Pause, Pop, Pullback – It’s a Pattern, Not a Prediction

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

…After all the “Breakout!” chest-beating, SPX has pulled the oldest trick in the book – bait the bulls, squeeze the bears, and roll straight back into the box. Textbook.

And while the FinNuts crowd still chants “Tech earnings will save us,” I’m just over here watching the same 70-point range box do its dirty work – again.

“Grab your popcorn. The trap door just reopened…”

SPX Doesn’t Need You To Be Right. Just Consistent.

Pulse bar tells you when. Credit spreads handle the rest.

SPX Market Briefing:

1. The Breakout Lost Its Mojo

Monday’s wick is now a museum piece in the Hall of Failed Rallies. Price pushed out, then got slapped back like it owed volatility some rent. We’re trading below 6,310 already – and momentum? Limp at best.

2. Pullback Season Has Started

SPX didn’t so much break out as it dabbled. And now that dabble is bleeding points. We’re approaching the Gamma Flip at 6,275 – and if that doesn’t hold, we may just tumble back into…

3. …The Old Range We Already Mapped

Let’s not forget: this breakout was born from a BBWidth pinch that started July 14th. That gave us a clear compression box with upper resistance around 6,290 and the lower edge near 6,220.

We broke out.

We tested.

And now we’re teetering.

A clean break back into that range – especially under 6,275 – could be the trigger for the deeper selloff we flagged back when everyone else was high on NATH fumes. Remember the roadmap:

NATH → Pause → Flush.

We nailed the pause. Now the market decides if it wants to cash in on the flush.

4. ADD Screaming “This Ain’t It”

Advance-Decline was a no-show during the breakout. SPX pushed highs, but ADD stalled around zero. That divergence is an edge-killer – especially when paired with a rejection bar and BBW compression unwind.

5. Premium Sellers: Start Your Engines

This is the exact kind of setup where rule-based sellers thrive and hopium chasers get smoked. The setup’s clean, the backtest zones are mapped, and the trap window is wide open. Pulse Bar reversal near 6,260? That’s the money play.

Gameplan

-

✅ Hold 6,275 (Gamma Flip) → Watch for reversal Pulse Bar → go bull-side with spreads above 6290

-

❌ Break 6,290 + re-enter range → Flip bear bias. Short rips. Target: 6,240, then 6,220.

-

Fade the Hype → Tech earnings will scream. You’ll sell premium instead.

In Other News…

Markets on Snooze Patrol

Zero conviction, full caffeine, and everyone blaming currency math

-

Asia: the brave little toaster of global finance.

MSCI crawled up 0.3% because… reasons. Nikkei yawned past Japan’s election drama like a hungover intern ignoring Slack pings. Traders are long “hope,” short “reality.” -

Europe: wrecked by the alphabet.

SAP’s earnings math now reads: €1 = panic. With every tick up in the euro, a CFO somewhere in Frankfurt reaches for whiskey. Milan and Frankfurt trading like someone pulled the plug and walked off mid-shift. -

U.S. futures: spiritual limbo edition.

Powell’s up next, and traders are frozen like teenagers waiting to see if dad’s mad or just “disappointed.” Mega-cap earnings lurk like a bad Tinder date you agreed to anyway. Nobody’s moving until the lights flicker. -

Commodities: meh and meher.

Oil drooped 0.5% because trade drama is sucking the life out of demand. Dollar’s tight. Crypto’s smirking in the corner like the only kid who studied for the exam. EMs? Still in timeout.

Expert Insights:

Fact: SPX has re-entered the prior pinch-defined range of 6290–6220 after faking a breakout. These kinds of failed breakouts have historically led to follow-through selloffs more often than not, particularly when tagged to an NATH pause event.

The AntiVestor Truth: This is the market’s version of “just kidding.” The fake breakout sets up an each-way trade – sell the fade, scalp the intraday bounce. Don’t buy the hype. Sell the premium.

Rumour Has It…

FinNuts just ran with this:

“Tech Earnings Week Will Decide Everything”

Cute.

Meanwhile, half of the Nasdaq’s mega caps already reported last quarter and nothing changed – except for a few tweet storms and CNBC desk high-fives.

The real move? It’s already halfway done.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Did You Know: Over the past 8 “tech earnings weeks,” the SPX has opened bullish… but closed lower on the week in 5 of them.

[Source: FactSet – “Earnings Season Returns Tracker”]

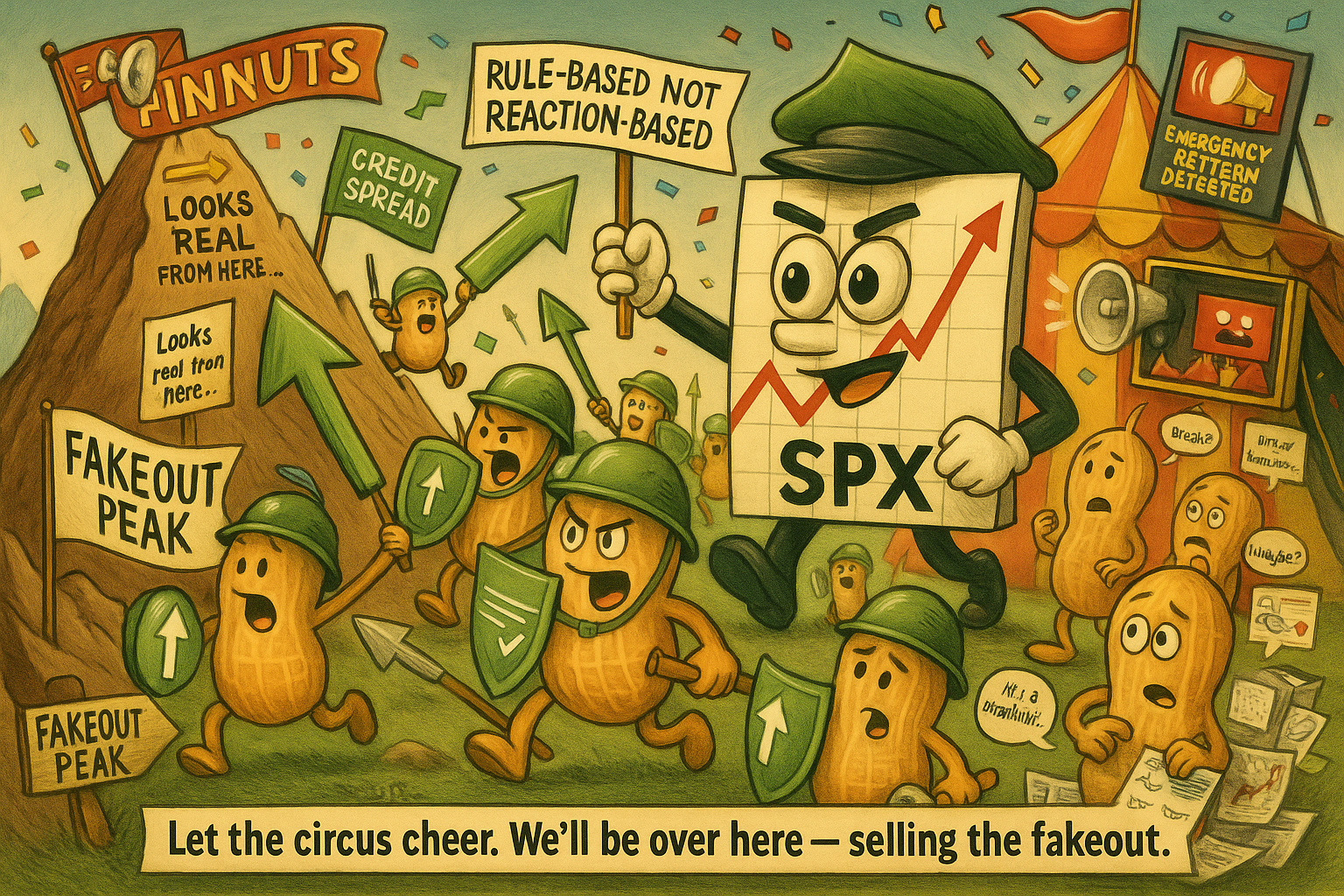

Meme of the Day:

“Let the circus cheer. We’ll be over here – selling the fakeout.”

“The Assault on Fakeout Peak”

It was earnings week. Again.

Somewhere between the seventh FinNuts “emergency update” and another hot take about “Tech Deciding The Market,” the FinNuts News Blimp descended from the clouds, blaring air horns and firing confetti labeled “BREAKOUT CONFIRMED!”

But on the battlefield below, a different army had assembled.

Enter the Peanut-Minions…

Clad in ironclad credit spread shields, these rule-following renegades marched toward the towering slope of Fakeout Peak, a jagged mountain of trap candles, false breakouts, and blown accounts.

Leading the charge:

General SPXson – clipboard in one hand, premium payout in the other, smirk locked in smug-mode.

By his side, General Peanut waved a war banner that read:

“Rule-Based Not Reaction-Based”

As FinNuts reporters shrieked, “ATH incoming!” and launched another emergency pattern alert, the peanut platoon calmly deployed spreads into the chaos – one contract at a time.

Each peanut had a simple plan:

-

Spot the trap

-

Sell the reaction

-

Collect the check

-

Ignore the circus

Behind them, the ghosts of fallen strategies whispered warnings:

-

“Trust the pattern,” said a broken Fib wizard.

-

“MACD crossover!” yelled a backtested corpse.

-

“But the RSI was oversold…” muttered a trendline skeleton.

Unbothered, the AntiVestor army pressed on – past resistance ridges, through sentiment fog, all the way to the gamma-flip flagpole at the summit.

And as the smoke cleared?

Just another payday.

Just another fakeout.

Just another Tuesday.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.