulse bar entry complete

- Tuesday/Wednesday Retest: Unfolded right out the gate as predicted

- Inside Day Liquidity: High and low sweeps executed perfectly

- Entry Positioning: Few strikes better off after yoyo dust settled

- RUT: Same pattern with ridiculous follow-through move developing

- CL Crude: Likely sweeping prior swing high to collect bear breakdown stops before next bear leg

- Scalping Activity: Premium/Lazy Poppers delivering whilst waiting, futures adaptations also in progress

The Retest Prediction Materialises

Tuesday/Wednesday retest thinking played out right out the gate Wednesday morning. The inside day high and low liquidity sweeps executed with textbook precision.

When systematic analysis predicts behaviour and market makers obligingly follow the hunting script before real moves begin, that’s not luck – that’s proper framework understanding of how modern markets operate.

Patience avoided the drawdown shenanigans. Whilst others got whipsawed through the liquidity hunt, systematic frameworks simply waited for the dust to settle.

The Ole Noggin’ Entry Protocol

The system was officially bullish. Now so am I.

Entry components:

- Gap down ✓

- 60-min ORB ✓

- First pulse bar of the day ✓

- Interpretive dance involving coffee beans and questionable hand gestures that would horrify professional choreographers ✓

All systematic entry criteria aligned. The trading gods received their ceremonial offerings. Position initiated at strikes significantly better than jumping in prematurely would have delivered.

That’s the mathematics of patience: A few strikes improvement multiplied across position size creates substantially better risk/reward profiles than forcing entries into liquidity hunting zones.

The Yoyo Dust Settlement

After all the back-and-forth, the whipsaws, the liquidity sweeps hunting bracket orders – we’re now bullish a few strikes better off after the yoyo dust has settled.

This is what systematic frameworks provide: The ability to watch market makers do their thing, recognise the patterns, wait for conclusion signals, then enter with superior positioning.

Not exciting. Not dramatic. Just systematically profitable through patience and proper entry protocol.

RUT’s Ridiculous Follow-Through

Similarly with RUT, you’ll see the same pattern playing out. The follow-through move is absolutely ridiculous.

When multiple instruments show identical systematic behaviour simultaneously, that’s not coincidence – that’s coordinated market structure operating across correlated assets.

RUT’s movement validates the SPX positioning. When both dance to the same tune, systematic traders benefit from confirmation rather than confusion.

CL Crude Oil Liquidity Sweep Incoming

Taking a look at CL crude oil futures, we also see something very similar developing. I suspect we’ll push up to sweep the prior swing high and collect all those bear breakdown stops before putting in any more bear moves.

Market makers don’t just abandon hunting because one session concludes. They systematically collect liquidity wherever it’s concentrated. Bear breakdown stops sitting above prior highs? That’s the next buffet station.

For now: TnT setup with the V-Entry active. X marks the spot for my target. Let the market do its liquidity collection routine, then position for the next systematic leg.

The Scalping Entertainment

I’ve also been having some fun with the scalper setups whilst waiting for swings to materialise. Both Premium and Lazy Poppers delivering opportunities, plus looking to adapt and update things for my futures traders.

When larger timeframes require patience, smaller timeframes still provide action. Scalping generates profits and maintains engagement whilst systematic swing setups develop properly.

Wednesday’s Unfolding

Wednesday should be fun, and we should start to see the real next move begin unfolding now that the liquidity hunting preliminaries have concluded.

The retest happened. The sweeps executed. The patient positioned. Now we watch whether bulls deliver on this setup or if more games remain before genuine directional commitment materialises.

Today’s Systematic Plan:

- SPX: Now officially bullish – gap down + ORB + pulse bar entry complete at better strikes

- RUT: Same pattern with ridiculous follow-through developing

- CL Crude: TnT V-Entry active, expecting prior swing high sweep before next bear leg

- Entry Improvement: Few strikes better positioning through patience versus premature commitment

- Scalping Activity: Premium/Lazy Poppers plus futures adaptations generating activity

- Next Move: Real directional commitment should start unfolding Wednesday

In Other News…

Earnings beats meet guidance misses in banking confession season

Futures flat Wednesday ahead of Bank of America and Morgan Stanley earnings like Percy cautiously approaching the office tea supplies after previous disappointments. Tuesday close showed Dow +0.4% at 46,270 whilst S&P dropped -0.2% to 6,644 and Nasdaq fell -0.8% to 22,522. VIX settled 20.81 after hitting 22 intraday as markets whipsawed 1.5% from highs to close negative when Trump trade rhetoric spooked late buyers proving presidential commentary still moves markets unpredictably.

Sector rotation reveals earnings results versus guidance divergence

Financials led Tuesday with Wells Fargo soaring 7.2% and Citigroup climbing 4.5% on earnings beats like Mac celebrating premium whisky restock. But JPMorgan fell 1.9% and Goldman dropped 2% despite beating estimates as cautious forward guidance outweighed strong quarters proving markets care more about future than present. Regional banks gained 3.1% on lower funding cost expectations whilst technology weakened as China sanctions on Hanwha Ocean rattled supply chains.

Banking results demonstrate profitable pessimism

JPMorgan posted record $9B trading revenue with profit up 12% but Dimon’s tariff warnings spooked investors like Wallie’s productivity reports containing excellent past performance with terrible future outlook. Wells Fargo raised ROTCE target to 17-18% after Fed removed asset cap unlocking growth proving regulatory relief beats operational improvements. BlackRock gained 3% on strong quarter whilst Papa John’s surged 14% after-hours on Apollo’s $64/share takeover bid.

Cross-asset signals reveal dovish pivot consequences

Powell’s dovish pivot Tuesday noting employment risks rising and balance sheet runoff ending soon pushed October Fed cut odds to 97% proving central bankers signal intentions clearly sometimes. Gold touched $4,205 whilst silver near $52 all-time high as precious metals continue spectacular runs. Oil concerns mounting as IEA warns four million barrel per day surplus next year. Dollar weak at 97.54 whilst government shutdown day thirteen strips economic data flow completely.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Interpretive Dance Formation Flying” whilst claiming they had mastered “Systematic Coffee Bean Hand Gesture Entry Protocol During Liquidity Sweep Conclusion Advanced Cooing.”

Hazel updated her crisis management protocols to include “Trading Gods Ceremonial Offering Procedures” alongside emergency plans for “Better Strike Positioning Through Yoyo Dust Settlement Wait Integration Processes.”

Mac raised his Wednesday morning whisky and declared, “When retest predictions materialise right out the gate whilst patient traders avoid drawdown shenanigans, questionable hand gestures prove themselves delightfully effective!”

Kash attempted livestreaming about “RUT follow-through moves being basically like DeFi liquidity cascades but with actual ridiculous systematic confirmation across correlated instruments” but got distracted demonstrating his own interpretive dance ritual.

Wallie grumbled that in his day, entries required “immediate positioning without ceremonial nonsense, not this modern patience protocol with coffee bean hand gestures and strike improvement calculations!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The Dutch East India Company: History’s First Corporate Empire

The VOC had a 200-year run and paid dividends in actual spices—because nothing says “solid investment returns” like being paid in nutmeg and cinnamon!

The Dutch East India Company wasn’t just a business; it was essentially a country with shareholders. They had their own army, navy, currency, and the authority to wage war—imagine if Amazon could declare war on FedEx and make it official!

For nearly two centuries, the VOC was the world’s first multinational megacorporation, with operations spanning from Indonesia to India to South Africa. Their business model was beautifully simple: sail to exotic places, buy spices cheap, sell them expensive, and occasionally conquer entire islands if the locals were uncooperative.

Early dividends were sometimes paid in actual spices because hard currency was apparently too mainstream for history’s first corporate empire. Shareholders literally received bags of nutmeg as investment returns, making their portfolios smell significantly better than modern ones.

The company existed for 197 years and basically created the template for modern capitalism—complete with shareholder meetings, quarterly reports, and the occasional hostile takeover of entire countries.

They proved that with enough boats, weapons, and really good spices, you could build a business empire that would make today’s tech giants look like lemonade stands! ️⛵

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.