Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Now and then, the market gifts you a little surprise.

Sometimes it’s a pop.

Sometimes it’s a punch.

This time? It was a payout I’d long since written off.

Let me set the scene…

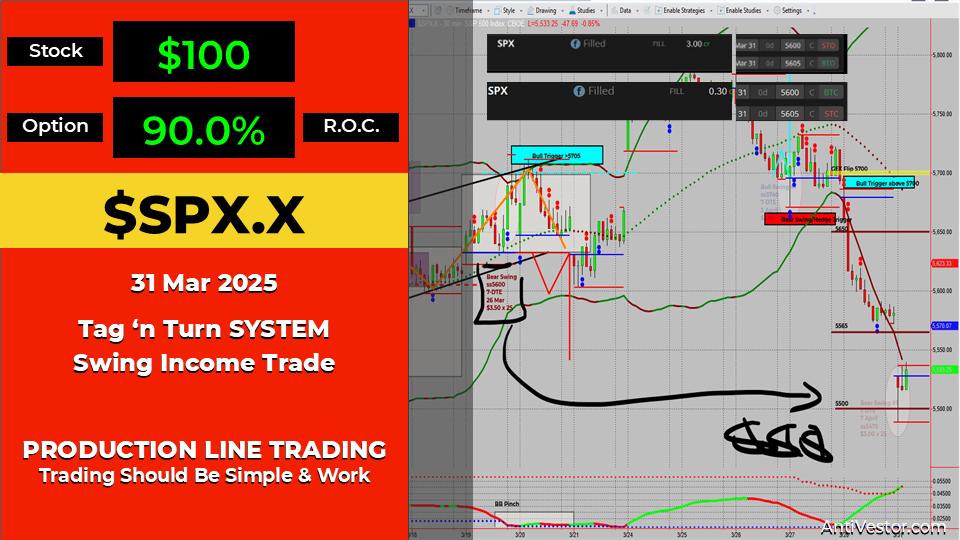

I placed a bear swing trade around the 20th of March. Looked solid. Clean setup. Then… whack – the trade rallied 100+ points almost immediately. No time to hedge. No wiggle room. Just sat there like a sinking ship I couldn’t plug.

At that point, I mentally filed it under:

“We’ll see what expiration brings.”

But here’s the kicker…

I always leave my target exit orders live, even if I’ve emotionally let go. That’s the rule. It helps me stay out of the way and trade the plan, not my mood.

And lo and behold – Monday rolls around, we see a gap down, and ding!… “Order Filled.”

- Hit the target I’d set from day one.

- Closed the trade for a 90% profit.

- Collected $3.00, exited at $0.30.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

The Breakdown: From +100 to -100… to Banked

Let’s get into the mechanics:

-

Entry: 20th March (bear swing).

-

Immediate rally: +100 points (yikes).

-

Premium collected: $3.00.

-

Target exit: $0.30 (automated, as always).

-

Friday’s sell-off continues into Monday with a gap down.

-

Price moves from -100 to +100… again!

-

Trade hits exit shortly after open.

No stress. No scrambling. No second-guessing.

Just a well-placed exit, triggered like clockwork.

It’s like the market looked back at me and said,

“I got you, mate.”

Expert Insights: Why “Set & Forget” Sometimes Pays Best

Here’s the trap most traders fall into:

They micromanage every trade.

They cancel orders the moment price moves against them.

They think “managing risk” means “fiddling with everything constantly.”

But here’s what this trade proves:

- ✅ Your best defence is leave the plan you built in peace.

- ✅ Exit orders exist for a reason – use them.

- ✅ A dead trade isn’t dead until expiration… or target.

And perhaps most importantly…

The trade that feels hopeless today might just be your win next week.

Fun Market Fact

The term “Blue Chip stock” came from poker, where blue chips held the highest value.

So when early financial writers wanted to refer to top-tier, high-quality companies, they borrowed the term. Imagine if it had been “Red Chip” instead – sounds like a crypto pump.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. Ready to stop scratching your head and start stacking profits?

If you want to trade with clarity – not confusion – then it’s time to get serious about structure.

- Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

- Or watch the free training to see the SPX Income System in action.

No fluff. Just profits, pulse bars, and patterns that actually work.