Tag ‘n Turn v2.4.1 Released With Major Software Engine Overhaul

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Rabbits! Which I think is customary to start the day off on 1st October, not that we need luck with a data-driven trading system, but there you have it. October has officially arrived, and the markets have responded with characteristic drama.

SPX and RUT ground hard for most of yesterday, staying compressed between their bull and bear anchored VWAP levels. That was until mid-afternoon when someone lit a firework under the market. This is typical on last days of months, expiration days, and similar – the bean counters need to balance books, so you’ll often see erratic movements as positions wind and unwind.

The futures tell a different story – or rather, a more complete picture. Overnight trading took a swan dive like a champion cliff diver, and yesterday’s lows have already been swept. Unfortunately, Mr Miyagi isn’t here to do the “hand clappy thing” to make it better.

Keep scrolling for the crash party pizza order…

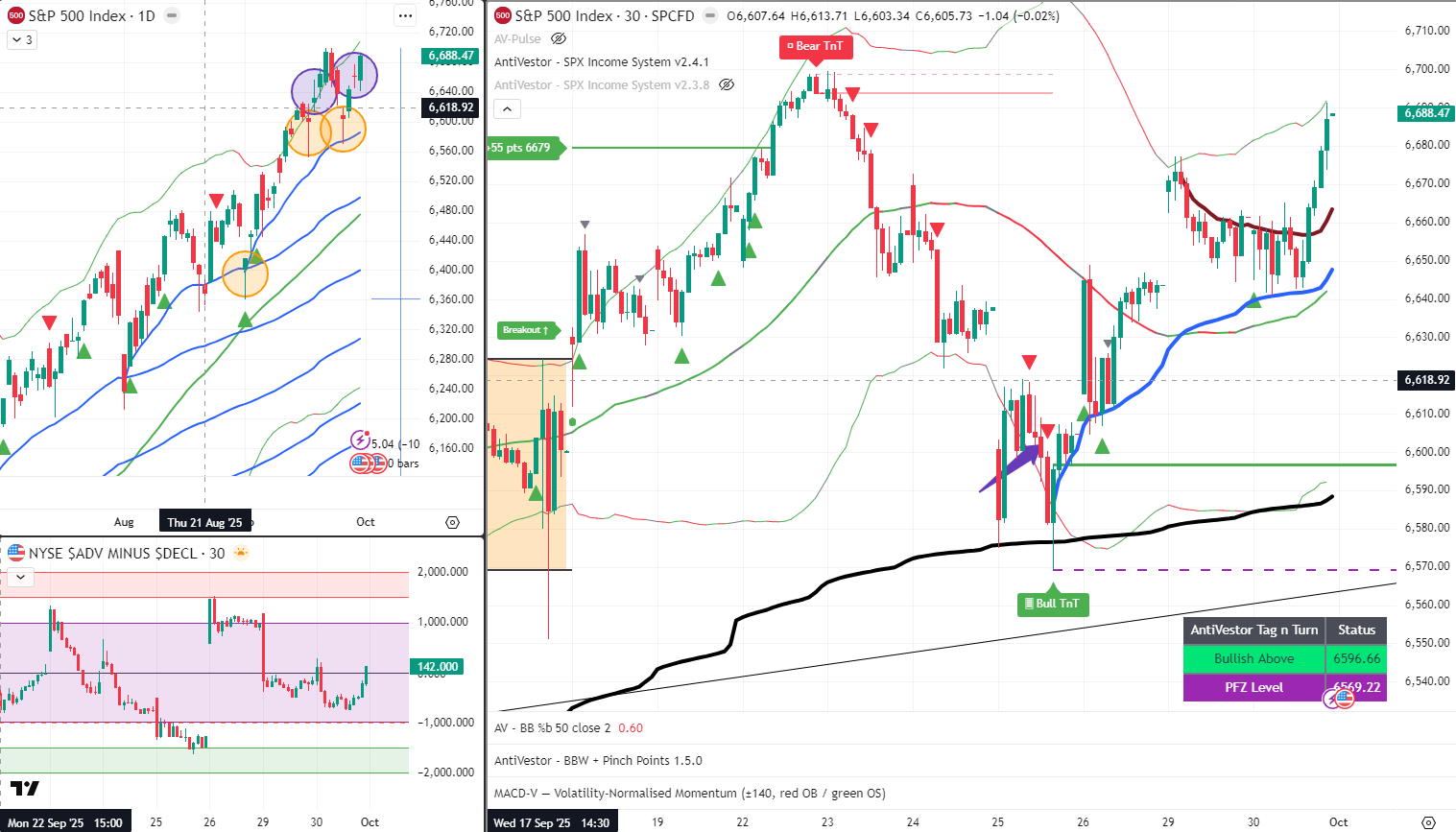

SPX Market Briefing:

Wednesday brings proper October crash season energy with overnight action delivering exactly the sort of volatility systematic approaches handle brilliantly.

Current Multi-Market Status:

- SPX: Tagged upper boundary, awaiting bear pulse bar confirmation

- RUT: Rising channel breakout retest discussed Monday, awaiting PFZ bearish flip

- ES/RTY: Bearish positioning active and performing nicely

- /CL: 35c profit locked, risk-free at range target assessment point

The Bean Counter Fireworks:

Yesterday’s compression between bull and bear A.VWAP levels lasted most of the session until mid-afternoon fireworks erupted. Month-end positioning creates these erratic movements as bean counters balance their books through position wind and unwind cycles.

The overnight session delivered champion cliff diver form, sweeping yesterday’s lows with systematic precision. When futures gap down whilst you’re sleeping, systematic positioning either profits or waits patiently – no emotional attachment required.

SPX Upper Boundary Tag:

SPX has tagged the upper boundary level, and it’s now a case of waiting for the bear pulse bars to confirm directional intent. Systematic patience beats premature positioning every time, especially during volatile October openings.

RUT Channel Breakout Assessment:

RUT unfortunately didn’t have an official tag, but the rising channel breakout retest on Monday – which we discussed during Monday’s Fast Forward mentor call – did provide opportunity for those positioned correctly.

Official entry signals will have to wait for the PFZ levels to flip over to bearish, which aren’t that far away from current price action.

ES and RTY Bigger Picture:

Index futures for the bigger picture remain bearish and bear’ing nicely. Now if we can just order in one crash party pizza to go, that would set my holiday time up very nicely indeed.

The systematic positioning aligns perfectly with the 6-10th October family time planning – bigger timeframe exposure working independently whilst enjoying life away from screens.

Crude Oil Risk-Free Territory:

/CL crude oil futures continue behaving nicely – or badly, since we have a bear swinger swinging. We’re a cat’s whisker from the range target, and potential breakouts or reversals can then be assessed properly.

For now, I’ve locked in about 35 cents on the move, making it risk-free. I can let the patterns play out without trying to guess or second-guess what comes next. A bear breakout would be lovely, but we don’t always get our wishes fulfilled.

NFP Crescendo Building:

October proper starts today with ever-increasing red flag news building towards Friday’s NFP crescendo. Will it be crash cancelled or a “holy shit, how did things get that bad” moment?

Time will tell, and I’ll play the setups systematically until then.

Software Development Update:

The Tag ‘n Turn software engine received a major overhaul overnight. Existing members should see an update to v2.4.1 as the latest version, improving the systematic signal generation and execution framework.

Today’s Systematic Plan:

- SPX: Monitor for bear pulse bar confirmation after upper boundary tag

- RUT: Await PFZ bearish flip for official entry signals

- ES/RTY: Continue bearish positioning into holiday period

- /CL: Risk-free at range target, assess breakout vs reversal next

- Premium/Lazy Poppers: Standing by for NFP week volatility opportunities

In Other News…

FinNuts Market Flash

Futures drop sharply as shutdown reality replaces theatre

S&P futures plunged 53 points to 6,615 like Percy discovering the office actually ran out of tea permanently rather than temporarily. Nasdaq futures falling 220 points whilst Dow contracts shedding 180 because apparently government closure at midnight constitutes actual news rather than political posturing. Overnight range widening to 6,605-6,635 after September’s +3.0% gain marked best month since 2010, proving markets can celebrate before crying.

Sector rotation discovers defensive positioning urgency

Defensive bid emerging overnight with utilities and consumer staples holding relative strength whilst cyclicals lagged like Wallie during productivity initiatives. Energy continuing Monday’s weakness down 2% on OPEC production concerns with Halliburton down 1.6%, Exxon shedding 1% on 2,000 job cuts because apparently energy companies discovered cost management during price weakness. Technology mixed as semiconductor weakness offset AI infrastructure strength proving not all computer chips share same emotional baggage.

Earnings season approaches whilst data disappears

Q3 reporting season kicks off next week with October 7-11 bank earnings because financial institutions prefer confessing together rather than individually. FactSet expects 7.7% S&P 500 EPS growth whilst shutdown threatens data releases framing quarterly narratives. BLS confirmed October 3 jobs report cancelled, CPI report October 15 at risk if closure extends, proving even economic statistics need government funding to exist.

Cross-asset volatility reveals selective panic

VIX surging from 15.3 to 18.0 marked sharpest overnight jump since September 16 but remained below 20 panic threshold like Mac’s anxiety staying below genuine concern levels. Bond market showing resilience with ten-year yields steady at 4.24% despite equity weakness, suggesting fixed income pricing extended shutdown as temporary disruption versus systemic catastrophe. Dollar’s fourth-day decline confirmed historical shutdown pattern whilst gold held near $3,860 records providing haven bid.

-Hazel

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons to say “Rabbits! Rabbits! Rabbits!” on 1st October whilst claiming the traditional luck ritual would “enhance systematic positioning through ceremonial cooing coordination.”

Hazel updated her crisis management protocols to include “October Crash Party Pizza Ordering Procedures” alongside emergency plans for “Mr Miyagi Hand Clappy Thing Unavailability During Market Swan Dives.”

Mac raised his Wednesday morning whisky and declared, “When markets cliff dive overnight whilst systematic bears are positioned correctly, crash party pizzas become delightfully appropriate celebratory cuisine!”

Kash attempted livestreaming about “bean counter month-end fireworks versus DeFi protocol rebalancing mechanics” but got distracted explaining why saying “Rabbits” on 1st October was supposedly lucky for data-driven systems.

Wallie grumbled that in his day, October meant “proper crashes with genuine terror, not this swan diving nonsense with software updates and holiday planning integration!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

⏰ The Great Depression’s Endless Nightmare

An investor who bought at the S&P 500’s 1929 peak had to wait over 15 years-until January 1945-to break even. That’s longer than most marriages last!

Imagine buying stocks in 1929 and not seeing a profit until the end of World War II-that’s the kind of patience that would test anyone’s commitment to “buy and hold.” The Great Depression bear market was so brutal that it redefined what “long-term investing” meant.

An 83% drop followed by 15+ years of waiting for recovery makes today’s worst corrections look like minor inconveniences. This was the market equivalent of falling into a financial coma and waking up in a completely different world.

By the time investors finally broke even in 1945, the economy had gone through the Great Depression, the New Deal, World War II, and the beginning of America’s rise as a global superpower. Those who held on became legends, while those who sold became cautionary tales.

The experience was so traumatic it created an entire generation of investors who kept money in mattresses and never fully trusted the stock market again.

Sometimes the best investment strategy is simply surviving long enough to see the other side!

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.