Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Well, it seems last week’s bearish setup didn’t just show up; it kicked the door down!

Futures have tumbled, with the NASDAQ leading the charge into the red, and the S&P 500 has dropped all the way to its opening price for the year.

But is this a crash or just a fiery correction? Grab your coffee (or something stronger), and let’s break it all down before the markets open.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

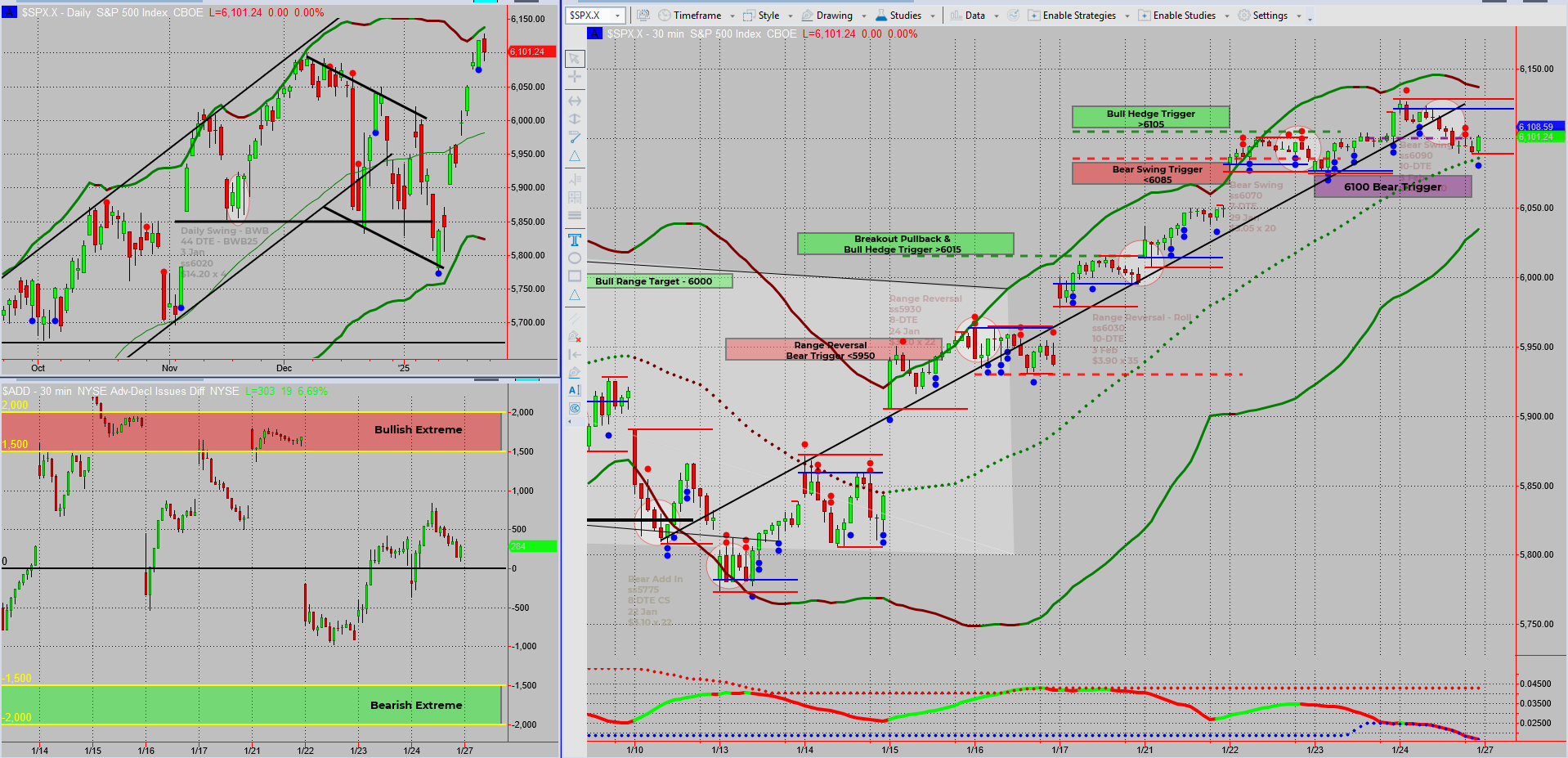

SPX Deeper Analysis:

SPX Futures Drop 200 Points

Friday’s bear triggers from the “Fast Forward” group call set the stage for this dramatic turn. During Mondays early overnight session, the futures plummeted 200 points, dragging the S&P 500 down to its yearly opening price. While this is dramatic, it feels more like an emotional overreaction than a genuine market collapse.

NASDAQ & Tech Stocks Take a Beating

NASDAQ is leading the charge downhill, currently down 4.7%. Tech stocks, which have been the darlings of this bull run, are getting hit the hardest. This could be the sharp correction many of us have been waiting for as the froth begins to settle.

Bear Positions Finally Shine

After a sluggish January due to missed opportunities, my bear positions are looking strong. The opening bell should see these positions come to fruition, easing some of the frustrations from earlier in the year. It’s proof that patience (and a little bearish bias) can pay off.

Is This a Crash? Probably Not.

Despite the chaos, this doesn’t feel like a crash. It’s more like a sharp corrective move – an overreaction by traders. As we’ve seen before, these moves tend to shake out the weak hands before finding stability again.

What’s Next?

The S&P futures testing the yearly open is a critical level. If we see further selling pressure at the open, it could set the tone for the week and month end as the January effect often sets the tone for the year ahead. But if the market stabilises, this may be the “flutter of panic selling” that precedes a bounce. Either way, the next few days are key.

For Traders:

- Watch for stabilisation or continuation at the open.

- Bear positions should remain profitable; don’t get greedy.

- Stay alert for signals of the next move – bullish or bearish.

Fun Fact

The NASDAQ’s 4.7% overnight dip might feel shocking, but during the dot-com bubble, it wasn’t uncommon for tech stocks to swing 5-10% in a single day – sometimes without a clear reason. History doesn’t repeat itself, but it often rhymes.

During the dot-com bubble, tech stocks could rise or fall dramatically with no major news driving the action. The NASDAQ once lost nearly 25% in a single month during the height of the mania. Compared to that, today’s 4.7% drop is almost tame. It’s a reminder that even in corrections, the market often overreacts – a lesson worth keeping in mind when emotions are high.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece