Crude Oil Back-to-Back Wins Continue – Breakout Setup Net Profitable

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Just a mini update today compared to previous briefings as I wind down for a few days’ holiday with the family, keeping my swings swinging whilst enjoying life away from screens.

SPX bull swing has sung right to the upper Bollinger Band and put in the tightest of bear setups right ahead of Friday’s NFP drama. Trade setups appear, trades go on – systematic precision regardless of holiday timing.

The beauty of mechanical approaches? They work independently whilst you’re planning which beach towel to pack. Systematic positioning doesn’t require constant attention, just proper setup recognition and disciplined execution.

Keep scrolling for the crude oil consecutive win streak…

SPX Market Briefing:

Thursday brings pre-NFP positioning with systematic setups aligning perfectly for holiday timing.

Current Multi-Market Status:

- SPX: Upper BB tag complete, tightest bear setup ahead of Friday NFP

- RUT: Confirmed range structure ready for break or reversal trading

- /CL: Range high to low complete, breakout initiated with locked profits

- Holiday Countdown: Two more sleeps until batteries get recharged

SPX Upper Bollinger Beauty:

The bull swing has delivered exactly what systematic approaches promise – methodical progression to technical targets. Upper Bollinger Band tag creates the tightest bear setup right before Friday’s employment data fireworks.

Trade setups materialise, trades get executed. The mechanical framework handles pre-NFP positioning without emotional attachment to outcomes or calendar anxiety about holiday timing.

RUT Range Confirmation:

RUT now shows confirmed range structure, allowing systematic trading of either breaks or reversals off range highs and lows. In this case, we’re focused on range low opportunities for potential bear continuation.

Clear structure provides clear trading parameters – exactly what systematic approaches thrive on regardless of whether you’re monitoring screens or packing suitcases.

Crude Oil Consecutive Wins:

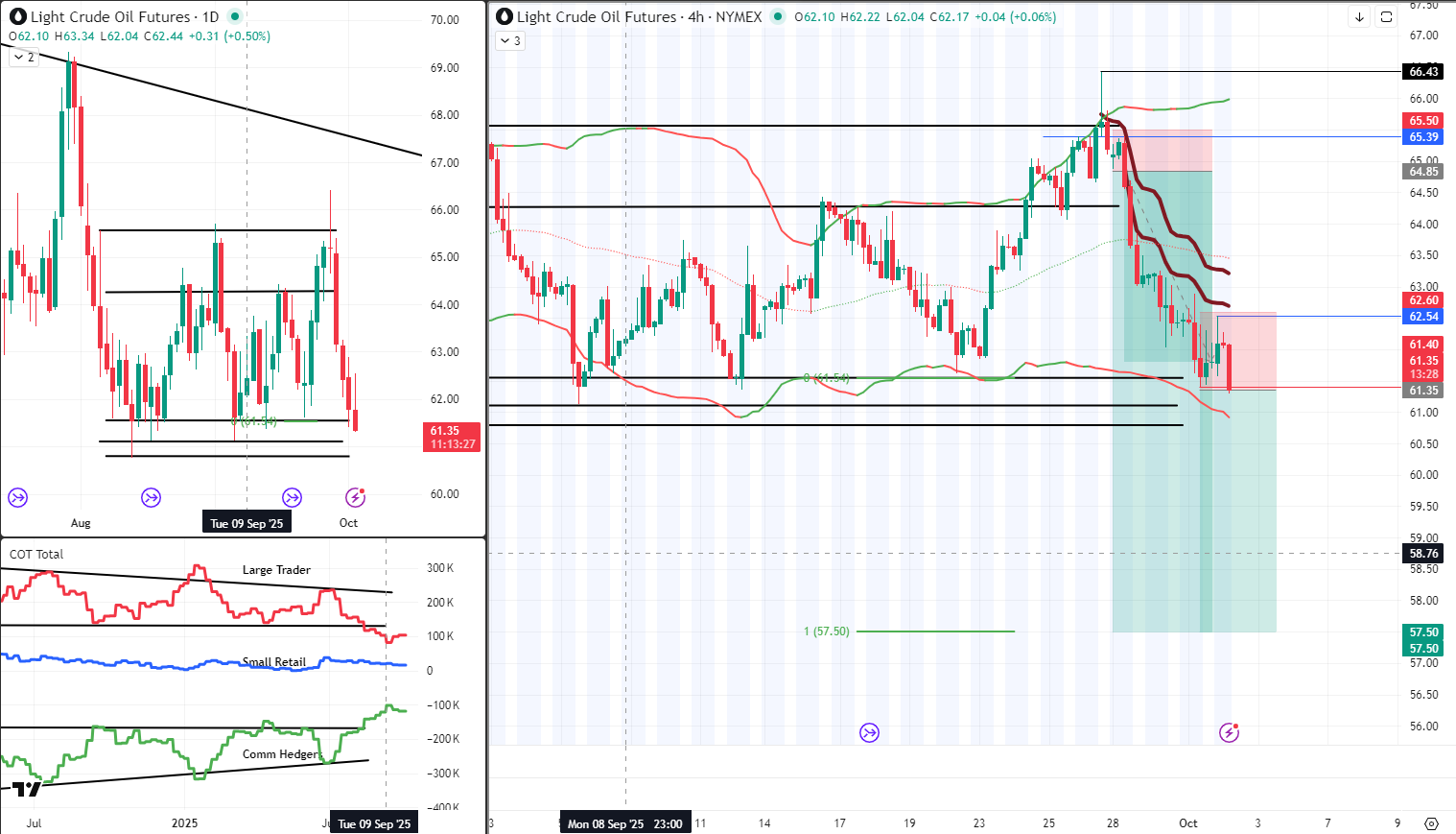

/CL crude oil remains my current favourite instrument to trade – not in any way influenced by the back-to-back wins producing consistent profits. We’ve travelled from range high to range low, now assessing potential breakout opportunities.

