SPX Slides Fast as Range Turns Hostile for Bulls

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

“Good morning traders – A day in the trading life is like a day on the farm. Every meal’s a banquet. Every paycheck a fortune!”

Let’s get after it.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing:

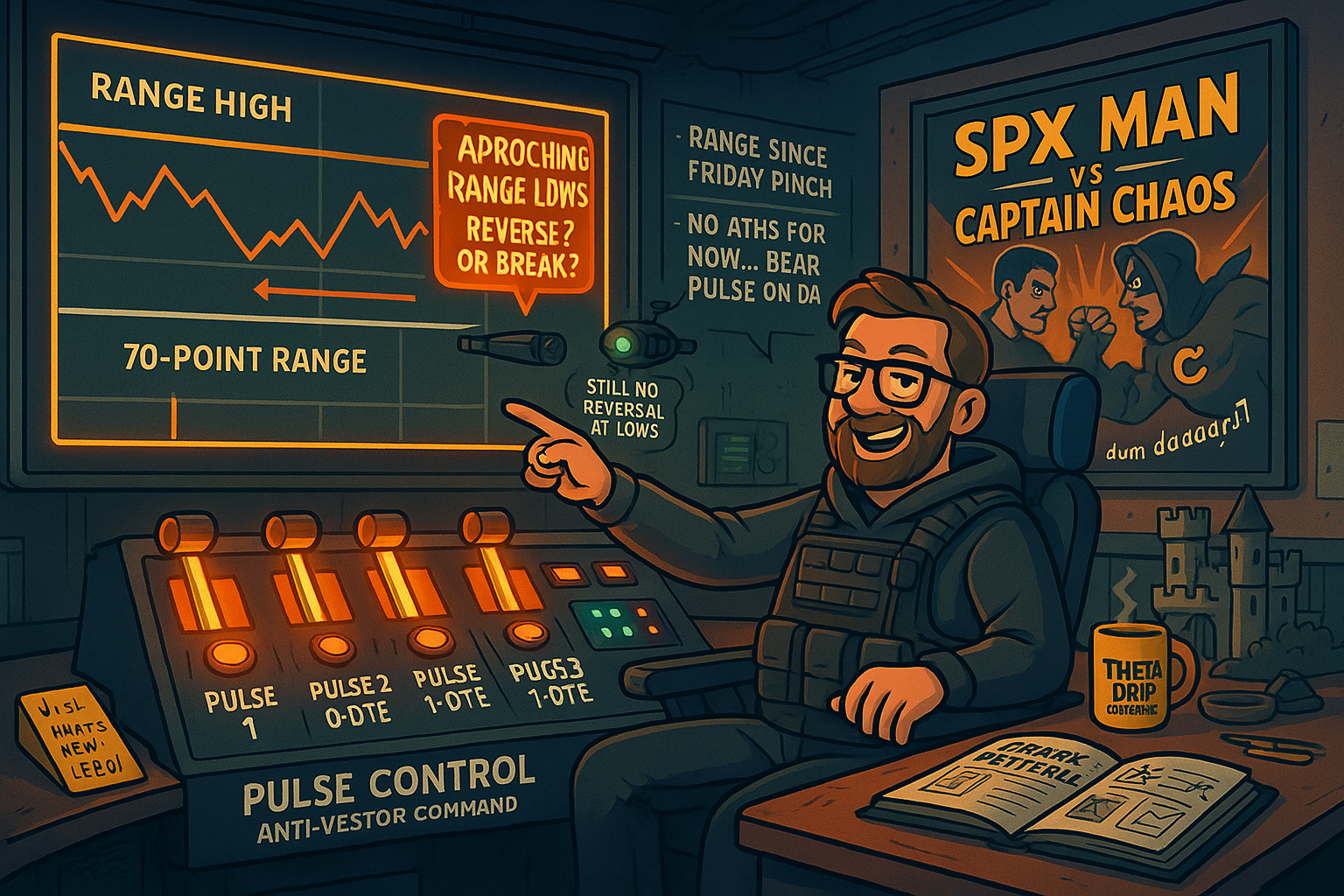

After a sleepy Monday, Tuesday brought a shock to the system. A textbook gap straight to the range highs gave way to a fast and wide bear Pulse Bar – and that was all the invitation we needed.

Trade 1 (swing) is still on, riding the potential move to range lows.

Trade 2 (Pulse 2) was the 0-DTE sniper hit – filled for $2.10 and bought back for $0.10. That’s a 95.5% ROC day trade while most were still waiting on confirmation signals.

Trade 3 (Pulse 3) was a rare 1-DTE deployment – not normally my thing, but with the range this narrow and me already at the desk, Papa wanted new Lego. So on it went.

Today, we open near the range lows. It’s too close for a fresh 0-DTE from scratch, but any bounce or breakdown here could activate one of two playbook patterns: a reversal off support or a clean trend continuation lower.

And then there’s the bigger picture…

First Daily Bear Pulse Since March – What It Could Mean

On Tuesday’s close, the SPX printed its first daily bear Pulse Bar since March. Historically, these signals tend to precede a short-term correction even during bull trends – often by a few days before new highs are resumed.

What to Do Now

Watch for continuation setups on smaller timeframes, but don’t chase. Range low interaction is key – trade the reversal or the break, not your feelings.

In Other News…

Tariffs, Tech and Tumbles

AI optimism spars with trade fog

“Nvidia lit the fuse-ASML threw on the wet towel.”

Chip stocks danced early as Nvidia got the all-clear to resume China-bound H20 GPU shipments, sparking a 4% surge. But ASML rained on the parade, warning that tariffs could nuke 2026 growth. Traders now juggle AI hype with a rising cost-per-transistor reality.

