1950s Trading Advice Meets Modern Market Maker Brutality

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Today we saw the result of being a little patient in the markets, exactly as mentioned in yesterday’s briefing. And we also saw the inside/narrow ranging bar develop – just as we thought it might do and discussed quite a bit in the Fast Forward group call.

While there was some interesting movement yesterday from a points perspective, relative to Friday’s massive move it was narrow ranging. The day pretty much rolled out as discussed, which leaves us a lovely inside bar to play with on the dailies.

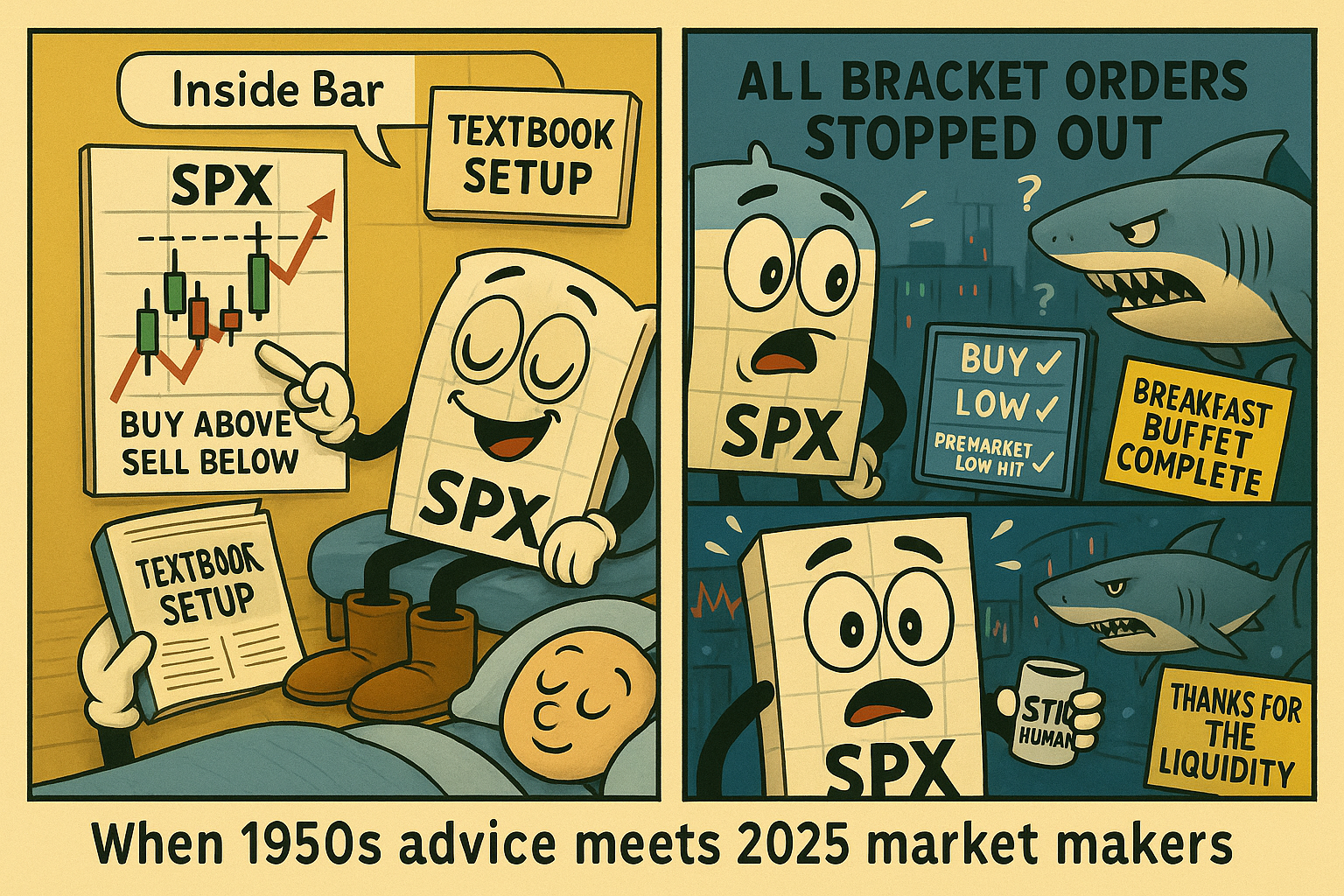

Here’s what retail traders get told about these bars: Place buy orders above and sell orders below – just like a trading range – then close your eyes and hope for the best.

That advice might have worked in the 1950s.

Today? The big boys and girls looking for liquidity also know this and will often drive prices above and below – sometimes multiple times across various sessions – to scoop up the small fishes.

Already we’re seeing this play out beautifully on overnight futures.

Keep scrolling for the liquidity hunting massacre…

Inside Bar Develops. Retail Brackets Set. Big Boys Hunt Small Fish.

SPX Market Briefing:

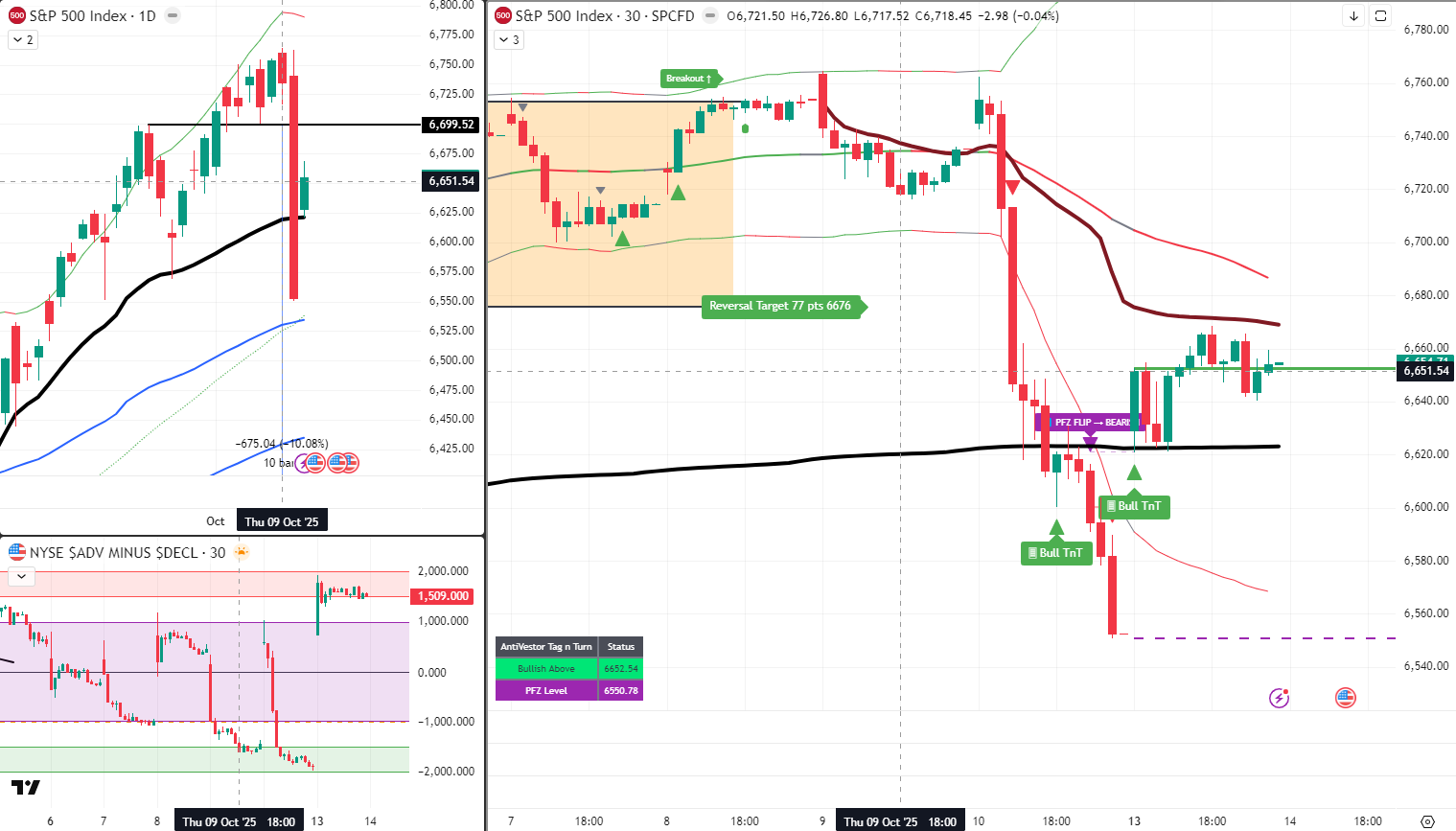

Tuesday brings the inside bar setup materialising exactly as systematic analysis predicted, with overnight action already demonstrating why patience beats premature positioning.

Current Multi-Market Status:

- SPX: Inside bar perfect setup on dailies, TnT system technically bullish

- Monday’s Prediction: Played out exactly as discussed – narrow ranging inside bar

- Overnight ES: Hit Monday’s high, low, AND premarket low – triple liquidity hunt

- Other Indexes: Dinged yesterday’s highs/lows – Asian/European traders stopped out

- Direction Timeline: Wednesday and beyond for confident moves (per Monday’s call)

- Tuesday Strategy: Patience before swing trades, scalping fills waiting time

Monday’s Patience Validation

Yesterday’s cautious approach proved exactly correct. The inside bar developed precisely as discussed in the Fast Forward group call. While points movement looked interesting, relative to Friday’s massive flush it was narrow ranging.

When systematic analysis predicts price behaviour and price obliges by following the script, that’s not luck – that’s proper framework application.

The day rolled out as discussed. Patience delivered.

The Inside Bar Bracket Trap

What retail traders get told about inside bars sounds deceptively simple:

Place buy orders above the high, sell orders below the low, then wait for the breakout to deliver profits.

This advice probably worked brilliantly in the 1950s when markets were gentlemen’s agreements and information travelled by telegram.

Today’s reality?

The big boys and girls looking for liquidity also know this retail playbook.

They will systematically drive prices above and below inside bar boundaries – sometimes multiple times across different trading sessions – specifically to scoop up those small fish bracket orders.

It’s not manipulation. It’s just business. Liquidity hunting is how market makers make markets.

The Overnight Liquidity Massacre

Already we’re seeing this play out beautifully on overnight futures. ES futures has hit:

- Monday’s main session high ✓

- Monday’s main session low ✓

- Monday’s premarket low ✓

That’s a triple liquidity hunt across three distinct levels. Every retail bracket trader who placed their “textbook” orders got systematically stopped out whilst sleeping.

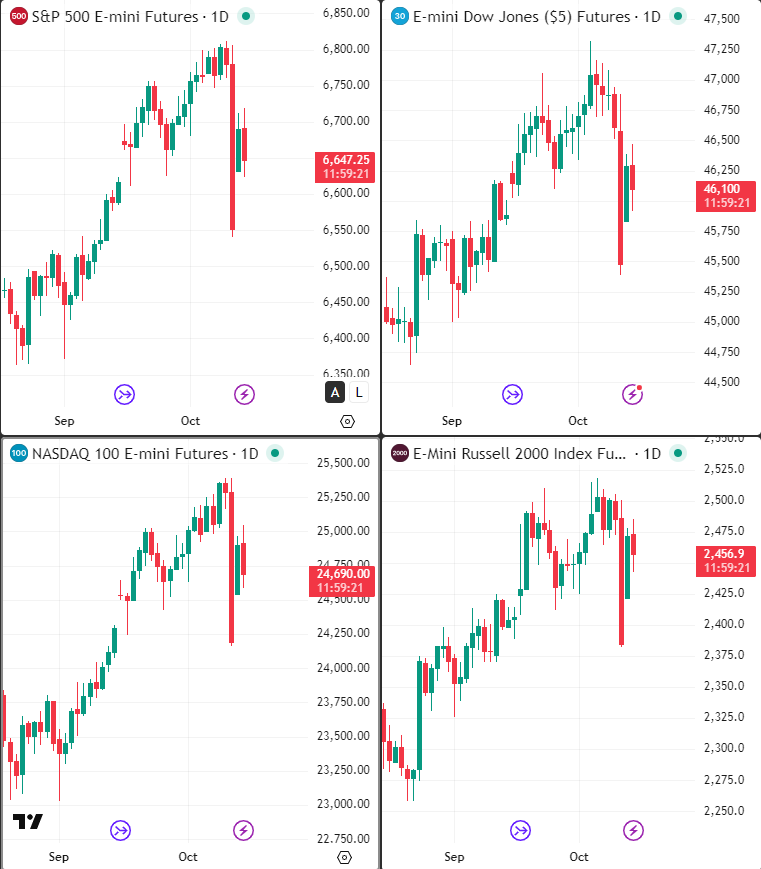

The Global Small Fish Buffet

On the other indexes – DOW, NASDAQ, RUT – we’ve seen yesterday’s main session highs and lows dinged during Asian and European trading hours.

Those Asian and European “bracket traders” are currently questioning their life choices whilst staring at stopped-out positions that were “supposed” to work according to the 1950s playbook they learned.

The small fish got scooped. The big boys collected their liquidity. The inside bar remains unbroken on larger timeframes.

Today’s US Session Liquidity Hunt

The same thing could happen again during the main US session today. Prices might drive to new highs and lows before the real moves actually start developing.

This is why patience matters. This is why systematic frameworks wait for confirmation rather than jumping on textbook setups that market makers can see from space.

Direction Development Timeline

From Monday’s Fast Forward call, we discussed how Tuesday/Wednesday might see confident directions start developing. Based on current price action, that timeline now looks like Wednesday and beyond before proper systematic entry signals materialise.

The TnT swing system on SPX is technically bullish. But technical signals without proper confirmation are just invitations to join the small fish buffet.

I shall remain patient before joining the fun and games.

The Scalping Strategy

Yesterday morning’s scalping action worked out quite nicely whilst waiting for larger timeframe clarity. Same approach today.

When swing timeframes require patience, shorter timeframes still provide opportunities. Scalping fills the waiting time productively rather than forcing premature directional commitment into liquidity hunting zones.

Today’s Systematic Plan:

- SPX: TnT technically bullish but patience required before swing entry

- Inside Bar Status: Perfect daily setup being liquidity hunted overnight and likely during US session

- Retail Bracket Traders: Getting systematically stopped out across global sessions

- Direction Clarity: Wednesday and beyond per Monday’s Fast Forward call timeline

- Tuesday Approach: Scalping fills waiting time whilst larger picture develops

- Caution Protocol: Yesterday’s patience proved correct – continuing same discipline today

Yesterdays highs and lows dinged

Same view on the daily charts

In Other News…

FinNuts Market Flash

Relief rally retraces 60% of Friday’s carnage

S&P 500 closed 6,655 surging +1.56% like Percy discovering the office restocked his favourite tea after apparent permanent elimination. Nasdaq jumped +2.21% to 22,695 whilst Dow added 587 points in broad rally as nearly 80% of S&P components finished green. Trump’s Sunday conciliatory post toward China gave bulls green light after Friday’s $2T wipeout proving presidential mood swings drive trillions in market value. Russell 2000 jumped 2.8% leading all indices whilst Broadcom surged 10-12% on OpenAI deal for ten gigawatts AI accelerators.

Bank earnings become economic beacon during data blackout

JPMorgan, Citigroup, Wells Fargo, Goldman Sachs report Q3 results 7:00 AM Tuesday providing only legitimate economic pulse available. Analysts expect JPM $4.84 EPS on $45.4B revenue with forecasts upgraded citing strong investment banking recovery and elevated Q3 trading revenues from volatility. With September jobs report cancelled and CPI/PPI uncertain, bank results offer sole window into economic reality. Trading desks likely capitalised on April-style turbulence and tariff whipsaws proving chaos generates trading profits.

Relief rally questions persist – dip buy or dead-cat bounce

Monday’s surge retraced roughly 60% of Friday’s damage but leaves markets vulnerable with November 1 tariff deadline still eighteen days away. China has not backed down with Commerce Ministry warning countermeasures persist and rare earth export restrictions unchanged. Markets betting on Trump negotiating theatre but risk remains substantial. Technical levels key with S&P holding above 6,650 and Nasdaq above 22,500 – breaks below signal deeper correction ahead.

Oil holds near May lows whilst gold consolidates records

WTI crude traded $59.89 Tuesday up slightly from $58.90 Friday close but still near May lows as demand destruction fears from tariff-induced slowdown persist despite relief rally. Gold holding approximately $4,070 near all-time high after eighth straight weekly gain. Fed rate cut odds for October 28-29 meeting remain elevated at 95% despite Monday stock rally proving central bankers cut regardless of market behaviour. Shutdown day fourteen continues with no resolution in sight.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Liquidity Hunting Formation Flying” whilst claiming they had mastered “Systematic Small Fish Scooping During Inside Bar Bracket Trap Deployment Advanced Cooing.”

Hazel updated her crisis management protocols to include “1950s Trading Advice Obsolescence Procedures” alongside emergency plans for “Asian and European Bracket Trader Life Choice Questioning Integration Processes.”

Mac raised his Tuesday morning whisky and declared, “When big boys hunt retail bracket orders across three distinct liquidity levels overnight, patience protocols prove themselves delightfully profitable through non-participation!”

Kash attempted livestreaming about “inside bar liquidity hunting being basically like DeFi liquidity pool stop-loss cascades but with actual market maker breakfast buffets” but got distracted explaining why 1950s advice doesn’t work in modern electronic markets.

Wallie grumbled that in his day, inside bar breakouts meant “proper directional commitment, not this systematic patience nonsense whilst market makers feast on bracket trading small fish!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

70% of Trades Are Just Robots Arguing

About 70% of all stock trades are executed by algorithms, meaning the market is essentially thousands of robots having high-speed arguments about whether Apple is worth $150.00 or $150.01!

Welcome to the future, where artificial intelligence spends all day bickering about stock prices like caffeinated day traders! Roughly 70% of all trading volume comes from algorithms—computer programs designed to buy and sell stocks faster than humans can even think about it.

These aren’t sophisticated investment strategies; they’re basically digital creatures that live in the millisecond gaps between when you click “buy” and when your order actually executes.

The algorithms are constantly arguing with each other: one thinks Microsoft is slightly overpriced at $299.47 and tries to sell, while another thinks it’s undervalued and immediately buys, creating a never-ending digital shouting match that happens thousands of times per second!

The best part is that these robot arguments often have nothing to do with whether companies are actually worth anything—they’re just mathematical formulas trying to outsmart other mathematical formulas in an endless game of rock-paper-scissors played at the speed of light.

Meanwhile, human investors are trying to make rational long-term decisions while surrounded by thousands of artificial intelligences having emotional breakdowns about price movements that last for microseconds! ⚔️

Meme of The Day

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.