Bear range reversal profits have been locked in systematically. Breakout setup has been initiated with proper risk management. Even if this add-in gets stopped out, there will be net profit – exactly the way systematic trade management should function.

Insider Tools Development:

Rolling out some special tools for my own Insiders Group members, dropping those into the private channel hopefully later today. Continuous improvement of systematic frameworks never stops, even during holiday preparation.

Holiday Mindset:

All in all, I’m looking forward to breaking away to refresh and recharge batteries. Systematic trading provides this freedom – positions work independently whilst life gets properly enjoyed.

Tick-tock… two more sleeps until proper downtime with the family!

Today’s Systematic Plan:

- SPX: Monitor bear setup development ahead of Friday NFP

- RUT: Watch confirmed range for break or reversal opportunities

- /CL: Breakout setup active with locked profits securing net positive outcome

- Premium/Lazy Poppers: Standing by for pre-NFP volatility if opportunities present

- Holiday Prep: Ensure systematic positions work independently during family time

In Other News…

FinNuts Market Flash

S&P hits record whilst ignoring catastrophic employment data

S&P futures opened negative down 0.4% to 6,665 like Percy discovering morning tea supplies depleted. Nasdaq futures fell 0.5% whilst Dow dropped 0.1% as traders digested government shutdown beginning midnight. Then ADP released catastrophic -32,000 September payrolls versus +45,000 expected – worst since March 2023 – and markets did something extraordinary: completely ignored reality. S&P bottomed at 09:45, reversed by 11:00, closed at record 6,711 proving bad news equals good news when central bankers exist.

Sector rotation discovers selective reality distortion

Healthcare drove gains with Regeneron and Moderna surging on biopharma strength whilst consumer discretionary lagged on demand concerns that apparently matter less than pharmaceutical optimism. Energy remained weak following Monday’s 2% plunge because OPEC production speculation still depresses whilst catastrophic employment data doesn’t. Technology mixed as semiconductor names consolidated like confused investors unsure which narrative to follow. Lithium Americas surged 32% on DOE equity stake news proving government can simultaneously shut down and invest strategically.

Earnings season approaches during data blackout

Calendar light ahead of October 7 earnings season kickoff with banks confessing quarterly sins together. FactSet expects 7.7% S&P 500 Q3 EPS growth whilst shutdown threatens October 15 CPI release if dysfunction extends beyond two weeks. Management commentary will substitute for missing BLS data, providing Fed with corporate anecdotes versus actual statistics. October 3 jobs report officially cancelled proving even employment statistics need government funding whilst markets apparently don’t need economic data.

Cross-asset behaviour defies fundamental logic

VIX plunging from Wednesday’s 18 peak to 16.2 close despite worse fundamental backdrop suggests traders pricing transient shutdown and discounting -32,000 ADP as noise rather than signal. Dollar’s 10% annual decline – worst since 2003 – accelerating safe-haven flight to gold holding $3,860 records. Treasury yields sticky at 4.24% showing bond market scepticism of equity euphoria. Record S&P close whilst labour market craters and government stays shut reveals market’s faith in brief resolution, Fed cutting regardless of data, and October seasonal strength overpowering reality completely.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Holiday Countdown Formation” whilst claiming they had mastered “Two More Sleeps Systematic Positioning Through Advanced Vacation Anticipation Cooing.”

Hazel updated her crisis management protocols to include “Pre-Holiday Bear Setup Procedures” alongside emergency plans for “Systematic Trading During Beach Towel Selection Processes.”

Mac raised his Thursday morning whisky and declared, “When systematic swings work independently whilst one packs for holiday, trading becomes delightfully compatible with actual life enjoyment!”

Kash attempted livestreaming about “consecutive crude oil wins being basically like DeFi yield farming but with actual back-to-back profitable execution” but got distracted planning which trading screens to bring on holiday (answer: none).

Wallie grumbled that in his day, traders didn’t take holidays because “markets required constant attention rather than this systematic independence nonsense with family time integration!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Fear & Greed Index: The Market’s Mood Ring

CNN’s Fear & Greed Index measures market sentiment on a 0-100 scale using seven indicators—proving that Wall Street is basically one giant emotional support group!

The Fear & Greed Index is what happens when you try to turn human emotions into spreadsheet data, and somehow it actually works!

This composite index tracks seven different market indicators including stock momentum, volatility (VIX), safe haven demand, and put/call ratios to determine whether investors are being driven by fear (0-49) or greed (51-100).

It’s like having a mood ring for the entire stock market, except instead of changing colours, it changes your portfolio value. When the index hits extreme fear (0-25), it often signals a contrarian buying opportunity because everyone’s panicking and selling at low prices.

When it reaches extreme greed (75-100), it suggests the market might be getting too frothy and due for a correction. Warren Buffett’s famous advice to “be fearful when others are greedy and greedy when others are fearful” basically gets automated through this index.

The genius is that it quantifies what every trader already knows: markets are driven by human emotions, and humans are terrible at making rational decisions when money is involved!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.