Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Monday’s market theatrics turned out to be an overreaction—just as we suspected. While I wouldn’t have minded a bit more bearish follow-through for personal satisfaction, the lack of it has confirmed a correction in sentiment.

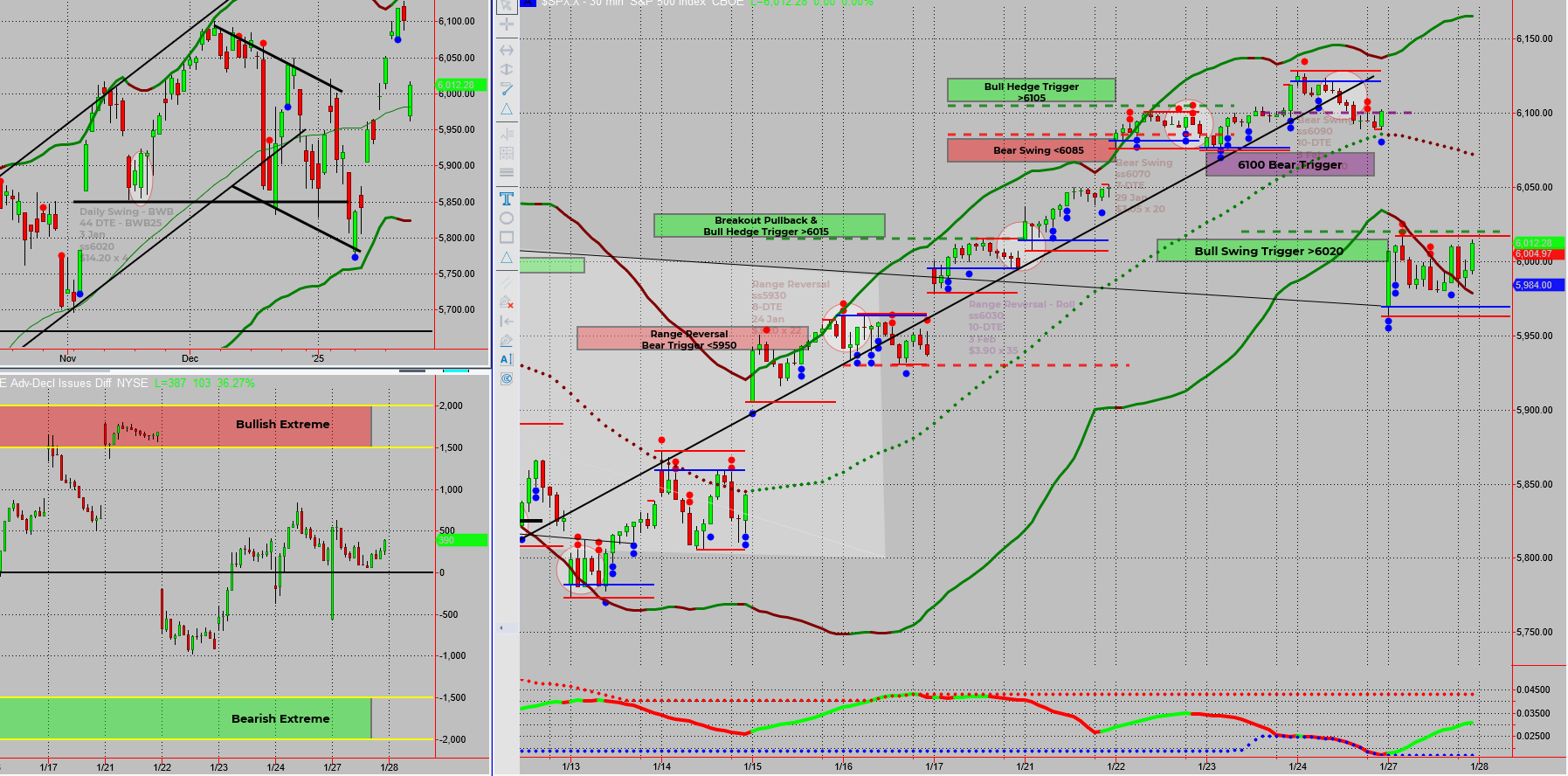

Let’s dive into the Tag ‘n Turn setup that’s lighting up with bullish potential and set our sights on the 6020 trigger level.

The FOMC awaits, but there’s plenty to discuss before the Fed takes the stage.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

Monday’s Overreaction: A Rewind

The market’s reaction to Monday’s sell-off screamed “panic,” but as suspected, it fizzled out quickly. What could have spiralled into extended bearish territory instead turned into a stabilisation phase, leaning back towards bullish sentiment. This confirms what we discussed in our Fast Forward Group calls—patience often wins the day.

Tag ‘n Turn Setup: Ready to Engage

The Tag ‘n Turn setup is firing on all cylinders:

- Pulse Bars: Multiple bullish signals on key timeframes.

- Conservative Entry: A clean price-action-based setup is aligned with a bullish trigger above 6020.

This setup allows for unwinding bearish positions while transitioning into fresh bullish trades. The cautious shift signals that it’s time to keep an eye on those upward opportunities.

FOMC: The Waiting Game

Wednesday brings the Fed’s decision, and while it’s unlikely to be a curveball, markets will undoubtedly overanalyse every word and pause from Powell. Until then, it’s business as usual—trade the setups, stick to the plan, and avoid overcommitting until the dust settles.

Fun Fact:

Did you know the Federal Reserve has been setting interest rates since 1913, but the infamous “Fed speak”—their vague and cryptic language—became a thing under Alan Greenspan in the 1980s? Greenspan once said, “If I seem unduly clear to you, you must have misunderstood what I said.” Classic Central B(w)anker move!

Greenspan’s style gave birth to an entire era of deciphering cryptic Fed statements. Markets hung on every syllable, trying to decode the future. Since then, Fed chairs have evolved their communication styles, but the habit of overanalysing every statement persists. FOMC day has practically become a holiday for market pundits!

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece