RUT Clarity Beats SPX Sloppiness Across Multiple Setups

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The day pretty much started out just like any other – waiting for the opening bell to get going whilst I was holding my Fast Forward Group mentor sessions for some live trading.

Nothing fancy. Nothing dramatic. Just systematic setups presenting themselves whilst students watched the frameworks function in real-time.

By end of session: Five trades executed. Five winners banked. ROCs ranging from 50.4% to 54.5%. Fast Forward students got front-row seats to mechanical execution delivering exactly what probability mathematics promise.

Let me break down how textbook systematic trading actually looks when frameworks meet proper market conditions.

Keep scrolling for the trade-by-trade breakdown…

Five Setups. Five Executions. Five Wins. Zero Drama.

Premium Popper Debrief:

Wednesday’s Fast Forward mentor sessions provided the perfect live trading laboratory for demonstrating how Premium Popper setups function when executed mechanically.

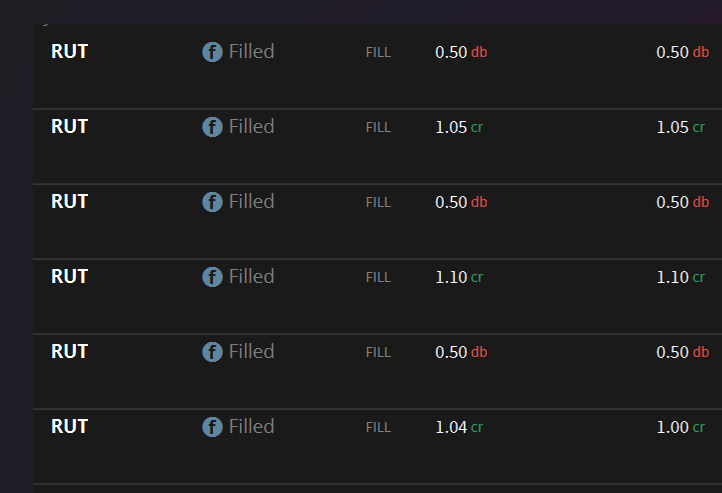

Session Results:

- Total Trades: 5 Premium Popper setups

- Winners: 5 (100% win rate for the session)

- ROC Range: 50.4% to 54.5%

- Instruments: SPX and RUT options

- Timeframe: US morning session through close

- Audience: Fast Forward Group students watching live execution

The Statistical Edge Foundation

The 20-min opening range setup was used throughout because statistically this provides a better edge than the 15-min for my setups.

This isn’t preference. This isn’t gut feeling. This is backtested probability mathematics showing measurable improvement in win rates and risk/reward profiles when using 20-min over 15-min opening range parameters.

Statistical edges matter. Small improvements in probability compound dramatically over hundreds of executions.

Trade #1: SPX Premium Popper 1st Breakout

Setup: Classic Premium Popper 1st breakout (purple arrow on chart)

Execution: Strike 6705 0-DTE

Result: 50% ROC

Notes: SPX was quite sloppy, but the breakout signal was clear enough for systematic entry

Even when price action looks messy, proper framework signals cut through the noise. The setup either triggers or it doesn’t. Emotions about “sloppiness” don’t enter mechanical execution protocols.

Moved quite quickly to options exit target. When setups work, they tend to work fast with these 0-DTE scalps.

Trade #2: RUT Premium Popper 1st Breakout

Setup: Classic Premium Popper 1st breakout (purple arrow on chart)

Execution: Strike 2535 0-DTE

Result: 51.9% ROC

Notes: RUT actually provided a very clear opening continuation pattern

Whilst SPX was being sloppy, RUT showed textbook behaviour. This is why monitoring multiple instruments matters – when one misbehaves, others often provide clearer systematic opportunities.

RUT’s clarity delivered slightly better ROC than SPX’s sloppiness. Framework flexibility across instruments creates more consistent execution opportunities.

Trade #3: SPX Reversal V-Entry (Futures Derisk)

Setup: Reversal after target reached on SPX, 60-min opening range formed, V-Entry visible

Execution: Strike 6705 0-DTE after 60-min OR highs

Result: 50.4% ROC

Notes: Used to derisk ES Futures trade without buggering around with stop-loss orders

This trade served dual purposes: scalp the reversal setup mechanically whilst simultaneously derisking the larger ES futures bear swing position.

Strategic brilliance: Why mess about with stop-loss orders on futures when you can collect premium on the opposite direction through options? If futures trade goes against you, options profit offsets. If futures trade works, you’ve banked additional premium from the derisk scalp.

Trade #4: RUT 2nd Breakout

Setup: 2nd breakout of opening range plus break of 60-min opening range

Execution: Strike value not specified

Result: 54.5% ROC (highest of the day)

Notes: Chose not to trade SPX as already holding ES futures position

Decision-making note: With ES futures bear position already running, adding another SPX short through options felt like position concentration risk. RUT provided the same systematic setup without correlation overlap.

Hindsight is wonderful, so don’t judge me for what turned out to be an easy day! Sometimes avoiding trades works out brilliantly. Sometimes it costs opportunity. Systematic discipline requires accepting both outcomes.

After a little dithering, price followed through quite nicely to target, delivering the session’s best ROC at 54.5%.

Trade #5: RUT End of Day Sympathy Play

Setup: SPX sold off 25 mins before close, RUT sitting at 20/60-min opening range levels

Execution: Lazy Popper style targeting SPX sympathy movement

Result: 52.4% ROC

Notes: Sympathetic movement didn’t materialise, time decay delivered win anyway

Only took this trade because I was at the desk tinkering near the closing bell. Saw SPX selling pressure and anticipated RUT would follow sympathetically given positioning at opening range levels.

The sympathetic movement didn’t actually happen. But that’s the beauty of proper options positioning – time decay did its thing very quickly, and another winner popped onto the scoreboard regardless of directional accuracy.

5 for 5 just on the Premium Popper scalps.

The Opening Range Discipline Secret

I wish they were all like this – but there are some clues to consider:

Assuming price stays out of the 20-min opening range AND then the 60-min opening range, there is a good chance of seeing similar moves and days like this on a regular basis.

This is the systematic edge hidden in plain sight:

- Wait for 20-min opening range to form

- Watch for price to respect those boundaries

- When 60-min opening range forms outside the 20-min zone

- Breakouts and reversals from these levels carry higher probability

It’s not magic. It’s statistical edge from proper opening range discipline.

The Results Summary

RUT Trades:

- 51.9% ROC – 1st Breakout

- 54.5% ROC – 2nd Breakout

- 52.4% ROC – End of day 60 OR retest (SPX sympathy setup)

SPX Trades:

- 50% ROC – 1st Breakout

- 50.4% ROC – Reversal after V-Entry developed near 60-min opening range highs

Combined Performance: 5 wins from 5 executions during Fast Forward Group mentor sessions with live student audience watching systematic frameworks deliver exactly as designed.

Lessons From Perfect Execution

- Statistical edges compound: 20-min over 15-min opening range isn’t dramatic improvement, but over hundreds of trades the mathematics favour the better probability

- Instrument flexibility matters: SPX sloppy? RUT often provides clearer setups. Framework flexibility across correlated instruments creates consistent opportunity

- Strategic derisking beats stop-losses: V-Entry reversal setup served dual purpose – collect premium whilst derisking futures without stop-loss order complications

- Position concentration awareness: Skipping SPX #4 due to ES futures exposure showed systematic discipline over opportunity greed

- Time decay delivers when direction doesn’t: Trade #5 didn’t get sympathetic movement but won anyway through proper options positioning

- Opening range discipline creates regular high-probability days: Stay out of 20-min and 60-min zones, watch probability mathematics deliver consistent results

Today’s Systematic Lessons:

- Opening Range Edge: 20-min provides better statistical probability than 15-min for these setups

- Instrument Selection: RUT clarity beat SPX sloppiness throughout session

- Strategic Positioning: Derisk futures through options rather than stop-loss complications

- Execution Discipline: 5 setups presented, 5 executions completed, 5 wins banked

- Fast Forward Value: Students watched live systematic execution delivering textbook results

- Opening Range Secret: Price staying out of 20-min + 60-min zones creates regular high-probability conditions

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “20-Min Opening Range Statistical Edge Formation Flying” whilst claiming they had mastered “Systematic Five-for-Five Premium Popper Execution During Live Fast Forward Sessions Advanced Cooing.”

Hazel updated her crisis management protocols to include “RUT Clarity Beating SPX Sloppiness Assessment Procedures” alongside emergency plans for “V-Entry Futures Derisking Without Buggering Around With Stop-Loss Integration Processes.”

Mac raised his Wednesday morning whisky and declared, “When opening range discipline delivers perfect execution days whilst Fast Forward students watch live, statistical edges prove themselves delightfully reliable through mechanical framework function!”

Kash attempted livestreaming about “20-min versus 15-min opening range probability mathematics being basically like DeFi liquidity pool parameter optimisation but with actual measurable win rate improvements” but got distracted celebrating his own 5-for-5 Premium Popper day.

Wallie grumbled that in his day, perfect execution required “proper intuition and market feel, not this modern opening range statistical nonsense with 20-min probability edges and mechanical framework delivery!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.