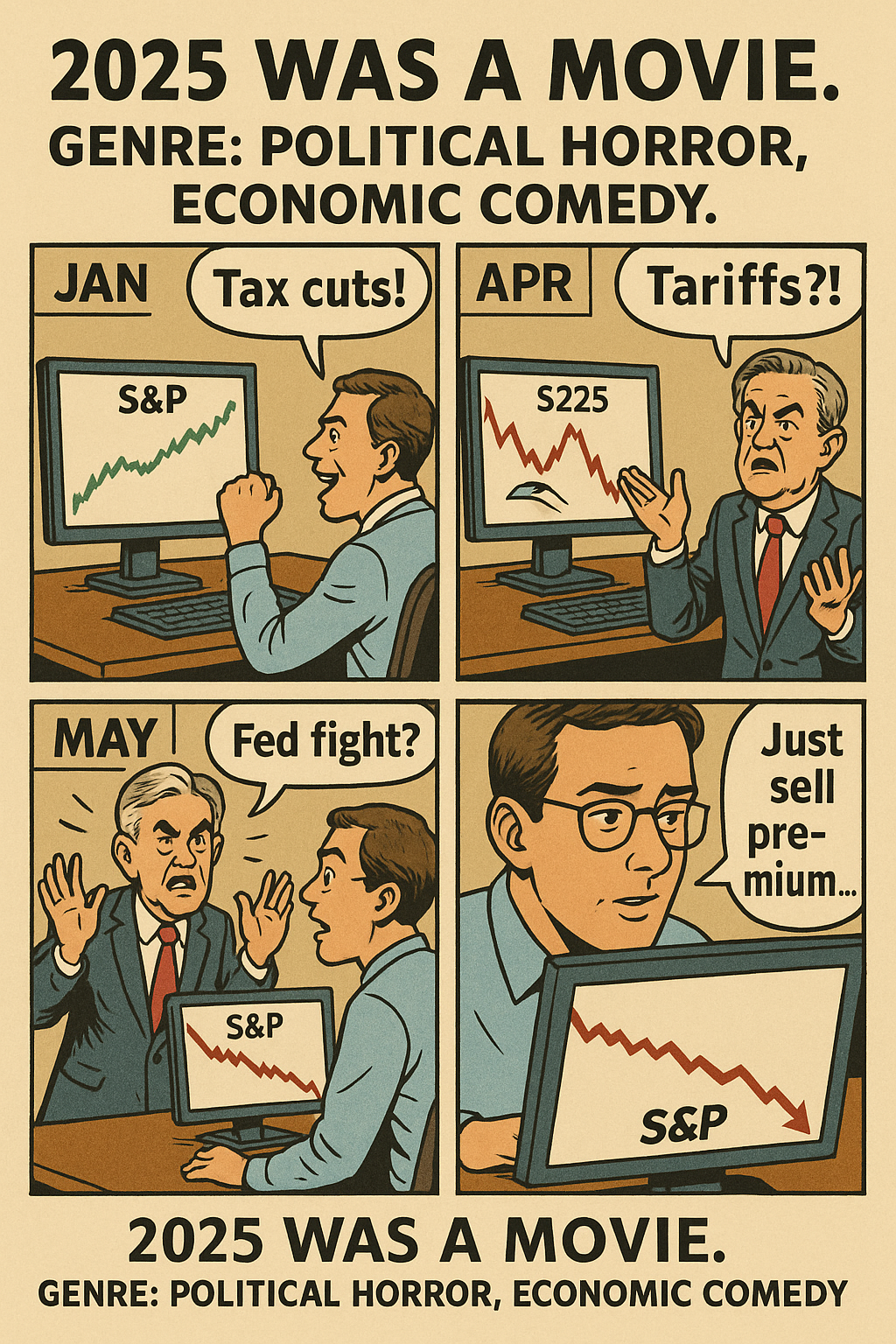

From Tax Cuts to Trade Chaos – The Real Events That Moved the Tape in 2025

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The first half of 2025 wasn’t about headlines or soundbite’s.

It was about money, markets, and policy that punched the tape.

So if you’re wondering what really mattered in U.S. politics this year-forget the noise.

This is the good, the bad, and the financially stupid.

✅ The Good: Tax Cuts, Defence Money, and Deregulation

1. Pro-Growth Tax Push Sent Consumer Stocks Flying

The administration pushed to make 2017 tax cuts permanent, hike deductions for small businesses, and even offered tax-free overtime if the car you bought was made in the U.S.

-

Small-cap and consumer stocks jumped.

-

Retail, autos, and industrials caught the bid.

If you sell to the U.S. consumer, early 2025 was your time to run.

2. $1 Trillion Defence Budget? Lockheed and Friends Say Thanks

The U.S. passed its first-ever $1 trillion defence budget, and border security spending surged 65%.

-

Defence contractors rallied.

-

Aerospace firms got ahead of new procurement.

The market took the hint-

defence and security were in. And funded.

3. Fossil Fuels Win as Energy Policy Flips the Script

A sweeping rollback of climate rules handed wins to oil, gas, and mining companies.

-

LNG names like Cheniere soared.

-

Solar and wind got side-eyed.

SPX Options = Cashflow Engine.

With this setup? It’s practically an ATM with a checklist.

❌ The Bad: Tariff Shock and Recession Risk

4. April Tariffs Sparked the Worst Sell-Off Since 2020

On April 2, 2025, the White House slapped 10% tariffs on all imports, with higher rates for “troublemakers.”

Markets tanked.

-

S&P 500: -4.8% in one day

-

Nasdaq: Down ~6%

-

Gold and yen: Moonwalked higher

-

VIX: Spike city

5. Trade War Backfires: Investors Start Pricing U.S. as the Loser

Semis, exporters, and banks got hammered.

Even allies like Canada and Japan were targeted.

And when retaliation loomed, markets realized: This wasn’t strategic. It was scattershot.

Result? Volatility spiked. Treasury yields dropped. Safe havens caught fire.

⚠️ The Ugly: Debt, Deficits, and Fed Drama

6. Fiscal Package = $3.8 Trillion in New Debt

The “One Big Beautiful Bill” aimed to juice the economy… and ballooned the deficit.

-

Moody’s downgraded the U.S. credit rating

-

Long-term Treasury yields surged

-

Utilities and real estate tanked

Banks loved the steeper curve-for a minute. Then came recession whispers.

7. Trump vs. Powell: Rate Cuts or You’re Fired?

The President met with Fed Chair Powell in May and told him not cutting rates was “a mistake.”

Rumors swirled of replacing Powell. Markets got twitchy.

Powell held his ground-barely.

-

The Fed paused.

-

Bond traders braced.

-

Inflation expectations nudged higher.

Takeaway: You Can’t Trade Headlines. But You Can Trade Impact.

In 2025, what mattered was policy that moved sectors, shifted flows, and cracked the Fed narrative.

Ignore the culture wars. Watch the yield curve.

Winners:

-

Defence, energy, select consumer

Losers: -

Global exporters, rate-sensitive stocks, ESG darlings

The market didn’t care who was in charge.

It cared who was in the way.

Sources

[1] Reuters – “Trump tariffs slam markets, stunned investors brace for slow growth, retaliation” – https://www.reuters.com

[2] Reuters – “US House narrowly passes Trump’s sweeping tax-cut bill, sends on to Senate” – https://www.reuters.com

[3] Reuters – “Investors see worsening US deficit outlook as tax bill heads to Senate” – https://www.reuters.com

[4] Morgan Stanley – “7 Political Trends Investors Should Watch in 2025” – https://www.morganstanley.com

[5] WTOP – “Trump Executive Orders 2025: Energy Stock Winners and Losers” – https://wtop.com

[6] Reuters – “Trump has discussed firing Fed’s Powell with Warsh” – https://www.reuters.com

[7] Reuters – “Trump summons Fed’s Powell, tells him he’s making a mistake on rates” – https://www.reuters.com

[8] Harvard Gazette – “Can Trump fire Fed chairman?” – https://www.news.harvard.edu

[9] White House – “Fact Sheet: President Trump Secures a Historic Trade Win” – https://www.whitehouse.gov

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.