Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

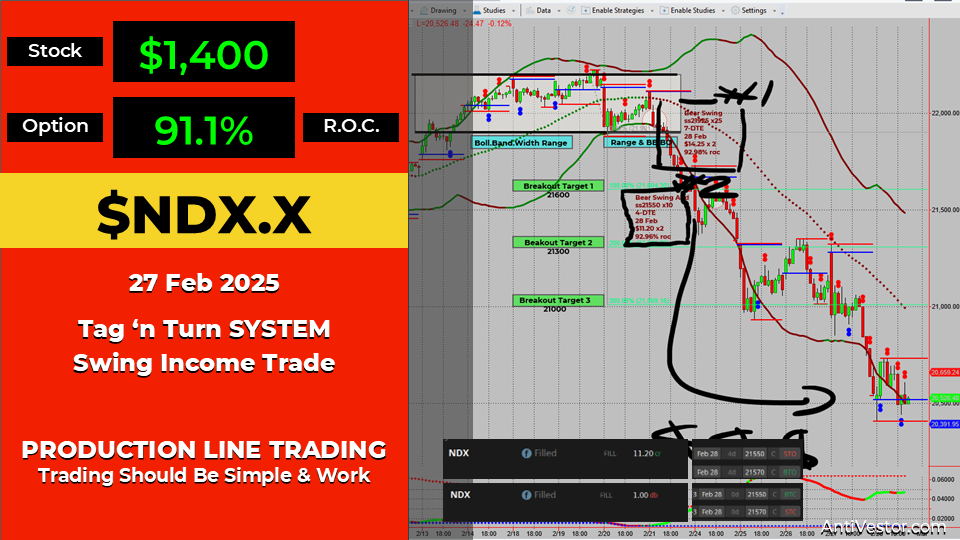

Another NDX trade, another easy win, another great example of why simple setups work best.

This trade was an add-in to the previous breakout trade, using a textbook pullback entry to continue the trend.

A few days later, NDX dropped fast, locked in profits, and paid out a 91.1% return—all while I was off enjoying The Lakes for my wedding anniversary (courtesy of Mrs N).

I wish they were all this easy!

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

NDX continues to show promise for cash-settled options, and while liquidity is still a bit hit or miss, I was able to get filled on this add-in trade.

The Trade Setup – Pullback Entry After Breakout

✅ One of my 6 money-making patterns

✅ Entered as a simple pullback continuation trade

✅ Didn’t need a directional move, but got one anyway

The Execution – Another Quick Trade

✅ Collected $11.20 in credit on entry

✅ A few days later, price dropped fast

✅ Exited for $1.00, locking in a 91.1% return

This trade was as effortless as they come—set up, let it run, and cash out on schedule.

And the best part? It happened while I was away, enjoying a surprise anniversary trip. Trading doesn’t get much easier than this.

Why This Trade Worked So Well:

✅ Breakout trades tend to follow through – this was a clean continuation move

✅ Pullbacks offer great entry points – letting us ride momentum safely

✅ Directional moves aren’t required – but they help get paid faster

Final Takeaways:

✅ NDX is becoming more tradeable as liquidity improves

✅ Breakout pullbacks continue to be an effective strategy

✅ This is why I love income trading—you profit even when you’re not watching the market

For now, I’ll keep an eye on NDX and look for the next opportunity as more liquidity starts to flow into this index it should get easier to be filled.

We walk through the trades often in real time during our Fast Forward Mentoring calls – Want to join us?

Fun Fact

Did you know? The Nasdaq Stock Market was the first electronic exchange when it launched in 1971, but in its early days, no actual trading happened on computers—it was just a digital quote display system for brokers.

The Lesson? Even the most high-tech innovations start small. Today, NDX is a major player in cash-settled options, but liquidity challenges show that not every product is as efficient as SPX just yet.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece