The Wolfe Wave Blueprint: Reversals, Targets, and Timing

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

You ever stare at a chart and swear it’s speaking in riddles?

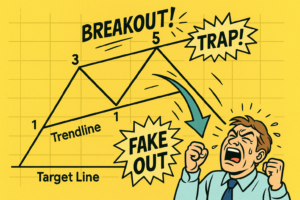

Wiggle up. Wiggle down. Trap here. Fakeout there. A classic market seesaw of deception.

But what if I told you there was a pattern hidden in that chaos—a recurring formation that literally tells you when price is about to reverse… and where it’s likely headed?

Enter the Wolfe Wave.

It’s like nature’s way of saying, “Here’s a roadmap… and a built-in price target while you’re at it.”

It’s symmetrical. It’s logical. And when done right, it’s beautiful.

Most traders butcher it.

They force it. They guess. They draw squiggly lines like it’s abstract art night.

Not us.

We follow the process.

We trade validated triggers.

And we use patterns like the Wolfe Wave to build real confidence in our SPX swings.

So grab your charting compass, and let’s map out this 5-legged beast the right way…

SPX Is Rigged… In Your Favour (If You Know This).

The markets move. You get paid. No stress. No surprises.

The Wolfe Wave Pattern: A Reversal Blueprint

What Is It?

The Wolfe Wave is a 5-point pattern that shows up in every market, every timeframe.

It represents price oscillating toward equilibrium, then overshooting… and snapping back.

Wave Points:

-

1 to 2 sets the first swing.

-

3 to 4 forms the next.

-

Point 5 overshoots the trendline from 1 to 3, signaling a reversal.

It’s not a random zigzag. It’s a structured push-pull, often mistaken for a breakout – but really, it’s the market overextending before snapping back toward balance.

Why It Works

-

It’s based on market symmetry and crowd behaviour.

-

It gives both a price target (line from 1 to 4) and time estimate (intersection of 1-4 and 2-5).

-

It works best at key turning points – tops, bottoms, or consolidation breaks.

When to Trade It

Wolfe Waves are ideal for:

-

Swing trades off reversals

-

Tag ‘n Turn setups

-

Mean reversion plays

-

Identifying traps before breakouts fail

How to Spot Wolfe Waves (Without Guessing)

Wolfe Wave Rules:

-

Five distinct points forming a wedge.

-

Waves 1-3-5 share directional flow.

-

Wave 5 must overshoot the 1-3 trendline.

-

Wave 4 stays inside the price range of waves 1-2.

-

Symmetry matters – spacing and slope should be clean.

-

Target line = drawn from point 1 to point 4.

-

ETA line = drawn from 2 to 5.

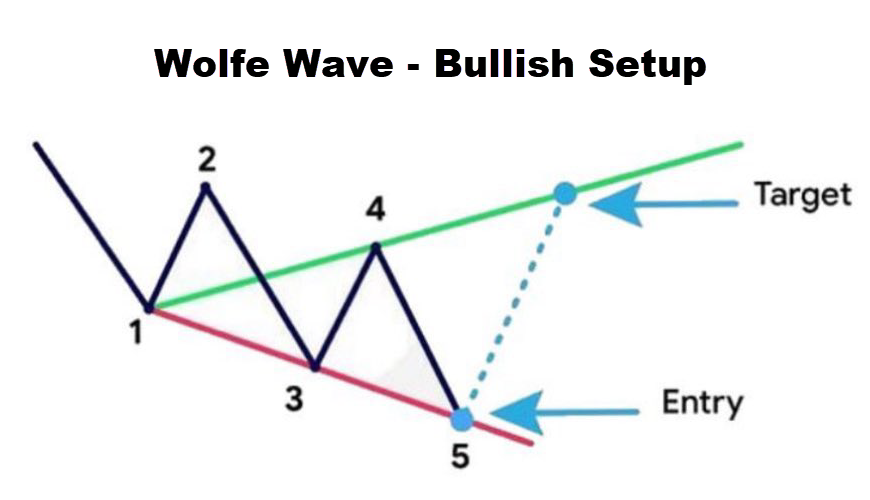

Bullish Example:

-

Price makes lower highs and lower lows.

-

Wave 5 breaks just below the lower trendline.

-

Reversal begins with confirmation candle.

-

Target: Line from point 1 to 4 (upward).

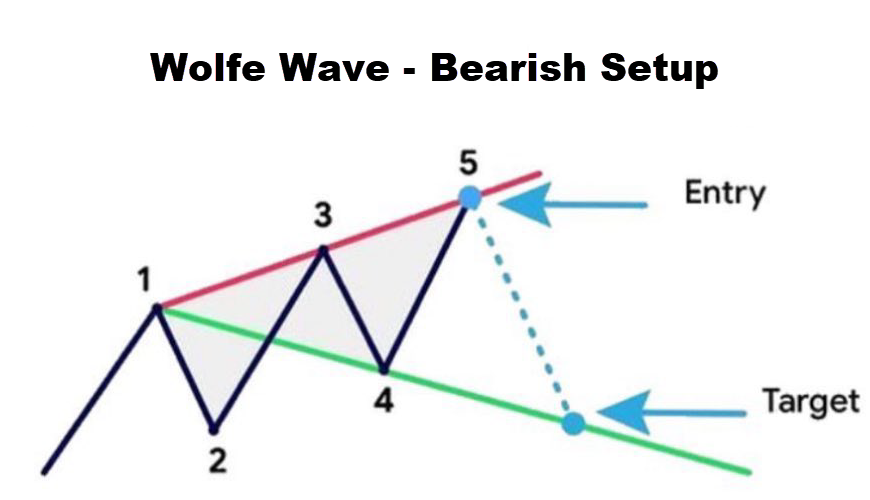

Bearish Example:

-

Price makes higher highs and higher lows.

-

Wave 5 breaks just above the upper trendline.

-

Price rolls over.

-

Target: Line from point 1 to 4 (downward).

Expert Insights: Why Most Traders Get Wolfe Waves Wrong

The Wolfe Wave pattern isn’t complex… but it’s ruthlessly unforgiving if you try to cheat it.

Here’s where most traders blow it:

❌ They force the setup

If you have to squint to find wave 5, it’s not a Wolfe.

You don’t “kind of” get a reversal. Either it’s clean, or it’s chaos.

❌ They skip the overshoot

Wave 5 must poke outside the 1–3 trendline.

No overshoot? No setup. That’s the law of Wolfe land.

❌ They forget the symmetry

If your 1–2–3–4 legs look like a toddler drew them with a crayon and a limp wrist, it’s probably not the one.

Symmetry matters. Rhythm matters.

❌ They treat point 5 like a magnet

Point 5 isn’t a buy/sell level. It’s a trigger zone.

You still need confirmation — candle reversal, divergence, or momentum stall.

✅ How to fix it

-

Use Wolfe Waves as a bias confirmation tool

-

Layer with GEX zones, price pauses, or exhaustion candles

-

Trade the reversal after wave 5 breaks down, not before

-

Plot the 1–4 target line before entering — know your exit before your entry

-

And most importantly… follow the damn system

Wolfe Waves work. But only when you respect the geometry.

Get sloppy, and the market will eat your lunch.

How to Use It in Your SPX Income System

Want to add Wolfe Waves to your AntiVestor playbook? Use it like this:

-

Weekly Swings: Use Wolfe as confirmation for your Tag ‘n Turn trades.

-

Bias Filter: Use it to identify exhaustion in trends or fake breakouts.

-

Stop-Fishing Detector: Wave 5 is often where amateur stops get blown.

-

Strategic Confidence: Knowing the target and timing gives you a plan – not a hope.

It’s a killer pattern once you stop guessing and start following the rules.

Fun Fact: Nature loves symmetry… and so do charts.

Wolfe Waves mirror the Golden Ratio, much like Fibonacci spirals.

But here’s the kicker:

Unlike Fibonacci, Wolfe Waves don’t require you to believe in numerology.

They’re geometry, not mysticism.

They show up on oil, gold, crypto, and SPX – and they’ve been working long before traders started arguing on Reddit about “harmonics”.

Want to see something trippy? Measure the distance between points 1-3 and 2-4. In textbook Wolfe Waves, they often match.

Like a financial metronome hiding in plain sight.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.