Shutdown #5 in 20 Years – Markets Respond With Complete Indifference

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well, the government’s officially shut down. Again.

Fifth time in 20 years.

This one’s brought to you by “Failure to pass a funding bill over divided priorities and spending” – which sounds like every Monday morning meeting I’ve ever attended.

Here’s the delicious bit: We now have an accidental free market condition. No government oar-sticking. Just markets doing their thing whilst 800,000+ federal workers wonder about paycheques.

SPX’s response? Acting like a Frenchman’s disdain for instant coffee – completely unbothered and mildly amused.

Bear TnT setup from yesterday threatens to flip bullish before the weekend closes. Crude’s testing breakdown levels. And I’m one sleep away from joining the government for some proper downtime.

Keep scrolling for the AI jobs heist nobody’s discussing…

SPX Market Briefing:

Friday brings the end of another week where literally everything should be falling apart, but instead it just… carries on.

Current Multi-Market Status:

- SPX: Bear TnT threatening bullish flip before weekend

- RUT: Bearish, also threatening bullish flip before weekend

- CL: Testing bear breakdown, toying with commitment

- Government: Shutdown active, markets completely indifferent

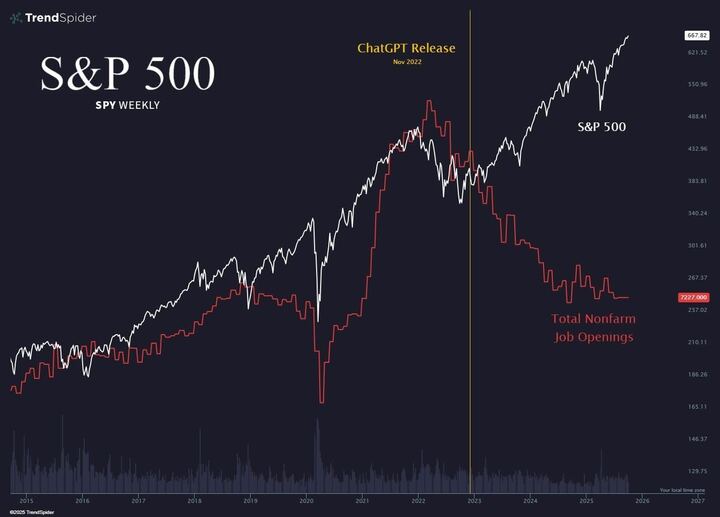

The AI Jobs Heist

TrendSpider chart shows something properly fascinating:

- ChatGPT launched November 2022.

- Job openings have been cratering ever since.

- SPX response? Straight fucking up.

Less jobs = More stonks.

AI automation destroying employment opportunities faster than you can say “prompt engineering” whilst market treats it like the best news since leveraged ETFs discovered margin.

Why? Companies slashing labour costs, boosting margins, delivering shareholders juicy returns whilst actual humans wonder why nobody’s hiring despite “record” conditions.

Robots cheap. Humans expensive. Stonks go brrrr.

SPX Commitment Issues

Went into Thursday with bear TnT. Now threatening to flip bullish before weekend close. It’s giving “I’m totally over you” at 11pm then “you up?” texts at 2am energy.

System’s watching. Waiting. Ready to respond when this market decides what it wants to be.

Current Status: Bear TnT (probably) (maybe) (check back Monday)

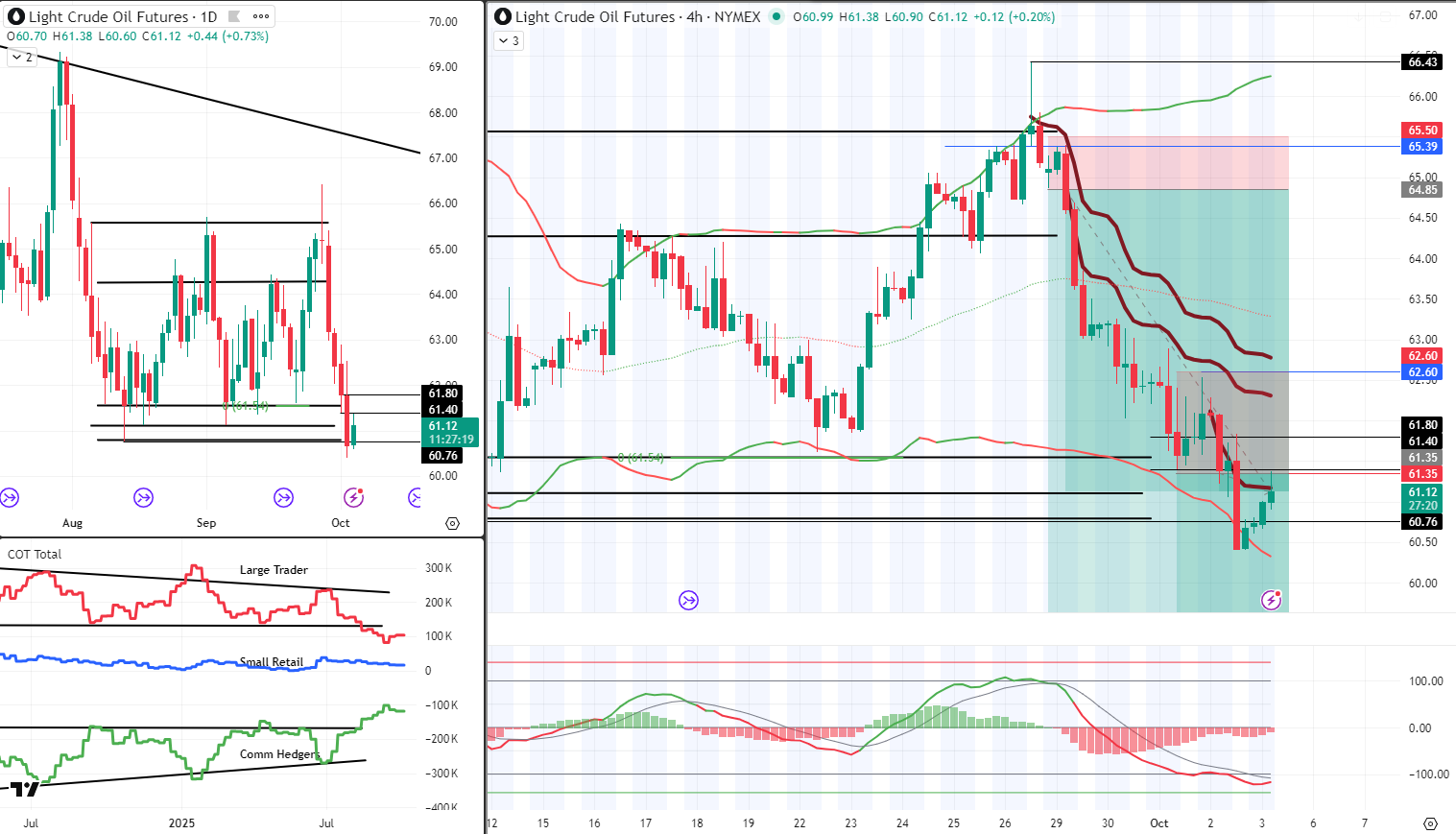

Crude Oil Breakdown Watch

CL futures continue elegant descent toward bear breakdown territory. Currently “toying” with the level like someone who says they’re “thinking about” leaving the party but has been hovering by the door for an hour.

Nice solid breakdown to close the week would be lovely. But this is 2025 – everything that should happen takes three times longer than expected.

Current Status: Testing bear breakdown, send thoughts and prayers

Vacation Mode Activated

Sophisticated trading strategy for today: Finish packing speedos. Load SF1,000 sunscreen. Join government for downtime. Sausages on sticks. Exotic cocktails with ridiculous names.

Markets will be here when I get back. Setups will still trigger. Systems will still work.

That’s the beauty of systematic trading – doesn’t require constant attention. Just trust the process and occasionally pack your speedos.

In Other News…

FinNuts Market Flash

AI chips carry markets to fourth consecutive record

S&P 500 futures showed resilience down 0.1% near 6,710 at 9:25 AM like Percy maintaining composure despite office biscuit shortage. Nasdaq-100 futures hovered unchanged near 24,830 whilst Dow futures shed 24 points because apparently government shutdowns rank below semiconductor enthusiasm. Wednesday’s cash close delivered fresh all-time highs across all three indices proving markets can ignore political dysfunction when computer chips provide distraction.

Technology dominates whilst semiconductors achieve euphoria

Nvidia gained 0.9% reaching new all-time high as AI infrastructure demand shows no cooling despite macro uncertainty. Intel surged over 3% on reports it approached Apple and Taiwan Semiconductor about potential investments because apparently desperation looks like strategic planning. AMD climbed over 3% as second-largest GPU maker gains traction with Meta and OpenAI. Invesco QQQ Trust notched 107th consecutive close above fifty-day moving average, tying longest streak since 2017 and up roughly 27% powered by breakouts proving momentum can sustain longer than rational analysis suggests.

Disney continues brand sentiment catastrophe

Entertainment giant’s brand sentiment plunged to multiyear lows among Democrats and Republicans following Jimmy Kimmel suspension. Stock dropped 6% over past month as boycott calls spread whilst shareholder groups threaten lawsuits claiming fiduciary duty breaches. Reported $4 billion market cap loss fuels concerns as Jefferies noted Disney managed alienating both political parties simultaneously – Democrats viewing move as censorship, Republicans demanding permanent removal proving corporate political navigation achieves new complexity levels.

Cross-asset signals reveal Fed certainty rising

Futures markets assigned 100% probability to twenty-five basis point rate cut at October 29-30 FOMC meeting, up from 87% before shutdown began. Shutdown’s cancellation of Friday’s September jobs report removes critical data point leading BofA economists arguing central bank will “err on side of caution” and proceed with easing. Ten-year Treasury yield held near 4.24% whilst VIX closed at 16.63 showing markets comfortable proceeding without economic data apparently.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Government Shutdown Formation Flying” whilst claiming they had mastered “Systematic Independence During Federal Budget Crisis Advanced Cooing.”

Hazel updated her crisis management protocols to include “Trading During Government Shutdown Procedures” alongside emergency plans for “Speedos Packing Integration With Bear TnT Monitoring Processes.”

Mac raised his Friday morning whisky and declared, “When government shuts down whilst systematic bears threaten to flip bullish, the proper response is obviously beach chairs and exotic cocktails!”

Kash attempted livestreaming about “AI stealing jobs being basically like automated DeFi protocol employment destruction but with actual stonks pumping” but got distracted packing his own speedos.

Wallie grumbled that in his day, government shutdowns meant “proper market panic, not this systematic positioning nonsense with holiday planning integration!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Black Monday 1987: The Day Computers Learned to Panic

On October 19, 1987, the Dow Jones dropped 22.6% in a single day—the largest one-day percentage decline in stock market history—thanks to computerized trading systems that created a digital domino effect!

Black Monday was the day Wall Street’s shiny new computer trading systems collectively had a nervous breakdown and decided to recreate the financial apocalypse in fast-forward!

The Dow plummeted 508 points (22.6%) in one day, making the Great Depression’s worst single-day drop of 12% look like a gentle hiccup by comparison.

Computer trading was still the new kid on the block in the 1980s, and these early algorithms were programmed with about as much emotional intelligence as a caffeinated toddler with a calculator.

When stocks started dropping, the computers automatically executed stop-loss orders, which triggered more selling, which triggered more stop-losses, creating a digital death spiral that made human panic look calm and rational!

It was like watching a room full of robots play hot potato with live grenades—every time one dropped the ball, all the others started throwing theirs too.

The best part? Nobody could stop it because the humans who programmed these systems were too busy running around screaming to hit the off switch.

Portfolio insurance, designed to protect against market declines, instead accelerated the crash by forcing massive selling as prices fell.

By the end of the day, $500 billion in market value had vanished into the digital ether, proving that artificial intelligence could panic just as spectacularly as human intelligence—only faster!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.