Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

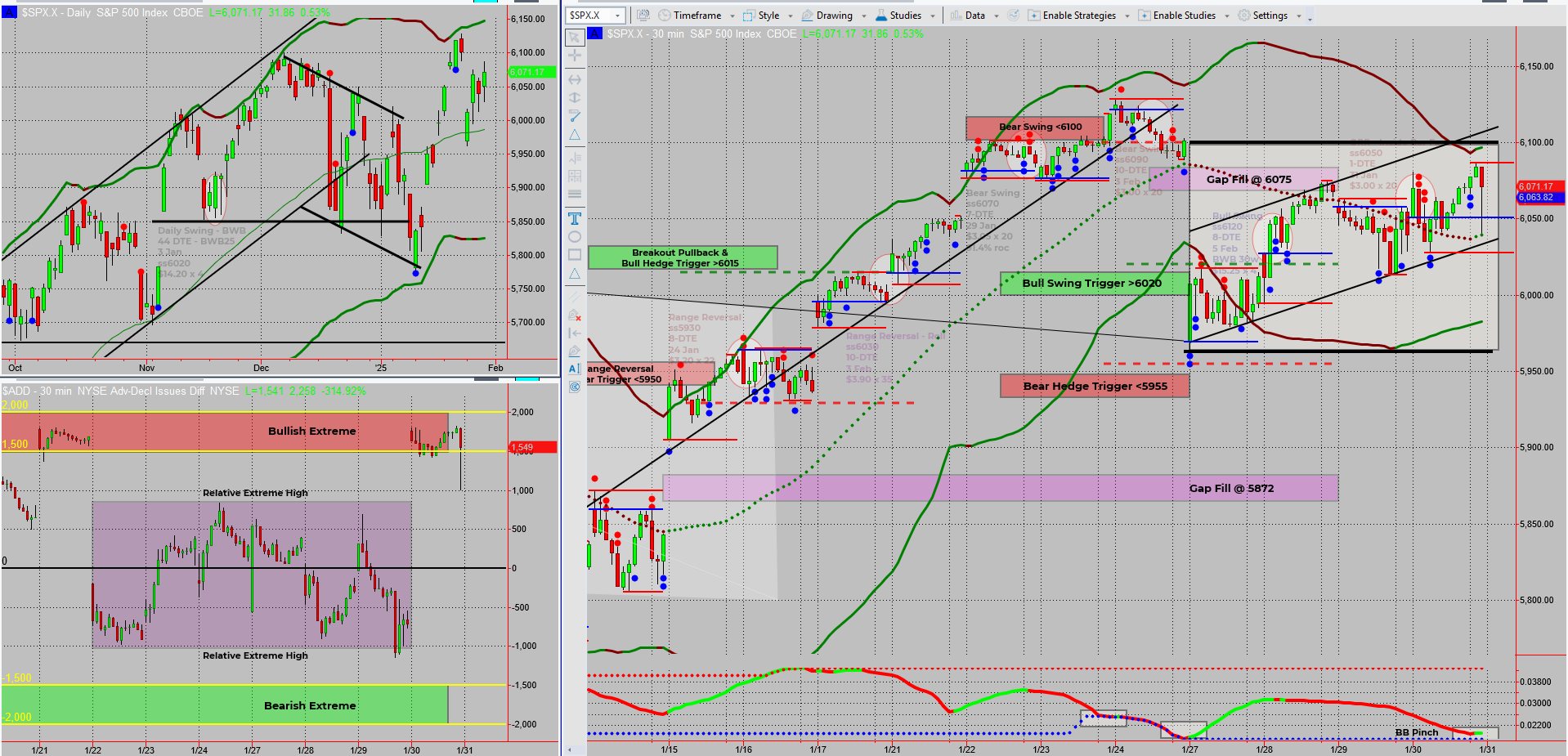

SPX is tightening up, and the Bollinger Bands are doing their best impression of a boa constrictor.

Price is stuck in one of the narrowest ranges in weeks, meaning a breakout is coming… but not just yet. So, what’s the plan? Pause the Tag ‘n Turn, pivot to range trading, and prepare for the inevitable move.

Let’s break it down!

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

SPX Trading in a Tight Box

- Bollinger Bands are pinching, signalling contraction.

- DJX shows an even clearer squeeze, reinforcing expectations.

- Price is stuck in a narrow high/low range – a setup for a breakout.

⏳ Time to Switch Gears

With this range-bound action, I’m pivoting to my six money-making patterns, focusing on the four range-trading setups:

1️⃣ Buy range lows for bullish opportunities.

2️⃣ Sell range highs for quick profit-taking.

3️⃣ Buy a breakout of range highs when momentum confirms.

4️⃣ Sell short a breakdown of range lows if the bears take control.

For now, I’m already positioned bullish, so a bullish breakout is preferred. But I’m keeping my bear hedge triggers intact in case things turn sour.

A Quick Drop Before a Breakout?

- $ADD is at a bullish extreme, hinting that SPX may test the range low before any real move up.

- This means a little downside shuffle before a breakout is very much on the cards.

- If so, I’ll be adding to my bullish positions near the range low.

Taking a Birthday Break!

Since the market has decided to play the waiting game, I’m taking this as a sign to start my weekend early. Let’s see what unfolds next week – a breakout, a fake-out, or another squeeze!

Fun Fact: Stock Market Birthday Anomaly?

Historically, the market has an upward bias during the week of a trader’s birthday – but only if they take the day off. (Okay, I may have made that up, but let’s see if it holds true!)

Real Fun Fact:

The shortest bear market in history lasted just 33 days – the COVID-19 crash in 2020. Even market meltdowns can be short and sweet (like cake).

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece