Perfect 5-for-5 Popper Day with Broker Statements for Naysayers

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well, it’s been a fun day and last few days scalping again and popping that premium. I found myself at the desk most of the US morning session due to my usual Fast Forward student calls, so it would have been rude not to take advantage of some setups presenting themselves.

The two usual Premium Poppers, a short futures trade, another Premium Popper to essentially derisk the futures trade, then two more Premium Popper style trades using the Lazy Popper setups.

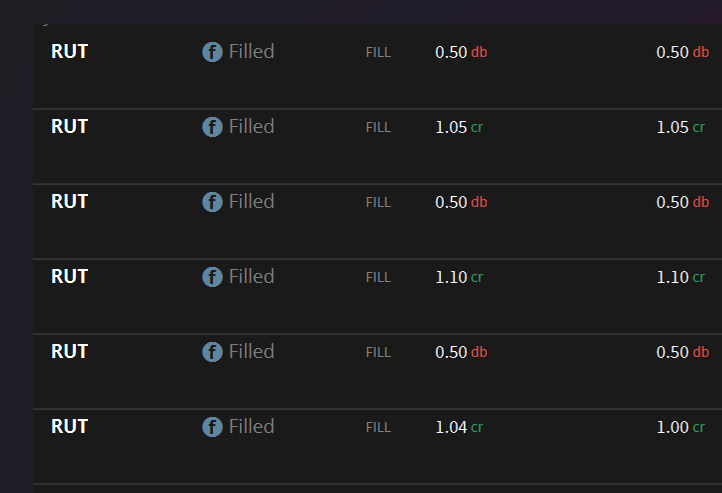

A fun day for certain, ending 5-for-5 just on the poppers. Broker statements below for the naysayers who think systematic approaches don’t deliver consistent execution.

But whilst individual wins stack nicely, the bigger picture’s getting properly interesting with volatility patterns developing and warning signs flashing across multiple instruments.

Keep scrolling for the Uncle Rus volatility question…

Five Poppers. Zero Losses. Dollar Warnings Flash.

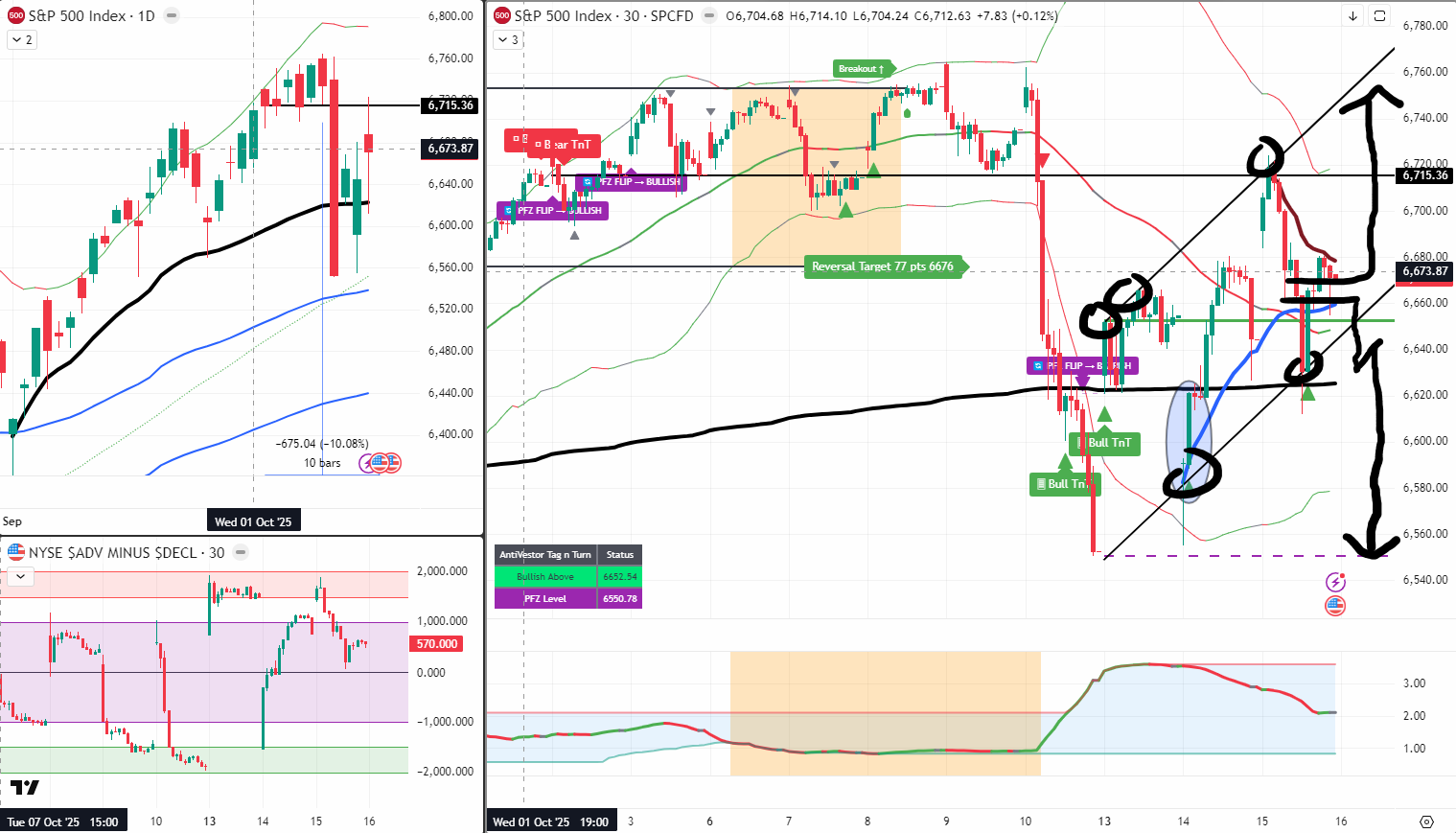

SPX Market Briefing:

Thursday brings perfect Popper execution whilst larger market structure shows three indexes meandering with lower highs and Uncle Rus pumping volatility patterns that demand answers.

Current Multi-Market Status:

- Popper Performance: Perfect 5-for-5 execution with broker statements attached

- SPX/DOW/NASDAQ: Three indexes meandering, making lower highs

- RUT (Uncle Rus): Pumping new highs like a champ – volatility pattern developing

- VIX: Holding recent highs whilst market holds breath on tenterhooks

- CL Crude: Short-term bottom potentially leading to retracement before breakdown continuation

- DXY (Dollar Index): Starting to shit the bed – warning sign for short term dollar trouble

The Perfect Popper Day

Fast Forward student calls kept me at the desk through US morning session. Would have been rude not to capitalise on setups presenting themselves with such clarity.

Execution breakdown:

- Two Premium Poppers ✓

- One short futures trade ✓

- Another Premium Popper to derisk futures position ✓

- Two Lazy Popper style trades ✓

Final score: 5-for-5 on poppers. Broker statements attached for anyone questioning whether systematic approaches deliver consistent execution.

This is what frameworks provide: Clear setups, mechanical execution, repeatable results. Not gambling. Not hoping. Just banking Benjamins through systematic probability exploitation.

The Meandering Three

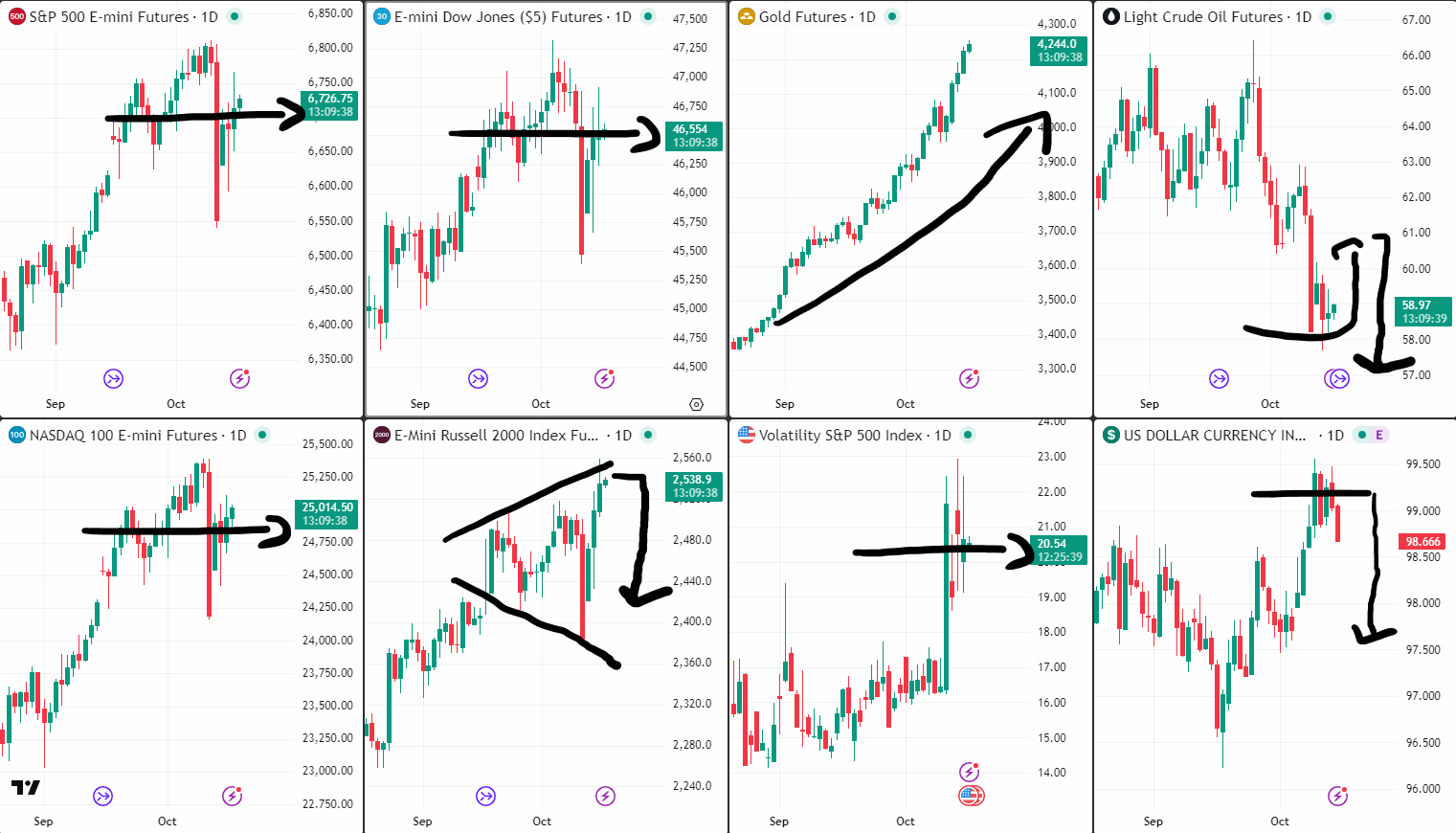

Starting with the daily market snapshot, we can see three of the four stock indexes are meandering and making what so far looks like lower highs.

SPX, DOW, NASDAQ: All showing similar behaviour – movement without conviction, higher prices without proper follow-through, rally attempts that fade rather than accelerate.

When three major indexes synchronise in indecisive price action whilst one outlier behaves completely differently, systematic traders pay attention to both the consensus behaviour and the divergence.

Uncle Rus’s Volatility Pattern Question

Meanwhile, Uncle Rus is pumping to new highs like a champ, and what is definitely looking like a volatility pattern developing.

The question: Will it continue to pump, or will the dump follow?

Volatility patterns create these lovely binary setups where price either explodes higher through breakout continuation or collapses back through failed breakout reversal. Both scenarios offer systematic opportunity. Neither requires prediction – just proper positioning when signals materialise.

Current observation: RUT showing strength whilst others show weakness. Divergence creates tension. Tension eventually resolves directionally.

VIX Holds Breath on Tenterhooks

I’m still favouring the bear side overall, and with VIX holding its recent highs, the market is also holding its breath for what may happen next. Everyone’s definitely on tenterhooks.

When volatility index refuses to collapse despite market strength, that’s not bullish confirmation – that’s warning sign preservation. The market’s pricing in uncertainty even whilst price grinds higher.

Tenterhooks reality: Nobody’s confident about sustainability. Everyone’s watching for the other shoe. VIX reflects this collective breath-holding beautifully.

CL Crude’s Retracement Setup

CL Crude oil futures still look like a short-term bottom that could lead to a small retracement before the eventual tipping over to continue the breakout move lower.

Markets rarely move in straight lines. Even strong directional trends need pauses, pullbacks, retracements that allow fresh positioning before next legs materialise.

Crude expectation: Bounce from current levels, retrace partially higher, then resume downward breakout continuation. Classic two-steps-forward-one-step-back systematic progression.

Dixie Shits the Bed

Lastly, and whilst I don’t normally look at it, Dixie (Dollar Index) has started shitting the bed, which could be the warning sign that all is not well with the dollar world – at least in the short term.

Currency moves telegraph capital flow changes before equity markets reflect them. When the dollar weakens suddenly, that’s money moving somewhere else for reasons worth investigating.