“Kazakhstan just OPEC-bombed your bullish crude thesis.”

A surprise 12% surge in Kazakh output hit the tape just as U.S. oil inventories swelled. Brent and WTI both sank, while Big Oil caught a downdraft. Refiners, however, found a silver lining-fat margins on the crack spread helped mop up the mess.

“Renault faceplants, GM smiles awkwardly.”

Renault slashed guidance and swapped CEOs midweek, triggering a 17% plunge. The fallout dragged Euro auto ETFs down 3%. In the U.S., GM gritted its teeth and tossed out a $4 billion truck expansion, but the sector still flinched at rising tariff tension.

“Shippers zig while tariffs zag.”

Japan’s K Line announced detours to dodge U.S. ports-tariff risk rerouted. That buoyed container rates and lifted shipping stocks like Maersk. But airlines, sniffing cheaper jet fuel, soaked up the gains. Net-net? The S&P ended flat, like a confused intern holding both a Tesla brochure and a steel tariff memo.

Expert Insights:

Bear Pulse at All-Time Highs = Temporary Reset, Not Reversal

When a Pulse Bar appears at new all-time highs, it often signals exhaustion, not collapse. The last time this happened was March 2024, and the SPX pulled back briefly before continuing higher.

What to Do Now

Let price tell the story. Watch for reversal signals at the range low – or trade the breakout clean if it comes. The system doesn’t chase.

Rumour Has It…

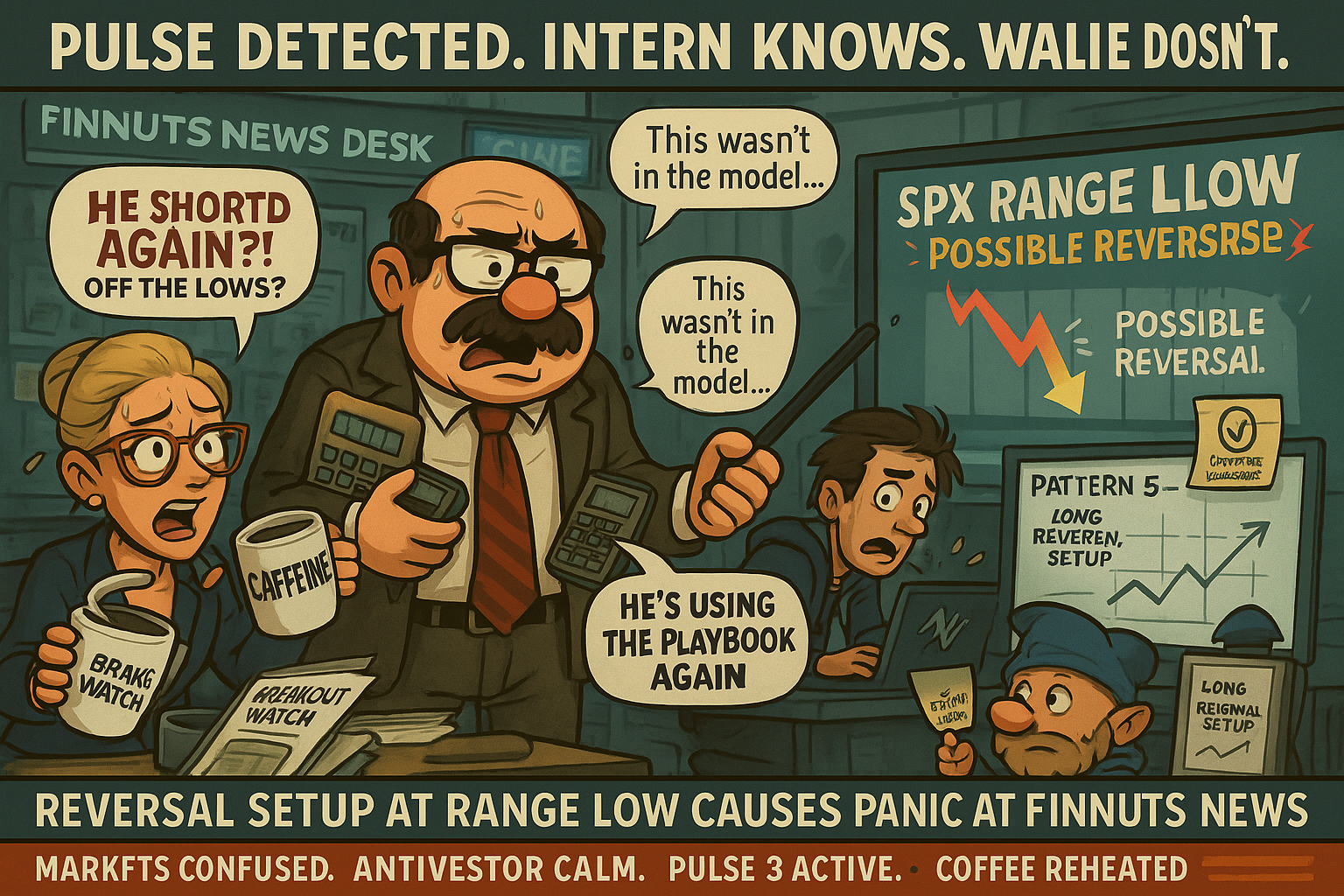

Wall Street’s most chaotic newsroom just got weirder.

Interns at FinNuts News Desk were caught drawing an obvious SPX range on live TV while the anchor yelled, “Bullish breakout confirmed!” Producers were later seen Googling “Pulse Bar reversal” while one analyst quietly clutched an AntiVestor manual like a sacred text.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.