Warning sign interpretation: Short-term dollar trouble potentially signals broader market instability ahead. Not prediction – just observation that systematic frameworks incorporate into probability assessments.

Banking Benjamin’s Remains the Plan

All in all – just another day banking Benjamin’s, as is to be expected when systematic approaches encounter proper setups.

The trading plans remain the same: Follow the setups. Trade the plan(s). Let probability mathematics compound through consistent mechanical execution.

5-for-5 isn’t luck. It’s frameworks functioning exactly as designed.

Today’s Systematic Results:

- Popper Execution: Perfect 5-for-5 with broker statement proof

- Premium Poppers: Two standard executions plus one futures derisk

- Lazy Poppers: Two style trades delivering systematic profits

- Larger Picture: Three indexes meander with lower highs, RUT pumps volatility pattern

- Warning Signs: VIX holding highs, markets on tenterhooks, dollar shitting bed

- Crude Oil: Short-term bottom into retracement before breakdown continuation expected

- Trading Plans: Remain unchanged – follow setups, trade systems, bank Benjamins

In Other News…

FinNuts Market Flash

Bank earnings strength fuels broad participation rally

Futures flat Thursday ahead of 08:30 ET retail sales and PPI data like Percy awaiting office tea delivery with cautious optimism. Wednesday close showed S&P +0.4% to 6,671 with intraday swing from -1.2% to +1.2% whilst Nasdaq climbed +0.7% to 22,670. Russell 2000 up 5.5% week-to-date on track for best weekly gain since November 2024 Trump rally. Market breadth exceptional with over 2,000 NYSE stocks advancing versus 512 declining proving broad participation beats narrow leadership.

Sector rotation demonstrates universal enthusiasm

Financials dominated as Bank of America surged +4.4% and Morgan Stanley climbed +4.7% to record crushing earnings like Mac discovering unlimited premium whisky budget approved. Regional banks climbed on lower funding cost optimism whilst technology strong with AMD jumping +9% on Oracle deal. Microsoft rallying on Copilot AI expansion and Apple +1.4% on M5 processor unveiling. Agriculture stocks surged 3-4% on Trump cooking oil embargo threats proving even agricultural commodities respond to presidential rhetoric.

Earnings season produces power shifts

Morgan Stanley equity trading revenue at $4.12B beat Goldman Sachs for first time in recent years breaking GS stranglehold on dominance like Wallie finally outperforming productivity expectations. Bank dealmaking fees surging on record M&A activity whilst Progressive dropped 6.3% despite earnings beat on Florida profit cap concerns. Regional banks underperformed majors despite beats with PNC -3%, First Horizon -10%, Citizens -1% proving size matters in banking celebrations.

Cross-asset signals reveal economic strength surprise

Empire State manufacturing index shocked with 10.7 reading versus -1.8 estimate jumping 19.4 points whilst employment component surged to 6.2. Six-month outlook hit 30.3 contradicting recession narratives entirely. Treasury Bessent announced price floor strategy across industries to combat China. Small-cap leadership suggests risk-on rotation accelerating dramatically. Dollar weak whilst gold hit $4,241 all-time high and oil under pressure proving assets can diverge spectacularly.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Perfect 5-for-5 Formation Flying” whilst claiming they had mastered “Systematic Benjamin Banking Through Premium Popping Advanced Cooing.”

Hazel updated her crisis management protocols to include “Uncle Rus Volatility Pattern Pump or Dump Assessment Procedures” alongside emergency plans for “Dollar Shitting Bed Warning Sign Integration Processes.”

Mac raised his Thursday morning whisky and declared, “When markets hold breath on tenterhooks whilst systematic traders bank Benjamin’s through perfect Popper execution, broker statements prove frameworks function beautifully!”

Kash attempted livestreaming about “RUT volatility patterns being basically like DeFi liquidity pool divergence signals but with actual pump or dump binary outcomes” but got distracted showing his own broker statements to naysayers.

Wallie grumbled that in his day, perfect 5-for-5 execution required “proper skill and intuition, not this modern systematic framework nonsense with mechanical setups and probability mathematics!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The VIX: Wall Street’s Official Anxiety Meter

The CBOE Volatility Index (VIX) is nicknamed the “fear gauge” because it spikes when markets panic—like a smoke alarm for financial disasters!

The VIX is essentially Wall Street’s emotional support animal that screams when everyone’s having a collective meltdown! Known as the “fear gauge,” this index measures the market’s expected volatility over the next 30 days using options prices, basically turning investor panic into a quantifiable number.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.

For the Naysayers…